In this Review

M1 Finance is a well-established investment and savings platform, but it has expanded with the aim of creating a one stop shop for your basic financial needs. While it started off with investment accounts and offering line of credit against your investments, now M1 Finance has a personal banking option and The Owner’s Rewards Card.

This credit card is issued by Celtic Bank and powered by Deserve. However, unlike traditional rewards cards, the structure of this card is more like a shareholder loyalty program.

You’ll earn rewards with the companies that you have investments in via your M1 portfolio. There are approximately 80 companies on the eligible list, but this does include some popular brands such as Amazon, Target, Peloton and Apple.

However, while these companies are the most attractive draw for this card offering up to 10% in rewards, you can still earn 1.5% if you spend outside the list of brands. The specific amounts of cash back you can earn will depend on what tier the brand is in on the bonus list.

For example, Amazon is in the tier offering 2.5% cash back, but this does mean that you’ll earn 2.5% on purchases with any Amazon company including Zappos and Whole Foods. Just bear in mind to access this higher cash back, you will need to have Amazon shares in your M1 Portfolio.

Rewards Plan

Sign up Bonus

0% Intro

PROS

- High Cashback

- M1 Plus Member Fee Waiver

CONS

- Annual Fee

- Rewards Cap

APR

20.24% – 30.24%

Annual Fee

$95 (waived for active M1 Plus customers)

Foreign Transfer Fee

$0

Credit Requirements

Good - Excellent

Main Features & Benefits

The Owner’s Reward Card by M1 is quite innovative and offers some unique features that you may not find with other reward cards. These include:

- Cash Back on Companies You Invest In

The card is designed to reward you for patronizing the companies that you own stock in. This is a very unique and innovative way approach to a credit card reward structure.

- Free Year of M1 Plus

Although the basic M1 membership is sufficient for most investors, M1 Plus offers some additional perks.

But, you need to pay a subscription to upgrade to M1 Plus. However, new cardholders can enjoy a year of M1 Plus for free.

- M1 Plus Member Fee Waiver

If you’re an M1 Plus member, you won’t need to pay the annual fee.

- Rewards Automatically Reinvested

While you can withdraw your accumulated rewards in the form of cash back, M1 can also automatically reinvest them into your M1 investment Pies to provide maximum long term returns.

This is a great way to boost your investment portfolio, if you don’t have a great deal of funds to use.

- Access to Visa Signature Benefits

The Owner’s Rewards Card is a Visa Signature credit card, so you can access the benefits package associated with this.

This includes top notch ID theft protection, travel and emergency assistance services, roadside dispatch and personalized support. You can also gain higher status at over 900 luxury hotel partners.

Drawbacks

- Annual Fee

The first potential downside to this card is that any rewards will need to be offset against the $95 (waived for active M1 Plus customers) annual fee.

While this is negated by the free year of M1 Plus, in year two, you’ll need to compensate for the fee with your rewards or pay the $125 to remain an M1 Plus member., and this while there are many alternative no annual fee cards.

- Limited List of Elevated Rewards Brands

Currently, the list of companies that offer elevated rewards is limited to approximately 80, but there is potential for this list to expand over time.

- May Encourage Risky Purchases

The nature of this card’s reward structure encourages M1 users to buy and hold individual stocks to achieve the top tier rewards.

This may not be the best move for your specific investment aims and goals.

- You Need to Own Shares

To qualify for the higher rewards tier, you'll need to own at least a fractional share in the companies listed as eligible stocks. Keep in mind, some well-known brands like Amazon can have shares worth thousands of dollars, so you'll need to make a meaningful investment to reach that higher rewards level.

- Difficult to Track Your Company Investments

Since M1 Finance operates on the basis of Pies, it can be difficult to see the individual companies that you are actually invested in.

Additionally, with the auto portfolio rebalancing feature active, the list of your investment companies could change overnight.

- Rewards Cap

The rewards are capped at $200 per month.

How's M1 Customer Service?

M1 has a great website and app (rating of 4.7 on AppStore, 4.6 on Google Play) that not only provides access to the customer service team, but offers extensive resources for any queries or questions.

If you do need help for a specific issue, there are a number of ways to access the team.

- Instant Help: This is a 24/7 automated function that you can access online and via the app. You just need to click the chat icon at the bottom of the screen for the fastest response.

- Email: If you send M1 an email, a representative will usually respond within one business day. M1 classes business days as when the U.S stock market is trading, which is usually Monday through Friday.

- Phone: If you have an urgent issue, you can call the M1 team. The lines are open from 9 am to 4 pm ET Monday through Friday unless it is a market holiday. However, if you have a credit card specific issue, there is a dedicated phone line that is available 9 am to 9 pm ET Monday through Friday and 10 am to 3 pm ET on Saturdays.

How to Maximize The M1 Owner’s Rewards Card?

The best way to earn the maximum rewards is to browse the list of eligible brands and look for some of your favorite retailers.

To access the higher tier rewards, you will need to invest in these companies, but M1 Finance does offer fractional shares.

However, there are other ways to maximize the benefits from this card including:

- Upgrade to M1 Plus: While this does incur a cost, you won’t need to pay the card annual fee. You’ll also gain access to the M1 Plus membership perks including additional trading windows and preferential rates.

- Browse the Visa Signature Rewards: Since there are a number of Visa Signature credit cards on the market, each with their own benefits, many cardholders tend to overlook the perks offered. This includes features like the Luxury Hotels collection, where you can make your vacation a little more special or the concierge services to help you book tickets to events.

How to Apply for The Owner’s Rewards Card by M1:

When you visit the M1 website, you’ll find the credit card under the “Spend” tab. This will provide you with an overview of the card and an “Apply” button.

Since you need to be an M1 member to have this card, you’ll now be redirected to a log in screen.

However, there is a prompt to sign up, if you’re not already a member.

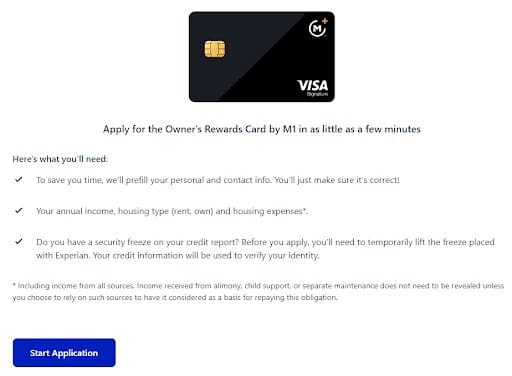

After you log in or create your account, you will be directed to the application page. M1 provides a breakdown of what you’ll need to start the application.

However, M1 will prefill some of the fields as per your membership profile, which will speed up the application.

From this point, the application process is quite straightforward. You’ll need to provide additional personal information such as your annual income and typical expenses.

However, once you click submit, M1 will assess your application and provide a prompt approval decision.

FAQs

What Are The Card Income Requirements?

M1 does not have any formal income requirements to qualify for the card. In fact, on the company website, it states that you only need to be an M1 member and live in one of the 50 U.S states.

However, since you need to have good to excellent credit to qualify, your income and current debt will play a role in whether you are approved along with your general creditworthiness.

Can I Get Pre Approved On The Owner’s Rewards Card?

The website application does not have any facility for getting pre approval or seeing if you qualify with a soft credit check. However, it is possible that members may receive a pre approval marketing message at some point.

What Is The Initial Credit Limit Of The Card?

There aren’t set guidelines for the initial credit limit on this card. M1 determines your limit based on the information you provide in your application, including your income, expenses, and debt. Similarly, there’s no specific timeline for credit limit increases. Typically, you may need to use the card and make timely payments for at least six months before requesting an increase.

What Are The Top Reasons Not To Get The Owner’s Rewards Card?

This card is specifically designed for investors on the M1 platform. So, if you are not interested in investing or don’t like using the M1 platform, this is not the right card for you.

Can I Add An Authorized User?

M1 currently does not allow cardholders to add authorized users to their accounts.

What’s The Main Uniqueness Of The Owner’s Rewards Card?

The main unique characteristic of this card is that it encourages you to shop with the brands that you invest in. This is a great incentive and since you can have your rewards automatically reinvested, it could help you to build an impressive portfolio.

Which Type Of Customer Can Most Benefit From This Card?

Obviously, M1 members are the target customers for this card, but not every M1 member would benefit from it. The customers who can most benefit are the ones who already shop with the top reward tier countries and are already planning to invest in them

Does The Owner’s Rewards Card Offer A Good Digital Experience?

M1 has an impressive website and app to manage investments and the financial products offered. So, as a cardholder you should expect a good digital experience

How Long It Takes To Get Approved On The Card?

In most cases, you can expect an almost immediate approval decision. However, there may be cases where you need to wait a few days to learn if your application has been approved or declined.

How’s The Owner’s Rewards Card’s Customer Service Availability?

In addition to using the email and chat methods to contact the customer service team, The Owner’s Rewards Cardholders have a dedicated phone line. This is available 9 am to 9 pm ET Monday through Friday and 10 am to 3 pm ET on Saturdays.