|

| |

|---|---|---|

Goldco | APMEX | |

Min. Investment | $15,000 / $25,000

$15,000 for cash purchases / $25,000 for gold IRA | $0 |

Established | 2006 | 2000 |

Storage Fees | $100 – $150

Non-Segregated: $100 | Segregated: $150 per year . Estimated annual fee. | About 0.55%

Annually, estimated – can be vary between accounts |

Coin & Bar Selection | Focused on IRA-approved coins and bars

| Wide variety, including collectibles and rounds |

Payment Methods | Cards, PayPal, Wire, eCheck, Crypto | Cards, PayPal, Wire, eCheck, Crypto |

Pricing Transparency | No, must contact for pricing

| Yes, prices shown on site |

Best For | Retirement investors, IRA-focused buyers

| Active buyers, collectors, AutoInvest |

Our Rating |

(4.7/5) |

(4.1/5) |

Read Review | Read Review |

Trust & Reputation: APMEX vs. Goldco

Goldco has significantly stronger customer reviews across all major platforms.

Goldco holds a 4.8 rating on Trustpilot and Consumer Affairs, along with a nearly perfect 4.9 on Google. APMEX, in contrast, has a 1.7 rating on Trustpilot and 2.8 on Consumer Affairs—despite being a major player in the industry.

[elementor-template id=”203484″]

While APMEX is BBB-accredited with an A+ rating, customer feedback tends to focus on issues with fulfillment and support. Goldco’s consistent high ratings point to stronger customer satisfaction and trust.

[elementor-template id=”203452″]

Buying Precious Metals: APMEX vs. Goldco

Our preferred choice for direct gold and silver purchases is APMEX, due to its larger inventory, flexible payment options, and extra investor tools.

Where They’re Both Strong:

Product Variety: Both offer gold and silver bars and coins, with IRA-eligible options.

Free Shipping: Orders over $199 qualify for free insured delivery.

Buyback Programs: Both dealers accept buybacks even if you didn’t purchase from them.

Payment Methods: Both accept wire transfers, checks, credit cards, and cryptocurrency.

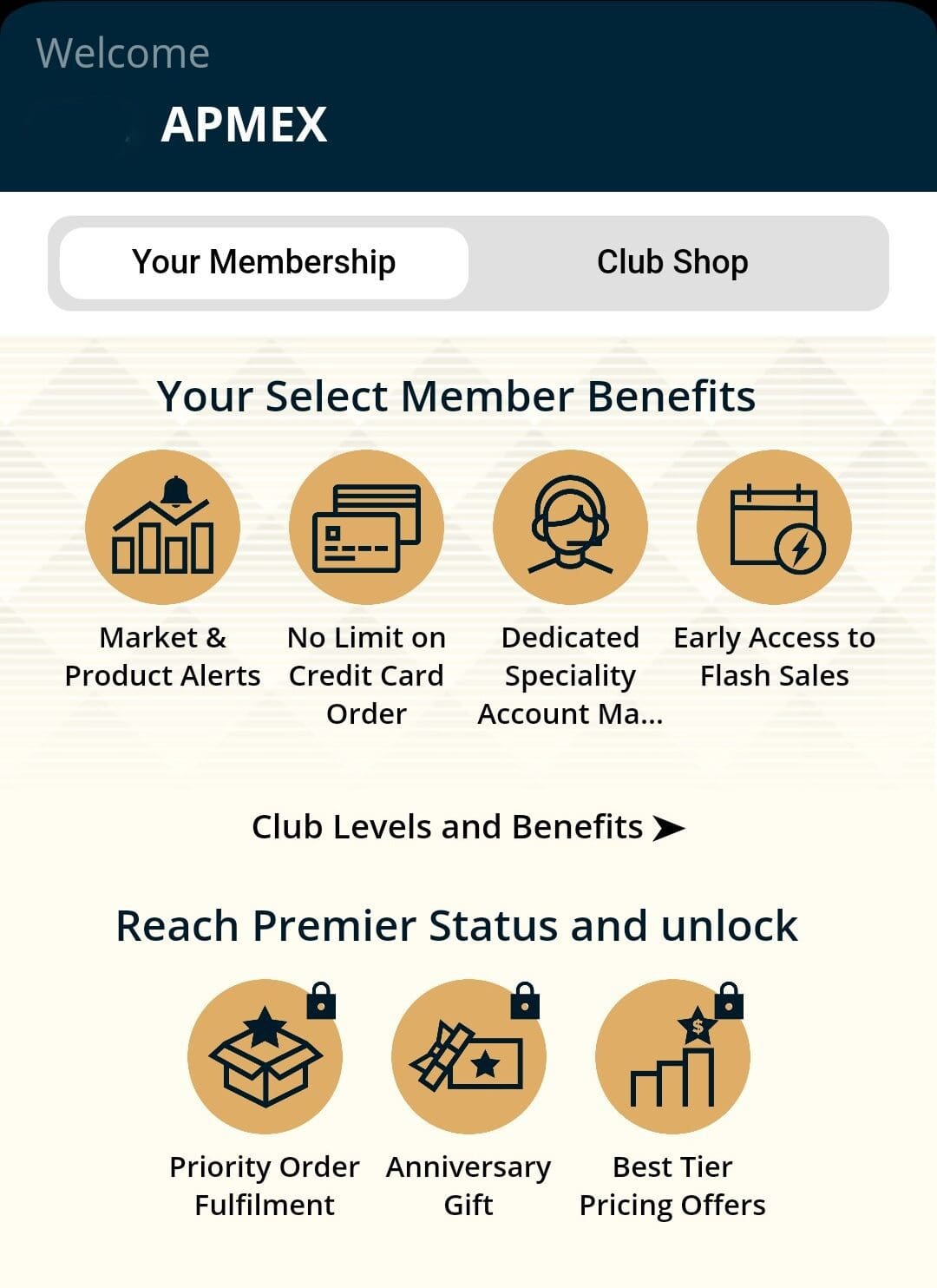

Where APMEX Stands Out:

Massive Selection: Includes bullion, rare coins, collectibles, jewelry, and even junk silver.

AutoInvest Feature: Allows recurring purchases of gold, silver, platinum, and palladium.

The Bullion Card: A unique credit card that gives cash-back rewards in gold or silver.

Digital Metals (OneGold): Lets you invest in digital gold/silver stored in real vaults.

Where Goldco Stands Out:

Hands-On Support: Investors work directly with representatives for product selection and delivery.

Streamlined Process: Excellent if you want help from a rep for direct purchases.

Buyback Guarantee: Assures highest price after three years of holding.

APMEX clearly appeals more to active buyers and collectors who want a broad range of products and modern tools. Goldco, while more focused on IRAs, offers a simpler route for traditional investors.

Best for Precious Metal IRAs: APMEX or Goldco?

Our preferred choice for precious metal IRAs is Goldco, mainly due to its focused IRA services, strong ratings, and reliable storage partnerships.

Where They’re Both Strong:

Custodian Partnerships: Both work with established IRA custodians like Equity Trust and Strata.

IRS-Approved Products: Offer IRA-eligible gold and silver bars and coins.

Secure Storage: Use IRS-approved vaults with insured, segregated or non-segregated options.

Buyback Programs: Both dealers support liquidation through their own buyback programs.

Where Goldco Stands Out:

Experience in Gold IRAs: Goldco is entirely IRA-focused, with thousands of satisfied customers.

Transparent Fees: Lists IRA setup, storage, and maintenance fees clearly.

Strong Reputation: Backed by excellent customer ratings, including a 4.8 on Consumer Affairs and Trustpilot.

Minimum Investment: Although higher ($25,000), it ensures dedicated support and streamlined onboarding.

Buyback Assurance: Goldco offers to buy back gold at the highest market price after 3 years.

Where APMEX Falls Short:

Customer Ratings: Mixed reviews raise concerns for long-term IRA investors.

Fee Clarity: IRA fees are not fully listed, which can make it harder to compare costs.

Focus: APMEX offers IRAs, but they are just one of many services—not a specialty.

If your primary goal is to protect your retirement savings with gold or silver, Goldco is the safer and more IRA-focused choice, with a proven system and higher client satisfaction.

Final Verdict: APMEX vs. Goldco

Overall, we recommend APMEX for buyers looking for variety and flexible purchase tools, and Goldco for investors focused on retirement gold and silver IRAs.

- Ratings Winner: Goldco – Excellent reputation across Trustpilot, BBB, and Consumer Affairs.

- Direct Purchase Winner: APMEX – Broader selection, AutoInvest, and flexible tools.

- IRA Winner: Goldco – Better fees, stronger reputation, and deeper expertise.

Your best choice depends on whether you’re building your stack now or securing your long-term savings.