Table Of Content

If you manage your bank account on both Citi and Discover or wondering which offers a better credit card for your needs, we've summarized the popular credit cards each of these banks offers by category.

Let's compare your options in cashback, travel, 0% intro, and other categories.

Discover vs. Citibank: Which Offers Better Cashback Card?

Both Citi and Discover offer various options for consumers looking for a cashback card with no annual fee.

For those who don't want to track categories and prefer flexibility, there is only one card that an be relevant – the Citi Double Cash card. In addition to flat rate cashback, it also offer long 0% intro APR on balance transfers.

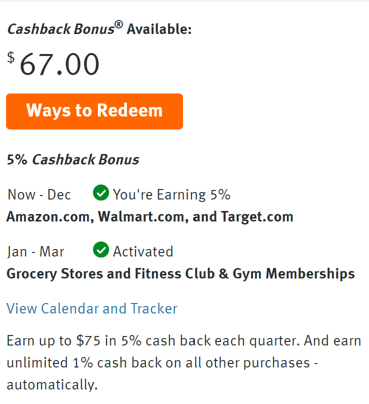

On the other hand, if you tend to spend more in specific categories, the other cards offer higher cashback rates for those. Among them, the Discover it® Cash Back card stands out with the highest cashback rate and a higher spending cap compared to the Citi Custom Cash and the Discover it® Chrome Gas & Restaurants card.

Lastly, Discover cards have another advantage—unlike Citi cards, they don't charge a foreign transaction fee.

| ||||

|---|---|---|---|---|

Citi® Double Cash Card | Citi Custom Cash℠ Card | Discover It Cash Back | Discover it® Chrome Gas & Restaurants | |

Annual Fee | $0 | $0 | $0 | $0 |

Rewards | 1% – 2%

2% cash back rewards rate – 1% every time you swipe and another 1% upon payment.

| 1-5%

5% cash back on your highest eligible spend category each billing cycle up to the first $500 spent and 1% cash back thereafter

| 1-5%

5% cashback on up to $1,500 in rotating category purchases each quarter when you activate the bonus category (then 1%), as well 1% percent cash back on all other purchases

| 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and 1% cash back on all your other purchases

|

Welcome bonus | N/A

$200 cash back after spending $1,500 on purchases in the first 6 months

| $200

$200 cash back after you spend $1,500 on purchases in the first 6 months of account opening (20,000 ThankYou® Points, which can be redeemed for $200 cash back)

| Cashback Match

All cash back earned at the end of the first 12 months is matched.

| Cashback Match

Discover matches all cash back you earn at the end of your first year

|

0% Intro APR | 18 months on balance transfers | 15 months on purchases and balance transfers | 15 months on purchases and balance transfers | 15 months on purchases and balance transfers |

Foreign Transaction Fee | 3% | 3% | $0 | 0% |

Purchase APR | 18.74% – 28.74% (Variable) | 18.49% – 28.49% (Variable) | 18.74% – 27.74% Variable APR | 18.74% – 27.74% Variable APR |

Read Review | Read Review | Read Review | Read Review |

Travel Card Comparison: Which Bank Wins?

When comparing travel cards, both banks offer basic, low-tier travel cards, while Citibank also offers a mid-tier travel card, the Citi Strata Premier card.

In the basic travel card battle, we think the Citi Rewards+ is the best choice for low—to mid-tier travel credit cards.

Like the Discover It Miles card, it offers 0% introductory APR and has no annual fee. However, its rewards program is much better. If you frequently use your card for travel expenses, gas, or groceries, the Citi Rewards+ is a better option..

For frequent travelers who want a premium travel card, the Citi Strata can be a good option. Points can be redeemed for travel through the Citi ThankYou® Rewards program, and the card offers valuable travel protections and benefits.

| |||

|---|---|---|---|

Citi Strata Premier Credit Card | Discover it Miles | Citi Rewards+® Card | |

Annual Fee | $95 | $0 | $0 |

Rewards | 1X – 10X

10X per dollar on hotel, car rentals and attractions booked through CitiTravel.com, 3X points on restaurant, supermarket, gas station, and air travel and other hotels purchases, and 1X points per dollar on all other purchases

| 1.5X

unlimited 1.5x miles for every dollar spent on all purchases

| 1X – 5X

Earn 5X points on rental car, hotel and attraction purchases booked through cititravel.com (ends 12/31/2025), 2X points at supermarkets and gas stations (on up to $6,000 in purchases per year, then 1X points) with 1X points on all other purchases

|

Welcome bonus | 75,000 points

75,000 bonus points after spending $4,000 in the first 3 months of account opening, redeemable for $750 in gift cards or travel rewards on thankyou.com

| Discover Match®

Discover matches your first year miles automatically.

| 20,000 points

Earn 20,000 bonus points after spending $1,500 within the first 3 months of account opening (redeemable for $200 in gift cards or travel rewards at thankyou.com)

|

0% Intro APR | None | 15 months on purchases and balance transfers | 15 months on purchases and balance transfers |

Foreign Transaction Fee | $0 | $0 | 3% |

Purchase APR | 21.24% – 29.24% (Variable) | 18.74% – 27.74% Variable APR | 17.99% – 27.99% (Variable) |

Read Review | Read Review | Read Review |

0% Intro APR: Citi Simplcity, Diamond or NHL Discover it?

If you're looking for a balance transfer card with a long 0% introductory APR, several options stand out for offering some of the longest terms available. Citi has two great choices—the Simplicity card and the Diamond Preferred card—while Discover's NHL card (along with other Discover cards) is another strong competitor.

For balance transfers, Citibank takes the lead with its longer 0% APR offer. However, the NHL card has the advantage of no foreign transaction fees and a lower balance transfer fee compared to Citi.

Citi Simplicity® Card | Citi® Diamond Preferred® Card | NHL Discover it | |

Annual Fee | $0 | $0 | $0 |

Rewards | None |

None | 1% – 5%

5% cash back on spending in the quarterly bonus categories and 1% on all other purchases |

0% Intro APR | 12 months on purchases and 21 months on balance transfers | 21 months on balance transfers and 12 months on purchases | 15 months on purchases and balance transfers |

Balance Transfer Fee | $5 or 5% (whichever is greater) | $5 or 5% (the greater) | 5% |

Foreign Transaction Fee | 3% | 3% | $0 |

Purchase APR | 18.74% – 29.49% (Variable) | 17.49% – 28.24% (Variable) | 18.74% – 27.74% |

Read Review | Read Review | Read Review |

Additional Cards To Consider

Both Discover and Citibank offer additional cards worth considering.

Discover excels in providing options for fair and poor credit. They offer the Discover it® Secured credit card, designed for individuals looking to build or rebuild their credit. This card requires a refundable security deposit, which determines the credit limit.

The Discover it® Student Chrome card is tailored for students aiming to build credit while earning rewards. It offers cash back and has no annual fee, making it an excellent choice for students.

Among Citibank's offerings, the Costco Anywhere Visa® Card by Citi stands out for its substantial rewards for Costco members. This card has no annual fee with a paid Costco membership. Additionally, it provides worldwide car rental insurance, travel accident insurance, and extended warranty protection.

Discover it® Secured

| Discover it® Student Chrome | Costco Anywhere Visa Card | |

Annual Fee | $0 | $0 | $0 ($60 Costco membership fee required) |

Rewards | 1-2%

2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter and unlimited 1% cash back on all other purchases

| 1-2%

2% cashback at gas and restaurants (up to $1,000 every quarter) and 1% on groceries and other student related products

| 1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

|

Welcome bonus | Cashback Match™

Discover will match all the cash back you’ve earned at the end of your first year.

| Match Bonus

Discover will match all cash back earned at the end of your first year

| None

|

0% Intro APR | None | 15 months on purchases and balance transfers | N/A |

Foreign Transaction Fee | 3% | $0 | $0 |

Purchase APR | 28.24% Variable | 18.24% – 27.24% Variable | 19.99% – 27.99% (Variable) |

Read Review | Read Review | Read Review |

Bottom Line

Overall, there is no significant difference between the pull of credit cards offered by both banks.

We think that Citibank offers better options when it comes to travel, while Discover offers better options for students and those who have fair-poor credit.