Table Of Content

For most of us, it’s necessary to resort to cash to pay a friend part of a takeout bill or to cover a share of the groceries. Maybe you need to send money to a family member or friend or to pay the babysitter for their services?

Handling these trivial amounts of money with physical cash is not always convenient. With Zelle, you can transfer money to anyone quickly and securely without resorting to cash. However, there are limitations on how much you can transfer each day and each month.

How Does Zelle Work?

Zelle Pay is a mobile payment application and you can use it to make peer-to-peer (P2P) money transfers. This simplifies the payment for goods and services and it’s easier to move funds around without visiting the bank or handling cash.

When money is transferred with Zelle, it’s sent directly from one bank account to the other. This is very different from the way that Venmo operates:

Faster And Free

Most bank account transfers can take several days, and they use account numbers to make the transactions. Zelle makes this unnecessary, and the funds are transferred in most cases in just a few minutes.

Zelle Pay can facilitate faster payments between U.S. bank accounts using the Automated Clearing House (ACH) payment system. Although it is possible to use ACH to make a payment from your bank account to another, this can take up to three days! If you made the same transfer with Zelle the money would arrive at the desired destination in a fraction of the time.

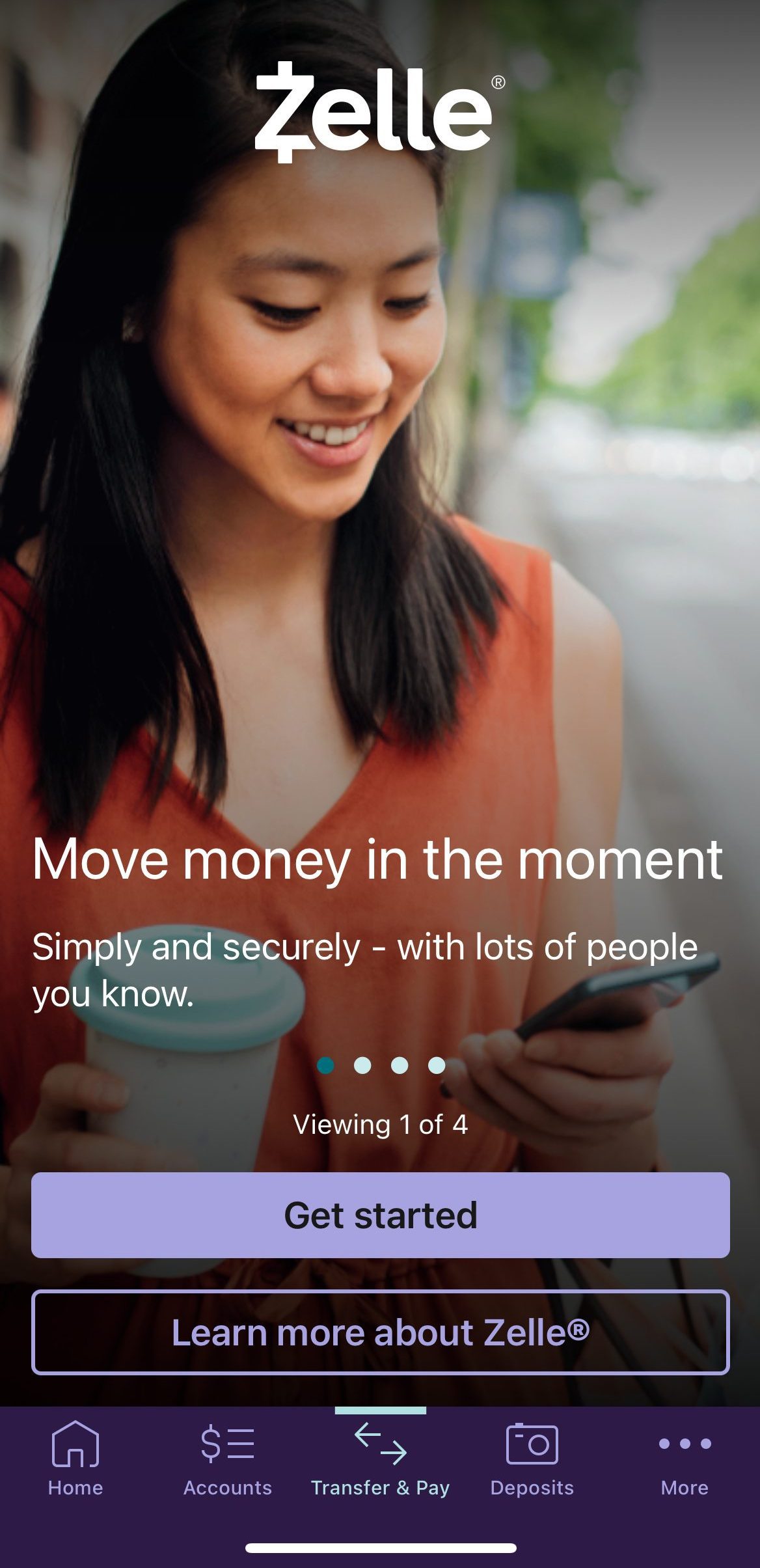

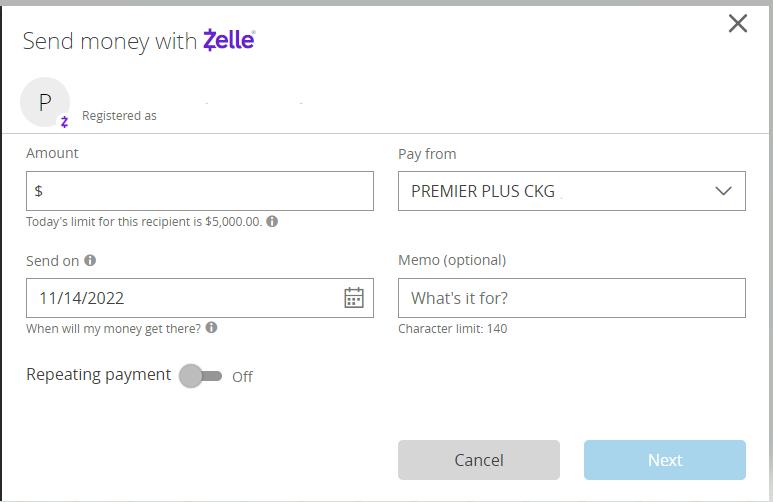

How to Make A Zelle Pay Transfer?

To make a Zelle Pay transfer, you need the phone number or email address of the person to that you want to send funds to. Zelle contacts the recipient with an email or text to inform them that there is a payment for them.

The recipient needs to activate a link to accept those funds from the sender. If the recipient uses a bank that is a participating partner, they can register for the Zelle service. Simply supply the phone number or email address to the bank’s website or mobile app, and the registration is complete.

After registration, the recipient can accept the funds that have been sent to them. But, a first time user may need to wait for up to three days before the payment can be accessed. If the recipient uses a bank that isn’t a participating member, they can still receive the funds using their email or phone number and the Zelle Pay mobile app or a debit card.

Zelle is compatible with most banks, and the service may be integrated into their mobile banking apps. The Zelle standalone app can be used with a Visa or Mastercard debit card to send money.

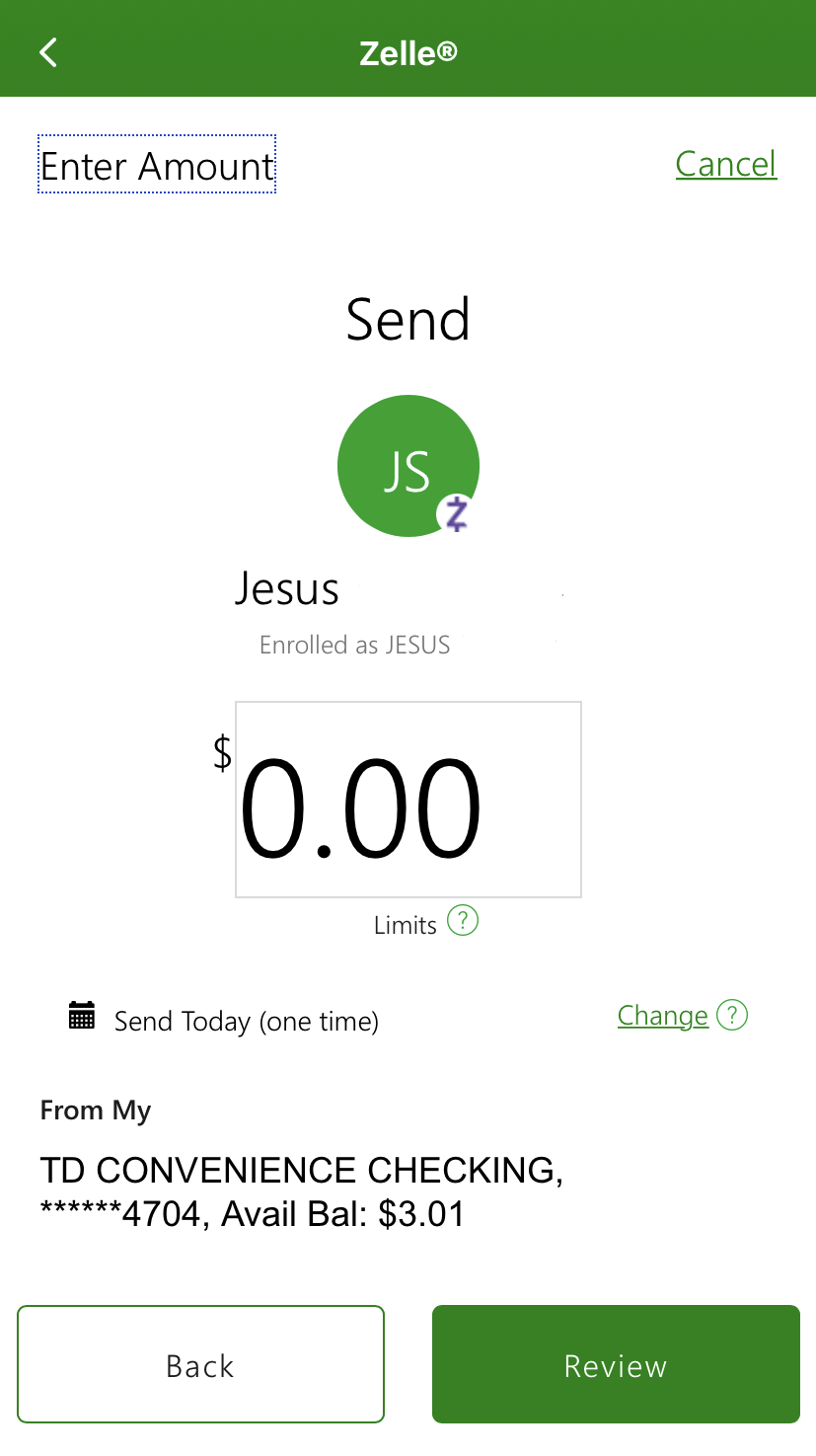

If your bank is already working with Zelle, the direction to the bank mobile app will be automatic if you have it downloaded on your device. Here's an Zelle transfer example from Chase bank:

What Is Zelle's Monthly And Daily Transfer Limit?

The Zelle Pay transfer limit will depend on the bank that you’re using to transfer the funds. If you’re using the Zelle standalone app, you’re limited to $500 per week.

Using Zelle with your bank will typically give you a higher limit, such as Chase Private Client, Citibank Citigold, Citi Priority, Citi Private Bank, Business Checking, and others, which have a $5,000 daily limit and a $10,000 monthly limit. Some major banks have lower daily limits set at $1,000 up to $2,500 per day such as PNC Bank and Bank of America respectively.

To use a Zelle transfer with a bank that has lower limits may necessitate a transfer over two or more days to complete. As long as you don’t exceed the weekly or monthly transfer limit, you’re good to go. Adopting these tactics to circumvent the restrictions can be annoying and time-consuming.

Why Do Banks Set Transfer Limits?

But, it’s important to remember that these limits are put in place to protect the security of your financial data. If you send the funds to the wrong person, it’s very difficult to get that money back.

Zelle Pay has sending limits to promote security, and the restrictions set on the amount of money that users can send are set with daily and monthly rolling limits.

If you’re receiving funds from Zelle, there are no limits to how much you can accept and the frequency of transfers.

Bank/institution | Daily Limit | Monthly Limit | |

|---|---|---|---|

| Bank of America | Up to $3,500 | Up to $20,000 |

| TD Bank | $1,000 – $2,500

| $5,000 – $10,000 |

| PNC Bank | Up to $1,000 | Up to $5,000 |

| Wells Fargo | Up to $3,500 | Up to $20,000 |

| Chase | Up to $2,000 | Up to $16,000 |

Capital One | Up to $2,500 | Unknown | |

Discover | Up to $600 | Unknown | |

| Ally | Up to $500 | Up to $10,000 |

Citi | $500 – $5,000 based on your account type | $5,000 – $20,000 based on your account type |

How To Check Zelle Limit?

If you know that your bank or credit union does offer Zelle within their mobile app, you can learn more about your sending limits within the bank mobile app or website.

If your preferred financial institution does not offer Zelle yet, you will have a weekly send limit capped at $500. There is no way to request an increase or decrease in this sending limit.

As we mentioned earlier, the amount that you can send will vary depending on the bank account that you want to use. Some other factors include the account type, the recipient, the payment history, and the online banking history.

Can You Use Zelle With Any Bank?

Zelle Pay has a standalone mobile app that you can download to your smartphone. The service was developed by more than thirty well known U.S. banks. Zelle is integrated into the mobile banking apps of many well known banks, including Chase, Bank of America, Wells Fargo, Citi, and many more. If you have the mobile app of a participating bank, you can use Zelle Pay right now.

At the time of writing, Zelle is included in more than a thousand mobile banking apps already. It’s easy to find Zelle in a participating banking app and if you’re not sure contact your bank or credit union for advice.

If your bank is partnered with Zelle, you can send and receive money immediately. If your bank is not a participant, you can download the standalone Zelle app and use that instead.

Can I Increase Zelle Limit?

One of the primary concerns for people using Zelle is how they raise their limit. Using the Zelle app without a bank gives the ability to accept up to the $500 per week limit. This can’t be raised or lowered, but if you’re using a banking mobile app that has a Zelle Pay integration you can rain the limit.

Simply contact your bank directly, they can assess your account status, and your spending habits to set a fairer limit for Zelle Pay. Let’s examine some of these criteria in more detail:

- Upgrade Your Bank Account

Upgrading your bank account is one of the best ways to raise the Zelle Pay spending limit. The banks that have ties to this P2P money transfer platform can raise the limit depending on the account that you have with them. A more basic account will have a lower spending limit and vice versa in most cases.

If you have a bank account that incurs a maintenance fee, it will tend to have a higher Zelle spending limit. A prime example: Basic Citibank account holders using Zelle have a $2,000 per day or $10,000 per month spending limit.

But, a Priority Citibank holder has a Zelle limit of around $5,000 per day or $15,000 per month. So, upgrading the bank account will raise the Zelle Pay account limit, but you need to speak to your bank to learn about the details.

The experiences of an individual customer will vary depending on their account history and other factors. If your bank will not let you upgrade your account at this time, you may want to consider moving to a different bank account with a higher Zelle spending limit.

- High Spend & Good Account History

A bank will look at a variety of factors to establish your Zelle Pay spending limit. This is done in a similar way to a credit card limit procedure and the bank will examine your account carefully before a final decision is reached.

Some key factors include

- Spending activity,

- Online banking history,

- Account history

- Zelle Pay recipients.

To get a fast raise on the spending limit, it’s essential to keep your bank account healthy. For up to date information on a spending limit increase, contact your bank directly.

- Use Your Account For A Long Time

Certain banks have a requirement that their customer accounts need to reach a certain age before a higher Zelle Pay limit is even considered.

The aforementioned Citibank account examples are for customer accounts that have been open for at least 90 days. If your account is younger than this, you will notice that the Zelle spending limit is much lower.

Many banks have a shorter waiting period to reach account maturity, and this will equate to a faster increase in Zelle spending limits. But, the banking industry standard is 90 days and in some cases, it may be as long as 120 days or more.

How To Get Around Zelle Limit ?

Dealing with spending limits can be a frustrating experience, and this is especially true if you only want to use Zelle Pay once to cover an unexpected situation. It’s natural to wonder if there is some way to speed up or circumvent the process.

Aside from the approach we’ve covered above, this is not possible and there is no way to speed up the waiting period. Until you’re eligible to spend again, you may have to wait, and direct contact with your bank cannot change this.

If you have hit your Zelle Pay limit and/or you want to use an alternative option, there are a few services and platforms to consider:

1. TransferWise

This is the best way to send international money transfers to a foreign bank account if you’re not using Zelle Pay.

TransferWise has a great mobile app, and the fees are low when compared to other options. There is a TransferWise Borderless account that allows users to hold and transact with multiple currencies at the same time.

With TransferWise you still have access to local banking services using USD, GBP, EUR, and AUD. A Borderless debit card is backed onto the multi-currency digital wallet and this allows you to spend different currencies with no monthly subscription fees.

At the time of writing, there is only one glaring omission, you cannot use TransferWise to send money to foreign mobile wallets.

2. WorldRemit

WorldRemit is probably the least expensive solution if you need cash pickup, mobile tops ups or if you have a foreign bill that you need to pay.

You can use Zelle Pay to send funds to people in the United States, but WorldRemit allows you to send funds overseas. The recipient must have a WorldRemit Digital Wallet, and you can send funds anywhere within the WorldRemit network.

You can also use WorldRemit to send money to in-country mobile wallets in Asia, Africa, and South America too. If you don’t want to send funds to a bank account, WorldRemit is a great alternative for Zelle international users.

3. PayPal

PayPal is probably the best option if you need to send funds to other PayPal users inside the United States. All you need is an email address, and there are protections in place to handle disputes that may arise from the purchase of goods or services.

It’s easy to connect a credit or debit card to a PayPal account, and you have a secure place to update your card details as needed.

But, Paypal is a bad option if you want to send money to overseas recipients with its 3% international transfer fees and currency conversion issues. PayPal has also fallen out of favor in recent months with some bizarre company behavior related to where you can spend money which has rankled the user base.

That aside, PayPal is very expensive if you want to send money abroad when it’s compared to TransferWise and WorldRemit.

4. Cash App

Cash App is available on Android and iOS devices, and there is a web-based platform to explore. The spending limits are set at $250 for unverified users over a week, and up to $1,000 can be received via Cash App every month. It's easy to understand how Cash App work, and that's what makes it so popular.

If you’re a verified user, this rises to $7,500 per week and there are no receipt limits in place. There is no fee for a personal transfer that’s funded by a debit card and credit card-funded transfers incur a 3% fee and a 1.5% fee is charged for a one-day withdrawal service.

Can I Get Paid With Zelle?

This is possible, but Zelle Pay may not be an option for an employer if they use a business bank account that doesn’t offer the service for commercial users. There are two main limitations:

- All banks operating within the Zelle network offer person-to-person (consumer) transfers, but they don’t all offer business-to-person (commercial/business) transfers.

- Zelle Pay will only work for a bank account based in the U.S. So if you’re working abroad or hiring and paying people in another nation, Zelle is not a viable option.

But, if you work as a freelancer and you have a bank account in the United States, you probably have the ability to use Zelle Pay. It isn't specifically designed for this purpose, but it is free to use and it can be linked to most bank accounts.

There are no transaction fees or transfers, and a bank deposit can take place in a few minutes. Simply sign up for Zelle Pay in your mobile banking app, and you’re ready to accept payments. The client only needs an email address or phone number to get started.

Is Zelle Safe?

Zelle Pay is considered to be a secure way to send money because no sensitive financial information is revealed during the process. A bank or credit union would have sufficient authentication, and they can monitor the transaction to ensure that you’re authorizing that transfer of funds.

Zelle is a fast service to use, it’s free and convenient, and it acts in a very similar way to handing someone physical cash. But, it’s important to understand that Zelle doesn’t have those payment protections that you have with debit or credit cards. So, there isn’t much protection from a fraudulent charge. This means that Zelle Pay should only be used to send funds to family, friends, and businesses that you know well.

Using Zelle to send large amounts of money to unknown people or to make online purchases is fraught with danger. Before you use Zelle, make sure you have the correct email address or mobile phone number to avoid problems. Even a simple typo can send those funds to the wrong person, and getting them back would be extremely difficult.

Zelle Scams: How to Protect Yourself?

There are four ways to protect yourself if you’re using Zelle Pay or any other P2P system:

- Limited Reversal Options: Consider all Zelle or P2P payments as cash. The transactions you make cannot be reversed easily, and no bank is going to refund the money that you lose. Double check the details of the recipient before you send any funds, and only deal with people you know and trust.

- Set a Strong Password: Use a strong password with 2-factor authentication via the mobile banking app. If you have to use a payment app, don’t skip the 2-factor authentication. The process takes longer, but it gives you an extra layer of protection.

- Don’t Self Transfer: Don’t send money to yourself because scammers can call or text Zelle users and impersonate their bank making claims that the account is compromised. If they get you on the phone, they may ask for personal details, and an attempt to reverse a transaction may be made to steal the funds.

- Act Quickly: If you are the victim of a scam, contact the bank or your credit union immediately. If an unauthorized payment has been made, you have legal rights and protections under the Electronic Funds Transfer Act. Before you start to use any service, read the user service agreement carefully and check with your preferred financial institution to understand what happens if fraud occurs.

FAQs

Yes, if you follow the advice in this article and restrict the use of Zelle Pay to people that you know and trust, this is a good option.

There are no fees to consider, the payment is virtually immediate for repeat users, and the spending limit thresholds are adequate for most people.

It is possible to use Zelle Pay without a bank, but the base limits are a hard ceiling, and there is no way to increase them.

If you’re sending money to an enrolled recipient with Zelle, they will have their funds in a few minutes, faster compared to regular wire transfers.

If the process takes longer than three days, it’s a good idea to check that your Zelle profile is fully enrolled and that the email address or phone number is correct.

If the recipient is not enrolled in Zelle, it is possible to cancel a transfer. View the transaction in the Zelle app; if it’s still “Pending,” a cancellation can be made.

The transaction disputing process can take up to ten business days to complete.

If you didn’t make the transaction or you don’t know who it is from on your account, this is likely to be a fraudulent transaction.

Most banks set the spending limit in line with the account type. So, a basic account will have a lower spending limit than a more advanced account.

If you have a bank account with a maintenance fee, it’s more likely that the spending limit will be much higher.

Unlike regular transfers between banks, Zelle doesn’t charge fees. As a comparison, both Cash App and Venmo do charge fees if you send money with a credit card and if the recipient wants to deposit those funds into a bank account.

Those fees may vary from 1.5% up to 3% which can make large fund transfers costly, and this is why Zelle may be a more attractive option.

Zelle Pay has a daily and weekly limit to consider when you want to send funds.

We covered this in detail earlier, upgrading your bank account or switching to a different bank may be the fastest way to raise your daily spending limit.

If your bank account is less than 90 days old, you may need to wait until it matures before you can request an upgrade. Check with your bank or credit union and they can offer more specific advice on your account.

At the time of writing, this would be the Bank of America with a daily spending limit of $2,500 per day and $20,000 per month.