Table Of Content

How Does Direct Deposit Work?

A direct deposit—AKA “direct credit”—is money that is electronically put into an account belonging either to a person or company. The person or company receiving the payment is called the “payee”. The person or company that performs it is usually called the “payer”.

Generally speaking, direct deposits are made to pay for services such as bills and taxes. In the case of businesses, they also employ direct deposits to their employees’ accounts to pay their salaries.

Regarding the way in which the direct deposit works, here is how: The payer uses referential information of the payee such as the account number, the bank routing number, or other relevant information from the payee that enables the payer to make a direct deposit.

This deposit modality has become the standard practice in many situations due to its convenience and practicality. More and more people are making direct deposits by the day.

What Do You Need to Set Up Direct Deposit?

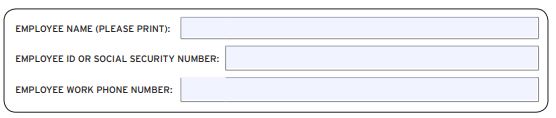

As a mere example, let us say you are an employer and need to pay a worker’s salary utilizing direct deposit. In this scenario, you require to fill in a direct deposit form.

Some of the requested information therein are their mailing address, bank routing number, and number and type of account. In some cases, the Social Security number might be requested as well. Yet, it is not as usual.

- The mailing address can be found on their bank’s website. You can also ask for it directly from your worker if needed.

- A routing number is a number of nine digits that the ABA provides. You might have to ask for this one as well.

- The account number is the one that follows the routing number on most checks. Most account numbers can be found in deposit slips.

- The type of account is a savings account most of the time, but you should double-check to avoid any further problems.

Here Are the Steps for Setting Up Direct Deposit

According to Intuit, whenever you need to set up a direct deposit, there are some steps you must follow in order not to make any mistakes, and to guarantee that the payee receives what is due in a timely manner.

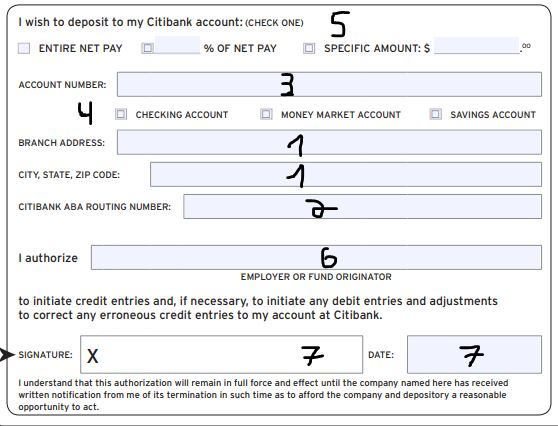

Here we will provide you with some insight on how to do it in a very straight-to-the-point and detailed way. We used Citi direct deposit form as an example.

These are the steps you should follow:

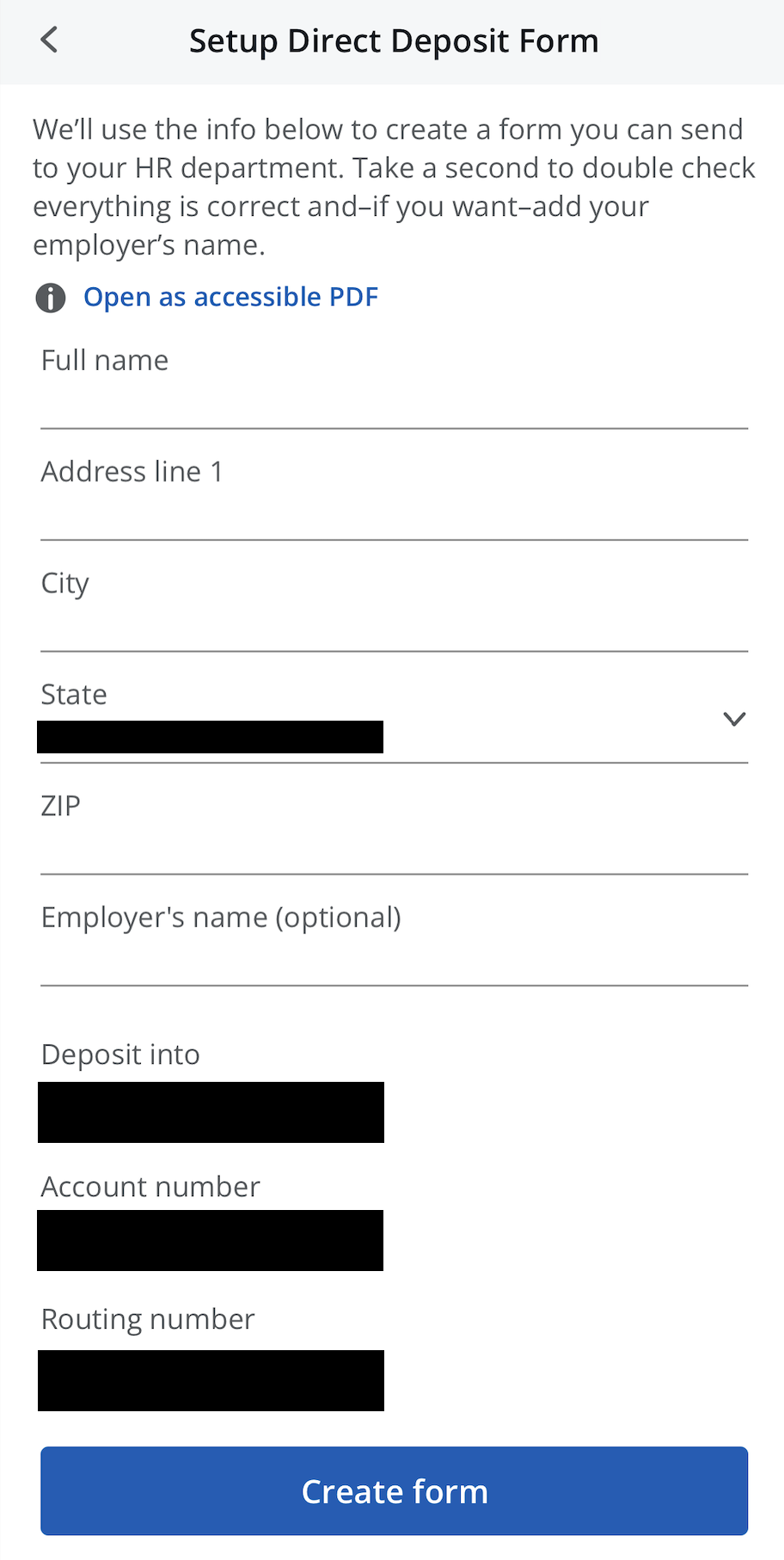

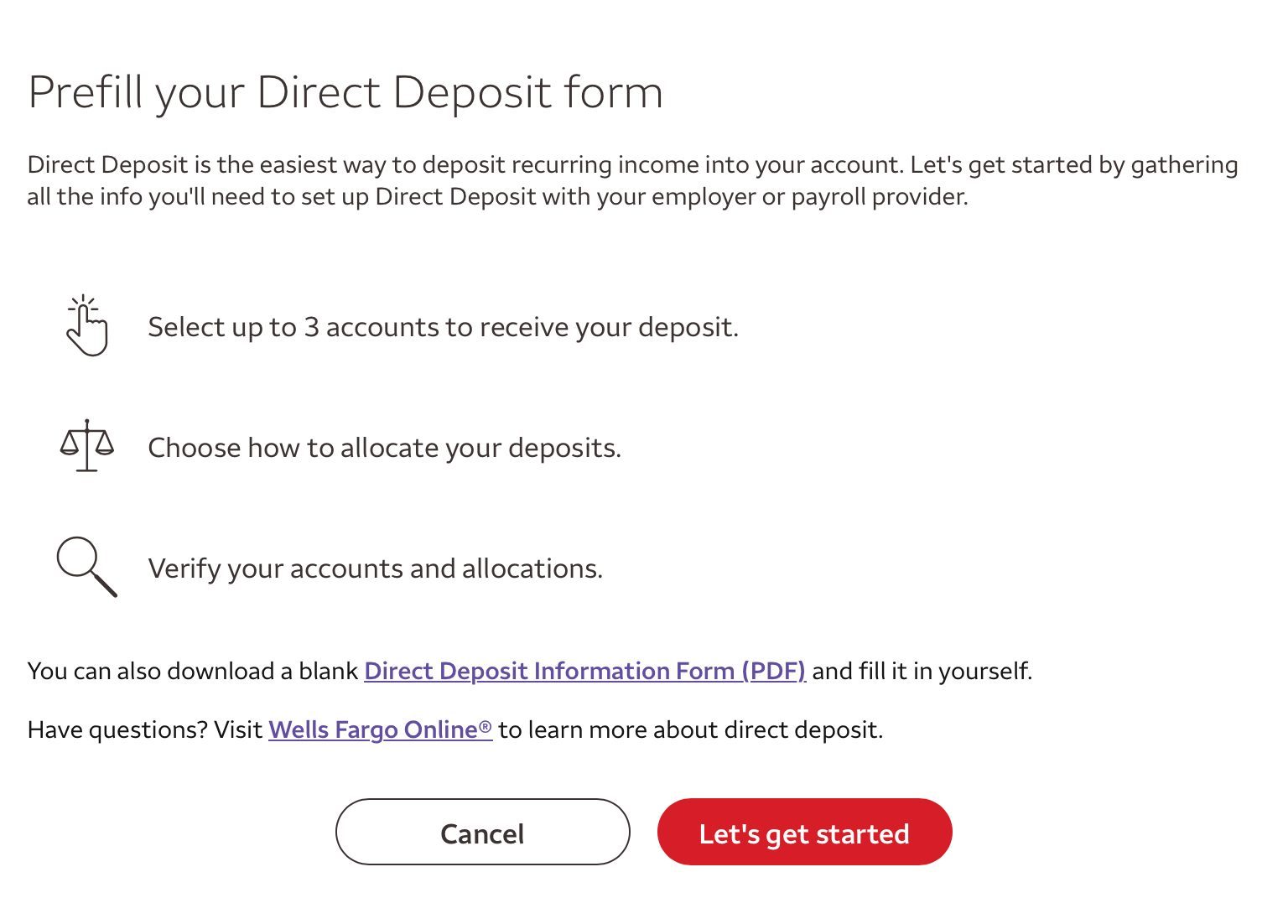

1. Download A Direct Deposit Authorization Form

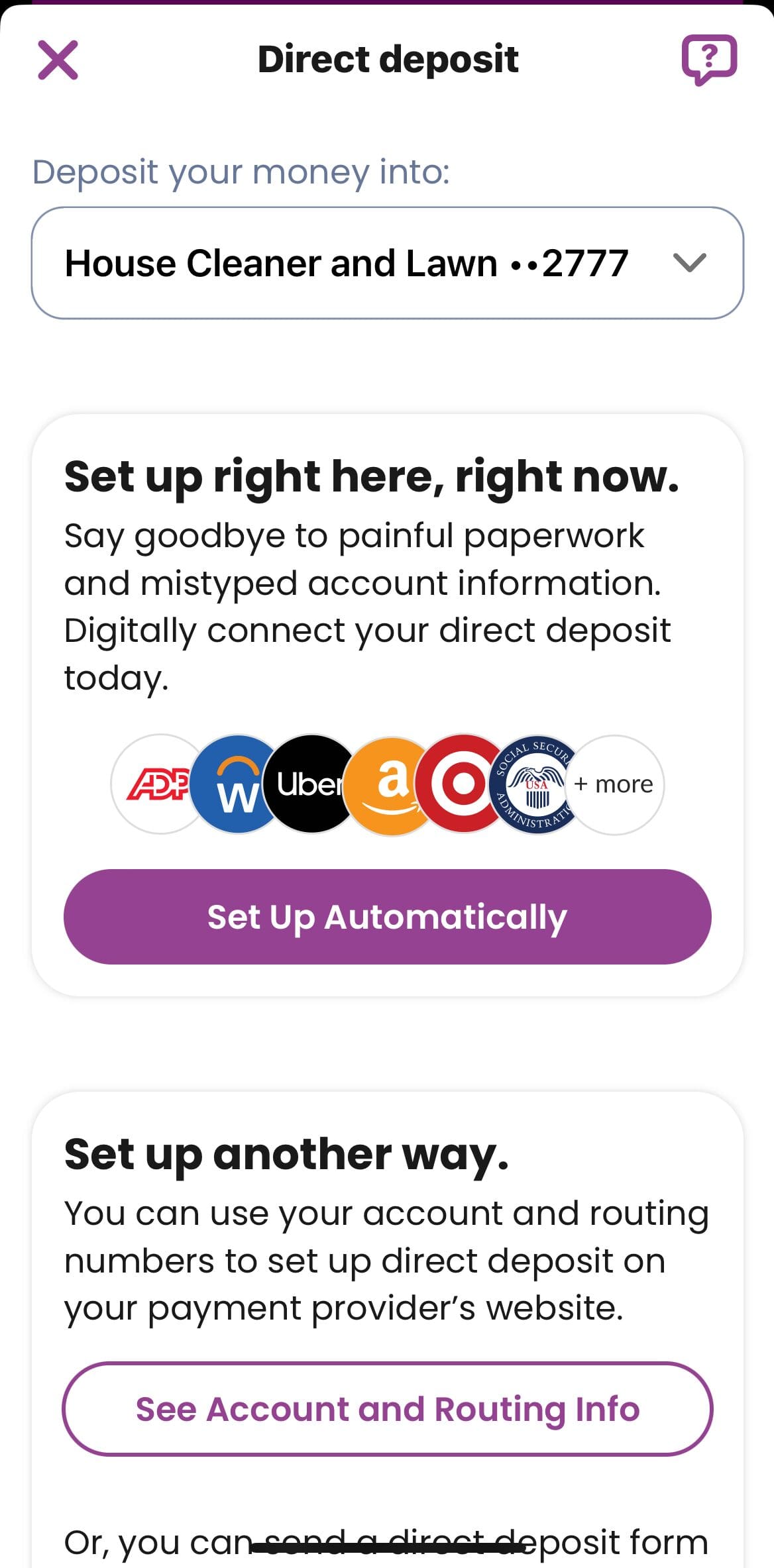

Whenever you want to receive a direct deposit from a third party, be it an employer, a friend, or some other bank user, you must fill in a direct deposit authorization form.

Direct deposit authorization forms can be found online, or you can also encounter them in printed versions. It basically allows this third party to send money to your bank account.

There are also several cases where either part does not have one, or you are simply transferring your funds from one account to another one. For this instance, you can also request your bank of interest for this form

2. Add Your Personal Details

You'll need to provide your personal details, including SSN. The Social Security Number is given by the IRS—the Internal Revenue Service, or tax collecting federal agency in the US—to track down a person’s financial information.

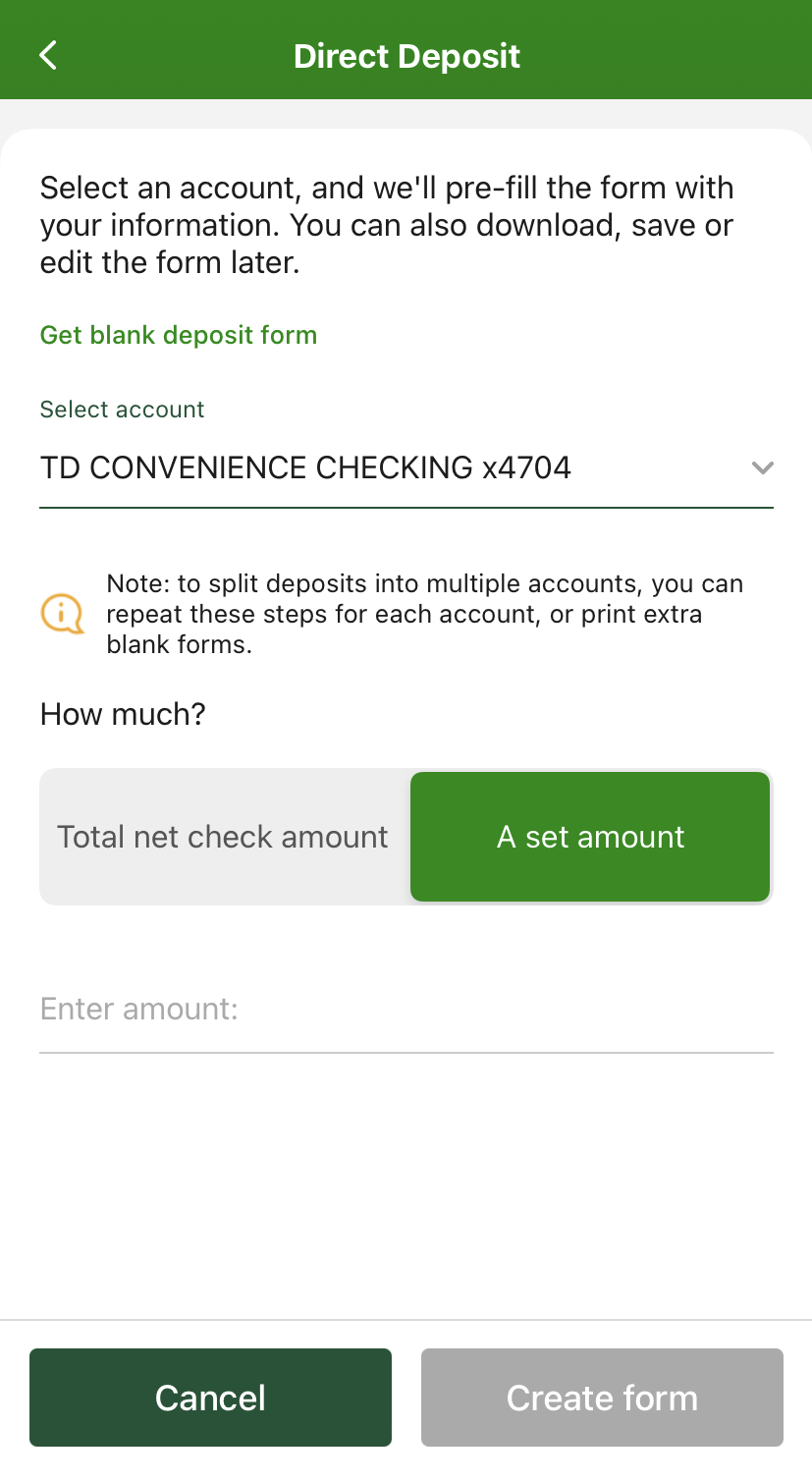

3. Add Bank Account Details And Amount

The form will be no good if you do not fulfill it with the pertinent data. You have got to validate the data so as to heighten security levels. All banks do this to avoid user problems and it is the standard procedure.

However, this information is easy to find. Some of the data you need to fill in are the ones that follow:

- Mailing Address of your bank of choice: This is the address where the bank carries out its operations. It is mostly found on your bank statement, or on their website. Furthermore, they may also ask for the bank address of the individual or the company you will be carrying out direct deposits with.

- Routing Number: This ABA-issued nine-digit number is usually located at the lower left bottom of checks. If you do not have a check at hand, you can also contact your bank and they will provide it to you. Oftentimes, you can see it on most bank statements as well.

- Account number: You can trace your account number in several places. From deposit slips to your bank statement, your account number is one of the easiest information items you can find.

- Type of account: They are generally checking accounts or savings accounts. If you hold more than one single type of account with a bank, you want to specify where you want to receive your deposit. Most people use their savings accounts for deposits.

- Amount: The highly beneficial aspect of direct deposits is that you do not require to receive the total amount in one single account. This is according to your personal preference and saving habits and you can diversify it through several accounts.

- Employer : Add your employer's name.

- Signature + Date: fill the current date and sign.

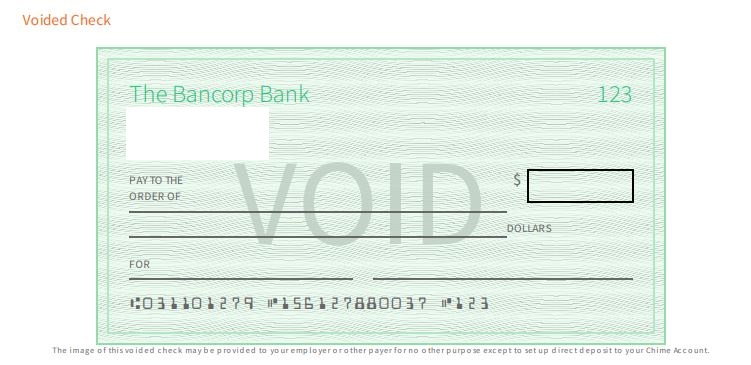

4. Consider Placing a Voided Check

A voided check is an empty check many bank organizations and financial institutions request to verify data. Sometimes, a simple deposit slip is sufficient for this. You can either send a physical check, or you can just send an online copy by utilizing a scanned check.

One caveat: Provided you decide to send it in a physical format, double-check to write the word “void” in the blank part so that nobody can withdraw money with it. All you have to do with this check is to attach it to the direct deposit form you have just filled out.

5. Send the Form!

Congratulations! This is the last step you have to take to set up direct deposit for your bank account—or accounts, as long as you decide to split the deposit.

You ought to send this form to the institution where you are going to deposit your funds. Nevertheless, it can sometimes take a couple—usually not more than one or two—of payment cycles to begin.

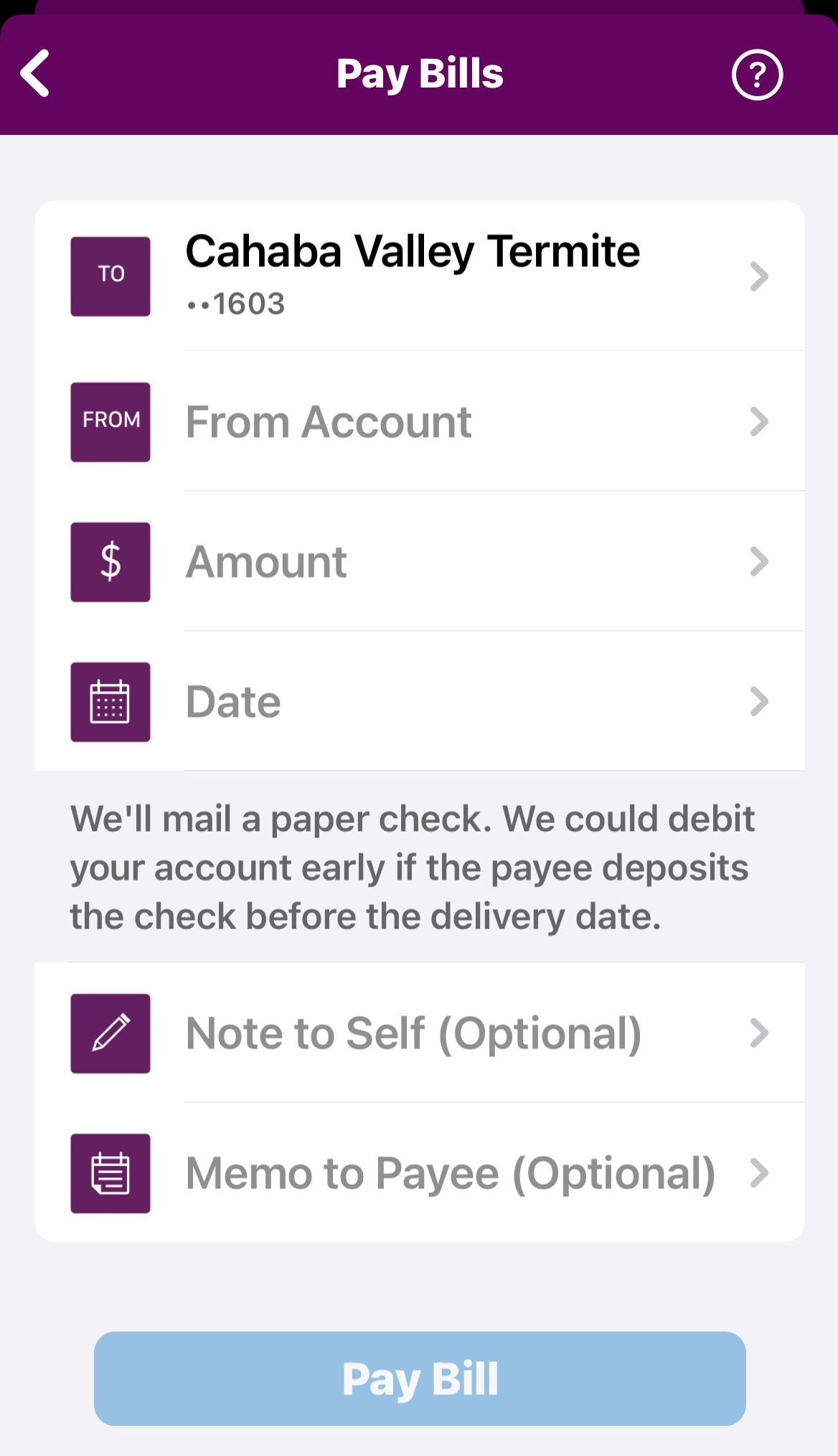

When it ensues, you can schedule payments for your bills automatically, so that you do not have to worry about paying the bills manually.

Something to note is that you should still track any transactions done, as some hidden banking fees sometimes surface when receiving direct deposits.

Direct Deposit Authorization Form Tips

At first, confecting a direct deposit form is a daunting process to many mortals, but you should have some tips in mind so that the process becomes easier. Once you become accustomed to it, this errand shall become as difficult as walking in the park:

- Read the form completely before writing down any information.

- Create a checklist of all the items you must fill in before sending it out.

- Gather all the information you believe is necessary, even if later on it is rendered superfluous.

- Keep the information secure and at hand before you dispatch it.

- Since it is a process that usually entails from one to two payment cycles, it is a sage idea to periodically monitor your request to assure that it has been properly issued and that upon completion you will receive your payments accordingly.

- If you are filling in a paper form, make sure to utilize both good, readable ink and an intelligible font.

- Make sure to complete the form in a safe and calm environment, free of distractions and hazards.

- You have to remember at all times that you are handling delicate information, both from yourself and third parties. Proceed discretely.

Who Uses Direct Deposits And What Are the Benefits?

In general, most of the bank users that make use of direct deposits are employers and employees, but the reality is that virtually anyone who possesses a bank account and wants to receive payments directly to their accounts can utilize it.

Direct deposit is a tool that enables you to receive any type of payment—it can be a one-time payment as well—in your account, regardless of the context. All you need is to fill out the form with the data, and send it out.

Some of the perks of direct deposits are these:

- They Are a Great Way to Keep Your Money Guarded

Most banks bestow users with FDIC (Federal Deposit Insurance Corporation) protection for their funds. The FDIC is in charge of insuring money allocated in banks. As per the official FDIC website, their mission is to spread stability and confidence among nationwide bank users.

In this way, you have another incentive for seizing all of the benefits direct deposits have to offer.

- You Can Budget Better

We acknowledge how difficult it can be to control your finances in a risk-averse way. Sometimes, something even as simple as paying a bill before its due date can pose a problem. With direct deposits, you can systematize payments better.

As soon as the direct deposit impacts your bank account, you can program it to make automated payments. These are some of the bills you can pay automatically:

- Car insurance

- Rent

- Phone company bills

- Many other utility bills too!

It also helps you save some money. It happens many times that you can feel tempted to spend more money than you should. Yet, you can also send part of the deposit to a savings account that prevents you from splurging money you intend to save for higher purposes.

- It Makes Paper Checks Obsolete

Long gone are the days of pen-and-paper checks. Not only have they been deemed obsolete by the current worldwide financial standards, and modern-day economic transaction status quo, but in addition by many other people and companies.

You can lose checks, you can forget them, or even have them stolen. You can let go of all of this with direct deposit.

Besides, any sensitive information that must be kept guarded will be much safer with direct deposits.

- You Save Time

You do not have to go to the bank, stand in endless lines, file complaints with managers due to subpar customer service at the bank, or have to switch ATMs because yours has a malfunction.

You can just cash in, and verify everything is in order with a couple of mouse clicks. So, not only your hard-earned capital is fiercely guarded by cutting-edge safety protocols, but so is your precious time.

- Convenience Is Granted

With direct deposits, you have all of the advantages that modern-day technologies provide. Provided that you have to print a paper copy of your check, all you have to do is log in to your online bank account, and print it out, making it easier to manage your account.

Furthermore, these transactions also make a presence on your bank statements, so that you can closely surveil your banking activity remotely.

As you can see, all the upsides of direct deposits are available at the palm of your hand for you to seize. Forget about the discomfort of cashing in checks at banks with direct deposits.

Direct Deposit vs. Wire Transfer

For starters, wire transfers are a form of transaction that is chiefly employed to deposit large sums of money to other accounts for single—and generally considerable—payments, and most of the time, they are meant to be forwarded overseas. Direct deposits tend to be ongoing throughout time, and they are mostly local transactions.

Regarding the currency, with wire transfers, you are able to send the money in one type of currency and have the payee receive it in their local currency. With direct deposits, you can only collect your income in your local currency.

The time factor is also to be considered, as wire transfers are almost instantaneous, whereas direct deposits can take longer.

For wire transfers, you may also require the SWIFT and IBAN codes. As every banking entity varies, the information you must provide for wire transfers may vary from country to country.

ACH vs. Direct Deposit

An ACH deposit is a deposit performed under a service named the Automated Clearing House. They are administrated by NACHA. This organization, previously known as the National Automated Clearing House Association, was founded in 1974 with the aim of overall ameliorating the US banking system.

The ACH network is a fee-free form of payment that encompasses many ways of paying, from direct payments to direct deposits.

From this, you can deduct that direct deposits are a payment mode that is overseen by the ACH, with active involvement on their part. In addition, the ACH is also in charge of other credit and debit transactions in the US.

Check vs. Direct Deposit

As stated by NACHA, 93% of Americans get paid by ACH network direct deposits, while only a meager 7% is still being paid in paper checks. This can only mean one thing: American check payment system users are decreasing consistently.

With direct deposits, you have got little to no fees to pay to grab a hold of your own money. Whenever you cash checks, you have to pay fees, as the vast majority of check cashing services that provide the service charge the payees for this matter.

Moreover, you have full availability of your funds the day the direct deposit enters your account. With checks, you do not have this possibility.

How Long Does Direct Deposit Take?

Direct deposit can take from one to three business days to arrive in your account. So, many factors influence the promptness of the transaction.

For instance, if the direct deposit is done on a Friday, you may receive your payment on the next Monday. But, since it can take two more business days, you may wind up getting it on a Wednesday.

The best course of action for direct deposits is to talk with your payer to decide upon the date of the transaction in order to avoid any inconveniences that may ensue from direct deposit.

FAQs

Banking services are diverse, so your best bet is to talk with a customer service representative to check if your bank offers early direct deposit.

Many banks offer this form of service while many others do not, so choose your bank wisely if you intend to use this function.

Direct deposits take from one to three business days to be completed.

If more than three business days have passed by, it is advisable to contact both your banking entity and your payer to assess any possible irregularities in data and bank services respectively.

You can get a direct deposit form from your banking institution, or you can also request one from your payer.

Broadly speaking, in the context of salary payments, many employers offer direct deposit forms to simplify the matter for their employees.

When you get direct deposited, the information for the transaction is registered on your bank account. You can access your bank statement to corroborate that you have been direct deposited.

You can get a stub from your payer, who should send you a copy of it.

This greatly depends on your bank’s processing times, as well as those of the ACH. In general, databases are updated around midnight, but you should always bear in mind the typical amount of days it takes to hit.

You should contact your bank account institution of choice to gather further information about this situation.

For the most part, direct service is a free-of-charge service for the payee. However, setting up direct deposit for the first time can cost from $50 to $149 for the payer, plus $1.50 to $1.90 per transaction.

If you are the payee, you should get in touch with your bank to double-check that there are no hidden fees.

Lottery winnings can effectively be direct deposited, but it varies from state to state. For example, the State of California does not permit direct deposit of any lottery winnings.

Given that the FDIC only covers up to $250,000 in your account, you ought to consider splitting your winnings between several accounts under the assumption that you can direct deposit them.