The American Express® Gold Card and the Hilton Honors Surpass Card are both popular credit cards, each offering unique benefits catering to different preferences and lifestyles.

Here's our full comparison to help you decide between the two:

General Comparison

The Amex gold card charges a higher annual fee than the Surpass card, but when it comes to accumulating points, – the Hilton earns more points in almost every category.

However, the Amex gold card is the winner when it comes to extra benefits, including a variety of statement credits and access to the Amex fine hotels & resorts program. Also, the Gold card has the advantage when it comes to redemption options as you are not tied to a specific hotel network and you can redeem your points for a variety of things, including transferring them to hotels/airline points.

Here's a side-by-side comparison:

American Express Gold Card | Hilton Honors Surpass | |

Annual Fee | $250. See Rates and Fees. | $150 ( See Rates and Fees. ) |

Rewards | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. | Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases |

Welcome bonus | 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership. | 130,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | None. See Rates and Fees. | $0. ( See Rates and Fees. ) |

Purchase APR | 21.24% – 29.24% Variable

| 20.99% – 29.99% variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Hilton Amex vs. Hilton Surpass: Point Rewards Analysis

In the comparison of points rewards between the two cards, the Surpass card is definitely a good surprise. Despite its lower annual fee, it can drive much more points than the Amex gold card.

The main strength of the Amex gold card is the high rewards ratio in U.S. supermarkets, but the Hilton Surpass card also covers this category, and wins in almost every other category as well.

Spend Per Category | American Express Gold Card | Hilton Honors Surpass |

$10,000 – U.S Supermarkets | 40,000 points | 60,000 points |

$4,000 – Restaurants

| 16,000 points | 24,000 points |

$4,000 – Airline | 12,000 points | 12,000 points |

$5,000 – Hotels | 5,000 points | 60,000 points |

$4,000 – Gas | 4,000 points | 24,000 points |

Total Points | 77,000 points | 180,000 points |

Redemption Value (Estimated) | 1 point = ~0.6 – 1.6 cent | 1 point = ~0.6 cent |

Estimated Annual Value | $462 – 1,232 | $1,080 |

Hilton Surpass offers various ways for you to redeem points you earn through its loyalty program. You can use points to book free hotel stays, covering the cost of your room. Beyond hotel stays, you can also redeem points for experiences, travel, shopping, and more through the Hilton Honors program

The American Express Gold Card offers versatile rewards redemption options. You can use points for travel, hotel stays, or dining expenses. Additionally, you can redeem points for statement credits, covering various purchases.

Can I Transfer Amex Gold Points To Hilton?

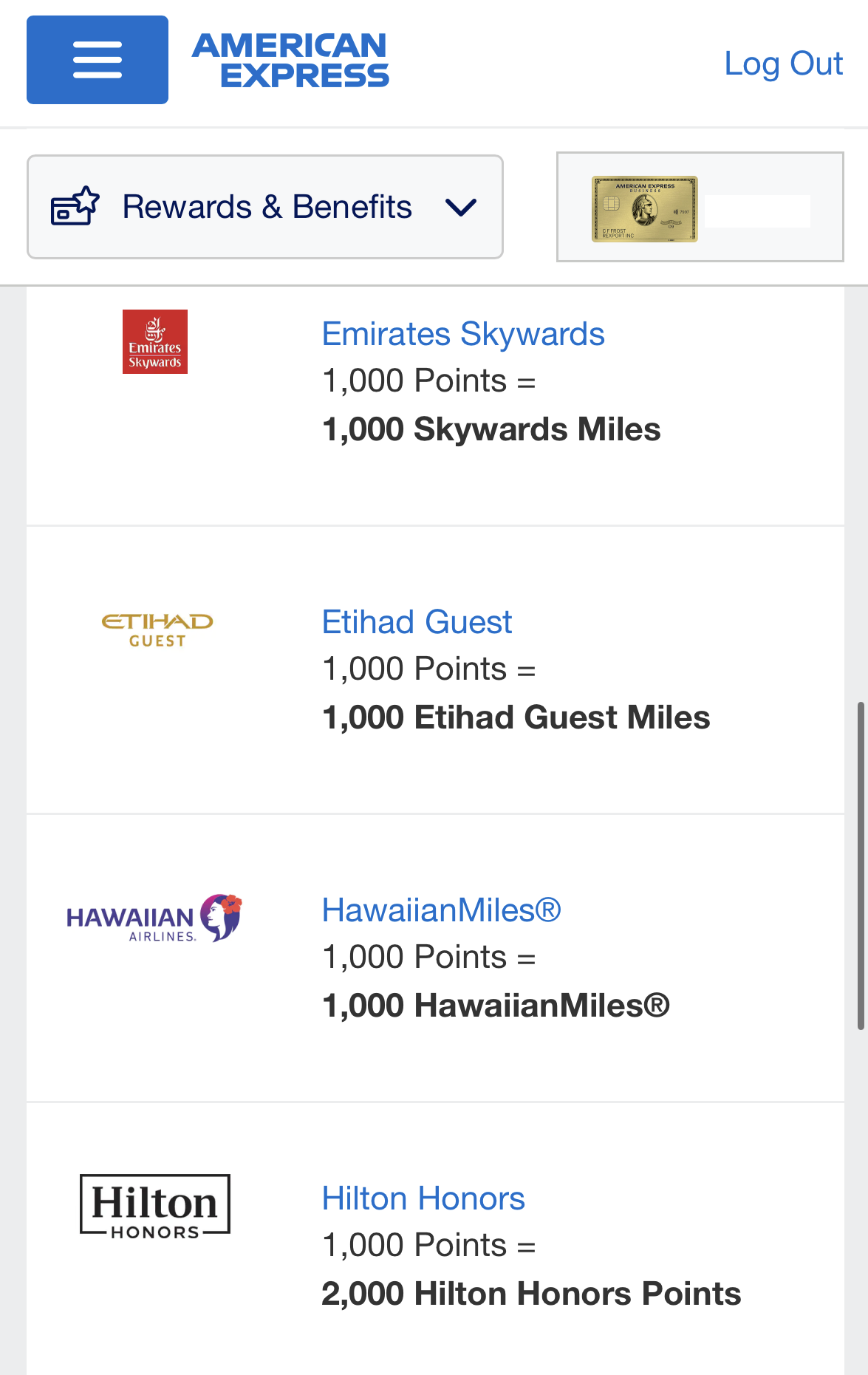

Certainly, you can transfer Amex Gold points to Hilton Honors at a 1:2 ratio, meaning 1 Amex Gold point equals 2 Hilton Honors points.

Keep in mind that transfer ratios may vary among different American Express cards. Transfers, starting at a minimum of 200 points in increments of 50, typically take 48-72 hours.

Despite the seemingly generous ratio, travel experts suggest caution as Amex points are generally more valuable when used for other redemptions like flights or transfers to alternative travel partners.

With Amex points valued around 1.5 cents for travel redemptions each compared to Hilton's 0.6 cent , transferring to Hilton may result in less favorable value for your Amex points.

Which Benefits You'll Get With Each Card?

The Amex gold card is the winner for extra perks, offering a variety of statement credits for dining, experience, TSA PreCheck, and Uber.

The Hilton Surpass offers a $200 Hilton annual credit and elite Gold Status which can be very valuable if you are a Hilton loyal customer.

American Express Gold Card

- Get up to $120 Uber Credit: Connect your new Gold Card to Uber and get $10 Uber Cash every month, usable for Uber rides or UberEats, with a yearly max of $120.

- Enjoy $120 Dining Credit: Pay with your Amex Gold Card at places like The Cheesecake Factory, Shake Shack, and more to get up to $10 in statement credit each month.

- Up to $100 Experience Credit: Book a two-night getaway with The Hotel Collection on Amex Travel and get a $100 experience credit (varies by property).

- Travel Smoothly with Global Entry or TSA PreCheck® Credit: Get up to $100 for Global Entry or up to $85 for TSA PreCheck.

- Entertainment Perks: Access exclusive events and get presale tickets for concerts and sports through the Amex Gold Card Entertainment Access program (subject to availability).

- Luxury Hotel Bonuses: Enjoy perks like room upgrades and free breakfast for two at select hotels with the American Express Fine Hotels & Resorts program.

- Top-Notch Concierge Service: The Amex Gold Card offers a concierge service for help with travel and dining reservations, though availability may limit fulfilling all requests.

Terms apply to American Express benefits and offers.

Hilton Amex Surpass Card

- $200 Hilton Credit: Enjoy up to $50 in statement credits per quarter, totaling $200 annually, for direct purchases with Hilton properties using your Hilton Honors American Express Surpass® Card.

- Hilton Honors™ Upgrade to Diamond Status: Achieve Hilton Honors Diamond status by spending $40,000 on eligible purchases in a calendar year, extending the status through the end of the next calendar year.

- Free Night Reward: Earn a Free Night Reward from Hilton Honors after spending $15,000 (Surpass) or $30,000 (Aspire) on eligible purchases on your Card in a calendar year.

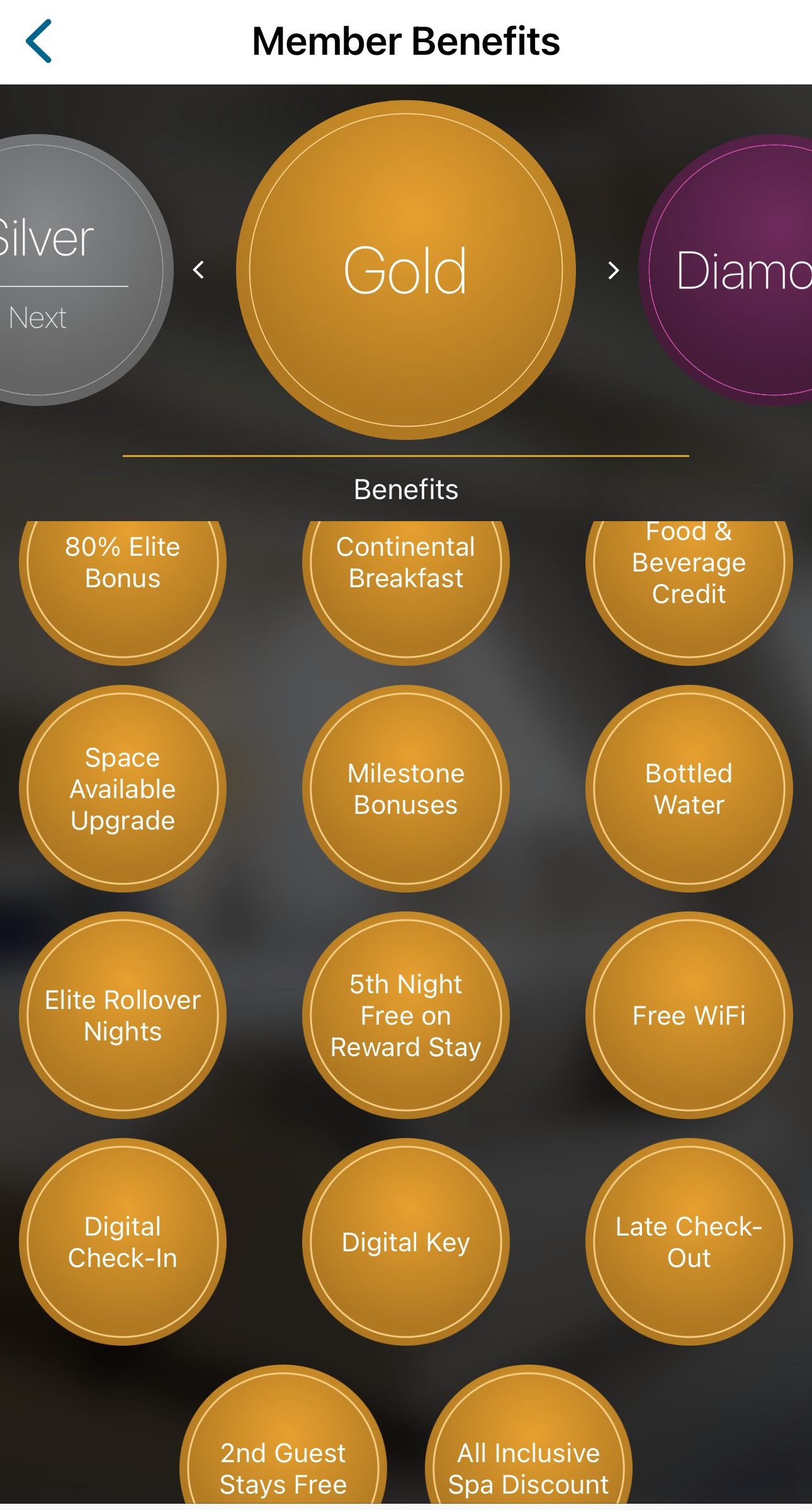

- Hilton Honors Gold Status: Receive complimentary Gold Status, providing benefits such as a 5th night free on standard room stays of 5+ nights, and an 80% Bonus on all Base Points to accelerate your free night earnings.

- ShopRunner: Enjoy complimentary membership with ShopRunner, providing free 2-day shipping on eligible items from a network of 100+ online stores, accessible by enrolling with your eligible Card at shoprunner.com/americanexpress.

- National Car Rental® Status: Surpass® Card Members can receive free National Car Rental® Emerald Club Executive® status. This includes benefits like access to the Executive Area (for full-size reservations and above) in the USA and Canada. Enrollment is required.

Terms apply to American Express benefits and offers.

Insurance Benefits

Since both cards are part of Amex cards, they offer quite similar travel insurance perks and protections:

- Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations.

- Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

- Global Assist® Hotline: Access the Global Assist Hotline for travel assistance over 100 miles from home, offering services like lost passport replacement, translation, missing luggage, and emergency legal and medical referrals.

However, the Hilton Surpass card offers better travel protections which also includes:

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

- Extended Warranty: When you use your card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Hilton Surpass Card?

You Might Prefer the Hilton Surpass card over the Amex Gold card if:

Loyalty to Hilton Properties: Choose the Hilton Honors Surpass over the Amex Gold Card if you frequently stay at Hilton properties, as the Surpass card offers elevated Hilton Honors status and bonus points for Hilton stays, maximizing your loyalty benefits.

Desire for Premium Hotel Benefits: Opt for the Hilton Honors Surpass if you value premium hotel perks, including Hilton resort credits, and Gold Elite status, which can significantly enhance your overall hotel experience, making it a superior option for those seeking added luxury.

High Points Rewards Ratio: As we can see in our analysis, while the Surpass annual fee is lower – the points rewrads ratio is higher than the Amex Gold card on most categories, giving you the option to earn a large amount of Hilton points.

When You Might Want the Hilton Surpass Card?

You Might Prefer the American Express Gold card if:

You Want Transferable Membership Rewards Points: If you value the flexibility of redemption options and transferable points, the Amex Gold Card allows you to convert Membership Rewards points to various airline and hotel partners, providing versatility in how you redeem your rewards beyond hotel stays.

Preference for a Broader Hotel Portfolio: If your travel preferences include a variety of hotel brands beyond Hilton, the Amex Gold Card allows you to explore diverse accommodations through the Membership Rewards Hotel Collection, providing flexibility in your choice of hotels.

You Want Global Entry or TSA PreCheck Fee Credit: If expedited airport security screening is a priority, the Amex Gold Card includes a statement credit for either Global Entry or TSA PreCheck, offering added convenience for frequent travelers.

Compare The Alternatives

If you're in search of a travel credit card offering hotel rewards, there are several compelling alternatives worth exploring:

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Hilton Honors Amex Surpass Card

The Surpass card boasts a notably higher annual fee, justified by its superior rewards ratio and benefits compared to the Hilton Honors card.

If you can maximize your points, rewards, and benefits, the Hilton Aspire is our winner. But, if your spend is not so high – the Surpass wins.

Hilton Honors Surpass vs. Hilton Aspire Card: How They Compare?

The Hilton Amex Surpass is our winner as it offers higher estimated total cashback than the Marriot Boundless card and additional hotel perks.

Marriott Bonvoy Boundless vs. Hilton Amex Surpass: Side By Side Comparison

Despite having a higher annual fee, the Hilton Surpass card is our winner with higher estimated annual cashback and better extra hotel perks.

IHG One Rewards Premier vs. Hilton Amex Surpass: Side By Side Comparison

The Hilton Surpass and World of Hyatt card are two of the best medium tier hotel cards with great cash back rates and extra hotel perks.

World of Hyatt Card vs. Hilton Amex Surpass: Side By Side Comparison

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

The Autograph is great for travelers who want to stay on budget, while Amex Gold provides premium travel benefits and redemption options.

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : Which Premium Card Is Best?

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison.

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.