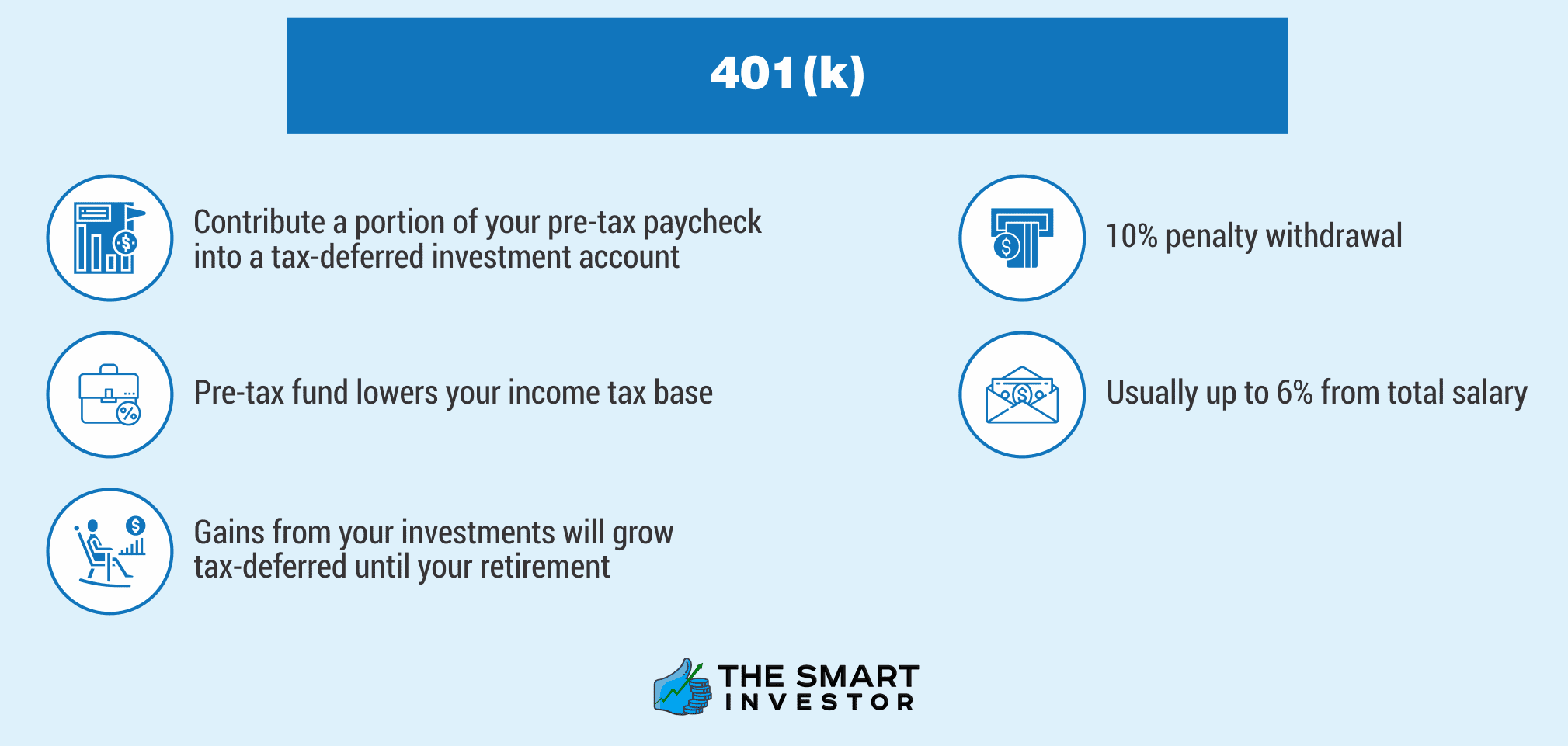

A 401(k) is a retirement savings plan offered by many employers in the United States. It allows employees to save and invest a portion of their paycheck before taxes are taken out.

How a 401(k) Works:

- Employee Contributions: You decide how much of your paycheck you want to contribute, up to annual limits set by the IRS. Contributions are typically deducted from your paycheck pre-tax.

- Employer Matching (Optional): Many employers match a portion of your contributions, effectively giving you free money for retirement. For example, an employer might match 50% of your contributions up to 6% of your salary.

- Investment Options: Your contributions are invested in options offered by the plan, such as mutual funds, index funds, or target-date funds.

- Tax Advantages:

- Traditional 401(k): Contributions reduce your taxable income now, but you pay taxes on withdrawals in retirement.

- Roth 401(k): Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free (subject to rules).

401(k) – Things You Have To Know

Even as a 401(k) you have lots of restrictions and caveats.

In maximum cases, you cannot faucet into your organization’s contributions right away. Vesting is the quantity of time you need to work for your company than having access to its payments for your 401(k). (Your payments, however, vest at once.) It’s insurance in opposition to personnel leaving early.

On top of that, there are complex guidelines about when you could withdraw your cash (almost the same as traditional IRA withdrawals conditions) and high priced consequences for pulling funds out earlier than retirement age.

Contribution Limits

Here's a table summarizing the 2025 contribution limits for various retirement plans:

Contribution Limits

How Much To Put?

With that settled, how a good deal must you put in?

As a good deal is feasible, being conscious that you’ll want to have enough cash to stay, devour and pay down any debt you have got. At least, invest sufficiently to get the full matching quantity that your company pays to match your contributions.

And remember:

You don’t want to leave free cash at the desk. Nearly every plan offers matching finances—the maximum popular being 3% of your profits, in line with the earnings Sharing/401k Council of America.

So how would 3% match work

If you put in 3% of your $60,000 income, or $1,800, your company puts another $1,800 in the pot. You can add an addition to $1,800 yourself, however the company won’t match beyond 3%. The policies for matching budget vary, so make sure to test with your organization about qualifying for its contributions.

Many employers will contribute into 401(k) plan for you. There are 3 principal of employer contributions: matching, non-optional, and profit sharing. Employer contributions are always pre-tax, this means that whilst they may be withdrawn in retirement, they will be taxable at that point.

Matching

With an identical contribution, your employer simply places cash into the 401(k) plan if you are setting cash in. For example, they will match your contributions dollar-for-dollar up to the first 4% of your pay, then 40 cents on the dollar up to the next 3% of your pay.

Let me explain:

In our example above, if you had been contributing 5% of your $60,000 profits, or $3,000 a year, your business employer could be contributing $3,120. They would suit the first four percent of your pay, or $2,400, by means of placing in $720.

On the subsequent 1% of your pay, $600, they could be matching 50 cents, or $300. As a consequence, the overall they contributions on your behalf could be $3,420 for the year.

Keep in mind:

If your employer offers a matching contribution, it makes sense to make enough contributions of money to obtain the match. Consider it as an immediate raise!

Non-Elective

With a non-non-obligatory contribution, your employer may also determine to position a hard and fast percentage into the plan for every person, irrespective of whether the worker is contributing any from their own money or not.

For example, an employer may additionally contribute 2% of pay to the plan every year for all eligible personnel.

Profit Sharing

With a profit-sharing contribution, if the employer makes an income, they will select to put in a fixed dollar quantity to the plan. There are extraordinary formulations that determine how a good deal can reach whom. The most common method is everyone receives an income sharing contribution proportional to their pay.

What Tax Benefits Do 401(k) s Offer?

You fund 401(k) s (and different types of defined contribution plans) with “pre-tax” dollars that means your contributions are taken out of your paycheck earlier than taxes are deducted.

Here’s the deal:

That means that if you fund a 401(k), you lower the number of earnings you need to pay taxes on, that can melt the blow in your take-home pay. For instance, in case you placed $200 your 401(k) each month, your paycheck would possibly get smaller by way of about $50-$70 in line per month. (The exact amount will vary depending to your profits and tax bracket.)

What's the result?

So, in case you make a small contribution to a 401(k), or if you increase your contribution by means of 2% every 12 months, probabilities are you will hardly ever even be aware the difference to your pay assessments, and your tax invoice might be lower.

You'll have to pay taxes sooner or later of direction, however no longer until you retire. The IRS taxes all withdrawals at your everyday profits tax price.

However, there is a seize:

In case you make withdrawals before age 59 ½, you generally ought to pay a 10% early withdrawal penalty on top of any taxes due. That can take a massive portion from your nest egg, and isn’t a great idea.

There's additionally a sort of 401(k) plan called the Roth 401(k), which gives a tax ruin that essentially acts as the reverse of the conventional 401(k): You must pay tax in your contributions, but you might not need to pay any tax whilst you withdraw the cash in retirement. So all of the money on your account grows tax free.

Tax Savings – Example

Let’s look at an example to see how the tax savings works:

Anticipate you're making $60,000 a year and determine to make contributions 7% of your pay, or $4,200 a year, in your 401(k) plan. If you are paid twice a month, then $175 is taken out of each pay check and positioned into the 401(k) plan.

Now:

On the end of the year, the earned income you record in your tax return might be $59,100 in place of $60,000 because you get to reduce your stated earned income by means of the amount you placed pre-tax into the 401(k) plan.

If you are within the 25% marginal tax charge, the $4,200 you positioned into the plan way $1,050 less in federal taxes paid.

The example above assumes you pick the traditional pre-tax 401(k) contributions, where you contribute cash on a pre-tax basis.

When Do I Pay Tax On a 401(k)?

When you ultimately make withdrawals from a conventionally described contribution plan, you should pay regular income taxes on the cash you withdraw – whether or not the cash came from your contributions, dividends or capital gains.

For classic plans, you'll owe income tax on all your withdrawals – both the money you contributed and the gains in your contributions.

Remember:

The cash you withdraw from a defined contribution plan is usually taxed at your profits tax fee at the time you withdraw it. (The current top income tax rate is 39.6%, even though it is feasible that the rate may be changed down the road.)

Within the case of a Roth 401(k), you'll have to pay tax to your contributions, however you may not be taxed later when you make withdrawals.

What If I Need The Money Before I Retire?

Normally you need to hold the cash within the plan until you attain age 59 ½.

Withdraw any of it earlier than then and you may be hit with a bruising 10% early withdrawal penalty, on top of the everyday income tax that is due on withdrawals from all traditional described contribution plans. Dreadful concept.

There are exceptions!

The IRS waives the 10% penalty for positive “destitute” withdrawals. Each plan's regulations vary (take a look at yours to make certain), however you will be capable to take cash out of your retirement account penalty-unfastened earlier than age 59 ½ if you use it for charges after the onset of an unexpected disability, or for unreimbursed clinical expenses that are extra than 7.5% of your adjusted gross earnings (10% if you’re below age 65).

Do not expect it, though

This money is locked up till retirement for a superb purpose: if you spend it now, you threat jeopardizing your financial safety whilst you're older. In case you cannot get the cash elsewhere, your satisfactory choice is probably a mortgage. Many described contribution plans will let you borrow in opposition to the amount for your account.

You have to pay off the money for your account within a hard and fast duration – typically some years – or the mortgage is treated as a withdrawal, meaning you'll owe taxes and a 10% penalty on it.

Major Drawbacks of 401(k)

There are 3 major drawbacks to 401(k):

- Limits for High-Income Earners

For maximum rank-and-report employees, the dollar contribution limits are high enough to allow for ok ranges of earnings deferral.

But the dollar contribution limits imposed on 401(k) plans can be a handicap for personnel who earn numerous hundred thousand dollars a year.

Employers have the choice of providing nonqualified plans, such as deferred compensation or executive bonus plans for these employees so one can allow them to keep additional earnings for retirement.

- Fees

401(k) plans charge expenses for administrative services, funding control offerings, and once in a while outside consulting services.

They can be charged to the employer, the plan contributors or to the plan itself and the expenses may be allocated on a consistent with per participant basis, in line with plan, or as a percent of the plan's assets.

- Risk

Unlike defined advantage ERISA plans or banking group savings money owed, there's no Government Insurance coverage for assets held in 401(k) accounts. Plans of sponsors experiencing financial problems every now and then have investment issues.

The good news:

Thankfully, the Bankruptcy guidelines deliver an excessive priority to sponsor funding legal responsibility. In transferring among jobs, this needs to be a consideration by means of a planned player in whether to leave assets inside the vintage plan or roll over the property to a new organization plan or to an individual retirement association (an IRA).

Expenses charged by using IRA companies can be notably less than expenses charged by using organization plans and typically offer a far wider choice of investment mechanisms than corporation plans.