Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- No Security Deposit

- Reports to Three Credit Bureaus

- Annual Fee

- No Rewards

Rewards Plan

Sign up Bonus

0% Intro

PROS

- No Security Deposit

- Reports to Three Credit Bureaus

CONS

- Annual Fee

- No Rewards

APR

35.99% Variable

Annual Fee

$59

Balance Transfer Fee

Unknown

Credit Requirements

Poor – Average

- Our Verdict

- Pros & Cons

- FAQ

The Avant Credit Card is a great starting place for anyone who is looking to build a line of credit, or has limited credit options due to past credit encounters.

Despite the fact that the Avant Card has limited bonus options and perks when compared to other credit cards, it does give a lot of love for people who are looking for a card that can help boost their credit score quickly, especially when it comes to people who are applying for a first credit card. The Avant Credit Card offers an alternative route when it comes to building a credit history.

While there isn’t a security deposit required, Avant does has an annual fee. This fee is disclosed to applicants during the pre-qualification process, and while this is generally $59 annually, Avant does state that this can vary depending on market tests.

The card isn't available if you live in Colorado, Iowa, Massachusetts, Vermont, West Virginia or Wisconsin. Avant Credit Card isn’t available in these states. Avant Credit Card is offered through Avant, which is based out of Chicago, Illinois.

- No Security Deposit

- Reports to Three Credit Bureaus

- Travel Friendly Benefits

- Pre-Qualification Process

- Periodic Account Review

- Annual Fee

- No Rewards

- Lower Credit Limit

- High APR Rate

- Hard set Payment Date

Does Avant Report Payments To All Credit Bureaus?

Avant does report all payment activity for its cards to all three credit bureaus. This means that using your card responsibly can help to improve your credit score across various credit scoring platforms.

Can I Get Pre Approved?

Before going through a complete application, there is an option to get pre-approved for the Avant Card. This pre-qualification process will not impact your credit score and will give you a reliable indicator of whether you will likely be approved.

This process does not trigger a hard credit pull, which will only be initiated if you proceed with a full application.

Can I Add An Authorized User?

Avant does not allow you to add authorized users to your account or to create a joint account. So, if you want to share your credit card with family members or friends, this is not the right card choice.

What Is The Initial Credit Limit?

You can expect an initial credit limit with the Avant card of at least $300. However, your specific credit limit will be determined by your creditworthiness, income and other factors.

In this Review..

Benefits

Cardholders can redeem their miles in several ways, including booking travel to over 1,000 destinations worldwide for both one-way and round-trip flights.

Miles can also be used for seat upgrades to business or first class, as well as for car rentals, hotel stays, and vacation packages.

Since there’s no cap on how many miles you can earn, the travel possibilities are virtually limitless.

- No Security Deposit

The Avant card is an unsecured credit card, which means that it does not require a security deposit as collateral like many other cards that are like this.

As previously mentioned, however, there is an annual fee of $59 for some cardholders.

- Reports to Three Credit Bureaus

Because this card is designed for people with limited credit, having a card that reports to at least one of the three major credit bureaus is extremely important for long term credit success.

The Avant Credit Card reports to all three (TransUnion, Equifax, and Experian), which will record payment history. As long as the card holder makes their payments on time, this can help build a better credit score.

- Travel Friendly Benefits

The Avant Credit Card is a Mastercard, which means that it will be accepted worldwide. On top of this, it doesn’t charge a foreign transaction fee, which can potentially be a money-saver for any card holder that does travel often.

- Pre-Qualification Process

Before an applicant would officially apply for this card, Avant requires the user go through a pre-qualification process that doesn’t impact your credit score. This process gives a closer insight to see the likelihood of getting approved, and states the terms that the card holder would have if they decided to move forward.

Although this insight is given, it is not a 100% guarantee of approval. If the applicant likes these terms, then they can move forward and actually have the hard inquiry to get approved for the Avant card.

- Periodic Account Review

The issuer of the Avant Credit Card reviews each account periodically to potentially increase your credit limit. This can play a key factor in establishing credit, just so long as the card holder doesn’t use too much of their credit.

Drawbacks

- Annual Fee

While for some AvantCredit Card holders the annual fee may be $59 , the company does state that this is subject to change based on market testing.

Even within credit building credit cards, there are other options, such as the Petal Visa credit card, that serve as a great credit building tool while not charging an annual fee or security deposit.

Along with the 35.99% Variable, there certainly are some other things to consider.

- No Rewards

Because the Avant Credit Card’s main purpose is to act as a credit builder, it isn’t a big surprise that there are no types of cash back or travel rewards that come with using this card. Despite the fact that rewards aren’t largely important, there are other starter cards that do offer them.

Cards like the Deserve Pro MasterCard offer a 1% cashback on every purchase, while offering a $0 annual fee.

- Lower Credit Limit

The credit limit range for the Avant Credit Card is a bit low for a starter card – up to $1,000. With this being said, there are other alternatives like the Petal2 Visa card that offer higher credit limits that can go as high as $10,000.

If a person is looking for more flexibility with their spending limits, these are possible alternatives to consider.

- High APR Rate

With any credit card, the goal is to pay off your balance every month. However, life happens and sometimes you may not be able to pay off your statement balance in full.

If this happens with the Avant card you’re going to feel the sting as you get hit with a 35.99% Variable APR which is high compared to other secured credit cards.

- Hard set Payment Date

Unlike other cards, the card holder can’t switch their “payment due” date to a more convenient payday.

While this isn’t a dealbreaker with the Avant Credit Card, it certainly can be an inconvenience having to plan out how to make the payments if they don’t like up with other bills that you pay.

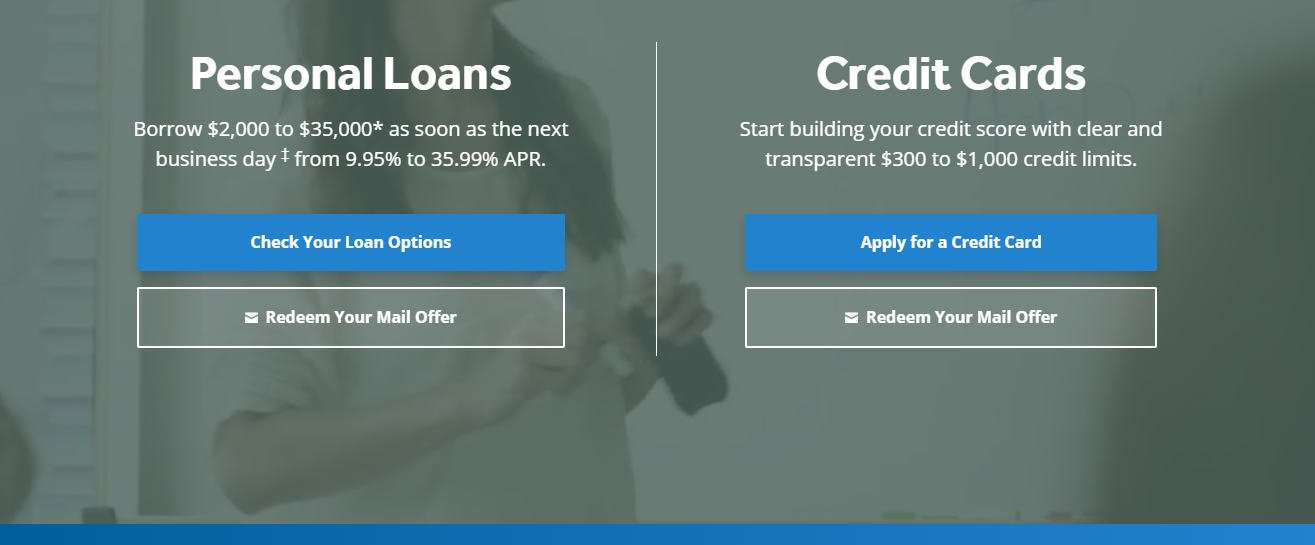

How To Apply For Avant Credit Card?

- 1.

Visit the avant Credit Card homepage and click “Apply Now.”

- 2.

This takes you to the next page, where you can fill in your “Personal Information” such as your Names, date of birth etc.

- 3.

Lastly, ensure you read through the important disclosure page to know your eligibility, fees, costs, rates, etc. Then click on “Continue” to complete the process.

Is the Avant Credit Card Right for You?

The Avant Credit Card is a solid option for anyone looking to get back on track and build a strong credit history.

What sets it apart is that it considers more than just your credit history when deciding eligibility, making it more accessible for a wider range of applicants.

With no security deposit required, travel-friendly perks, and the fact that Avant reports to all three major credit bureaus, it’s a great way to take the next step toward improving your credit.

Are there any credit cards with guaranteed approval for people with bad credit?

Secured cards are the closest thing to a card with a 100% approval rate. To protect your card, you must first give a cash security deposit. This deposit is held in a separate account by the card issuer to ensure that if you fail to pay your bill, they can recover the funds. Because the issuer is protected, it is simpler for those with low credit to get approved.

Most issuers, however, will do a credit check, so you may be required to satisfy a minimum credit score.

Your card issuer will report your activity and payments to the credit bureaus when you use the card. As a result, you can increase your credit score by using this card. In reality, after a specific length of good payment history, several issuers provide the option of upgrading to an unsecured card.

What Are the Best Credit Cards with No Annual Fees for People with Bad Credit?

When picking a credit card, the annual fee is an important item to consider. Fortunately, there are some excellent no annual charge credit cards available for people with weak credit.

You may get cash back with the Discover It Secured Card, which has no annual fee. You can earn 2% in restaurants and gas stations with a combined cap of $1,000 every quarter, and an unlimited 1% on all other transactions. The card also features a six-month introductory APR of 10.99 percent for balance transfers. After that, the rate is changeable at 22.99 percent.

A security deposit of $200 or more is required to establish your credit line with this card. This is a non-refundable fee that will assist in determining your credit limit.

Capital One's Secured Mastercard is another alternative. You can get a $200 initial credit line if you make a $49, $99, or $200 security deposit. The more money you deposit, the more likely you are to be given a larger credit line.

Although there are no benefits with this card, you may be automatically eligible for a larger credit line after 6 months. Capital One also keeps track of your account, and if you show that you're responsible with it, you can get your initial deposit back as a statement credit.

For many consumers, a lack of an annual fee is an attractive feature of any credit card. Lenders have recognized this trend, and today, most cards do not have an annual fee. However, savvy consumers want more from their credit cards. In this chart created with US news data, you can see the percentage of no-annual fee cards by card type.

What is the Easiest Way to Get a Credit Card With Bad Credit?

If you're afraid about getting a card because of your terrible credit, there are those that are considered the simplest to get. The Indigo Unsecured Mastercard is one such card.

This card was created for folks with less-than-perfect credit in mind. Prequalification is straightforward and has no bearing on your credit score. Despite the lack of a security deposit, this is an unsecured credit card. Your card payments will also be recorded to all of the main credit agencies, which will aid in the development of your credit history.

The OpenSky Secured Visa is another alternative. This is a secured card, but no credit check is required. With a cash deposit of up to $3,000, you can choose your own credit limit. Like the Indigo, all your account activity will be reported to the credit bureaus, helping you to qualify for an unsecured card in the future.

The OpenSky application process takes just five minutes, but you should be aware that there is a $35 annual fee.

Compare The Alternatives

There are more cards for bad credit worth mentioning as alternatives to the Avant card:

|

|

| |

|---|---|---|---|

Chime Credit Builder | Capital One Journey | Discover It Student Cash Back | |

Annual Fee | $0 | $0

| $0

|

Rewards |

None

None

|

Up to 1.25%

earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25%

|

1-5%

5% cash back on activated rotating category purchases (up to $1,500 in purchases each quarter, then 1%) and 1% on all other purchases

|

Welcome bonus |

None

None

|

None

$5 per month for 12 months on select streaming subscriptions when you pay on time

|

Match Bonus

Discover will automatically match all cash back you earn at the end of your first year with the card without a minimum spending requirement or maximum rewards.

|

Foreign Transaction Fee | 0%

| None

| $0

|

Purchase APR | N/A

| 29.99% (Variable)

| 16.99% – 25.99% Variable

|

FAQ

Avant does not give a specific answer to this question, as the results can vary depending on your specific financial circumstances. However, a good guideline is that you should see a change in your credit score after three to six months of responsible car usage.

Avant is unlikely to give you a specific reason if your application has been denied. You will need to do a little investigating to check your overall credit score, debt to income ratio, credit utilization and if there are any red flags on your credit history. If you identify any areas of concern, you can work on these and then look at reapplying after several months.

This card is designed for those with average credit, but it does have a high APR and an annual fee. If your credit score is average to good, you are likely to find there are other available cards with a lower rate and card perks that could be of better benefit to you.