Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- No Credit Check

- You Don’t Need A Bank Account

- No Upgrade

- $200 Minimum Deposit

Rewards Plan

Sign up Bonus

0% Intro

PROS

- No Credit Check

- You Don’t Need A Bank Account

CONS

- No Upgrade

- $200 Minimum Deposit

APR

24.64% Variable

Annual Fee

$35

Balance Transfer Fee

N/A

Credit Requirements

Limited/No Credit

- Our Verdict

- Pros & Cons

- FAQ

The No Credit Check feature is probably the most exciting thing about the OpenSky® Secured Visa® Credit Card. This is perfect for anyone trying to build credit, whether you’re just starting out or trying to rebuild previously damaged credit.

The OpenSky Secured Credit Card operates like the conventional unsecured credit card, except that it doesn’t check your credit. This means a poor credit score will have no impact on your account approval. You are only required to pay a refundable security deposit ($200 – $3,000) when you create an account. This deposit is what determines your credit card limit. So if you deposit $400, your credit card limit is set to $400. And you can begin using it immediately.

OpenSky reports to all three major credit bureaus monthly. This is critical in helping you build credit quickly, as long as you make payments on time and properly maintain your account. You can create email alerts so you’re never behind on your monthly payments.

A major drawback is the inability to upgrade to an unsecured card even after you have built up a good credit score.

- No Credit Check

- You Don’t Need A Bank Account

- Reports To The Three Major Bureaus

- You Define Your Credit Limit

- Annual Fee

- Minimum Deposit

- No Upgrade

What’s the initial credit limit?

The credit limit for an OpenSky Secured Visa credit card is determined by your deposit. You can provide a security deposit of $200 to $3,000 and this will act as your credit limit. So, if you pay a $500 security deposit, you’ll have a $500 limit. However, after six months you may be eligible for a credit limit increase without needing to provide an additional deposit.

What are the card income requirements?

The OpenSky has flexible requirements, so you don’t need to worry about your income to qualify. In the case of OpenSky, you simply need to prove that your income is greater than your typical monthly expenses.

How's OpenSky Digital Experience?

OpenSky also has a solid website, but it can only be accessed within the U.S. If you want to check your account while you’re abroad on vacation, the international IP will be rejected.

How long will I use the card until my credit score goes up?

This really depends on your circumstances and spending habits. If you’re regularly using the card and making your payments on time, you should start to see your credit score increasing in several months.

According to OpenSky, half of its customers who make payments on time see a FICO score increase of 30 or more points after just three months.

How long does it take for card approval?

OpenSky approval takes up to 48 hours and once you’re approved, the card can take up to two weeks to arrive.

How’s the card’s customer service availability?

OpenSky has a toll free number and you can also speak to the customer service team via the OpenSky app.

Table of Contents

Advantages

Let’s take a look at the advantages of this card and see if it’s the right one for your wallet or not.

- No Credit Check

OpenSky Secured Credit Card does not care for your credit history, and that’s a good thing. Most credit card companies will not approve your card requests if your credit score is bad. This card offers you the chance to offset that while enjoying the full benefits of a normal Visa credit card.

While your previous credit doesn’t affect your card approval, you still need to meet other financial requirements before your application is approved. Compared to other credit cards, however, this is a walk in the park.

- You Don’t Need A Bank Account

This card allows you to operate it using payment options such as Western Union and money order. This is useful if you do not own a bank account yet or prefer not to use one.

- Reports To The Three Major Bureaus

Your card activity is reported monthly to Equifax, Experian, and TransUnion — the three major credit bureaus.

As long as you stay below your credit limit and show financial responsibility, this can quickly help you grow or rebuild your credit rating. They say 99% of their credit cardholders are able to build their credit scores in as short as six months.

- You Define Your Credit Limit

Your credit limit is flexible, within a range. If your initial deposit was $700, for instance, and you would like to increase your credit limit from $700, you could submit a request. If this request is approved, you’ll be able to move to a higher credit limit after paying a matching deposit fee.

Disadvantages

Let’s take a look at the disadvantages of this credit card and see if it’s the right one for your wallet or not.

- Annual Fee

Compared to similar cards, the $35 fee is relatively low. For anyone eligible to obtain better credit cards, however, this is an expensive deal. Many credit card companies do not charge annual fees to their users.

- Minimum Deposit

Unlike other secured credit cards, there is no option to pay smaller deposits or pay the fees in small installments. This can be quite expensive for those who cannot afford the required $200 at once.

- No Upgrade

You are stuck with a permanently secured account. This can quickly become inconvenient if you’ve built up a good credit score and would like to shift to a less restrictive credit card system.

The only way to upgrade to an unsecured credit card with greater flexibility is to close your account. This will negatively affect your credit score rating. Leaving is costly, but so is staying. You will still be required to pay the $35 annual fee.

How To Apply For OpenSky Secured : Build Credit With No Credit Check Card?

The application process is straightforward and can be completed in one sitting. To qualify, you’ll need to:

- Be a U.S. citizen or permanent resident.

- Pay a refundable security deposit between $200 and $3,000.

- Have a monthly income that exceeds your monthly expenses.

- Provide a Social Security number or Individual Taxpayer Identification Number.

A bank account is not required.

To get started, simply visit the OpenSky website and click “Apply Now” at the top or middle of the homepage.

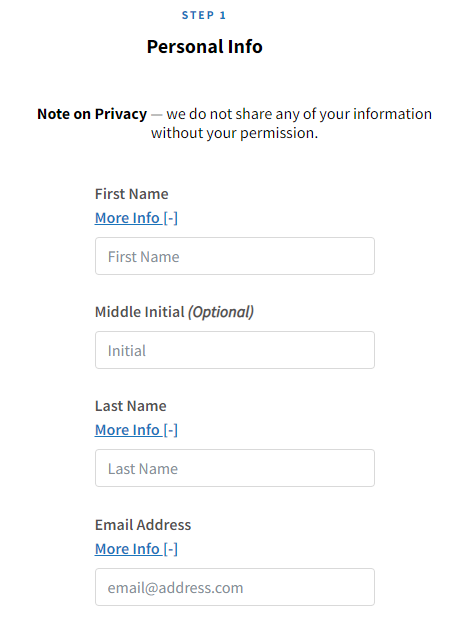

Step 1: Personal Information

You will be required to provide your names and email address. Your email address will be the primary means of communication with the bank.

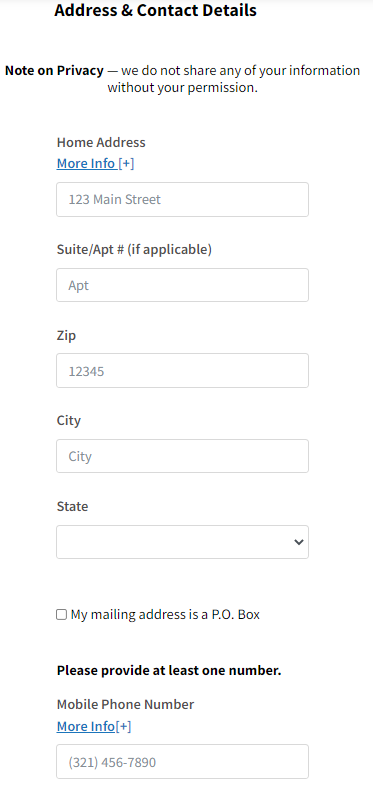

Step 2: Address and Contact Details.

Provide your home address, zip code, and phone numbers. These will not be shared with anyone.

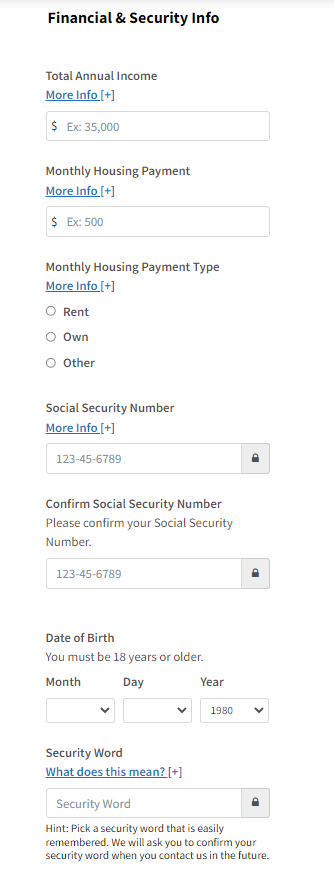

Step 3: Financial and Security Information

Fill in your total annual income, date of birth, monthly housing payment and type, social security number, and a security word. Your total annual income is the total amount you earn or expect to earn in one year. If you share a monthly housing payment, only include your part. Your security word will be used to verify your identity when the bank contacts you.

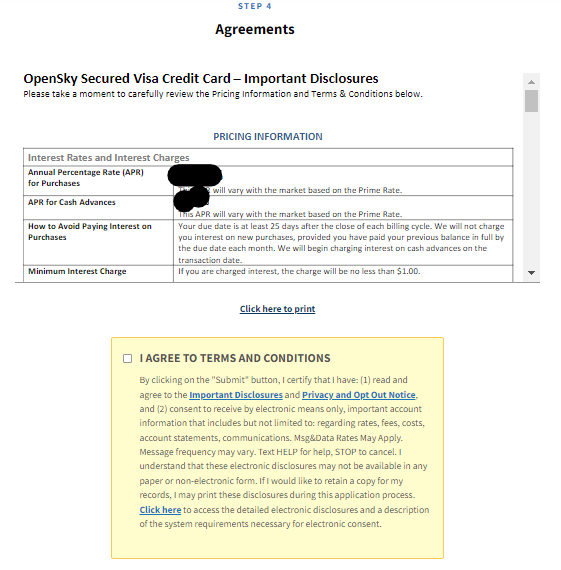

Step 4: Agreements

You will be presented with the pricing information and asked to agree with their terms and conditions.

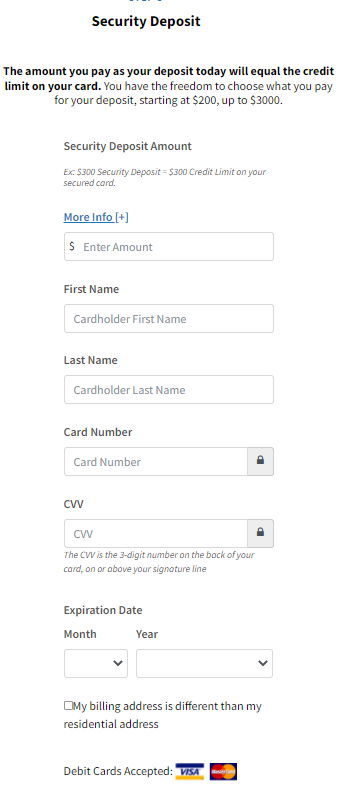

Step 5: Security Deposit

This is the final step. You will be required to enter the amount you want to pay as deposit. The amount you pay here ($200-$3000) will be the same as your credit limit. You may pay with your debit card immediately or choose to pay at a later date. Once you’re done, click on “Submit.” Your application will be sent, but you will only receive your card after paying the deposit.

The application is usually processed within 24-48 hours. If it is approved, you will be informed via email. Your receipt and security deposit will be processed, after which your credit card is mailed to your address. This typically takes 12-14 business days.

Is the OpenSky Secured Card Right for You?

If you have a low credit score, no bank account, or are looking to build credit from scratch, this card could be a great option for you. With a relatively low APR, competitive annual fees, and a credit-blind application process, the OpenSky Credit Card is designed to help improve your credit.

However, the OpenSky Credit Card is specifically geared toward those who need it. If your credit score is already good, this card likely isn’t necessary for you.

Compare The Alternatives

If you're looking for a build your credit with a secured card – OpenSky is definitely a good option, but there are some good alternatives:

|

|

| |

|---|---|---|---|

Capital One Secured | Citi Secured | Discover It Secured | |

Annual Fee | $0

| $0

| $0

|

Rewards |

None

None

|

None

None

|

1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases

|

Welcome bonus |

None

None

|

None

None

|

Match Bonus

Discover will match all the cash back you’ve earned at the end of your first year.

|

Foreign Transaction Fee | $0

| 3%

| 3%

|

Purchase APR | 29.49% (Variable)

| 21.24% – 29.24% (Variable)

| 26.99% Variable

|

FAQ

OpenSky also allows you to add an authorized user to your account, but this can only be done after you’ve been approved for an account and it is not possible during the application process.

Yes, OpenSky (Capital Bank) reports your payment activity to all three major credit bureaus; TransUnion, Equifax and Experian which can help to boost your credit score in a matter of months.

The top reason not to consider the OpenSky Secured visa is similar. While you can have some flexibility about your credit limit according to the amount you provide as a deposit, it is dollar for dollar. At a base $200 deposit, you’ll only get a $200 limit. There are other secured credit card options that provide a $200 limit with a deposit as low as $49.

OpenSky does not require a credit check to apply, so there really is no need to pre qualify. You can simply apply and see if you qualify without impacting your credit with a hard pull. In fact, OpenSky claims an 85% average approval rate.