|

| |

|---|---|---|

American Hartford Gold | Birch Gold Group | |

Min. Investment | $5,000 / $10,000

$5,000 for cash purchases / $10,000 for gold IRA | $10,000

|

Established | 2015 | 2003 |

Storage Fees | $200 – $280 | $100

$100 for annual storage fee, but there is additional $125 for account maintenance . Estimated annual fee. |

Coin & Bar Selection | IRA-approved plus exclusive collector coins

| Broad IRA-approved & collectible options |

Payment Methods | Wire, checks (no crypto)

| Wire, checks (no crypto)

|

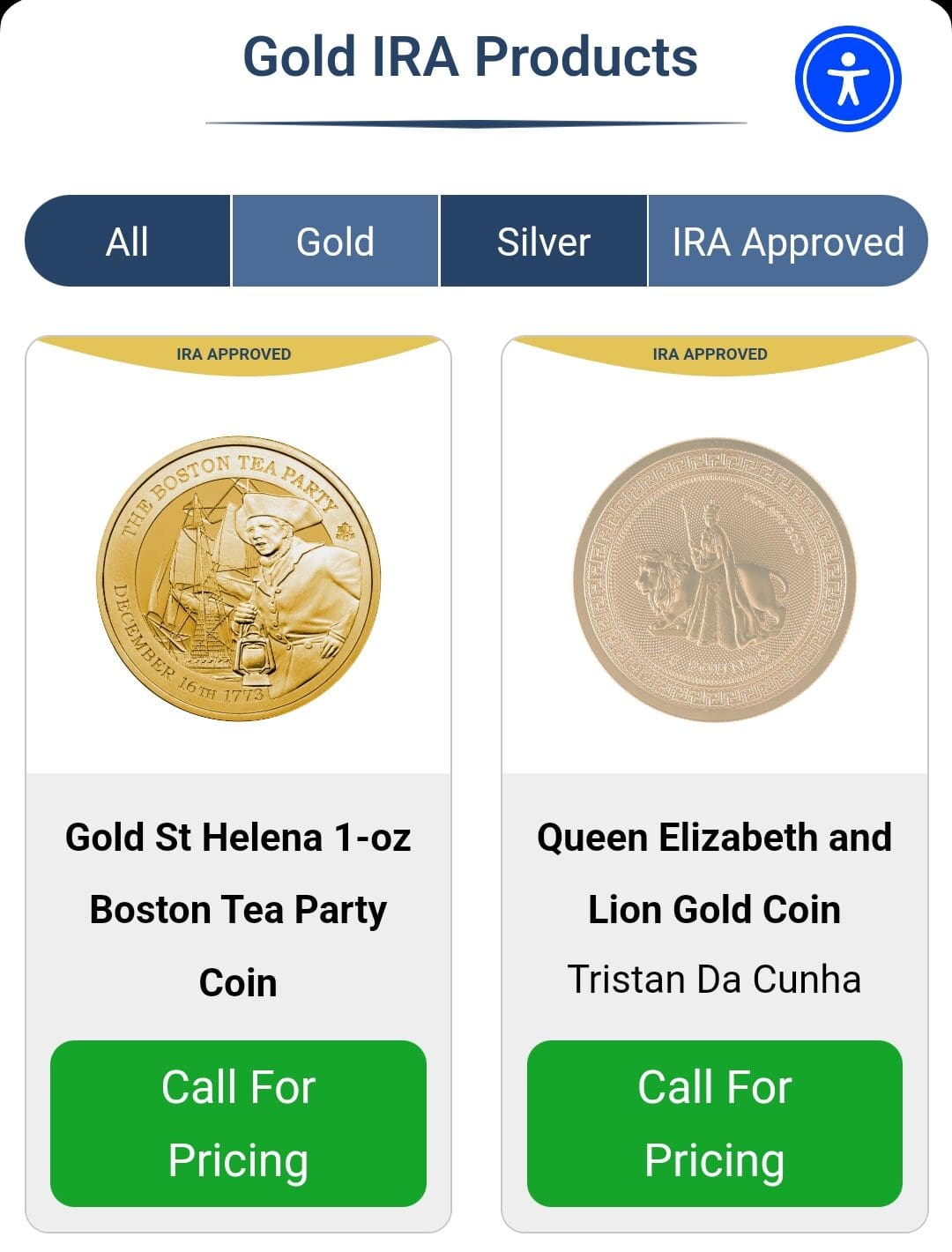

Pricing Transparency | Must call for pricing

| No live prices, but transparent fees |

Best For | Precious Metal IRA, Direct buyers

| Retirement-focused investors |

Our Rating |

(4.6/5) |

(4.5/5) |

Read Review | Read Review |

Birch Gold vs. American Hartford: Customer Ratings Battle

There is no clear winner when it comes to customer ratings, as both companies have high ratings across most platforms.

[elementor-template id=”203545″]

While AHG shines on Trustpilot with a 4.7 rating from over 1,300 reviews, Birch maintains a broader base of strong feedback across Trustpilot (4.3), BBB (A+ since 2013), Consumer Affairs (5.0), and Google (4.7).

[elementor-template id=”203460″]

Birch has fewer complaints and is praised for resolving issues promptly, showing strong customer commitment.

Buying Gold & Silver: American Hartford vs. Birch Gold

Our preferred choice for buying gold and silver is American Hartford Gold, mainly due to its competitive buyback program, free shipping, and special promotions for qualifying investors.

Both Birch Gold Group and American Hartford Gold provide investors with a wide range of gold, silver, platinum, and palladium products in coin and bar form.

Each offers free insured shipping within the U.S. and a no-fee buyback program.

Where they’re both strong:

Product Variety: From American Gold Eagles to Canadian Maple Leafs and even unique coins like St. Helena, both offer IRA-approved and collectible items.

Shipping: Both offer discreet, insured delivery at no cost.

Buyback Support: No extra fees for selling metals back.

Where American Hartford Gold stands out:

Promotional Offers: Investors may qualify for up to $15,000 in free silver for IRA accounts.

Price Match Guarantee: AHG will match lower prices from competitors on the same products.

No Buyback Fees: The buyback program is fast and fee-free.

Where Birch Gold stands out:

Transparent Pricing: While AHG requires a phone call for pricing, Birch has a more transparent approach overall, though still not live.

Educational Resources: Birch offers more tools and market content for new buyers.

AHG may not list prices online, but its promotional perks, lower minimum, and reputation for fast, insured shipping give it an edge for direct buyers.

Which Is Better for a Gold or Silver IRA?

Our preferred choice for precious metal IRAs is Birch Gold Group, due to its experience, flat-rate fees, storage flexibility, and strong reputation.

Both companies offer robust Gold IRA services, helping clients roll over funds from existing 401(k)s or IRAs into self-directed accounts backed by physical metals.

They each use IRS-approved depositories like Brink’s and Delaware Depository and provide full insurance on stored assets.

Where they’re both strong:

Rollover Assistance: Both make the process simple and penalty-free.

IRS-Approved Metals: Investors can choose from a wide variety of eligible coins and bars.

Secure Storage: Both partner with top-tier vaults for safekeeping.

Buyback Program: Both offer no-fee liquidation options.

Where Birch Gold stands out:

Flat-Rate Fees: Birch charges a simple $200 annually (storage + management), compared to AHG’s tiered system that can reach $280.

More Experience: Birch has been operating since 2003 and has a long-standing A+ BBB accreditation.

Multiple Storage Partners: In addition to Brink’s and Delaware, Birch offers more options like Texas Precious Metals Depository.

Educational Resources: Birch offers real-time metal charts and more detailed insights for retirement investors.

Where American Hartford Gold stands out:

Dedicated Specialist Support: One-on-one guidance for the entire process.

Still, Birch Gold’s clarity in pricing, deeper storage partnerships, and long history in the industry make it our preferred IRA partner.

Final Verdict: AHG vs. Birch Gold Group

Overall, we recommend Birch Gold Group for long-term investors focused on Gold IRAs and American Hartford Gold for those looking to buy physical metals with added incentives and buyback support.

- Ratings Winner: Both

- Best for Direct Purchase: American Hartford Gold, thanks to its price match, buyback perks, and generous promotions.

- Best for IRA: Birch Gold Group, for its flat fees, storage options, and educational resources.