Table Of Content

The banking industry is undergoing a significant transformation. The days of conducting all your banking at an actual bank branch are long gone.

For a long time, customers only had one option for banking: traditional banking. Due to the rise of online banks, all you need to do your banking is a device with an internet connection.

Read on to learn the critical differences between traditional banks and online banks.

Traditional Banks vs Online Banks: Key Differences

Knowing the key differences is essential when choosing between traditional and online banks. Knowing about them will help you decide which one is best for you.

1. Interest Rates

If you want to protect your money from inflation, opening a savings account when an interest rate increases can be a smart choice in inflation times.

Traditional banks generally don't offer rates that are as competitive as online banks. They need specialized buildings and cutting-edge technology to keep your money safe. They are in business to make money, not just to store yours. That means the fees go up when the bank's costs go up.

Most of the time, the interest rates at online banks are better. They do not always have the costs that traditional banks do, like buildings so that they can give the customer more savings. Some online banks offer up to Up to 5.02% APY, which is way better than traditional banks.

Bank/institution | APY Savings | APY CDs | Type | |

|---|---|---|---|---|

| Chase Bank | 0.01% | 0.02% – 3.80%

| Traditional Bank |

| Discover Bank | 3.50% | 2.00% – 4.00%

| Online Bank |

| SoFi Bank | up to 4.50%

| / | Online Bank |

| Citibank | 0.03% – 1.18%

| 0.05% – 4.00%

| Traditional Bank |

| Marcus | 3.65% | 3.85% – 4.25%

| Online Banking |

2. Personal Service

Employees may assist you in setting up financial products such as loans and credit cards and explain how they function. Traditional banks are clearly to your advantage if you desire a more personalized banking experience. Because conventional banks have bank branches, so they will also provide ATM access through their network.

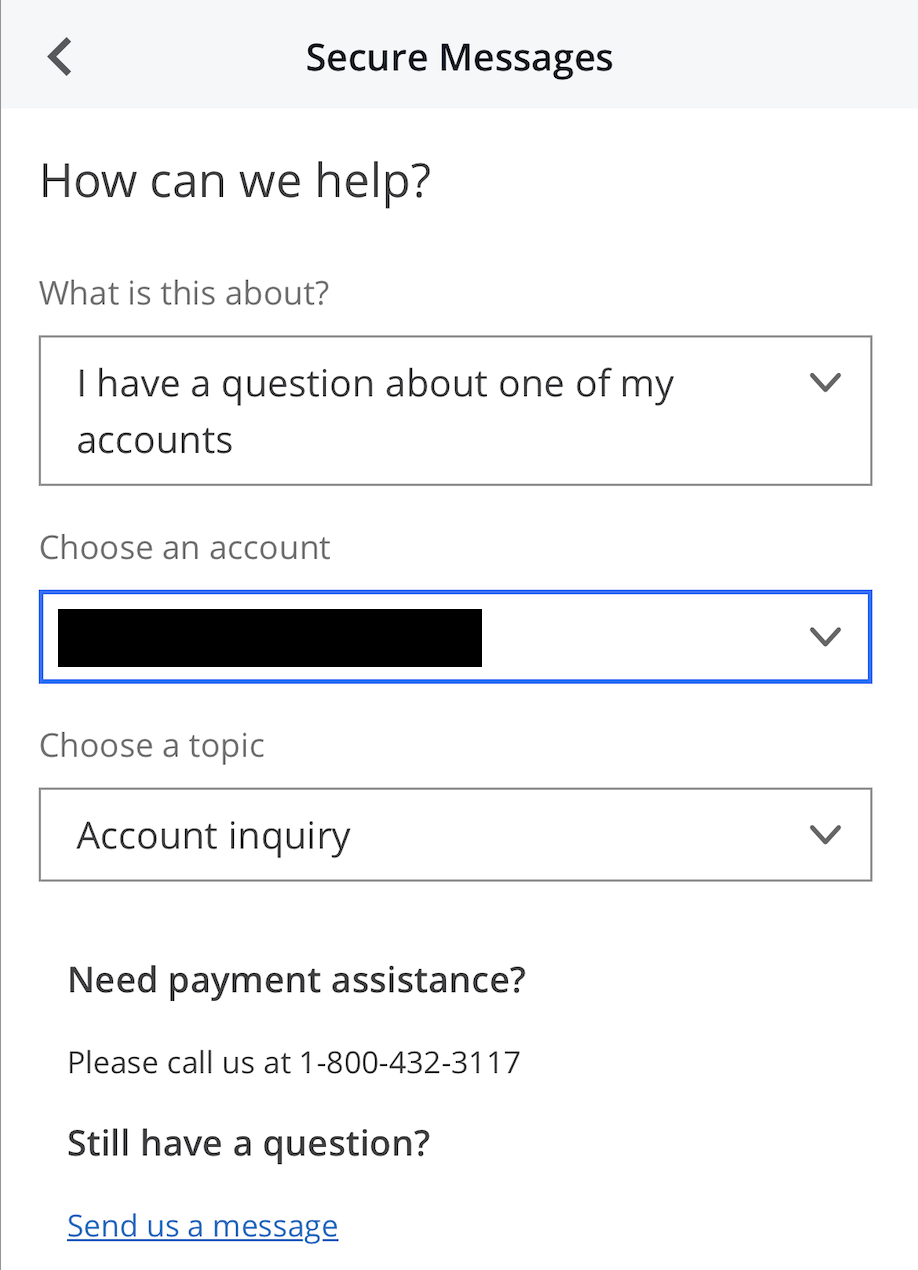

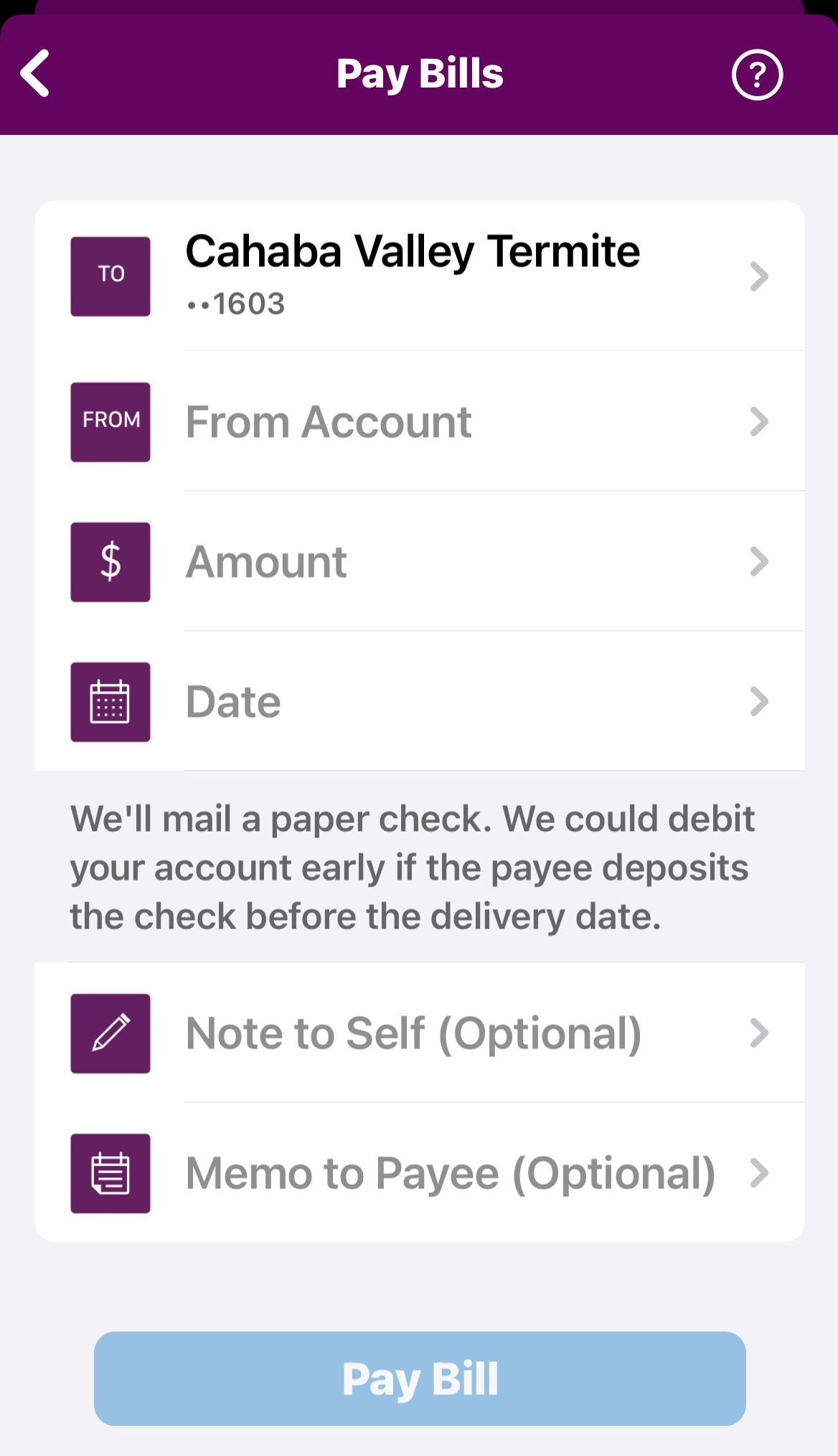

Because of the 24/7 availability of internet banking, online bank customers have the freedom to manage their finances whenever and wherever they want. In addition, mobile banking applications allow you to check your balance, pay bills, set up recurring payments, and get support.

3. Variety Of Products

Traditional banks' services and products include money market accounts, certificates of deposit (CDs), mortgages, vehicle loans, personal loans, and investment choices.

It's possible that some online-only banks don't provide the full range of banking services that brick-and-mortar establishments offer, such as checking, savings, insurance, and investment accounts.

Dedicated customers of traditional banks may be eligible for perks like lower interest rates and free investment advice.

4. Fees

A checking account at a conventional bank may cost you $10 to $15 each month. Minimum balance costs, direct deposit fees, late fees, over-limit fines, check fees, and debit card fees are typical charges by traditional banks.

The vast overhead expenses of traditional banks are the root cause of their high fees and poor interest rates.

With online banks, keeping a low balance, making direct deposits, and using a check or debit card to make payments are all things that are less likely to incur costs while banking online.

Most internet banking accounts do not require a minimum balance and don't charge any monthly maintenance fees. Therefore, you can open multiple checking accounts.

Bank/institution | Monthly Fee | Type | |

|---|---|---|---|

| Wells Fargo Everyday Checking | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| Traditional Bank |

| Bank Of America Advantage Banking | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| Traditional Bank |

| Capital One 360 Checking | $0 | Online Bank |

| Ally Interest Checking Account | $0 | Online Bank |

| Amex Rewards Checking | $0 | Online Bank |

| Chase Total Checking | $12 ($15, effective 8/24/2025)

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| Traditional Bank |

5. Convenience

Customers today are used to digital experiences that are quick and easy to use. For example, before an account or loan can be opened at a traditional bank, the customer must come to the branch in person and give the bank a lot of paperwork. That is not convenient at all.

One of the best things about online banks is that they are easy to use. You can bank just about anywhere and at any time.

If you have an account at an online-only bank, you can do business any day, any time, and from anywhere if you have a computer or other digital device. You don't have to go to the bank.

When To Consider An Online Bank?

Opening an online bank account can be relevant in some cases, here are the main of them:

- You want lower fees: Account costs at online-only banks are frequently softer than those at traditional banks. Most digital banks, for example, do not impose a monthly account maintenance fee, but many conventional banks do.

- You Prefer to Communicate Online – If you are the kind of person who hates visiting banks, online banking is an excellent option for you. Mobile banking features allow you to perform tasks such as setting up recurring transfers, scheduling bill payments, and checking account balances. If you want your work done online, go to The convenience of internet banking: accounts may be accessed at any time, from any location.

- You need a savings account: The interest rate on checking and savings accounts is often higher at online-only banks than at traditional banks. To earn more on your savings, you should use online banking, as some offer interest rates of up to 4%.

- You Live Online: On your computer or mobile device, you may access your bank accounts and bank services whenever there is an internet connection. Additionally, you may call customer assistance, sometimes 24 hours a day, seven days a week.

When To Consider An Online Bank? | When To Consider A Traditional Bank? |

|---|---|

You want lower fees | When you want more options |

You Prefer to Communicate Online | Cash deposit |

You need a savings account | Extra security |

You Live Online | You Need Personal Banking |

When To Consider A Traditional Bank?

Opening a traditional bank account can be relevant in some cases, here are the main of them:

- When you want more options: Most critical financial institutions may offer all these services in one location, whether you desire personal savings or checking account, trust fund, certificate of deposit, Roth IRA, or corporate checking understanding. Many traditional banks offer wealth management and investing services, too.

- Cash deposit: Despite all of the advances in fintech, the business still needs to deal with a traditional type of currency: cash. A conventional bank is an appealing and convenient alternative for banking consumers who often deal with money.

- Extra security: Another advantage of using a traditional bank is the availability of safe deposit boxes. Internet banking is not for you if you have essential items, such as jewelry or papers, that you wish to keep in a secure location.

- You Need Personal Banking: You do not need to be technologically adept. A traditional bank does not need consumers to have a digital device, such as a smartphone or personal computer, or the skills to use it correctly and responsibly. A typical bank customer may stroll into a branch and chat with a banker about their needs.

Traditional vs Online Banks: Which Is Best For You?

Your banking demands, tastes, and financial constraints will strongly influence whether you choose an online or traditional bank. Online banking could be the best option for the independent, low-cost road, while traditional banks might be a better choice for the expensive but feature-rich approach.

Here are some questions which will help you determine which is best for you:

- Do You Need A Personal Service?

Online banks lack physical branches; thus, they cannot offer in-person client support. To receive assistance with your banking requirements, you can end up speaking to someone on the phone via live chat.

You may talk with a banker in person during regular business hours since traditional banks do retain branches. If you are looking for an in-person service, you may go with a conventional bank.

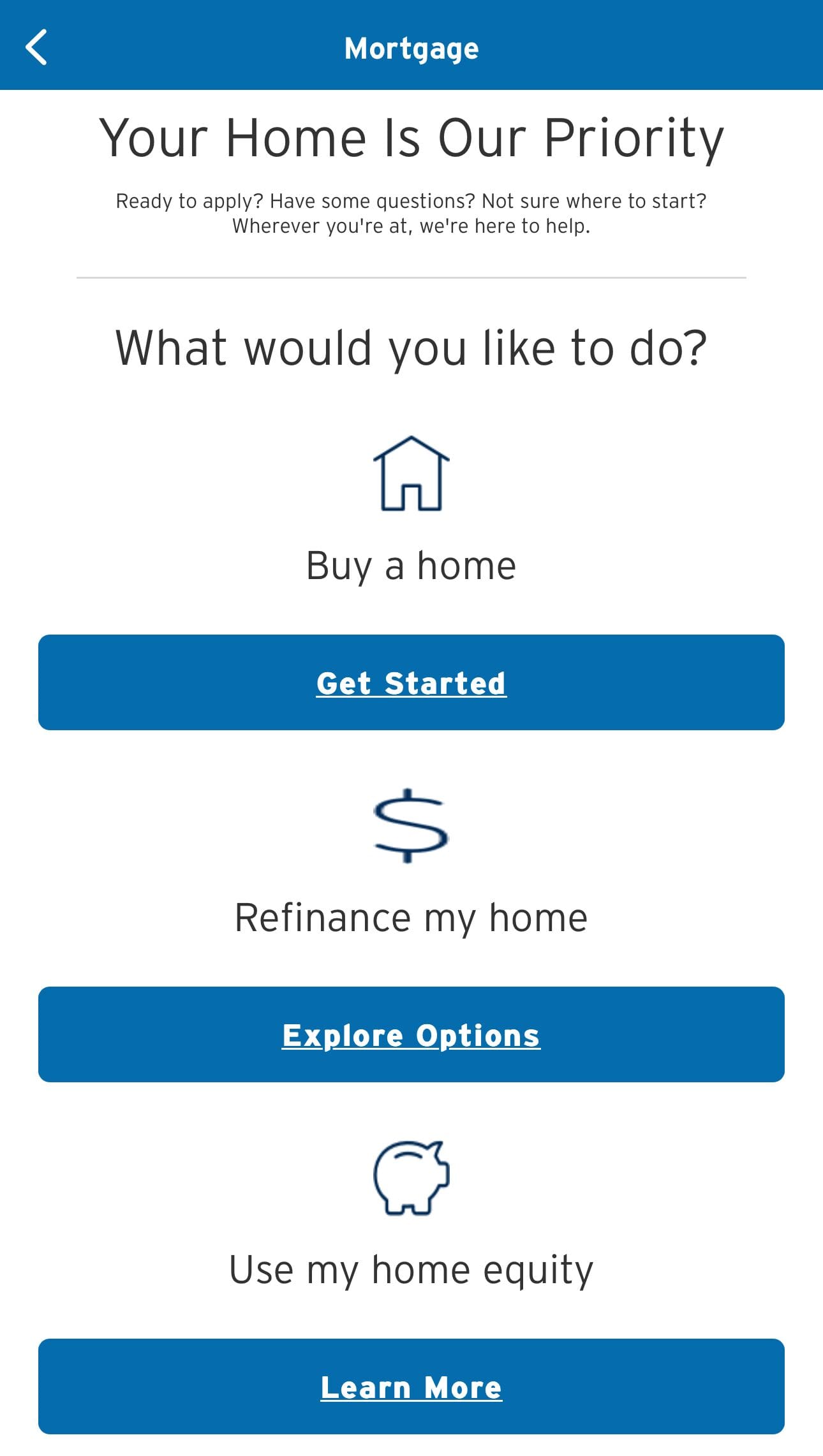

- Are You Looking To Get A Mortgage?

Traditional banks offer a variety of mortgage products and can provide you with a lot of education and help during the process. Traditional banks are helpful for homebuyers who desire a recognizable name and don't mind lengthy processing times.

Online companies for mortgages and refinancing offer ease of use and automation. Sometimes, they can save you money. And if you want to see a friendly face before you close a deal, online mortgage lenders and banks can often do that too.

- Do You Intend To Use It Mainly For Deposits?

While depositing a check into an online bank account is relatively simple, doing so with cash is more complicated. Since digital banks often don't have physical locations, you'll probably need to locate an ATM that takes deposits.

The money may also need to be deposited into a regular bank account before being transferred to your online bank account. If you work with traditional banking, you generally won't have the same difficulties.

- Do You Need A Variety Of Accounts And Products?

Traditional banks often provide a greater variety of accounts and goods than their digital competitors. Typically, a conventional bank can provide safe deposit boxes and check-writing rights, among other services.

It is possible that an online bank does not offer these and other possibilities.

- Do You Need No-cost Access to ATMs?

Traditional banks, huge ones, can provide free usage of ATMs in their network, whether you need to withdraw or deposit cash to your bank ATM. The amount to which conventional bank clients profit from this is determined by the size of their bank's ATM network.

However, whether large or small, many customers appreciate not having to pay a fee – often as much as 2% or 3% of the amount taken – every time they want tiny quantities of cash.

FAQs

You can open a bank account online, or visit a branch. If you visit a branch, make sure to bring all the relevant documents needed.

It is simple to open an online bank account. You only need to give the necessary information and papers.

Some bank accounts have a zero-balance requirement, but others require you always to keep a certain amount in your account.

Online banks provide better savings rates.

While most traditional banks are now offering savings rates that are far lower than those provided by online banks.

Another advantage of banking online is that you may be able to save more money on bank fees. With a traditional bank, you may be charged a variety of prices.

Online banks provide customer support by phone, email, or online chat. Now that internet connection is generally available; mobile banking is becoming increasingly popular. It is also possible to accomplish it on a desktop computer.