|

| |

|---|---|---|

American Hartford Gold | APMEX | |

Min. Investment | $5,000 / $10,000

$5,000 for cash purchases / $10,000 for gold IRA | $0 |

Established | 2015 | 2000 |

Storage Fees | $200 – $280 | About 0.55%

Annually, estimated – can be vary between accounts |

Coin & Bar Selection | Limited but IRA-focused selection

| Extensive variety + collectibles |

Payment Methods | Cards, PayPal, Wire, eCheck, Crypto | Cards, PayPal, Wire, eCheck, Crypto |

Pricing Transparency | Must call for pricing

| Real-time spot price updates |

Best For | Hands-off investors, IRA | Active buyers + collectors |

Our Rating |

(4.6/5) |

(4.1/5) |

Read Review | Read Review |

APMEX vs AHG: Who Do Customers Trust More?

American Hartford Gold clearly has the edge in customer satisfaction.

With a 4.7 rating on Trustpilot and a 4.6 on Consumer Affairs, AHG is known for consistent, high-quality service. Meanwhile, APMEX suffers from low Trustpilot (1.7) and middling Consumer Affairs (2.8) scores.

Platform | Rating |

|---|---|

Trustpilot

| 4.3 (1,493 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2014 |

Consumer Affairs | 4.5 (790 reviews) |

Despite its A+ BBB rating, APMEX’s volume of negative feedback signals issues with customer experience. AHG, on the other hand, is regularly praised for clarity, professionalism, and ease of service—especially for IRA rollovers and direct buyers.

Platform | Rating |

|---|---|

Trustpilot

| 4.7 (1,373 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2016 |

Consumer Affairs | 4.6 (891 reviews) |

Buying Physical Metals: APMEX or AHG?

Our preferred choice for direct gold and silver purchases is APMEX, thanks to its vast selection, digital tools, and added investor features.

Both APMEX and American Hartford Gold offer solid options for buying physical metals, but there are key differences depending on what kind of buyer you are.

Where they’re both strong:

Product Variety: Both dealers offer gold, silver, platinum, and palladium coins and bars suitable for investors and collectors.

Shipping: Free, insured shipping on qualified orders ensures peace of mind.

Buyback Options: Each company allows you to sell metals back securely.

Customer Support: Phone and email support are available for both dealers, with AHG adding one-on-one guidance.

Where APMEX stands out:

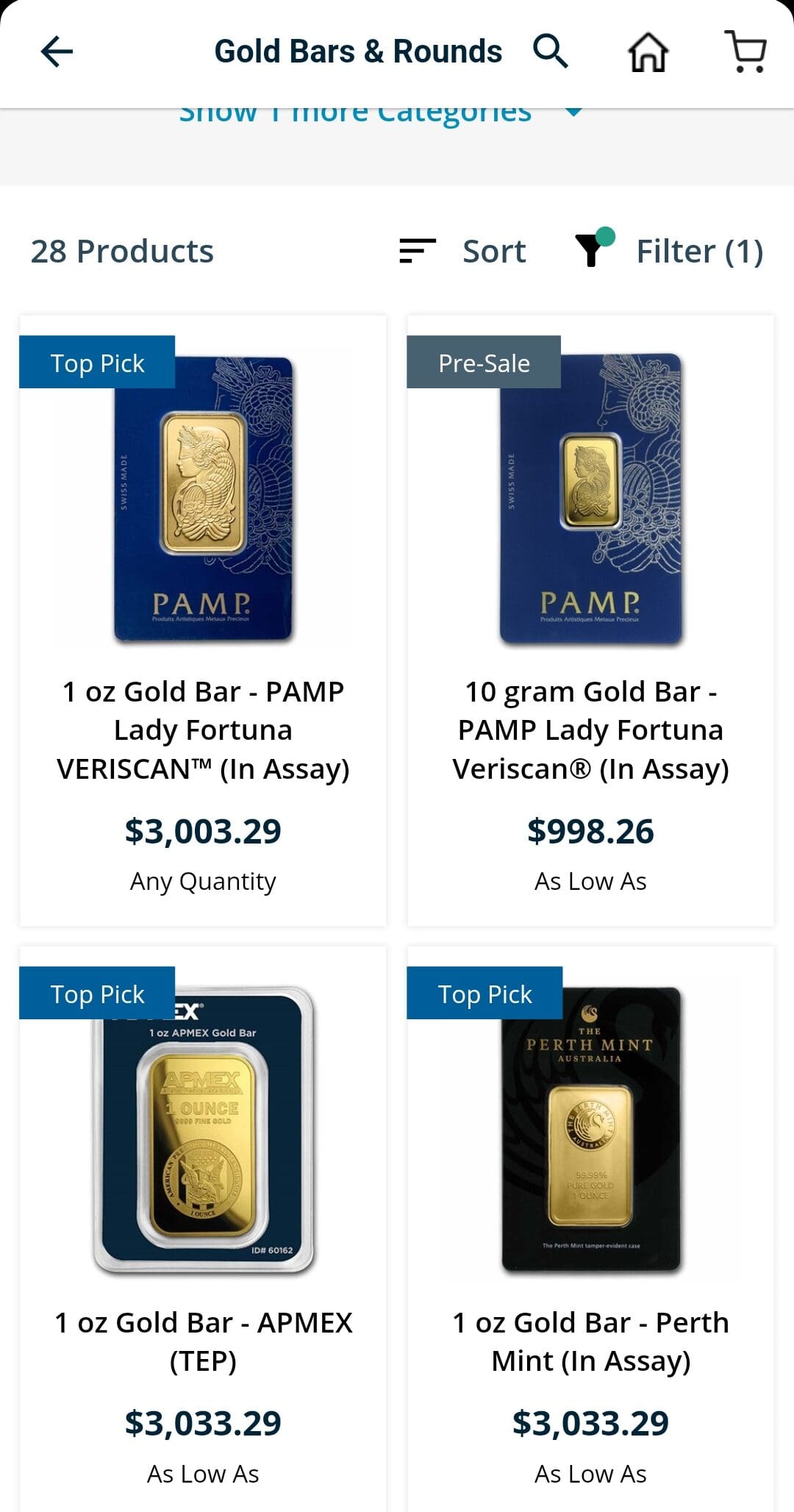

Inventory Depth: APMEX offers everything from bullion to collectibles, numismatic coins, and even themed gifts.

Digital Tools: The APMEX portfolio tracker, price alerts, and AutoInvest make managing your metals easier.

The Bullion Card: A first-of-its-kind rewards credit card earning you gold and silver on purchases.

Crypto Payments & PayPal: APMEX accepts Bitcoin, Ethereum, and Dogecoin—something AHG doesn’t.

Where AHG stands out:

Personal Touch: Specialists walk you through purchases step-by-step.

Low Minimums: You can start buying with as little as $5,000.

Transparent Buyback: AHG doesn’t charge fees and provides insured packaging for returns.

If you’re focused on personal support and simplicity, AHG delivers. But if you're an active buyer looking for flexibility, rewards, and a broader selection, APMEX offers more tools and features.

Which Dealer Offers the Better Gold IRA?

Our preferred choice for precious metal IRAs is American Hartford Gold, due to its low investment minimums, excellent support, and no-fee buyback program.

Both APMEX and AHG offer strong Gold IRA services, but their approaches differ.

Where they’re both strong:

IRA-Eligible Metals: Each offers a wide range of IRS-approved gold and silver bars and coins.

Trusted Custodians: Both partner with established custodians and IRS-approved storage facilities like Brink’s.

Rollover Process: Both help clients transfer funds from 401(k)s or IRAs with no tax penalties.

Where AHG stands out:

Lower Investment Minimums: AHG requires only $10,000 to get started with an IRA.

Buyback Guarantee (No Fees): AHG doesn’t charge liquidation fees, making it easy to exit.

Fee Waivers: Investors over $50K get the first year of IRA fees waived (and up to 3 years for $100K+).

Client Service: AHG assigns dedicated IRA specialists who handle setup, transfers, and metal selection.

Where APMEX stands out:

Product Variety: You’ll find platinum, palladium, and a wider mix of coins and bars.

Custodian Options: APMEX works with several leading custodians, offering flexibility.

Online Tools: The APMEX portfolio dashboard allows for easier tracking of IRA holdings.

While APMEX gives you more bells and whistles, AHG’s streamlined setup and personal guidance make it better suited for those prioritizing simplicity, especially first-time Gold IRA investors.

Final Verdict: APMEX or American Hartford Gold

APMEX is the better choice for active buyers and collectors thanks to its massive product catalog, advanced online tools, and flexible payment options, including crypto.

On the other hand, American Hartford Gold stands out for retirement-focused investors, with a smoother IRA setup process, no-fee buyback program, and exceptional customer service ratings.

Here’s how the two stack up:

Ratings Winner: American Hartford Gold – Consistently strong reviews and customer service.

Best for Direct Purchase: APMEX – Huge selection, transparent pricing, and useful digital features.

Best for Gold IRA: American Hartford Gold – Low minimums, no-fee buybacks, and personal guidance.