Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- Reports to All Three Credit Bureaus

- Fast Processing

- Annual Fee

- No Rewards

Rewards Plan

Sign up Bonus

0% Intro

PROS

- Reports to All Three Credit Bureaus

- Fast Processing

CONS

- Annual Fee

- No Rewards

APR

29.99% APR (Variable)

Annual Fee

$75-$99 per year, plus $0-$120 per year (assessed as $0-$10 monthly) in maintenance fees after your first year

Balance Transfer Fee

N/A

Credit Requirements

NoCredit / Bad Credit

- Our Verdict

- Pros & Cons

- FAQ

The Reflex® Platinum Mastercard® is a credit card designed for those with bad credit or no credit history at all. The card offers a low line of credit with a variable interest rate. However, the card charges very high fee so it's better to shop around for another card, if you have the option.

The card offers several benefits, including a credit protection program and the waiver of maintenance fees for the first 12 months. Reflex also reports your card activity to the major credit bureaus. However, since good credit isn't required for approval, the card does come with a higher interest rate.

Although there is no deposit required, you do need to be prepared to pay some regular fees. You'll pay $75-$99 per year, plus $0-$120 per year (assessed as $0-$10 monthly) in maintenance fees after your first year .

- Reports to All Three Credit Bureaus

- Mobile App

- Mobile App

- Fast Processing

- Widely Accepted

- Annual + Maintenance Fee

- Credit Limit is Capped

- Higher APR

- No Rewards

In this Review

Benefits

Let’s take a look at the benefits of the Reflex® Platinum Mastercard® and see if it’s the right one for your wallet or not.

- Reports to All Three Credit Bureaus

Reflex reports your card activity to all three major credit bureaus, which is important for building your credit. When you make on-time payments each month, it will be reflected on your credit reports, showing potential lenders that you are responsible with your finances.

The 15 months on purchases and balance transfers 0% purchase APR is longer than most credit cards which works well if you plan to spend right away with it and pay it off slowly.

- Mobile App

You can access your Reflex® Platinum Mastercard® account using the dedicated mobile app. This allows you to check your balance, track your FICO score and make payments.

The app is user friendly, but it is encrypted with security layers so your information is protected.

- Higher Credit Limit

The initial credit limit for the Reflex® Platinum Mastercard® is typically $300 to $1,000. However, after 6 to 12 months, there is the possibility of getting a credit limit increase to as much as $2,000.

It is possible to increase your credit limit when you demonstrate responsible use. In addition to a possible credit limit increase after six months, there is the potential to qualify for a card with more attractive features once you improve your credit.

- Fast Processing

Unlike many cards, the application process for the Reflex® Platinum Mastercard® is quite simple. You can receive an answer to your application within seconds.

In the event that you don’t qualify for the card, you’ll be offered a secured card and provide a detailed explanation of why your application was denied.

- Widely Accepted

Since the Reflex card is a Mastercard, it is widely accepted around the world. You can use your Reflex card overseas and if you qualify for a $300 credit limit, the foreign transaction fees are waived for the first year.

Top Offers From Our Partners

Advertiser Disclosure

The product offers that appear on this site are from companies from which this website receives compensation.

Drawbacks

- Annual + Maintenance Fee

The Reflex® Platinum Mastercard® has two different types of mandatory fees.

You'll pay $75-$99 per year, plus $0-$120 per year (assessed as $0-$10 monthly) in maintenance fees after your first year . Additionally, the fee is charged to your account and will reduce your available credit limit.

- Credit Limit is Capped

Regardless of your initial credit limit, the maximum limit for this card is capped at $2,000. This means that if you’re aiming to keep your credit utilization rate at below 33%, there is only the potential to use $660.

- Higher APR

Since the Reflex® Platinum Mastercard® is available to those with poor credit, the interest rate does reflect this higher risk. If you’re carrying a balance, you can expect to pay 29.99% APR (Variable)APR.

- No Rewards

The Reflex® Platinum Mastercard® is a basic card and offers no rewards.

Apart from building your credit, there are no other perks associated with this card. This can make it hard to justify the annual fees.

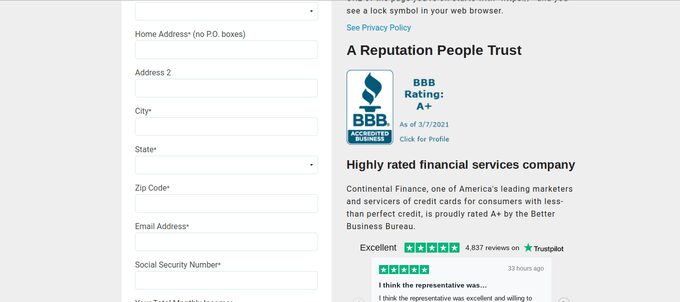

How To Apply For Reflex® Platinum Mastercard® ?

- 1.

You can apply for your Reflex credit card by mail, phone or online. You can pre qualify for the card, which involves a soft credit search that won’t impact your credit score.

You will need to provide your name and address, email address, and social security number.

- 2.

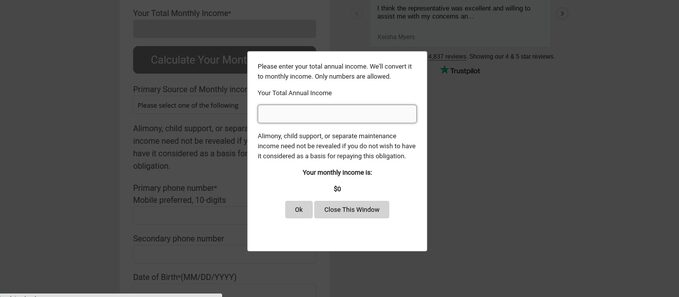

Reflex also requires you to provide your monthly income. The website provides a calculator tool to calculate your monthly income.

- 3.

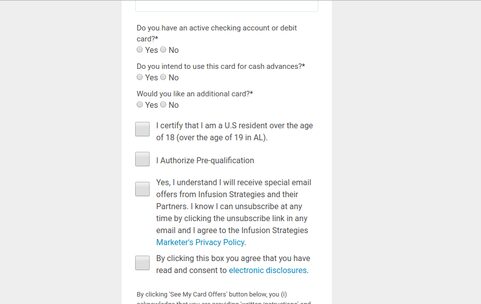

Finally, you need to provide your date of birth and phone number. You will also need to confirm if you have an active checking account, if you need an additional card, and authorize pre qualification.

Once you click see my card offers, you will see whether you qualify for this card or if you’ll be offered a secured card.

Is the Reflex® Platinum Mastercard® Right for You?

The Reflex Mastercard is a suitable for those who have poor credit or not credit history and are struggling to get approval for the other credit cards.

The card is designed to help you to build your credit. Credit activity is reported to all three of the major credit bureaus and you can qualify for a credit limit increase if you make your payments on time during the first six to 12 months after account opening.

However, you will need to be prepared for a hefty annual fee and monthly maintenance fees. These can add up to over $200 per year, which will take a chunk out of your card spending potential.

So, if you’re looking to repair your credit, and prefer the thought of paying fees rather than putting a security deposit in place, the Reflex Mastercard® could be worth consideration.

Compare The Alternatives

If you're looking for a build your credit – there are some good alternatives to consider:

|

|

| |

|---|---|---|---|

OpenSky® Secured Visa® Credit Card | First Progress Platinum | Milestone® Mastercard® | |

Annual Fee | $35 | $29

| $175 the first year; $49 thereafter |

Foreign Transaction Fee | 3%

| 3%

| 1% of each transaction in U.S. dollars

|

Purchase APR | 24.64% Variable | 25.24% Variable

| 35.90%

|