Table Of Content

Why Good Credit Score Matters?

Your credit score is only a number, but it has a significant impact on many aspects of your daily life. If you want to buy a car, get a job, or even rent an apartment, your credit score will follow you wherever you go. In many ways, having good credit is advantageous, whereas having bad credit can cost you money in unexpected ways.

Lenders use your credit score to determine your creditworthiness. Your credit score determines whether you are approved for credit cards, loans, mortgages, and auto loans, as well as the interest rate and terms that lenders may assign you if you are approved.

In this chart compiled with LendingTree customer data, you can see that those with a 720+ credit score pay an average of 7.63%. At the other end of the scale, for those with a poor credit rating of less than 560, the rate shoots up to an eye-watering 113%.

Insurance companies, landlords, and employers may check your credit score when you apply for a new apartment or a new policy. In these cases, a high credit score demonstrates your dependability and responsibility.

A good credit score can help you get a better deal on loans, credit cards, insurance premiums, apartments, and cell phone plans. Poor grades can force you to pass up opportunities or pay more money.

Why Bad Credit Score Matters?

Higher interest rates caused by bad credit can cost a person more than six figures over the course of their life. According to Informa Research Services, for example, interest rates are as follows:

- On a $200,000 mortgage, someone with a FICO score of 620 would pay $65,000 more than someone with a FICO score of 760 or higher.

- On a five-year, $30,000 auto loan, a borrower with a lower credit score would pay $5,100 more.

- A low-score borrower would pay $22,500 more for a $50,000 15-year home equity loan than a high-score borrower.

Overall, we can see the difference between good and bad credit score is crucial for your future financial journey.

What is a Good Credit Score For My Age?

Although age is not a factor in credit score calculation, older people are likely to have higher credit scores than young people. Older people have had lengthier credit history that boosts their credit score than younger people who have a few years of credit.

Typically, Generation Z (18 to 24) have an average credit score of 679, while millennials (25 to 40) have a slightly higher average credit score of 686.

Generation X (41 to 56) have an average credit score of 705, which is in the good credit score range. Baby boomers (57 to 74) have the second-highest average credit score of 740, after the Silent Generation (above 75) who have the highest average credit score of 760.

According to Experian data, the average credit score for United States residents was 714 across all age groups. In the table below you can see a breakdown per age:

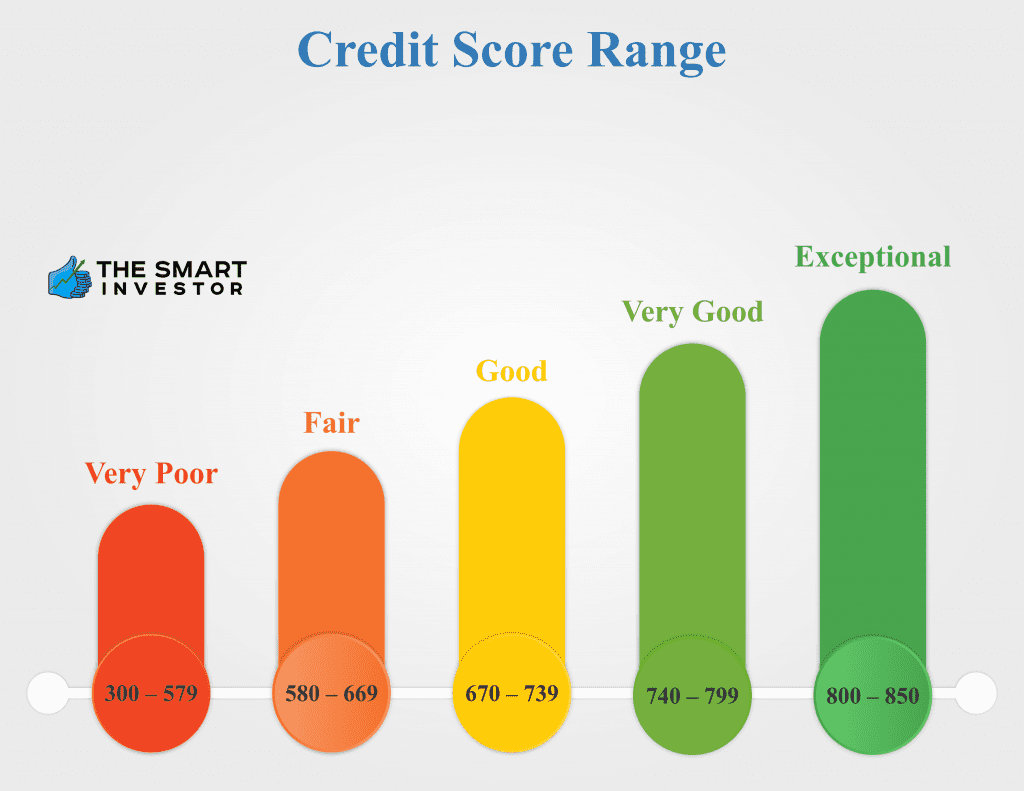

Ranges on Your Credit Score

It’s always a good idea to check your credit score, but it can be difficult to understand the different ones available. The truth is you can actually ask for a copy of your credit score from each of the credit reporting bureaus and you may find that they’re actually different.

When it comes to the scores you should be paying attention to most, they are FICO and VantageScore, ranged between 300 and 850. But you’ll find that there are a number of different variations of this too.

In general, your credit scores are going to let any lender know more about you and what kind of risk you’re going to be when it comes to paying your debt. If you have a higher score you appear to be a lower risk.

Now, it can be difficult to know what’s going on with your score because there are so many, but they’re extremely important for your to understand because of the weight lenders put on them.

| Credit Score | Rating | Impact |

| 300 – 579 | Very Poor | This type of credit score could be a result of many types of negative actions like defaults, bankruptcy and more. For these types of credit applicants, it can be more difficult to get credit at all or it may require you to have a deposit of some type. |

| 580 – 669 | Fair | Here you may have a few minor problems on your credit but it’s in general, not a big problem. You might get credit, in fact you’re likely to get credit, but you’re going to have a higher interest rate and you’ll be considered subprime. |

| 670 – 739 | Good | This is where most people are going to fall and while you’re going to get some of the better rates, you’re not going to get the best and you’re not going to qualify for all types of credit. |

| 740 – 799 | Very Good | Here you’re going to have people who pay nearly all their bills on time and keep their credit balances low. You’re going to get some of the best interest rates but not the best of the best. |

| 800 – 850 | Exceptional | These are the people who can get absolutely any type of credit and they can definitely get the top of the line rates for the credit that they want. |

FICO Vs Vantage Score

You’ll find that differences in these two scores are based on the criteria that’s used for scoring and of course the way they weigh out the behaviors that you may (or may not) participate in. Data that is too thin or even too stale could mean that you don’t have a FICO score at all.

-

FICO Score

When it comes to FICO Scores, from the Fair Isaac Corporation, you’ll have a range between 300 and 850. This is the one that’s used by a lot of different lenders and the usual optimum level is over 670.

This will be considered a pretty good credit score, though you’re going to need an 800 in order to get to exceptional levels.

-

Vantage Score

This is another set of credit scores that a lot of lenders use. Designed by all three of the credit bureaus in conjunction, the newest version is the VantageScore 3.0 model.

It ranges between 300 and 850, just like the FICO score, but here you’re going to look for a score of at least 700. A 700 score is a good one and a 750 is an excellent score.

It’s important to note that the earlier version of the score ranged between 501 and 990 and gave letter grades from A to F.

Why There Are Different Credit Scores?

You may have different credit scores since each credit bureau receives different information from your credit accounts. Lenders are not required to report credit accounts to all three credit bureaus, and this means each bureau will have different information on your credit habits.

Also, each bureau has its formula for calculating credit scores, and this may yield different credit scores even when they use the same information. Finally, you may have different credit scores at different times, depending on when each credit bureau updates their credit scores.

What Information Credit Scores Do Not Consider?

Some of the information excluded from credit score calculation include any financial information not related to debt such as checking and savings account balances, your income, or transactional data. Credit scores also exclude your age, race, color, marital status, where you live, and religion.

Certain types of inquiries such as promotional inquires and inquiries made by you are excluded. Usually, any information that does not appear in your credit report is not considered when calculating your credit score.

How Credit Score Is Calculated?

A credit score is calculated based on the information in a person's credit report, which includes the following factors:

- Payment history: 35%

- Credit utilization: 30%

- Length of credit history: 15%

- Credit mix: 10%

- Recent credit inquiries: 10%

The score ranges from 300 to 850, with a higher score indicating better credit health.

How to Get Your Credit Score?

If you’re looking for your FICO score you can actually purchase it directly from myFICO.com, though you can get a free copy with your monthly statement from several different credit card companies. If you’re looking for your VantageScore you can actually get it for free using a range of different websites.

Each of the three major credit reporting agencies is required to provide you with one free credit report every year. You can request yours by calling 1-877-322-8228 or by visiting annualcreditreport.com, which is the only official site for free reports. To verify your identity, you’ll need to provide your name, address, Social Security number, and date of birth.

You won’t get it with any kind of credit card though so you’ll either need to sign up for one of these or you can purchase directly from Experian or TransUnion.

What is the Fastest Way to Improve Your Credit Score?

Although there is no silver bullet to improve your credit score overnight, there are several ways to improve your credit scores over time. Start by paying down your revolving credit balances and requesting a higher credit limit to lower your credit utilization ratio.

You should also review your credit report for any errors such as fraudulent or duplicate transactions that affect your credit score negatively. If you have negative entries in your credit report that you have already paid off, you can request respective creditors to remove them.

You should pay down monthly bills on time, and clear old debts, while keeping the old credit accounts open.

How to Keep a Good Credit Score?

You must maintain good credit habits if you want to keep your good credit score. You must pay your bills on time, and avoid late payments by signing up for auto-pay.

You should also review your credit report to identify any errors and negative marks, and dispute with the credit bureau if they are inaccurate.

You should maintain balances below the credit limit, and only apply for new credit when you have no other option. Once you pay debts, you should keep the credit accounts open to help build a long credit history.

Which Parameters Lenders Consider Besides My Score?

Keep in mind that your credit score is not the only thing that lenders are going to pay attention to when it comes to setting your interest rate and approving you.

When it does come to your credit score, lenders look at your history so they can figure out whether or not you will repay the money that you’re given. Even someone who has a lot of debt could still keep their bills paid right and make sure that they have a great score.

Outside of your credit score, your income and your debts are extremely important. Lenders look at the amounts that you owe, the amount that you earn and the assets that you have.

Your credit report doesn't show lenders whether you're actually able to pay off your debt. That's why they also want to look at more details, like your income and other debts. This helps them calculate your debt-to-income ratio and assess whether you can realistically repay what you owe.

FAQs

What's a good credit score for a 20 year old?

A good credit score for a 20 year old is around 700, which is in the good credit score range. Generally, young adults in their 20s are still relatively young in credit age, which is one of the key elements that determine your credit score.

If you maintain good financial habits, pay bills on time, and keep your credit card open, you can build a good credit score in your 20s.

According to Experian data, the average credit score for United States residents was 714 across all age groups. In the table below you can see a breakdown per age:

What is good credit score for mortgage?

A credit score of 700 to 749 is typically considered good for mortgages. You can get approved if you have a credit score above 700, and you may qualify to get attractive interest rates.

Generally, the minimum credit score for conventional mortgages is 620, which is considered acceptable, even though you will pay higher interest rates than borrowers with a credit score above 700.

What is good credit score for car loan?

You need a credit score of 661 or more to get an auto loan. This credit score range is considered prime, and you can qualify for most conventional auto loans at a favorable interest rate.

If you have a credit score above 700, this credit score is considered attractive, and you can get the most competitive offers in the market. If your credit score is below 650, you can still qualify for an auto loan, but at higher interest rates.

What is good credit score to rent an apartment?

A good credit score above 620 can get you a rental apartment in a good neighborhood. Landlords expect potential tenants to have a solid credit history and an acceptable credit score to get assurance that you will pay rent on time.

If you are house-hunting in a competitive rental market, you may need a credit score above 650 to get a good apartment. If your credit score is below 620, landlords may consider you a high-risk tenant, and you are less likely to be approved for an apartment located in an area with high rental apartment demand.

What is a good credit score to refinance home?

Most lenders require a credit score of 620 or higher for a conventional mortgage refinance, but this score could be as low as 580 for FHA loans.

If your credit score is above 670, this credit score is considered good, and you can be approved easily for a refinance loan. Lenders offer lower refinance rates to borrowers in the good to excellent credit score range.

Is joint account good for credit score?

A joint bank account can be good or bad for the joint account owners. An account owner with lower credit scores can take advantage of the other joint account owner’s good credit scores to get loans with better interest rates.

If the joint account owner practices good credit behaviors such as on-time bill payments and paying old debts, the joint account can help improve their credit scores. On the downside, if one account owner racks up a lot of balances, makes late bill payments, or even defaults on a debt, the joint account owner's credit history will suffer, and their credit scores will take a hit.

Only joint bank accounts and joint credit cards impact credit scores. Joint savings and checking accounts do not affect credit scores.

What Is a good credit score for a credit card?

A credit score above 680 is considered generally good to be approved for a credit card. A credit score in the 680 to 740 range is considered good, and you can be approved for a credit card with attractive rates. If your credit score is below 680, you will have trouble getting approved for most of the premium credit cards, and you should find credit cards that offer the best chance of approval at your credit score range.

Is joint account good for credit score?

A joint bank account can be good or bad for the joint account owners. An account owner with lower credit scores can take advantage of the other joint account owner’s good credit scores to get loans with better interest rates.

If the joint account owner practices good credit behaviors such as on-time bill payments and paying old debts, the joint account can help improve their credit scores. On the downside, if one account owner racks up a lot of balances, makes late bill payments, or even defaults on a debt, the joint account owner's credit history will suffer, and their credit scores will take a hit.

Only joint bank accounts and joint credit cards impact credit scores. Joint savings and checking accounts do not affect credit scores.

What kind of loan can I get with a 650 credit score?

A 650 credit score is considered a fair credit score, you may qualify for a mortgage loan, auto loan, personal loan, or even credit cards, but you can expect to pay a higher interest rate than borrowers in the good credit score range.

With a 650 credit score, you quality to borrow conventional mortgage loans. You may also qualify for government-backed loans such as FHA loans, VA loans, and USDA loans.