Whether you're a seasoned trader, a beginner building your first portfolio, or a long-term investor focused on retirement, the right platform can make all the difference.

Looking for a powerful research tools, commission-free trading, or specialized retirement accounts?

We've summarized our top choices to help investors find the brokerage that aligns with your goals.

Fidelity

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

Fidelity’s brokerage accounts stand out for their wide range of investment options. Whether you’re into mutual funds, ETFs, stocks, or bonds, they’ve got you covered with thousands of low-cost choices—including their famous zero-expense-ratio index funds.

Fidelity’s robo-advisor, Fidelity Go, is an excellent choice for hands-off investors, offering automated portfolio management with no advisory fees for accounts under $25,000.

On top of that, Fidelity offers tons of tools to help you make smarter investment decisions.

From detailed research to easy-to-use portfolio tracking, they’ve got everything you need to stay on top of your investments and plan for the future.

Pros | Cons |

|---|---|

Wide Range of Investment Options | Low Interest Rates On Uninvested Cash |

Access to annuities, CDs and IPOs | Robo-Advisor/Wealth Management Fees |

Comprehensive Retirement Planning | No Paper Trading |

Strong Research and Educational Resources | No Futures Trading |

Charles Schwab

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

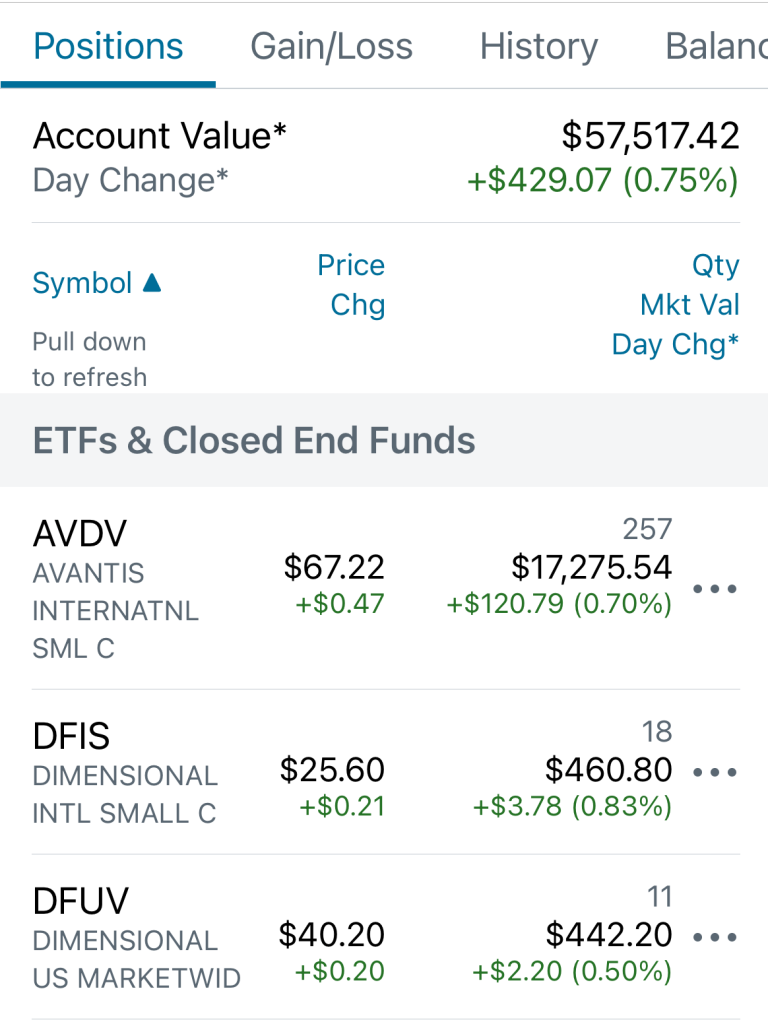

Charles Schwab is a fantastic option for investors of all types.

A standout feature is its powerful Thinkorswim platform, offering advanced tools like customizable charts, technical indicators, and real-time data. It’s perfect for active traders who want to analyze market trends and make informed decisions.

Schwab’s Intelligent Portfolios robo-advisor offers a fully automated experience with no advisory fees, requiring only a $5,000 minimum investment.

Schwab also shines when it comes to retirement planning, with a wide range of investment options, including mutual funds, ETFs, and bonds.

Their extensive research reports and analyst ratings help you make confident decisions, whether you're trading or working toward long-term goals.

Pros | Cons |

|---|---|

Investment & Banking Options | Fees |

Thinkorswim Trading App | Limited International Market Access |

Fractional Shares, Paper Trading | No Cryptocurrency Trading |

Robo Advisor | High Minimum for Auto Investing |

Deep Research & Reporting | No IPO Access |

Interactive Brokers

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

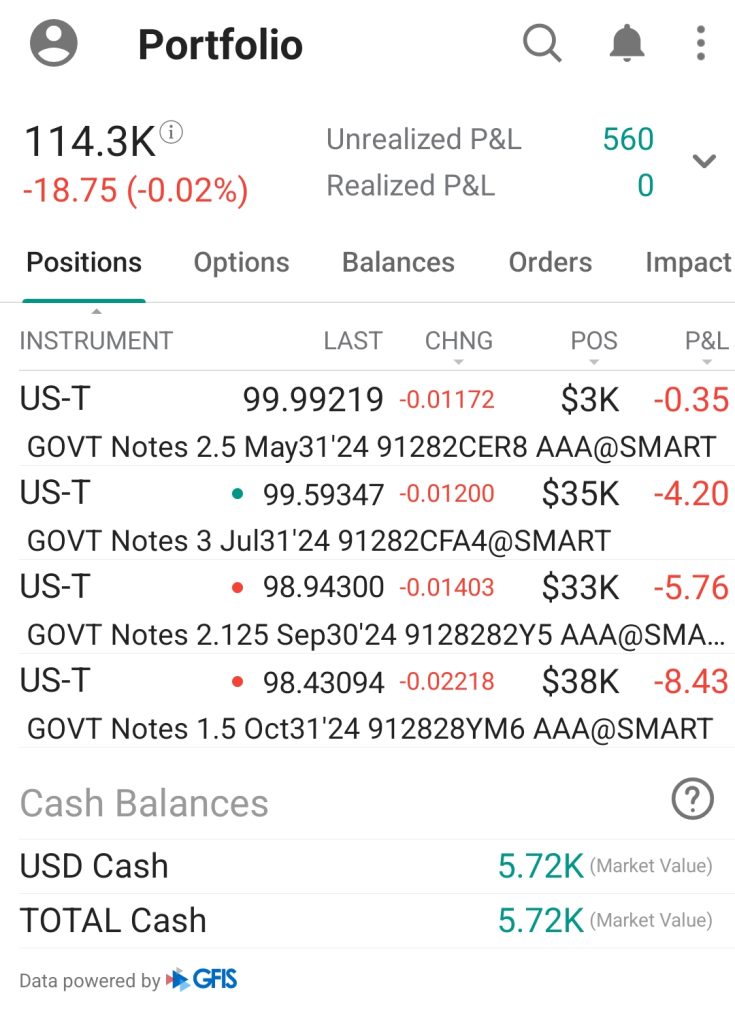

Overview

- Platform Screenshots

Interactive Brokers (IBKR) is a standout option for anyone looking to trade or invest, whether you're a day trader, long-term investor, or somewhere in between.

What sets IBKR apart is its access to a huge range of global markets, making it easy to explore opportunities far beyond the U.S. It’s a great choice for investors seeking diversification and access to international trading.

For active traders, the Trader Workstation (TWS) platform is a game-changer. Packed with advanced tools like detailed charts, customizable indicators, and real-time market data, it gives you everything you need to analyze trends and make quick, informed decisions.

IBKR also offers some of the lowest margin rates in the industry, giving traders more leverage to maximize their potential gains

Pros | Cons |

|---|---|

Extensive Global Market Access | Steep Learning Curve |

Low-Cost Trading | Limited Wealth Management Services |

Advanced Trading Platform | $10K Minimum For High APY On Cash |

Comprehensive Research Tools | |

Cash Management Account |

Wealthfront

Annual Advisory Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

Wealthfront is a great pick if you’re looking for a hands-off, easy-to-use investing platform that works for beginners and experienced investors alike. It’s super user-friendly and takes care of all the heavy lifting while still giving you the flexibility to customize your portfolio.

With Wealthfront, you can pick from hundreds of ETFs or go for specialized options like socially responsible investing or direct indexing (if you have a larger account).

This balance between automation and control makes it perfect for anyone who wants a little say in how their money is managed without the hassle of doing it all yourself.

Robinhood

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

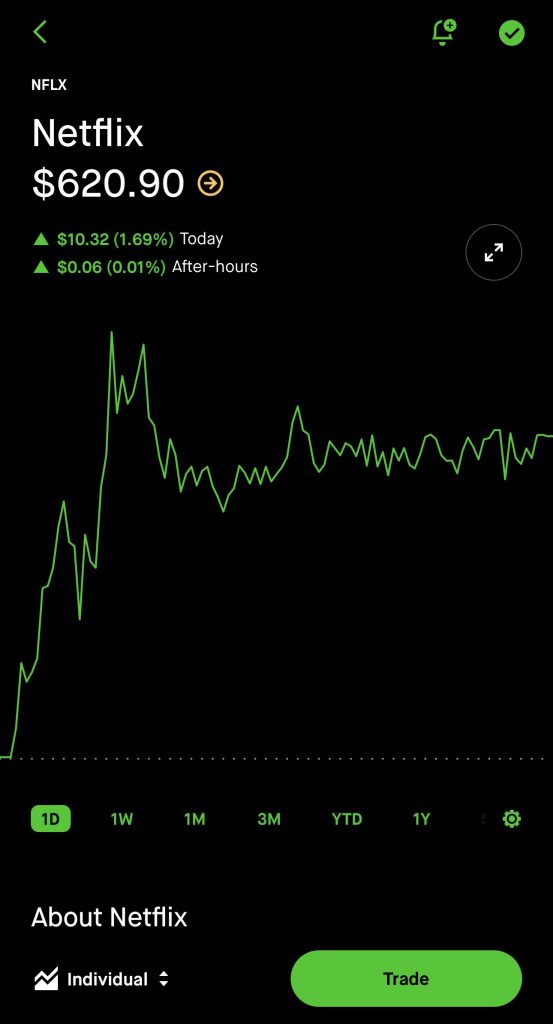

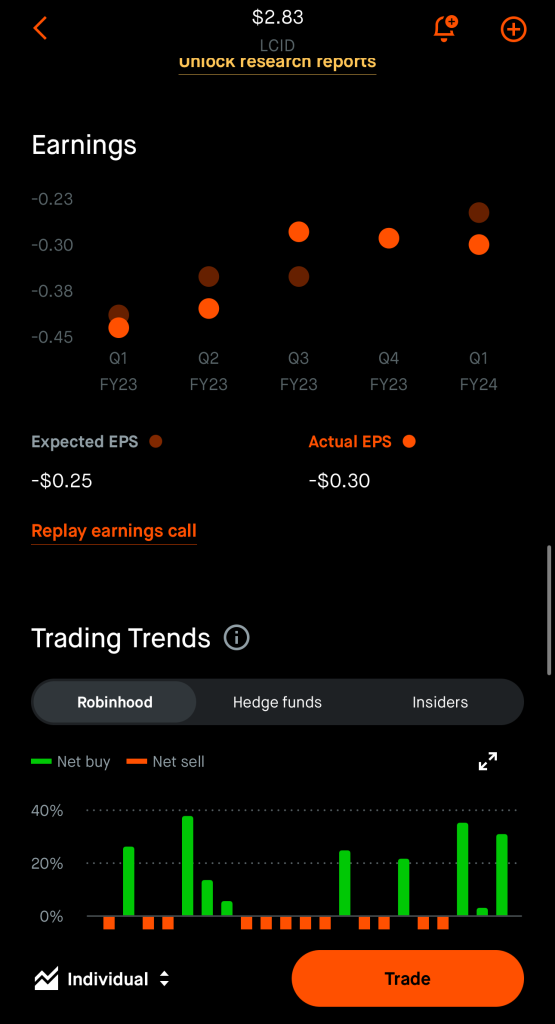

Robinhood is a favorite among day traders, especially beginners or those trading with smaller budgets.

Its biggest perk? Commission-free trading. You can buy and sell stocks, ETFs, options, and even cryptocurrencies without paying any fees (not including the regulatory transaction fee)—a huge win for active traders who make frequent moves.

The platform’s mobile app is another highlight. It’s super easy to use, with a clean and simple design that makes fast, on-the-go trading a breeze.

Pros | Cons |

|---|---|

Fractional Shares, Crypto Access | Lacking Mutual Funds and Bonds |

Advanced Charting And Research Tools

| No Automated Investing |

Robinhood Gold Features | No Advisory Services |

IPO Access | Reliability Issues |

Manage Retirement Accounts |

Vanguard

Monthly Fee

Minimum Deposit

Our Rating

Vanguard Cash APY

-

Overview

- Platform Screenshots

Vanguard is a great choice for both general investing and retirement planning, offering a wide selection of low-cost index funds and target-date funds.

These options are designed to help your money grow steadily while keeping fees low, so more of your investment stays working for you.

For long-term goals like retirement, Vanguard’s tools make it easy to plan and track progress.

Their calculators can estimate contributions, project future income, and show how your investments might grow over time, giving you a clear path toward your financial goals.

Additionally, Vanguard’s reputation for investor-first principles, along with its range of tools for tracking and planning, gives long-term investors the resources they need to stay on course.

Pros | Cons |

|---|---|

Wide Range of Investment Options | Limited Trading Platform |

Strong Retirement Planning Tools | No Paper Trading |

Low-Cost Funds | No Crypto & Fractional Share |

Robo Advisor & Personal Advisor Services | Limited Banking Options |