|

| |

|---|---|---|

Augusta Precious Metals | Birch Gold Group | |

Min. Investment | $50,000 | $10,000

|

Established | 2012 | 2003 |

Storage Fees | $200 – $250

$250 first year, $250 after that. Estimated annual fee for storage | $100

$100 for annual storage fee, but there is additional $125 for account maintenance . Estimated annual fee. |

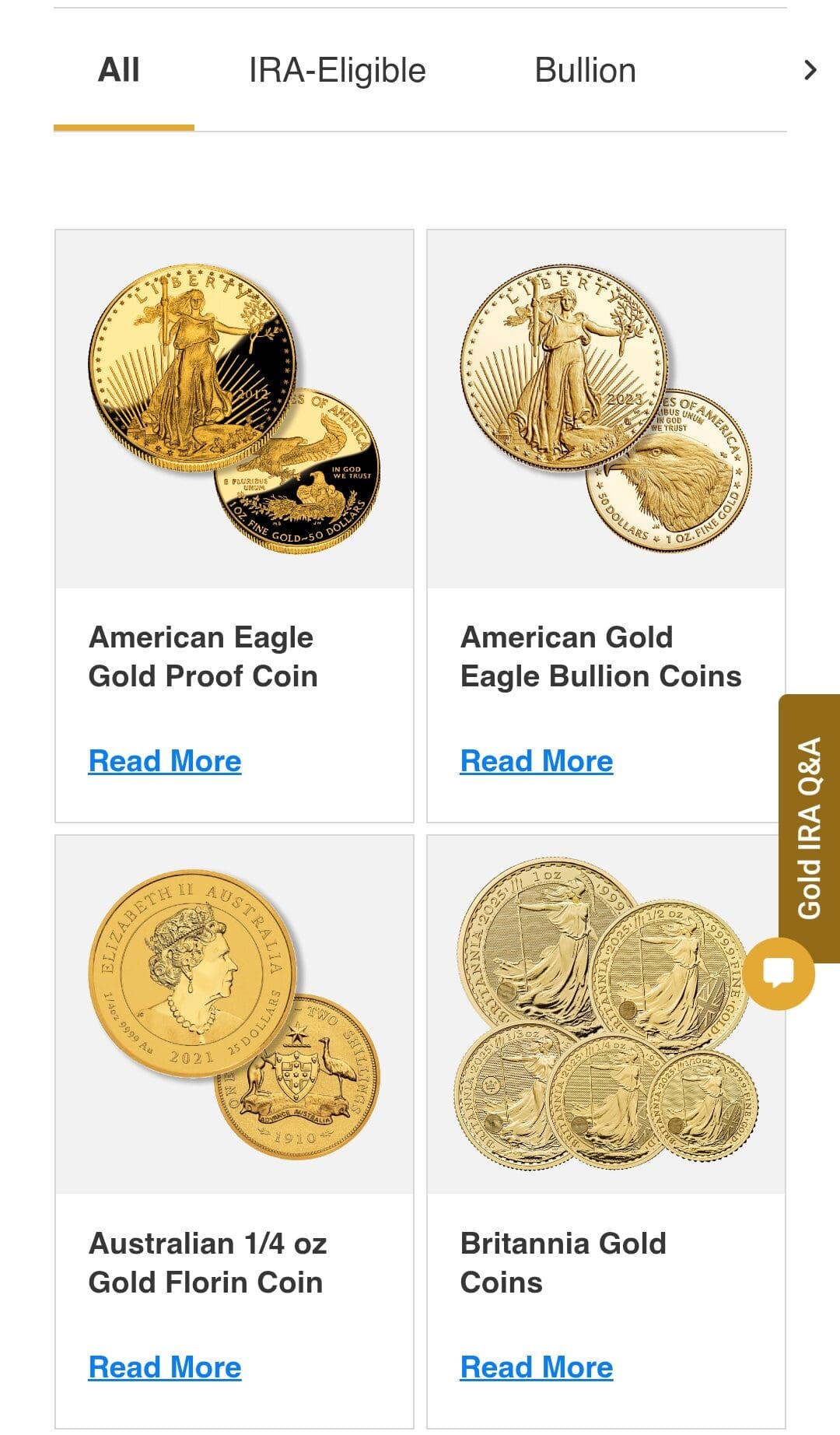

Coin & Bar Selection | Limited but IRA-focused

| Wide range including rare and collectible

|

Payment Methods | Bank wire, Check | Bank wire, Check |

Pricing Transparency | No, must contact for pricing

| No, must contact for pricing |

Best For | High-value IRA investors | IRA investors & direct buyers |

Our Rating |

(4.5/5) |

(4.5/5) |

Read Review | Read Review |

Augusta vs. Birch: Who Has the Better Reputation?

There is no clear winner, as both companies show high ratings across many platforms, but number of reviews is limited compared to other dealers.

[elementor-template id=”203460″]

With 197 Trustpilot reviews averaging 4.3 stars and a near-perfect 5.0 on Consumer Affairs, Birch appears more widely reviewed and consistently praised.

[elementor-template id=”203842″]

Augusta, while also highly rated (4.8 on Trustpilot, 4.9 on Consumer Affairs), has fewer reviews. Both companies have an A+ rating from the BBB. But based on review volume, response activity, and cross-platform consistency, Birch Gold gets our nod.

Where to Buy Physical Gold: Augusta vs Birch

Our preferred choice for direct purchases is Birch Gold Group, thanks to its broader metal selection, lower minimums, and simple purchasing process.

Both Augusta Precious Metals and Birch Gold Group offer strong direct purchase options for gold and silver investors. Each provides free insured shipping, access to government-minted coins, and a competitive buyback program. But there are key differences:

Where they’re both strong:

Product variety: Both offer gold and silver coins and bars, with secure home delivery and options for IRA-approved products.

Secure shipping: Orders are fully insured and discreetly delivered.

Buyback programs: Both companies allow investors to sell back metals at market rates.

Educational resources: Each offers robust materials to help guide investor decisions.

Where Birch Gold stands out:

Lower minimums: At $10,000, Birch is more accessible for newer investors than Augusta’s $50,000.

Wider metal selection: Birch offers not just gold and silver, but also platinum and palladium.

Real-time pricing charts: Birch provides live market tracking, aiding smarter purchase timing.

Purchase flexibility: Investors can buy over the phone with support, with transparent product and pricing info available online.

Where Augusta stands out:

White-glove service: Augusta assigns a dedicated success agent and provides personalized web conferences.

Focus on education: Their Harvard-trained economist adds unique value, especially for retirement-minded investors.

While Augusta is tailored for premium service and long-term investing, Birch Gold is our winner for everyday direct purchases due to better flexibility, lower barriers to entry, and more purchase options.

Best Gold IRA Experience: Augusta vs Birch

Our preferred choice for Gold and Silver IRAs is Augusta Precious Metals, primarily due to their educational-first approach, lifetime support, and seamless rollover process.

Both Birch Gold Group and Augusta Precious Metals offer strong Gold IRA services, helping investors roll over funds from retirement accounts and guiding them through setup and metal selection. But there are several factors that distinguish Augusta:

Where both are strong:

Secure storage: Both work with IRS-approved depositories and offer insured vault solutions.

Buyback programs: Each company allows investors to sell back metals at market value.

Experienced service: Both have over a decade in business and excellent customer satisfaction ratings.

Where Augusta stands out:

Educational edge: Augusta’s free one-on-one web conferences hosted by a Harvard-trained economist provide standout investor education.

Lifetime support: Investors get ongoing assistance, not just during account setup.

Streamlined process: Augusta simplifies rollovers from 401(k)s and other IRAs, ensuring a smoother, stress-free experience.

Customer focus: Their “no-pressure” sales model and transparency have earned customer trust.

Where Birch Gold stands out:

Lower entry point: Birch only requires $10,000 to start a Gold IRA, making it ideal for newer investors.

Flat fees: With a $200 flat annual fee, Birch keeps costs simple and predictable.

More metals: Birch supports platinum and palladium IRAs in addition to gold and silver.

Ultimately, Augusta caters best to investors who value high-touch guidance, education, and long-term support. It’s our winner for IRA investing due to its transparency, expertise, and investor-focused resources.

Summary: Which Dealer Is Best for You?

Overall, we recommend Birch Gold for those buying metals directly and Augusta for those opening a Gold or Silver IRA.

- Ratings Winner: Both dealers, with consistent (but limited) reviews across more platforms.

- Best for Direct Purchase: Birch Gold Group – lower minimums, broader product range, and easier buying process.

- Best for IRA: Augusta Precious Metals – premium education, seamless rollover, and long-term investor support.

Your best pick depends on whether you're buying physical metals now or planning for retirement with expert guidance.