Vanguard

Monthly Fee

Minimum Deposit

Our Rating

Vanguard Cash APY

-

Overview

- FAQ

While it is not the oldest brokerage brand, Vanguard has been operating since 1975. However, while decades of experience is a plus, what makes Vanguard stand apart is that it set out to distinguish itself well before online brokerages and low cost platforms.

Vanguard is also considered to be the founder of index funds and the concept of passive investment. Over almost half a century, Vanguard has pioneered a number of investment approaches, creating a more accessible option for those who lack the skills, experience and confidence for active investment.

Today, Vanguard is still a low cost platform for investors who are interested in long term wealth building. It offers “invest on your own” and robo advisor services, but how does it compare to other platforms in the marketplace?

What types of accounts does Vanguard offer?

Vanguard offers a range of accounts, including individual and joint brokerage accounts, IRAs (Traditional, Roth, SEP, and SIMPLE), 401(k) rollovers, college savings plans (529), and custodial accounts.

How can I open an account with Vanguard?

You can open an account online by visiting Vanguard's website. The process typically involves providing personal information, selecting the type of account, and funding it through a bank transfer.

Which Investing Options Can I buy through Vanguard?

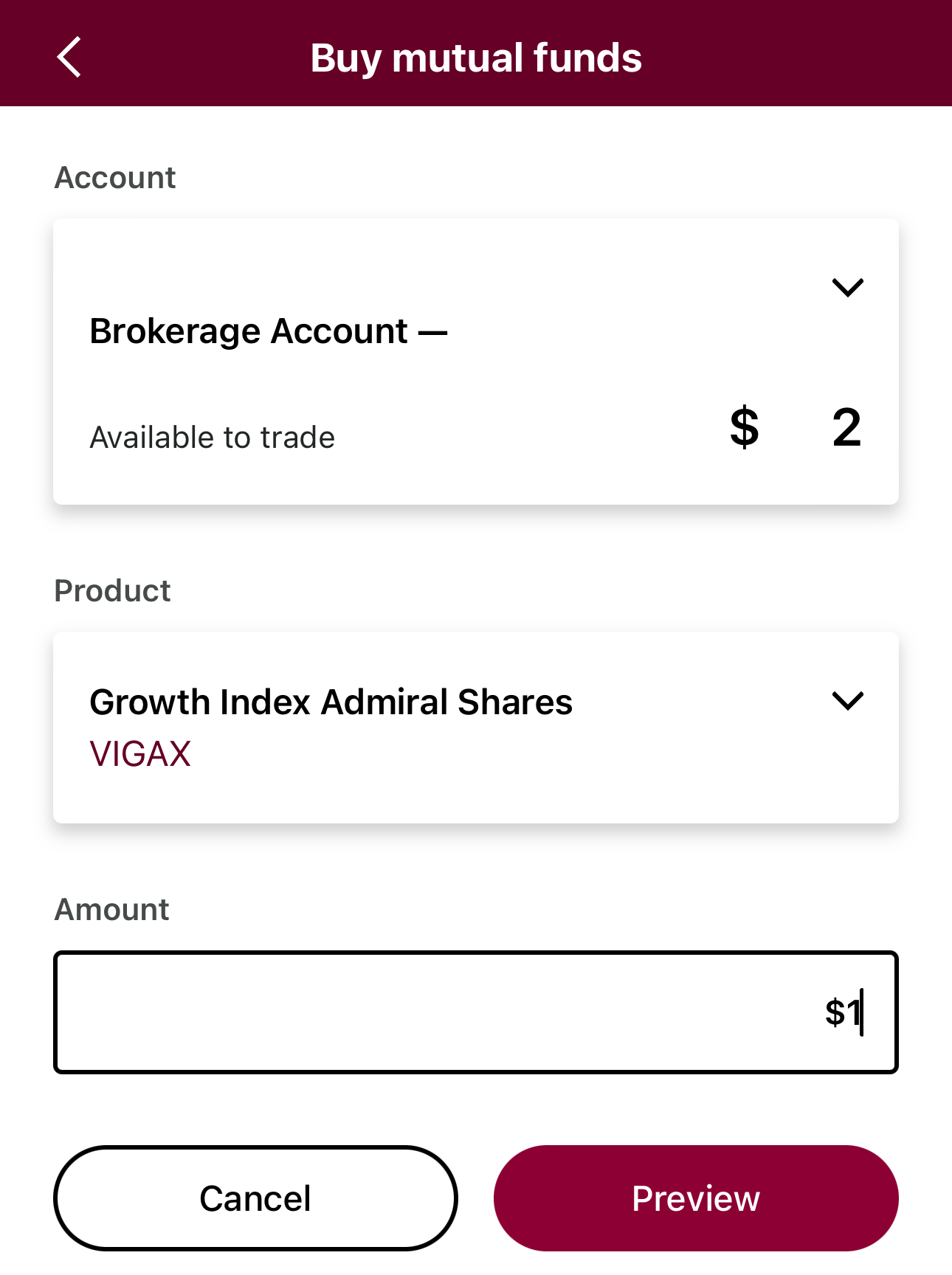

Yes, Vanguard's brokerage platform allows you to buy and sell individual stocks, bonds, mutual funds, and ETFs. It offers a broad range of investment products for self-directed investors.

What is the difference between Vanguard mutual funds and ETFs?

Vanguard mutual funds and ETFs often track the same indexes but differ in trading flexibility, fees, and investment minimums. ETFs can be traded throughout the day like stocks, while mutual funds are traded once daily at their net asset value (NAV).

Does Vanguard provide international investment options?

Yes, Vanguard offers a range of international funds, including developed and emerging market ETFs and mutual funds. These funds provide exposure to global markets, diversifying an investor's portfolio.

Pros | Cons |

|---|---|

Wide Range of Investment Options | Limited Trading Platform |

Strong Retirement Planning Tools | No Paper Trading |

Low-Cost Funds | No Crypto & Fractional Share |

Robo Advisor & Personal Advisor Services | Limited Banking Options |

Vanguard Features I Mostly Liked

Here are the key features that I found most appealing in Vanguard:

-

Invest on Your Own

I generally prefer to go my own way on investing platforms, so I appreciate the “Invest on Your Own” feature of the Vanguard platform.

This self directed investment feature includes several quick start tools, to begin retirement, emergency fund or general investing.

There are some decent resources to help build knowledge and investing skills, but Vanguard does lack analytical tools.

So, while I can enjoy commission free trading and low cost investment products, I did need to use a third party platform to fully research my trades.

The trading platform is quite straightforward and intuitive to use, so while it may be a little on the basic side, it is not particularly daunting for newbies who are just starting their investing journey.

-

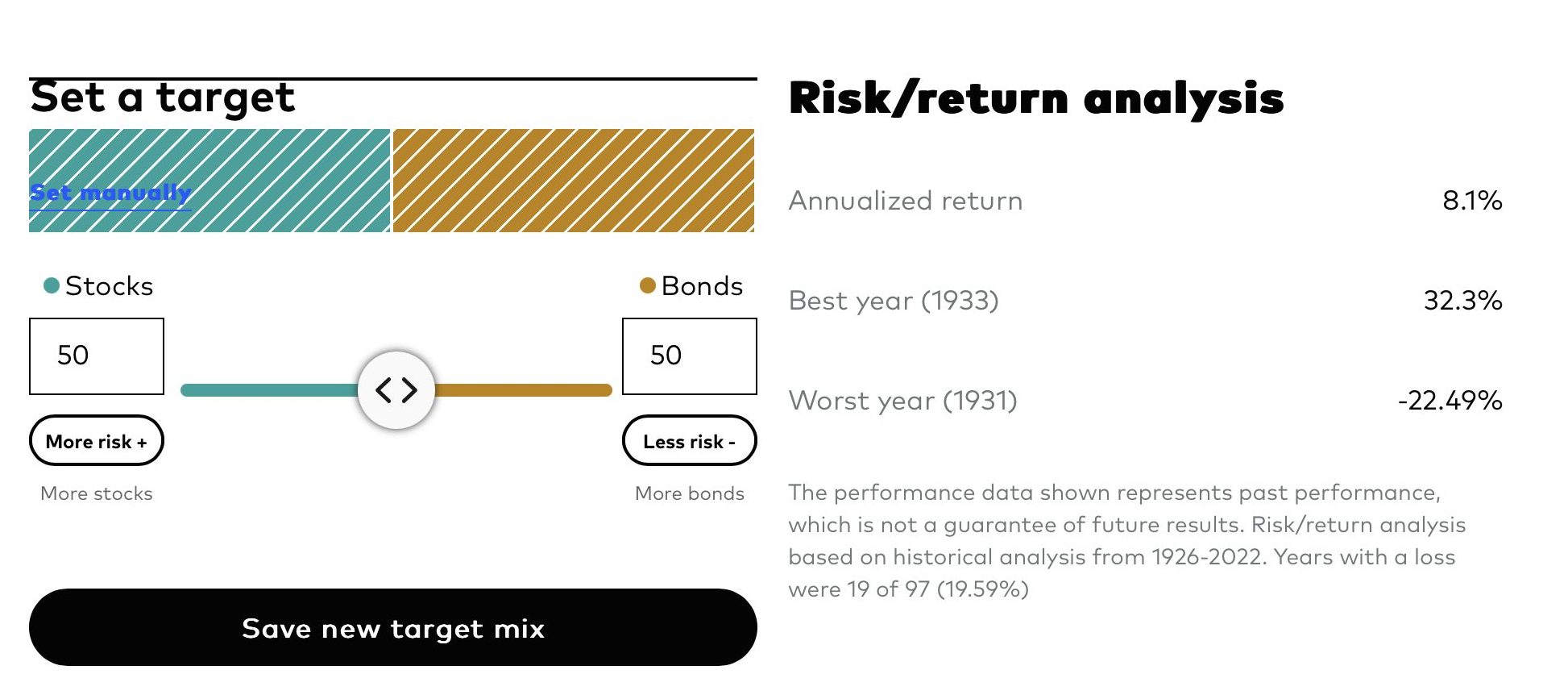

Robo Advisor (Vanguard Digital Advisor)

Vanguard has Digital Advisor, which is the platform’s robo advisor, but one of the features of this that I really liked was the personalized assessment.

The Digital Advisor process begins with a personalized assessment to determine your optimum risk profile and the best asset allocations.

The personalized assessment also creates a glide path which is an investment strategy to gradually adjust my portfolio asset allocation over time.

This is a great way to benefit from higher risk assets and glide over to lower risk products to reduce my risk as I approach my target date.

The entire process takes approximately 30 minutes, but it provides decent insight to help me develop my goals

-

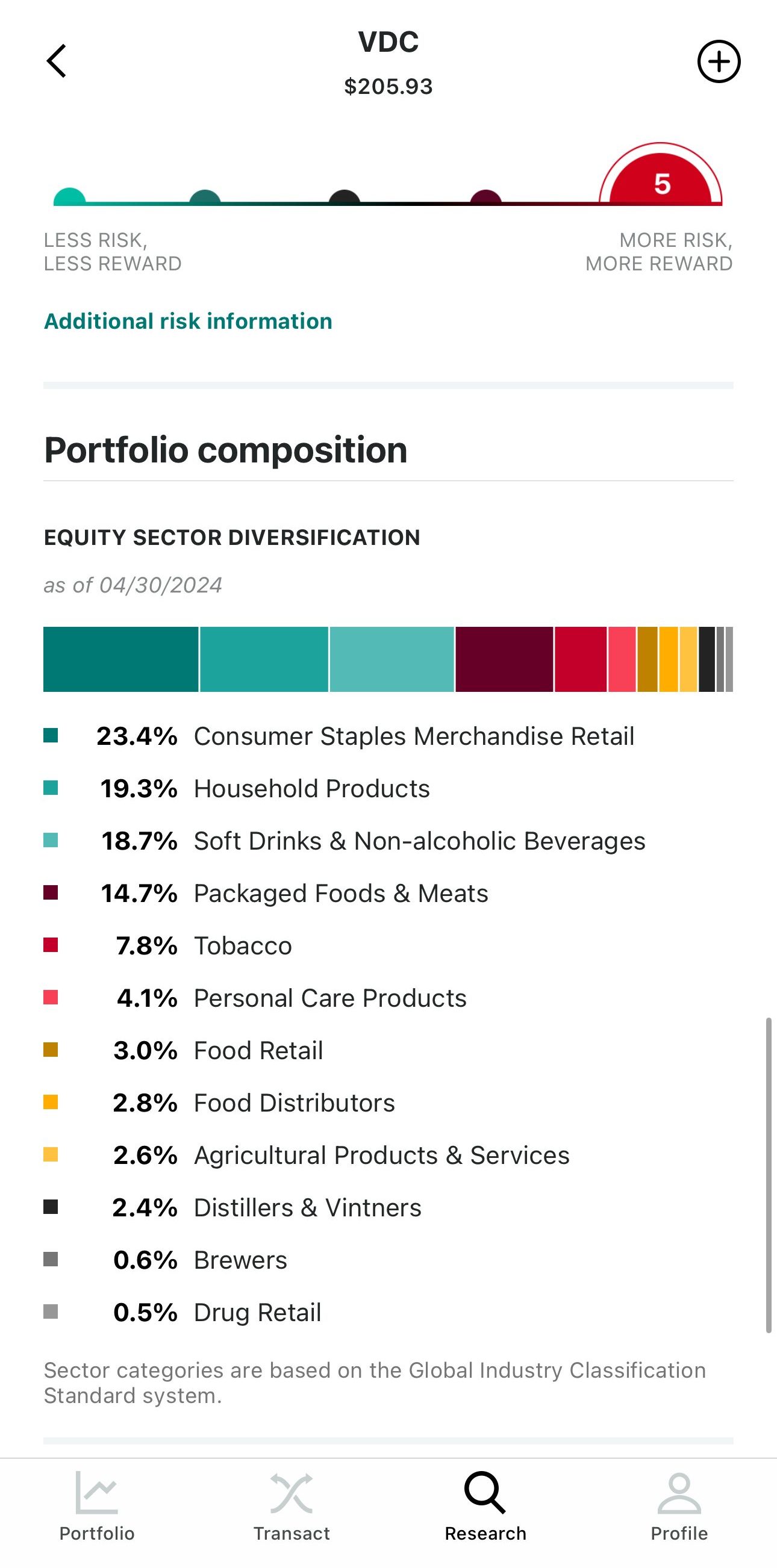

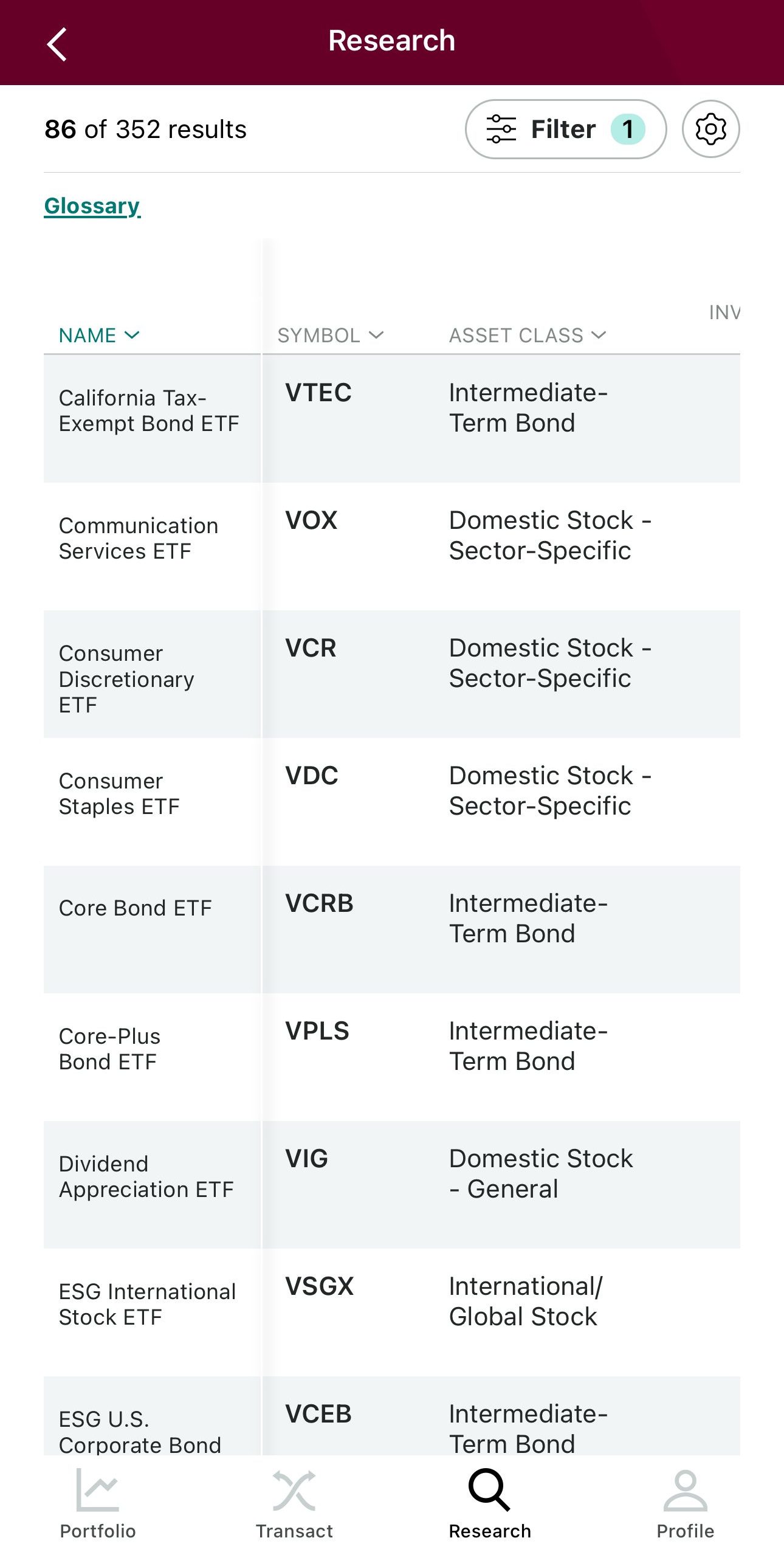

Wide Selection of ETFs

I like ETFs as an investment product as they can quickly add diversity to my portfolio and Vanguard has a wide selection of ETFs.

Investors can explore ETF risk and review its portfolio composition:

As you can see in this screenshot, I can filter the ETFs according to a number of factors, but Vanguard also divides the ETF selection into Core, ESG and Short Term ETFs. This makes it easier to choose an ETF that matches my investing goals and preferences.

I can invest in ETFs from just $1 and Vanguard is transparent about any associated fees.

Vanguard provides a key statistics brief on each ETF, so I can see the price, expense ratio, SEC yield and more to aid my purchasing decision.

-

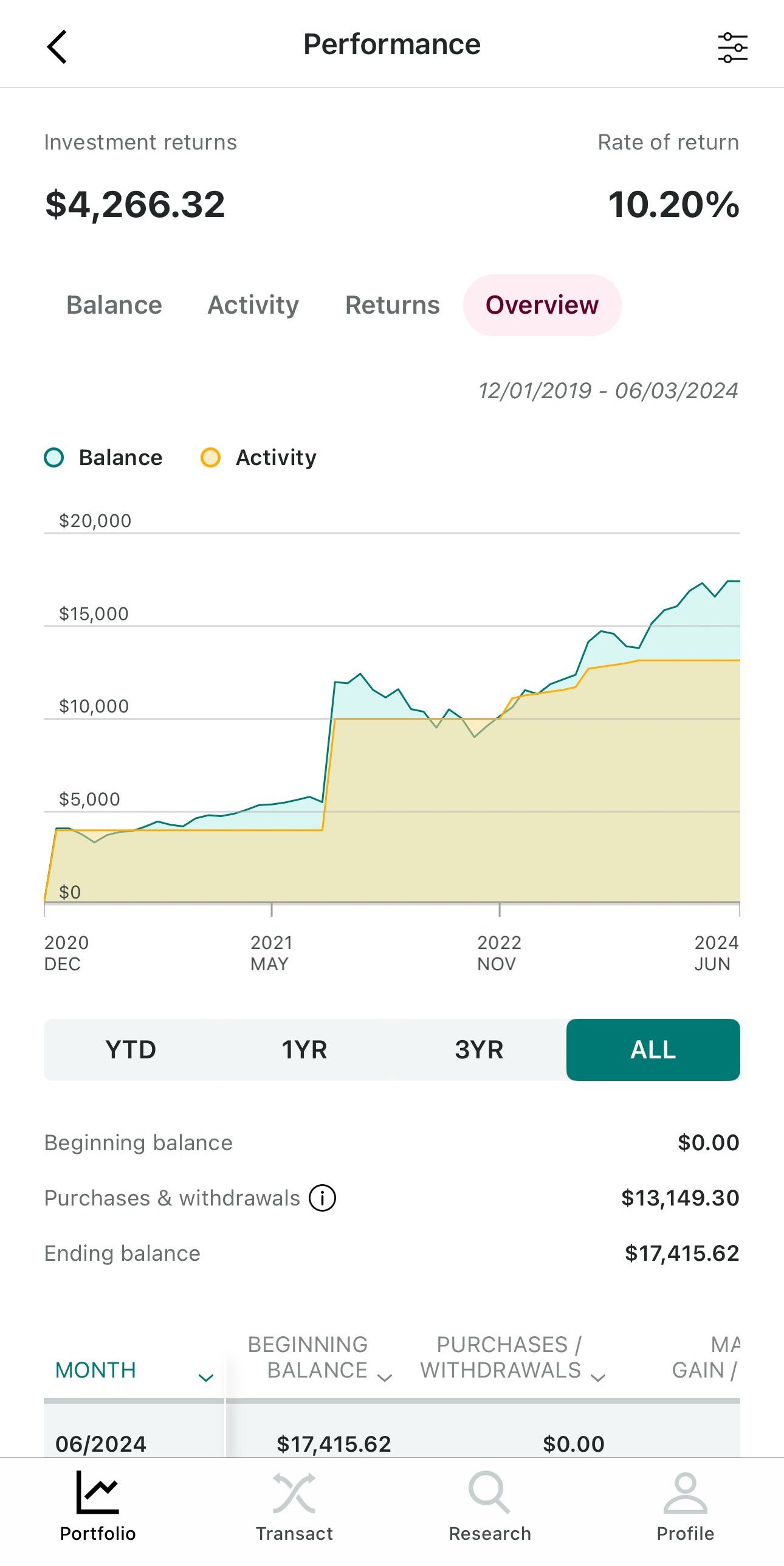

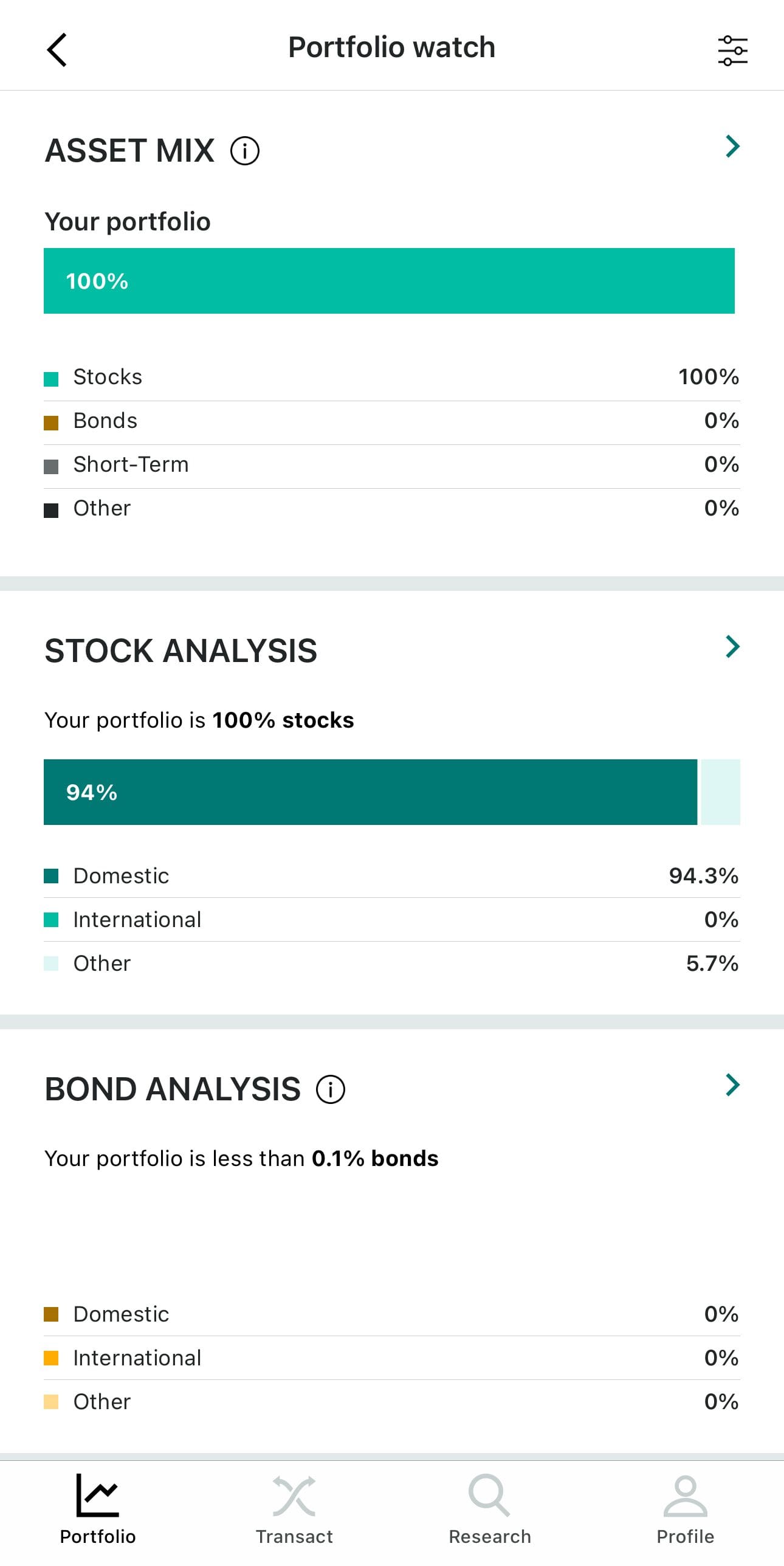

Portfolio Watch

Portfolio Watch is one of the tools I can access. Essentially, it automatically examines my portfolio to make comparisons between the current performance and the criteria I’ve set.

The ultimate goal of this tool is to ensure that my portfolio is diversified and risks are minimized where possible.

What I like about this feature is that I can not only include my Vanguard assets, but all my holdings, so I can see a comprehensive look of my financial life and any unidentified risk.

-

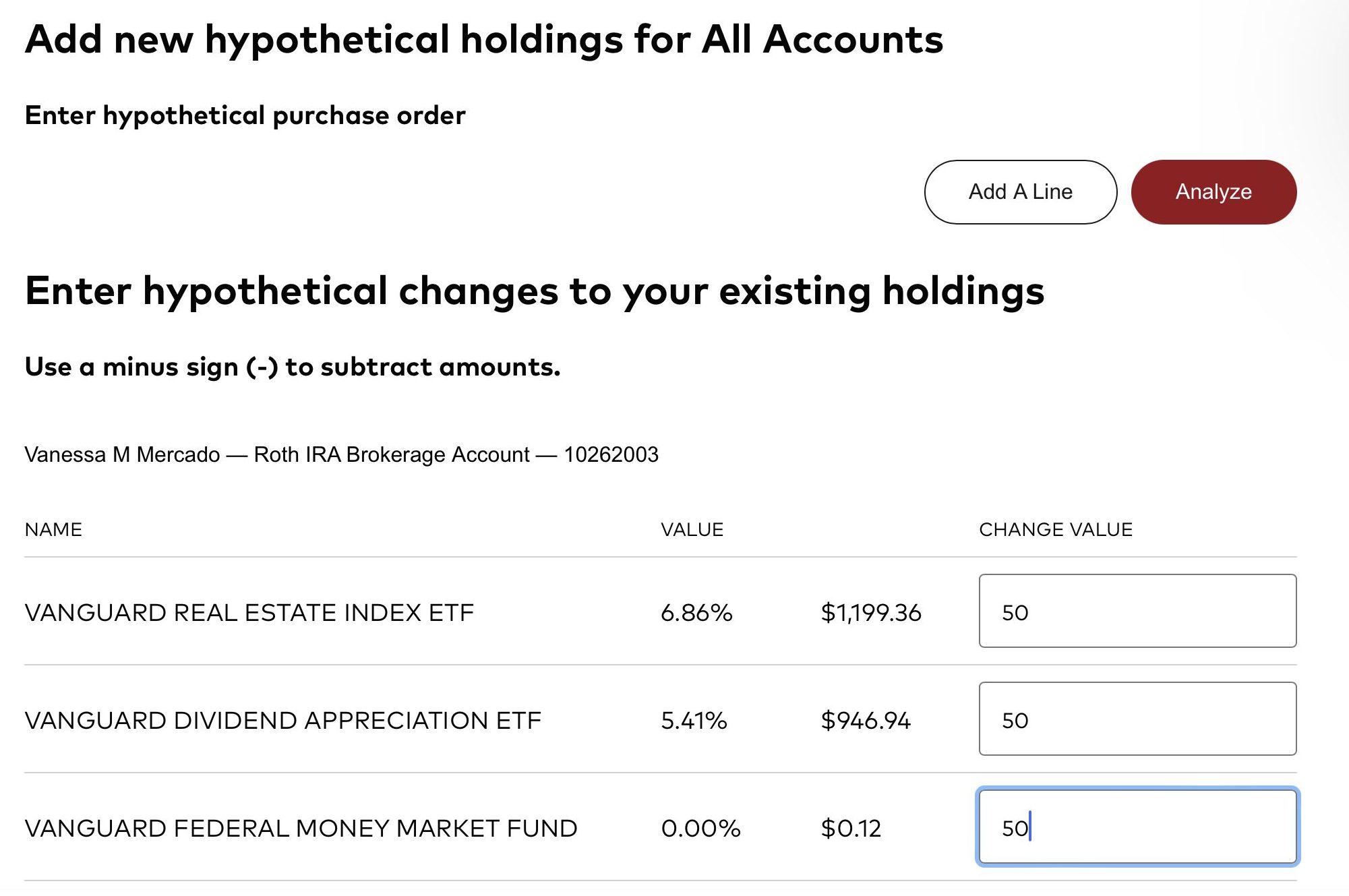

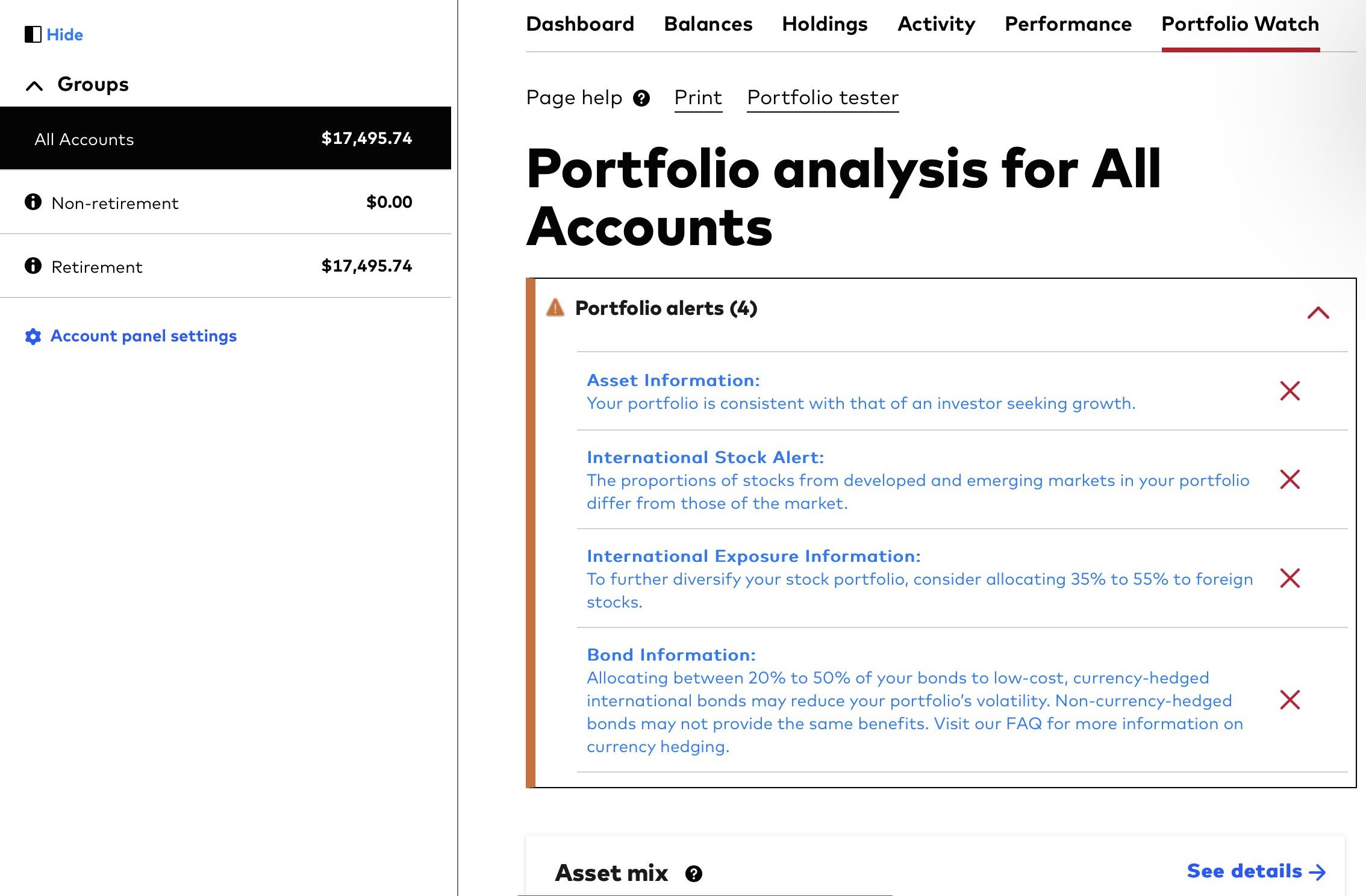

Portfolio Tester

I enjoyed the Portfolio Tester feature as I could play around to see how changes in my holdings would affect my portfolio.

I used Portfolio Tester to make hypothetical changes, adding stocks or mutual funds and then clicking “Analyze.”

This then shows a side by side comparison with my actual account and the hypothetical changes.

I can test changes to any of my account groups, adding individual stocks or mutual funds without changing my actual account, which helps me to form my investing strategy.

-

Personal Advisor

The Personal Advisor is a combination of robo advisor with professional guidance. This is a paid service, but I like that I can rely on the support of an advisor when I need it.

Personal Advisor uses advanced technology to break down my investment goals, mapping my progress and providing guidance to help me to prioritize.

The experienced advisors can help with more complex strategies such as tax loss harvesting, and the team is just a phone call away if I need help navigating my financial situation.

For those with a higher value portfolio of $500,000 or more, there is Personal Advisor Select which also provides a dedicated certified financial planner, personalized financial portfolio strategies and guidance for retirement.

More Vanguard Features Worth Exploring

Besides the main features I use regularly, there are additional features for investors:

-

Low Cost Mutual Funds

Since Vanguard is a professional investment advisor with decades of experience, I can also access a variety of mutual funds via the platform.

Vanguard boasts an average expense ratio that is far lower compared to the industry average, removing the potential barrier to entry for many investors.

I can browse a full list of the available mutual funds, but Vanguard has helpfully divided them into categories.

These include Index funds, which offer diversification and tax efficiency, Actively Managed Funds, Targeted Retirement Funds and ESG funds, which allow me to invest in companies that are taking steps to improve their environmental, social and governance actions.

-

Cash Plus Account

Vanguard aims to simplify finances with its Cash Plus Account. Essentially, this is a cash management account that allows me to manage my money and investments in just one place.

The account also includes bank sweep, which insures my funds with FDIC coverage. This means that I can use the account for my immediate requirements or my emergency fund and enjoy an impressive APY.

Additionally, rather than keeping all of my money in the bank sweep, I can choose from five available money market funds. However, there is $3,000 minimum investment required for each fund.

Vanguard provides a routing number, so I can use the account to receive my paycheck, but I can also pay bills and use payment apps such as Venmo and PayPal using the account.

-

Gifting

Another feature of the Vanguard platform that I liked is that there is an option to gift stock to friends, families or charities with a built in service.

I can gift assets like some shares or securities from my Vanguard non retirement account to any non retirement account regardless of whether it is a Vanguard account or not.

The gift transfer typically takes up to seven business days, depending on where the gift is being sent. If the account is a Vanguard account, it could take as little as one business day, but outside firms take longer.

-

Retirement Products

As an established brand, it is no surprise that Vanguard offers retirement products, but it is still nice that the platform features a variety of products to suit different circumstances.

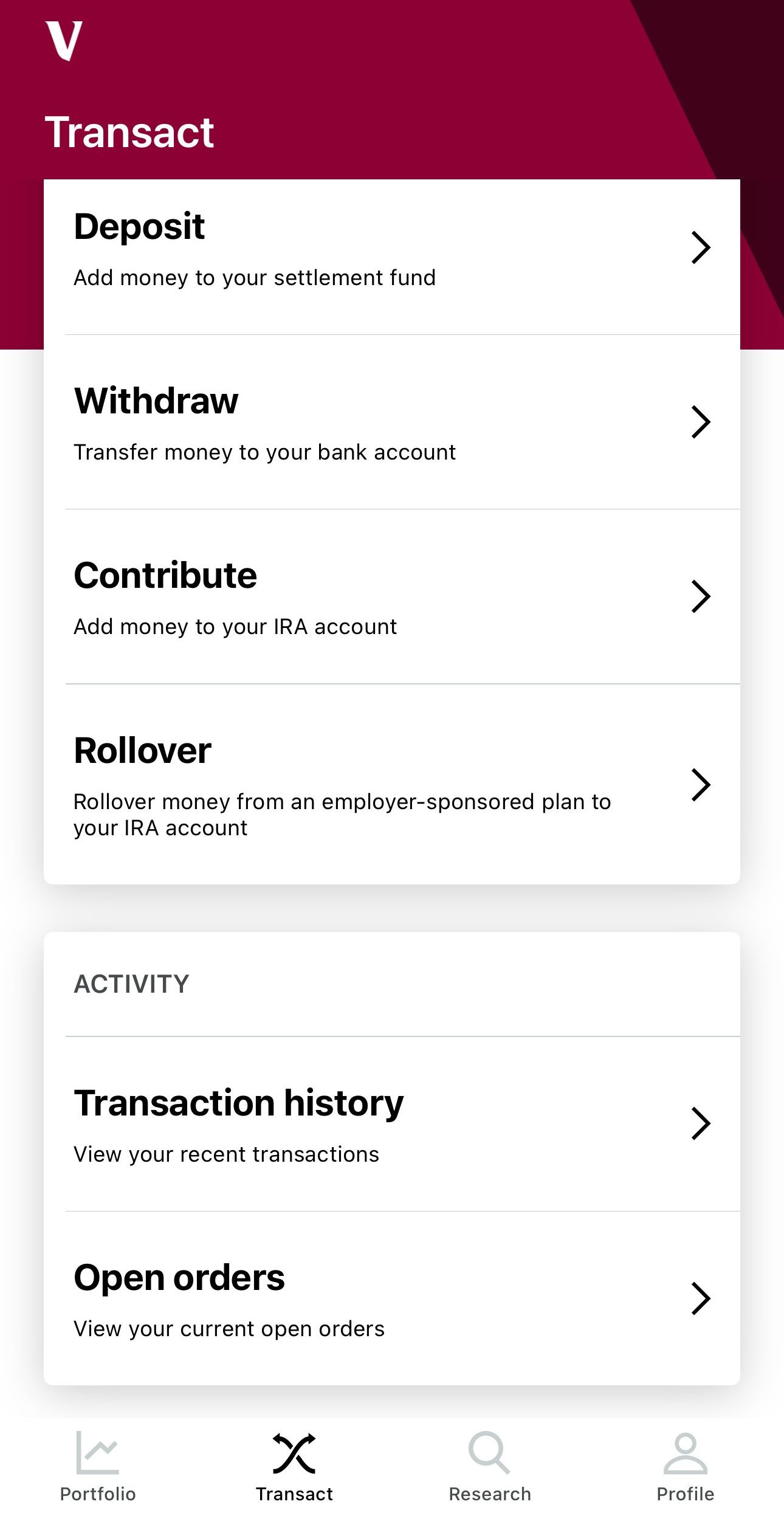

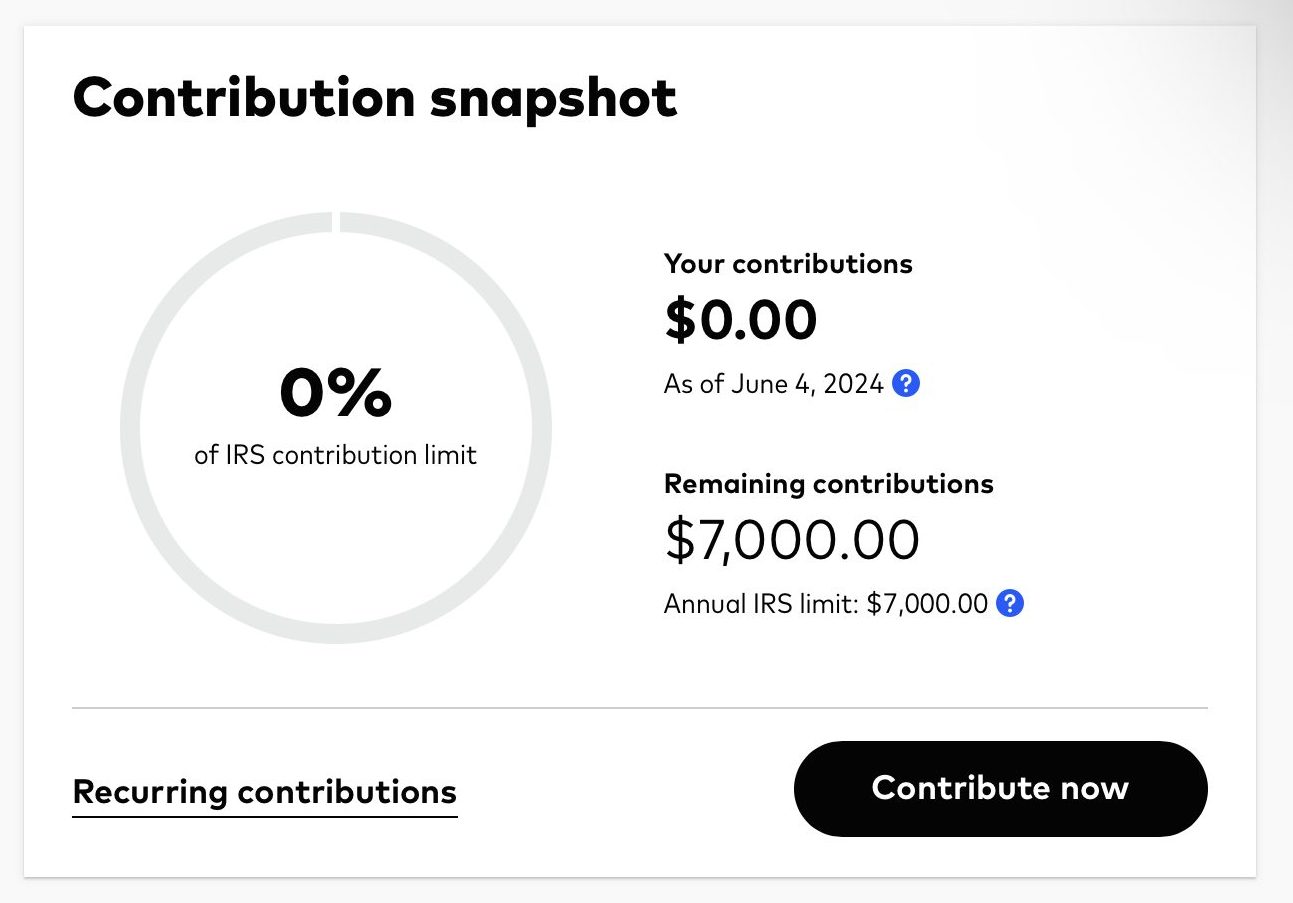

In addition to traditional and Roth IRAs, there is the option to rollover, which may be appealing for some.

Vanguard also has numerous retirement planning tools and calculators that I found helpful. As you can see in this screenshot, you can immediately see a snapshot of IRA contributions:

Vanguard has a number of worksheets including expenses and income for retirement, along with a retirement income calculator that make it easy for me to play around with the numbers to set my retirement goals.

-

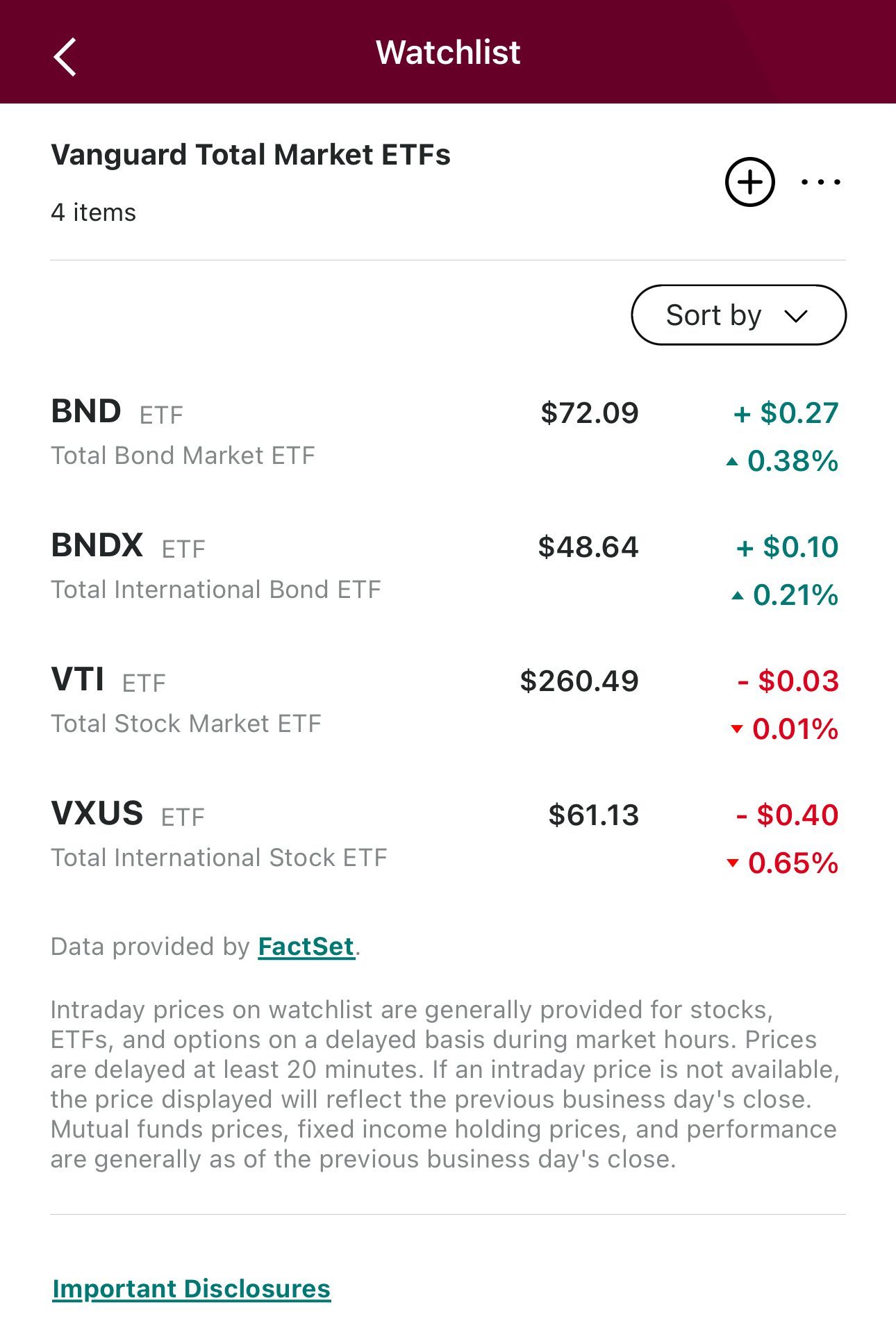

Watchlists

Although a watchlist is not a particularly unique feature on a trading platform, I did appreciate the ease of which I could set up multiple watchlists on Vanguard. If I’m not quite ready to make a purchase, I can add various assets to a watchlist and see a snapshot of market movements with key data.

As you can see in this screenshot, the watchlists are divided into different asset classes, but I can view my entire list if I prefer.

I can create multiple lists according to my preferences and access the asset details with just a couple of clicks.

-

Vanguard Perspectives

A news feed is another common feature on investing platforms, but I like that Vanguard’s is very comprehensive and filled with expert commentary.

There are hundreds of articles and videos in this section of the platform and I can filter the content by categories such as retirement, investment strategies, taxes, personal finance and the market and economy.

-

Wealth Management

While it is not currently something of interest to me, I did appreciate that Vanguard offered dedicated Wealth Management services.

This service is open to those who have a minimum of $5 million in Vanguard funds, but it offers Personal Advisor Wealth Management.

This is a fee based, full service financial planning advisory which includes investment advisory services, holistic financial planning, estate planning, tax efficiency strategies and more provided by a Certified Financial Planner.

-

Additional Tools and Calculators

I also found it helpful that Vanguard offered plenty of additional tools and calculators. This included a college saving planner, college cost projector, investment income calculator and potential growth tool.

There are even state tax calculators to help me assess my contributions and tax benefits, specific to my area.

What Can Be Improved

Vanguard isn’t for everyone, but there are some types of investors who are likely to appreciate the feature set of this platform. These include:

- Analytical Tools: Although the account analysis feature using Portfolio Watch is solid, there is little market analysis on the platform. If you’re interested in active trading, you’re likely to be disappointed at the basic order interface with no analytics.

- Mutual Funds Minimums: Vanguard does offer access to a decent selection of mutual funds, but many require an initial investment of several thousand dollars.

- Lack of Fractional Shares: When buying an ETF or mutual fund, it is possible to buy fractional shares, but if you’re trading in non Vanguard ETFs or stocks, you need to purchase entire shares.

What Type of Investor is Best Suited to Schwab?

Vanguard isn’t for everyone, but there are some types of investors who are likely to appreciate the feature set of this platform. These include:

-

Long Term Investors

If you’re interested in low cost funds for long term investment, you’re likely to appreciate the wide variety of funds available on the platform.

There are thousands of no transaction fee mutual funds and commission free ETFs.

You can also use the full suite of Portfolio Watch tools to keep track of your portfolio diversification to ensure that you remain on track for your long term goals.

-

Hands Off Investors

While there is the option to invest on your own, the basic platform and lack of research tools is not likely to appeal to active traders.

However, if you prefer a hands off approach, the Digital Advisor is a solid choice to build a diverse portfolio.

This robo advisor has some good features that will appeal to newbies and those lacking trading confidence.

-

Manage Retirement Portfolios

Vanguard offers a range of retirement accounts, including IRAs and 401(k)s, with target-date funds and a variety of investment options suited for retirement planning. This makes it a strong fit for investors looking to build and manage retirement portfolios.

Vanguard vs. Competitors: How Does It Stack Up?

While Vanguard appeals to buy-and-hold investors, Schwab’s platform is designed for those who want to engage actively with the market

Vanguard is our pick for long-term investors, wealth management, or retirement, while E-Trade may be better for traders active investors

Vanguard may be a better option for value, long-term investors, while Merrill offers better trading options. Here's a side-by-side comparison

Vanguard vs. Merrill Edge: Which Brokerage is Right for You?

Vanguard provides more options for investors, while Interactive Brokers offers superior technical tools for active traders

Vanguard vs. Interactive Brokers: Which Brokerage is Right for You?

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

Vanguard offers a better approach for serious investors, while JP Morgan's self-directed is better for beginners and advanced traders

Vanguard vs. J.P. Morgan Self-Directed: Which Broker is Best For You?

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.

Review Brokerage Accounts

How We Rated Brokerage Accounts: Review Methodology

At The Smart Investor, we evaluated brokerage account platforms based on their overall value, features, and user experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to investors, including fees, trading tools, investment options, and security. Each platform was rated based on the following criteria:

- Fees & Commissions (20%): We prioritized commission-free trading and low-margin rates. The best platforms had zero hidden fees, while others charged for inactivity or withdrawals.

- User Experience & Interface (20%): A clean, easy-to-navigate platform with smooth execution scored highest. Some apps felt outdated or laggy, impacting the experience.

- Trading Tools & Features (30%): We favored platforms with real-time data, smart order types, and special features that support smart investing. Some lacked depth, making it harder for active traders.

- Automated Investing (10%) : The best platforms offered AI-driven portfolios, robo-advisors, and automatic rebalancing. Some lacked automation or charged high fees for managed accounts.

- Investment Options (10%): Platforms with stocks, ETFs, options, crypto, and fractional shares scored highest. A few lacked key asset classes or international access.

- Account Types (5%): The best platforms supported taxable accounts, IRAs, and custodial options. Some lacked flexibility, limiting investment strategies.

- Cash Management & Banking Features (5%): We favored platforms with high-interest cash accounts, debit cards, and seamless banking. Many lacked competitive rates or useful features.