Rewards Plan

Welcome Bonus

Our Rating

0% Intro

Annual Fee

APR

- Complimentary Hilton Honors Gold Status

- 10 Airport Lounge Visits

- Low Point Value

- No Travel Credit

Rewards Plan

Welcome Bonus

Our Rating

PROS

- Complimentary Hilton Honors Gold Status

- 10 Airport Lounge Visits

CONS

- Low Point Value

- No Travel Credit

APR

20.99% - 29.99% variable

Annual Fee

$150

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Hilton Honors American Express Surpass Card is a suitable option for frequent Hilton guests seeking a co-branded credit card with a reasonable annual fee and valuable perks, without the high cost associated with the top-tier Hilton Honors American Express Aspire Card.

Cardholders earn Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases.

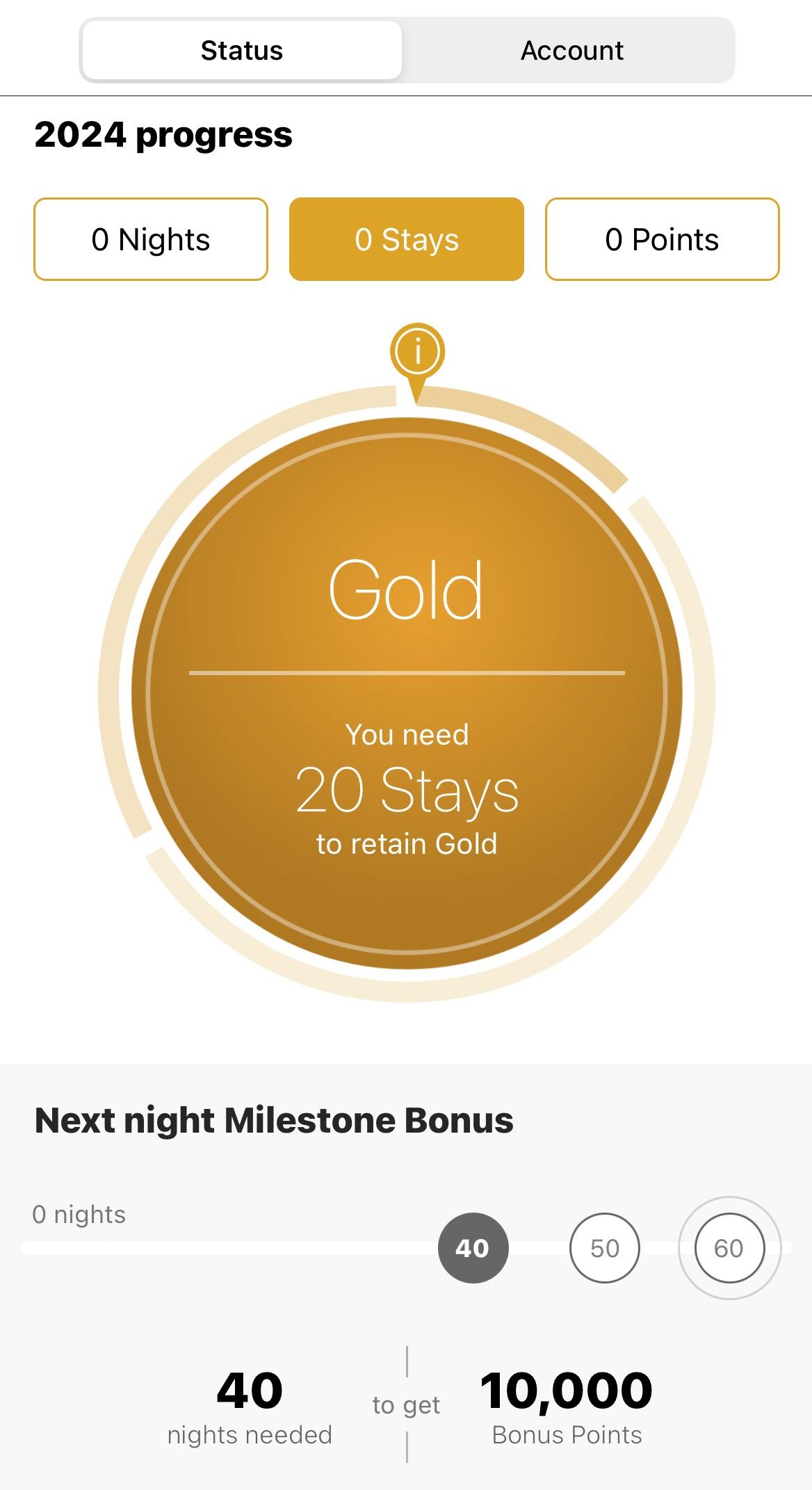

Cardholders also receive complimentary Hilton Honors Gold status, which includes benefits such as room upgrades, late check-out, 80% points earning Bonus on Stays, fifth night free, and daily food and beverage credit or continental breakfast.

Redeeming points with Hilton can be flexible, focusing on free nights or using the Points & Money option. The card comes with no foreign transaction fees and additional benefits like free two-day shipping and rental car insurance.

However, there is $150 annual fee and while the points rewards ratio is good, the value of Hilton points is about 0.6 cent, the lowest compared to other hotel cards.

Are there restrictions on redeeming Hilton Honors points?

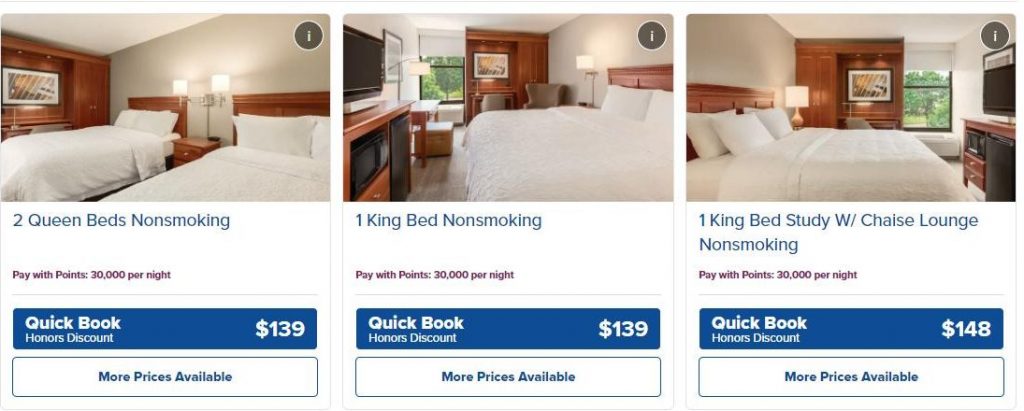

Hilton uses dynamic pricing, but points can be redeemed for free nights or with the Points & Money option.

How do I achieve Hilton Diamond status with the Hilton Surpass Card?

Spend $40,000 on the card in a calendar year to qualify for Hilton Diamond statu

Can I still get the welcome bonus if I already have another Hilton credit card?

Yes, having another Hilton credit card doesn't disqualify you from the welcome bonus.

What are the key perks of Hilton Honors Gold status?

Gold status includes benefits like room upgrades, an 80% points bonus on paid stays, and complimentary breakfast

Can I combine Hilton Honors points with others for an award stay?

Yes, you can pool points with up to 10 other Hilton Honors members.

Does the card offer rental car insurance?

Yes, the Hilton Surpass Card provides secondary rental car insurance up to $50,000 for theft or damage.

Are there alternative credit cards for earning Hilton rewards?

Yes, other options include the Hilton Honors American Express Card with no annual fee and the Hilton Honors American Express Aspire Card with luxury perks.

How does the Hilton Surpass Card compare to other hotel credit cards?

The Hilton Surpass Card offers a solid balance of benefits and rewards, but it's essential to evaluate alternatives based on individual preferences and travel habits

In this Review

Estimating Your Rewards: A Practical Simulation

In the following table, you will find a simulation that provides an overview of the expected rewards for the Hilton Honors Amex Surpass card.

This breakdown is based on both general usage and spending across various categories. By utilizing this table, you can gain a better understanding of the potential benefits that come with using this particular credit card.

It's important to note that the figures presented in this simulation are estimates, and actual rewards may vary depending on individual spending habits and other factors.

Spend Per Category | Hilton Honors American Express Surpass® Card |

$10,000 – U.S Supermarkets | 60,000 points |

$4,000 – Restaurants

| 24,000 points |

$4,000 – Airline | 12,000 points |

$5,000 – Hotels | 60,000 points |

$4,000 – Gas | 24,000 points |

Estimated Total Annual Points | 180,000 Points |

Pros and Cons

Just like any other credit card, the Hilton Honors Surpass has some advantages and disadvantages:

Pros | Cons |

|---|---|

Generous Rewards Program + Welcome Bonus | Annual Fee |

Complimentary Hilton Honors Gold Status | Low Point Value |

10 Complimentary Airport Lounge Visits | No Travel Credit |

No Foreign Transaction Fees | |

Free Night Reward |

- Generous Rewards Program

The card offers Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases.

- Free Night Reward

Cardholders can earn a free night reward after spending $15,000 on purchases in a calendar year.

- No Foreign Transaction Fees

The card has no foreign transaction fees, making it a good option for international travel.

- Welcome Bonus

New cardholders can earn 130,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership.

- National Car Rental® Status

Surpass® Card Members can receive free National Car Rental® Emerald Club Executive® status. This includes benefits like access to the Executive Area (for full-size reservations and above) in the USA and Canada. Enrollment is required.

- Complimentary Hilton Honors Gold Status

Cardholders receive complimentary Hilton Honors Gold status, which provides benefits such as room upgrades, free breakfast, and late check-out.

- 10 Complimentary Airport Lounge Visits

cardholders receive 10 complimentary visits and enjoy access to over 1,200 Priority Pass airport lounges in more than 130 countries each Membership year.

Editorial Note: Terms apply to American Express benefits and offers. Enrollments may be required for select benefits. Visit americanexpress.com to learn more

- Annual Fee

The card has an annual fee of $95 (see rates & fees).

- Low Point Value

Hilton offers about $0.6 per point, the lowest value compared to other hotel card or general travel cards.

- No Travel Credit

The card doesn't offer premium benefits such as airline fee credit or property credit.

Insurance And Travel Protections

The Hilton Honors American Express Surpass Card offers various travel protections, including:

- Extended Warranty: Use your Eligible Card for Covered Purchases and benefit from an extended warranty, matching the Original Manufacturer's Warranty for up to one additional year on warranties of 5 years or less in the United States or its territories.

Car Rental Loss and Damage Insurance: When using your eligible Card to reserve and pay for a rental vehicle, and declining the collision damage waiver, you're covered for damage or theft in a covered territory. Exclusions apply, and the coverage is secondary without liability coverage.

- Global Assist® Hotline: As a Card Member, access the Global Assist® Hotline for travel assistance over 100 miles from home, providing services like lost passport replacement, translation, missing luggage, and emergency legal and medical referrals. Costs from third-party service providers are the Card Member's responsibility.

Dispute Resolution: If faced with unrecognized charges or billing issues, American Express collaborates with you and the merchant to resolve the problem promptly.

Purchase Protection: Covered Purchases made with your Eligible Card are protected for up to 90 days from the purchase date, covering theft or accidental damage, with limits of up to $1,000 per occurrence and $50,000 per calendar year.

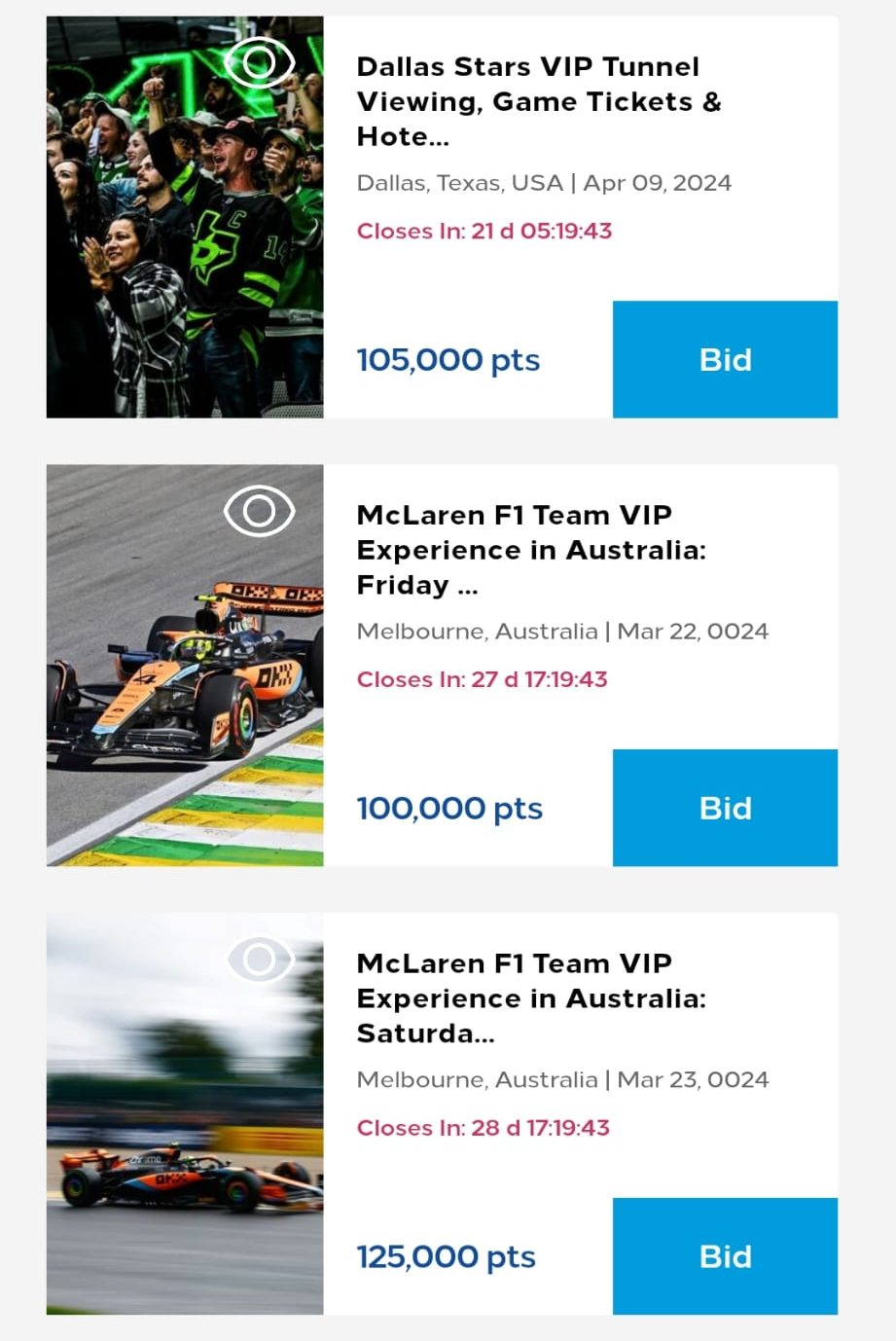

Top Offers

Top Offers From Our Partners

Top Offers

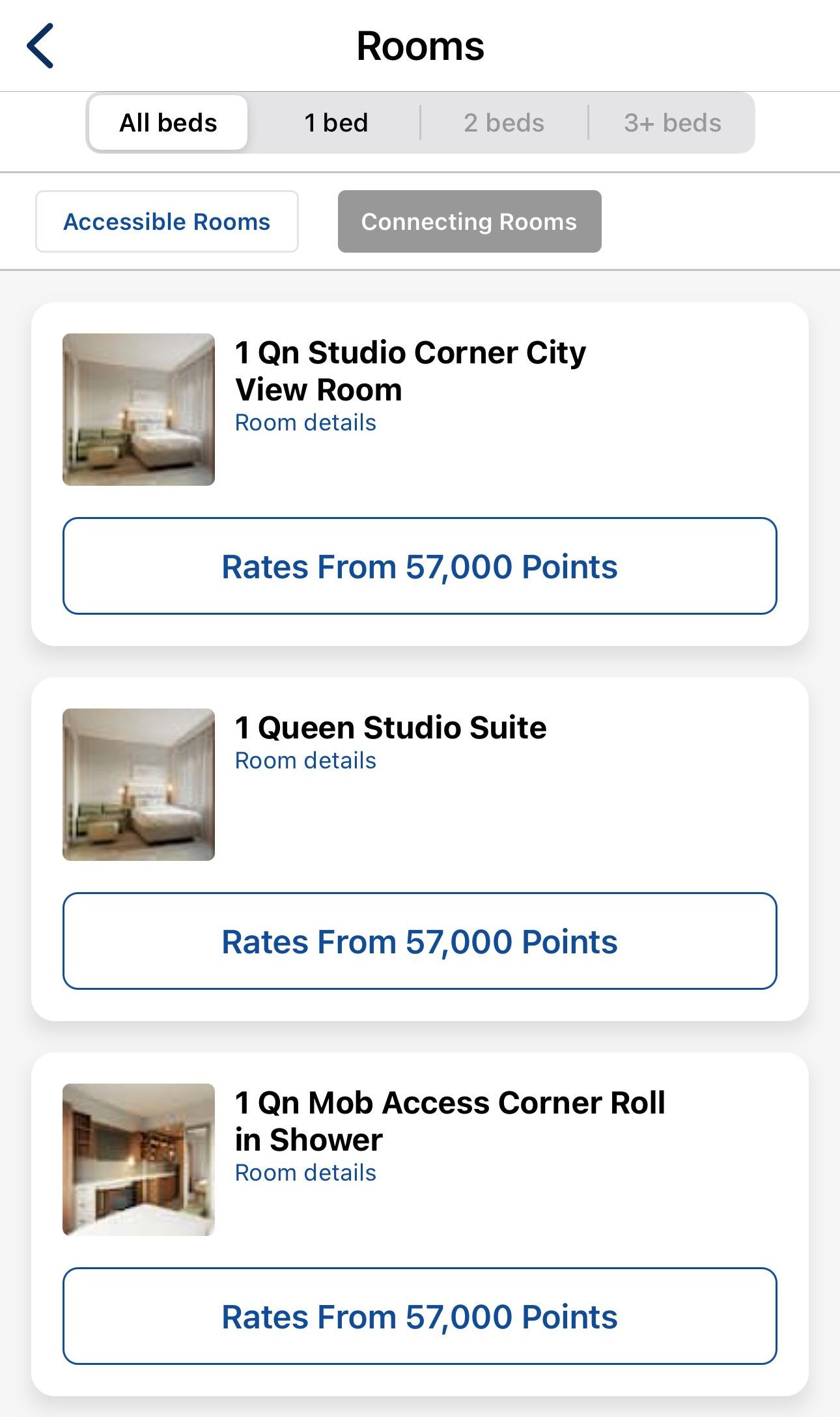

Unlocking Rewards: Points Redemption Options

With the Hilton Honors American Express Surpass Card, you can redeem your Hilton Honors points for a variety of rewards, including free hotel stays, experiences, merchandise, and more. Here are some of the redemption options available to cardholders:

Free hotel stays: One of the most obvious ways to redeem Hilton Honors points is by using them for free hotel nights at any of the 6,800 Hilton hotels and resorts worldwide. Use the Hilton search tool to check for award availability.

Experiences: Hilton Honors offers unique experiences, such as VIP concert tickets, culinary experiences, and sporting events, that can be purchased using your points.

Shopping: You can use your points to purchase merchandise, such as electronics, fashion, and home goods, through the Hilton Honors shopping portal.

Travel: You can use your points to book flights, car rentals, and other travel-related expenses through the Hilton Honors travel portal.

Transferring points: With the Hilton Honors program, can transfer your points to other loyalty programs, such as airline or hotel partners, for even more redemption options.

Is This Card Right for You?

The Hilton Honors American Express Surpass Card is a great option for those who frequently stay at Hilton properties and want to earn rewards on their hotel stays and everyday purchases. Here are some situations where you may want to consider the Hilton Honors American Express Surpass Card:

You frequently stay at Hilton hotels: If you're a frequent traveler and often stay at Hilton properties, the Hilton Honors American Express Surpass Card can provide significant rewards and benefits.

You want to earn rewards also on everyday purchases: With bonus points on U.S. restaurants, U.S. supermarkets, and U.S. gas stations, the Hilton Honors American Express Surpass Card is a great option for those who want to earn rewards on their everyday purchases.

You want automatic elite status: The card comes with automatic Gold status with Hilton Honors, which includes benefits such as room upgrades and late check-out.

You can look at additional Hilton cards if it's not the right card for your needs.

How It Compared To Other Hilton Cards?

The Hilton Honors American Express Surpass Card stands among several Hilton-branded credit cards, each catering to distinct traveler preferences and spending habits. In comparison to other Hilton cards, the Surpass Card offers a compelling balance of rewards and benefits.

For those desiring no annual fee and focusing on earning Hilton rewards, the Hilton Honors American Express Card is an alternative. While it lacks the extensive perks of the Surpass, it's an attractive option for occasional Hilton stays and straightforward rewards accrual.

On the luxury end, the Hilton Honors American Express Aspire Card caters to high-spending travelers. With a $550 annual fee, it offers Hilton Diamond status, airline fee credits, and a Hilton resort credit, making it ideal for those seeking premium benefits and indulgent stays.

The best fit for each card depends on individual preferences and travel habits. The Surpass Card suits semi-regular Hilton guests looking for a solid balance between benefits and affordability

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

| 80,000 points

80,000 Hilton Honors Bonus Points after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership

| $0 (Rates & Fees) | ||

Hilton Honors American Express Surpass® Card

| 3X – 12X

Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases

| 130,000 points

130,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership

| $150 (Rates & Fees) | |

Hilton Honors American Express Aspire Card

| 3x – 14x

14X Hilton Honors bonus points when you make eligible purchases on your card at participating hotels or resorts within the Hilton Portfolio, 7X Hilton Honors bonus points on eligible purchases on your card for: Flights booked directly with airlines or amextravel.com, car rentals booked directly from select car rental companies and U.S. restaurants, 3X Hilton Honors bonus points on other eligible purchases

| 150,000 points

150,000 Hilton Honors Bonus Points after you spend $4,000 in purchases on the Card within your first 3 Months of Card Membership

| $550 |

How To Apply For The Hilton Honors Surpass Card?

Here are the steps to apply for the Hilton Honors American Express Surpass Card:

Visit the American Express website: Navigate to the American Express website and search for the Hilton Honors American Express Surpass Card.

Submit your application: Complete the online application form with your personal and financial information. If you have a credit score of at least 680, there is a good chance for approval.

Wait for a decision: After submitting your application, American Express will review your application and may request additional information. If approved, you'll receive your card in the mail within 5-10 days.

Activate your card: Once you receive your card, you'll need to activate it online or by phone before you can start using it.

Top Offers

Top Offers From Our Partners

Top Offers

Compare Hilton Honors Amex Surpass Card

The Surpass card boasts a notably higher annual fee, justified by its superior rewards ratio and benefits compared to the Hilton Honors card.

If you can maximize your points, rewards, and benefits, the Hilton Aspire is our winner. But, if your spend is not so high – the Surpass wins.

Hilton Honors Surpass vs. Hilton Aspire Card: How They Compare?

The Hilton Amex Surpass is our winner as it offers higher estimated total cashback than the Marriot Boundless card and additional hotel perks.

Marriott Bonvoy Boundless vs. Hilton Amex Surpass: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

Despite having a higher annual fee, the Hilton Surpass card is our winner with higher estimated annual cashback and better extra hotel perks.

IHG One Rewards Premier vs. Hilton Amex Surpass: Side By Side Comparison

The Hilton Surpass and World of Hyatt card are two of the best medium tier hotel cards with great cash back rates and extra hotel perks.

World of Hyatt Card vs. Hilton Amex Surpass: Side By Side Comparison