Table Of Content

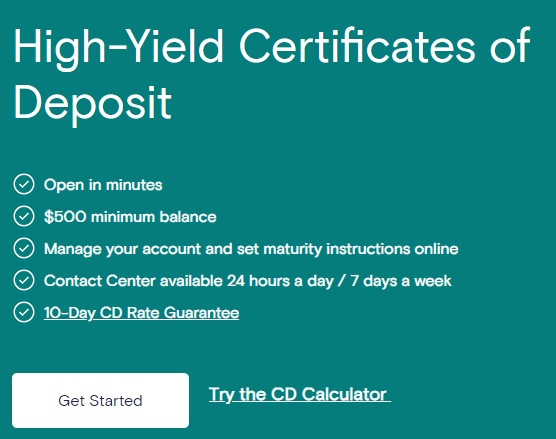

Goldman Sachs' Marcus offers a diverse range of products, one of which includes Certificates of Deposit (CDs) with a wide array of term options. Among the many online banks, Marcus stands out for providing some of the most competitive CD rates available.

Opening a CD account with Marcus is a swift process that can be completed within minutes. In this guide, we will take you through a step-by-step process of opening a Marcus CD account, accompanied by relevant screenshots to enhance your understanding.

1. Start Your CD Account Application On Marcus Website

To begin the process of opening a Marcus CD account, the first thing you need to do is go to the Marcus website.

Find the CD Account Section once you're on the Marcus website – this section is usually located on the homepage or can be found in the main menu.

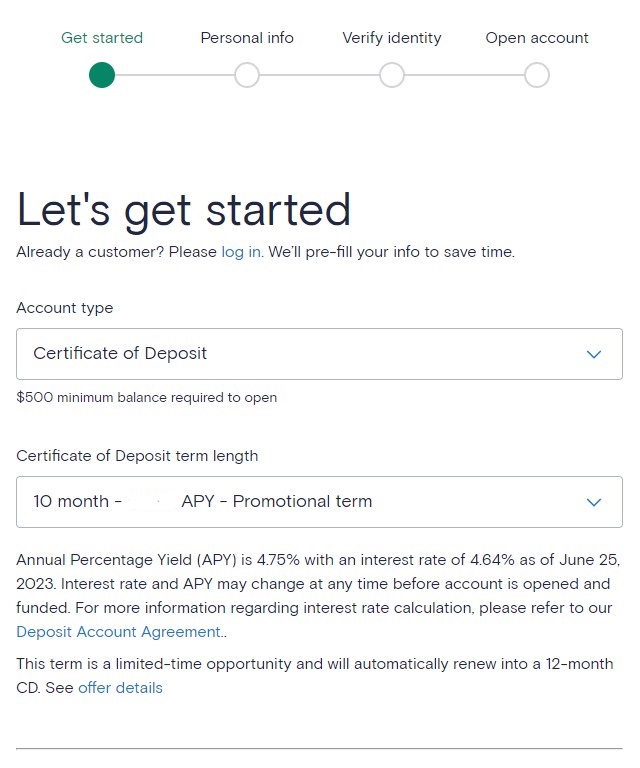

2. Choose CD Term

During this step, you'll have the opportunity to choose the term and rate for your Marcus CD account. The term refers to how long your money will be held in the CD before it reaches maturity.

Each term comes with its own interest rate, which can vary depending on market conditions and the rates currently offered by Marcus. It's important to consider your savings goals and timeline when deciding on the term for your CD account.

Marcus provides a variety of term options for their CD accounts, ranging from as short as 6 months to as long as 72 months (6 years). This flexibility allows you to select the term that best aligns with your financial goals and personal preferences for saving.

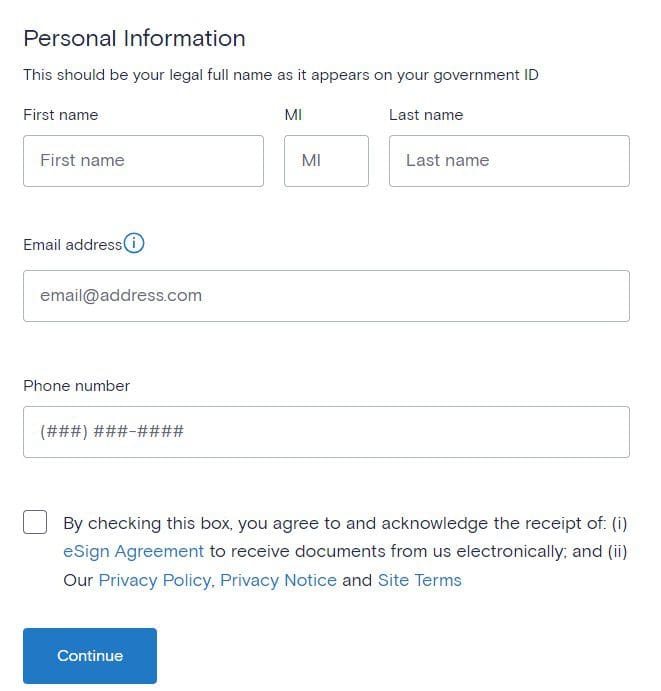

3. Add Personal Information

During this step, you will need to provide your personal information. This includes your full legal name as it appears on your government ID, first name, middle initial (if applicable), last name, email address, and phone number.

Additionally, there will be a checkbox that you need to check. By checking this box, you agree to and acknowledge that you have received and accepted eSign Agreement and Privacy Policy and Privacy Notice

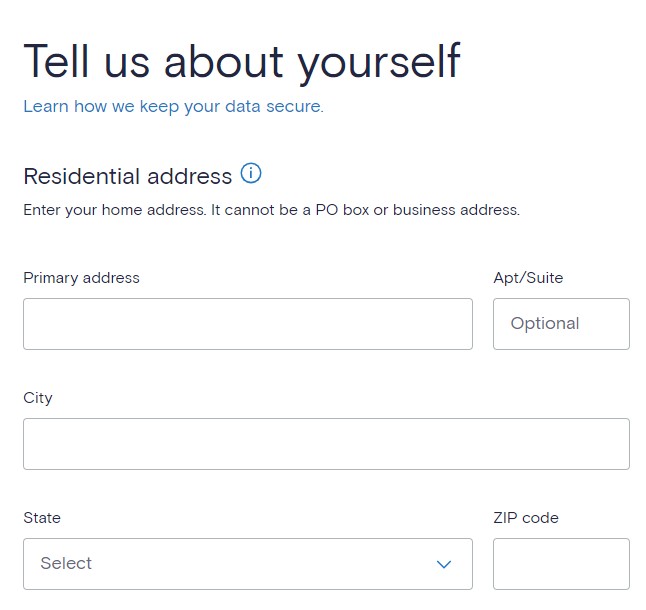

4. Add Contact Information

In this step, you will be asked to provide your contact information and residential address.

Residential Address: Enter your home address, excluding PO boxes or business addresses.

Primary Address: Provide additional details like apartment or suite number if applicable.

City: Input the name of the city where your residential address is located.

State: Select the state from the available options.

ZIP Code: Enter the ZIP code associated with your residential address.

By providing accurate information, you enable Marcus to communicate with you effectively and meet regulatory requirements.

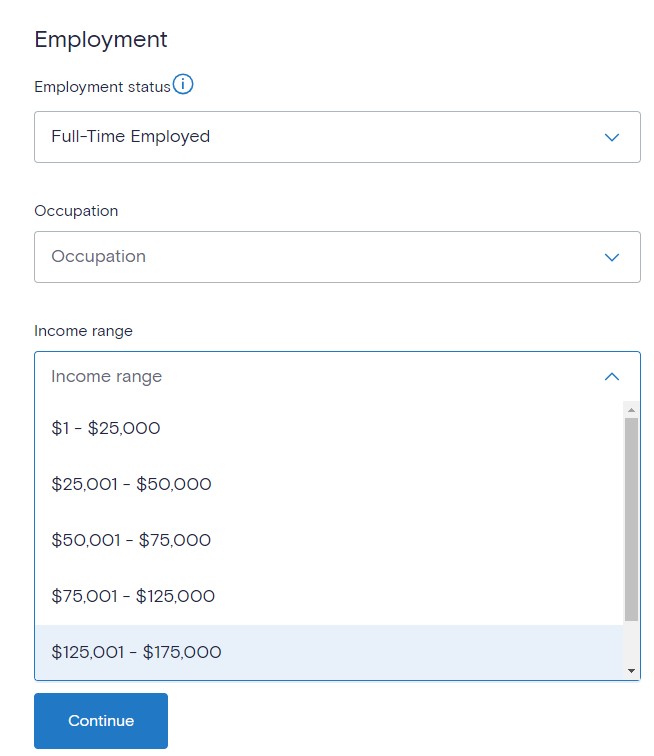

5. Add Employment Status And Income Range

During this step, Marcus will gather information about your employment details and give you the option to add a joint owner to your account.

- Employment Status: You will need to indicate your current employment status. This could be options like employed, self-employed, unemployed, or retired, among others.

- Occupation: Provide the details of your occupation or the type of work you are engaged in.

- Income Range: Select the income range that best corresponds to your annual income. This helps Marcus understand your financial situation.

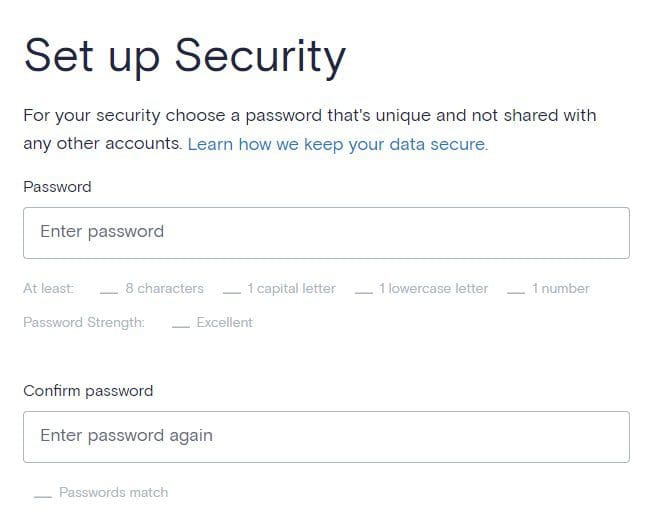

6. Set Up Security Passwords For Your CD Account

During this step, Marcus will guide you through setting up security passwords for your CD account. This ensures that your account remains protected from unauthorized access.

By setting up strong and unique passwords, you play an essential role in maintaining the security of your CD account and protecting your personal information from unauthorized access.

7. Approve Terms And Conditions

In this step, you will review and approve the Marcus CD terms and conditions before proceeding with your application. Here's what it entails:

Reviewing Terms and Conditions: You will be presented with the terms and conditions specific to the Marcus CD account. Take the time to read and understand the terms thoroughly.

Understanding Account Details: The terms and conditions will cover important information such as the interest rate, CD duration, early withdrawal penalties, account fees, and any other specific requirements or limitations related to the CD account.

Agreeing to Terms: To proceed with your application, you will need to indicate your approval and agreement with the Marcus CD terms and conditions. This confirms that you have read and understood the terms outlined.

Complying with Regulations: By approving the terms and conditions, you acknowledge your compliance with any applicable laws and regulations governing CD accounts.

It is crucial to carefully review the terms and conditions to ensure that you are comfortable with all aspects of the CD account before providing your approval.

Sign Up for

Our Newsletter

8. Fund Your CD Account

The final step, which can be completed even after opening the account, involves funding your Marcus CD account. Here are the available funding options:

Transfer from a linked external bank account: You can transfer money from a linked external bank account to your Marcus savings account.

Direct deposit: If you have a Marcus Online Savings Account, you can set up direct deposit, usually used for payroll.

Send a check by US mail: Deposit accounts can be funded by sending a check via US mail. However, cash deposits are not accepted as per the Deposit Account Agreement.

Send a domestic wire transfer from another bank: You can choose to send a domestic one to fund your Marcus savings account.

Should I Open Marcus CD Account?

Compared to traditional banks, Marcus offers highly competitive CD rates. Even their lower rate no penalty CDs provide rates significantly higher than what you would typically find at a traditional bank. When it comes to Marcus' standard CDs, the difference is even more pronounced.

When comparing Marcus CD rates with other online banks, the distinctions become less apparent. Marcus remains competitive within the online bank space, but there is a chance of finding better rates depending on the CD term. For example:

- Marcus vs. Discover: Which Offers Better CD Rates?

- Synchrony vs. Marcus: Which Offers Better CD Rates?

- Compare CD Rates: Capital One vs. Marcus

If you decide to withdraw your funds before the maturity date, there is a possibility of incurring an early withdrawal penalty. However, Marcus does offer no penalty CDs that have lower rates but provide the flexibility to withdraw your balance seven days or more after funding the CD.

The no penalty CDs from Marcus come in terms of 7, 11, and 13 months. If you haven't opted for a no penalty CD, there is a risk of facing a penalty of up to 365 days' worth of interest.

FAQs

What are my options when my CD matures?

When your CD matures, you have a 10-day grace period to decide what to do. You can withdraw the balance without penalties, renew the CD for the same term, or close it and open a new CD with a different term. If you don't take any action within the grace period, the CD will automatically renew for another term.

Can I add additional funds to a CD after it has been opened?

Yes, you have 30 days from the day you open your CD account to fully fund it. During this period, you can add more funds to your CD if you wish to do so.

What is the minimum deposit?

The minimum amount required to open a Marcus CD is $500.