Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

When it comes to starting your investment journey, choosing the right online broker can make all the difference.

For beginners, it’s crucial to find a platform that offers user-friendly features, educational resources, and low costs to help build confidence in the world of investing.

With a wide array of online brokers and apps available today, selecting the best one can seem overwhelming.

However, the right choice depends on what you value most, whether it’s simplicity, automation, low fees, or hands-on learning opportunities. Here are our top brokers for beginners:

Robinhood

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

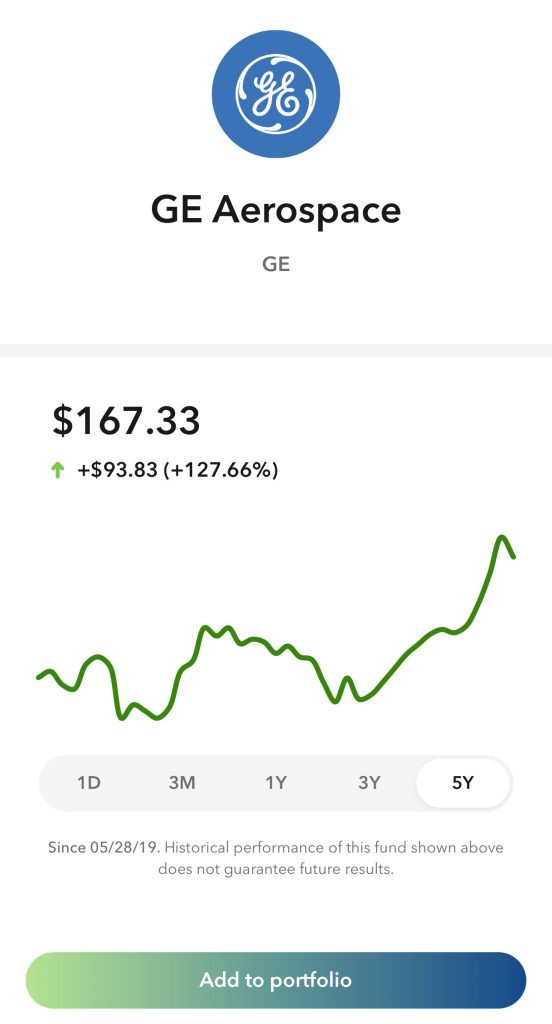

Robinhood is a great choice for beginners looking to start investing because it offers a simple and user-friendly platform that makes it easy to buy and sell stocks, even if you have no prior experience.

The app's clean, straightforward design is another big advantage. Robinhood makes the process of trading as easy as possible, with just a few taps to buy or sell stocks.

It also offers fractional shares, so you can invest in big companies like Apple or Tesla with just a few dollars.

This helps new investors get into the market without needing a large initial investment.

Robinhood also provides educational resources through its “Snacks” news feed, which offers bite-sized financial updates and investing tips in everyday language, helping beginners stay informed without feeling overwhelmed.

Pros | Cons |

|---|---|

Fractional Shares, Crypto Access | Lacking Mutual Funds and Bonds |

Advanced Charting And Research Tools

| No Automated Investing |

Robinhood Gold Features | No Advisory Services |

IPO Access | Reliability Issues |

Manage Retirement Accounts |

Merrill Edge

Monthly Fee

Minimum Deposit

Merrill Guided Investing – Robo Advisor: $1,000 for growth-focused strategies OR $50,000 for income-focused strategies

Merrill Guided Investing – Online Advisor : $20,000 for growth-focused strategies OR $50,000 for income-focused strategies

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

With its combination of educational resources, easy-to-navigate platform, and helpful tools, Merrill Edge is an excellent pick for anyone new to investing and looking for a solid, supportive start.

The platform offers a variety of articles, videos, and webinars to help beginners understand the basics of investing and make informed decisions.

The platform also includes an intuitive interface with easy-to-use tools that make buying and selling investments simple. Users can trade stocks, bonds, mutual funds, ETFs, and other investment products

Pros | Cons |

|---|---|

Extended Range of Investment Possibilities | No International Clients Accepted |

Bonus For Opening a New Trading Account | Demo Trading Unavailable |

Impressive Customer Service | Fees and Services |

Impressive Trading Education Services | Limited Options For Cryptocurrency |

Easy to Open a New Account |

Interactive Brokers

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

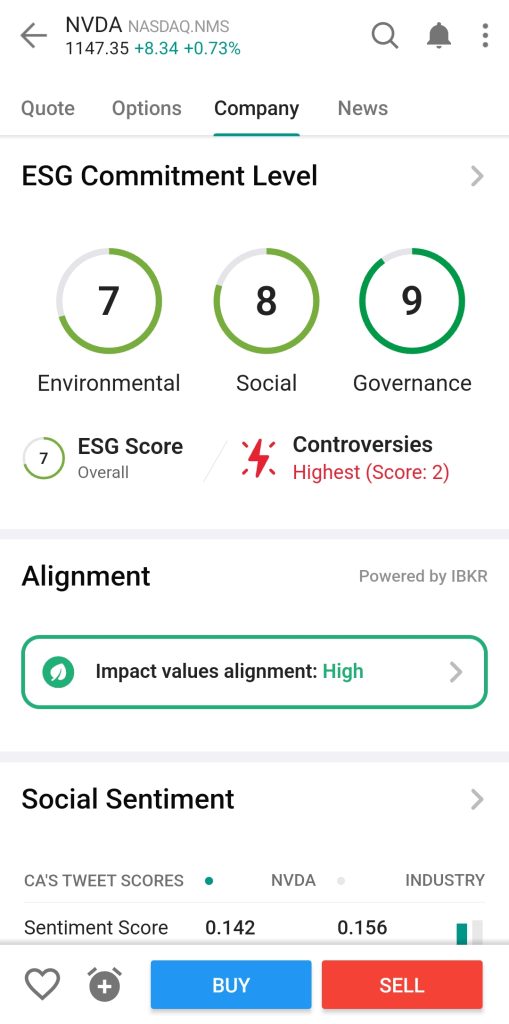

- Platform Screenshots

Interactive Brokers is a solid choice for new investors looking to get started with an online broker, especially if you’re serious about growing your knowledge and skills.

Interactive Brokers offers advanced trading tools such as charting capabilities, and research tools that can be beneficial for investors who want to take a more active approach to their investments.

Beginners can leverage the Interactive Brokers Lite option, which offers commission-free trading for U.S. stocks and ETFs.

There is a free access to educational resources and paper trading. Paper trading allows you to practice with virtual money before risking real funds, helping you get comfortable with how the platform works and learning how to trade without any financial risk.

Pros | Cons |

|---|---|

Extensive Global Market Access | Steep Learning Curve |

Low-Cost Trading | Limited Wealth Management Services |

Advanced Trading Platform | $10K Minimum For High APY On Cash |

Comprehensive Research Tools | |

Cash Management Account |

Acorns

Monthly Fee

Minimum Deposit

Our Rating

Savings Rate APY

-

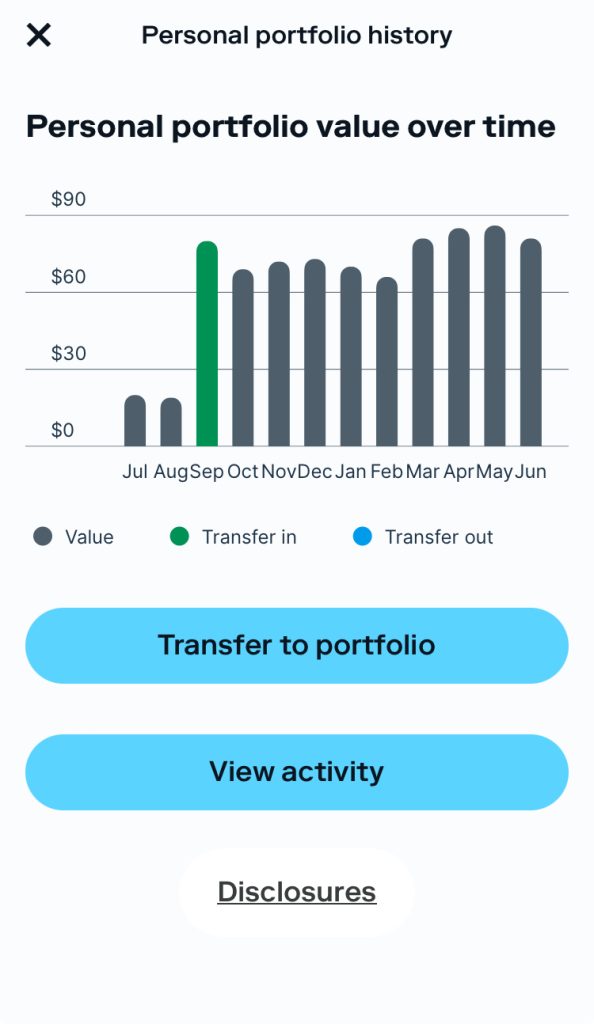

Overview

- Platform Screenshots

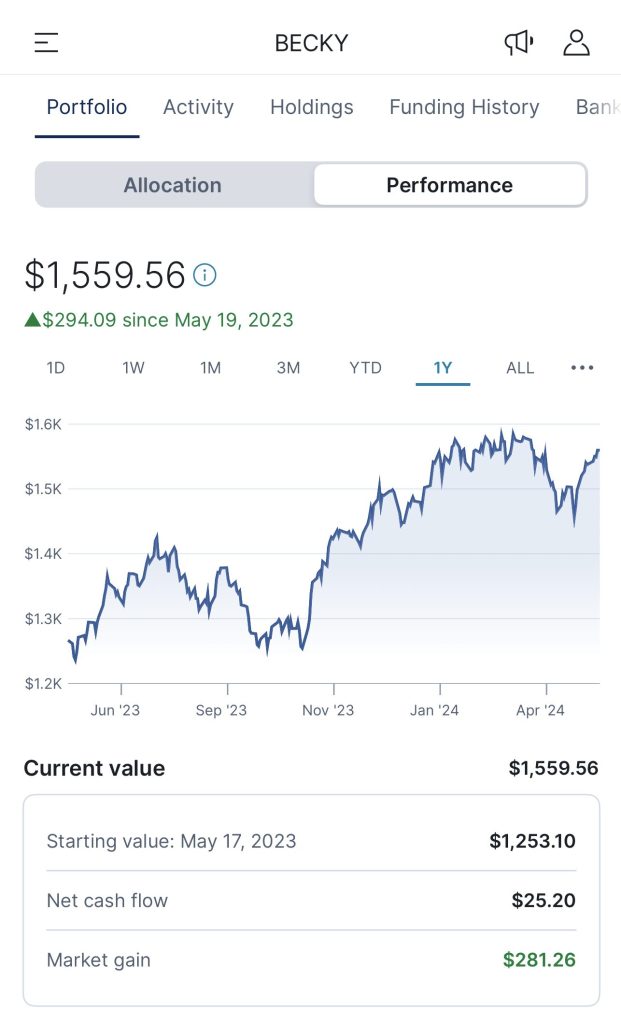

Acorns is a unique investment app that makes it easy for beginners to start investing with small amounts of money. It's designed to be user-friendly and accessible, making it a great option for those who are new to investing.

One of the standout features of Acorns is its “round-up” functionality. This feature automatically rounds up your purchases to the nearest dollar and invests the difference. For example, if you spend $12.34 on coffee, Acorns will round it up to $13 and invest the remaining 66 cents. This is a great way to start investing without having to make large deposits.

Acorns also takes the guesswork out of investing by offering pre-built portfolios based on your financial goals and risk tolerance. You don't need to worry about picking individual stocks or understanding complex financial terms—the app does that for you.

Pros | Cons |

|---|---|

Automated investing with pre made experts portfolio | High Fees For Low Portfolios |

Cash management account with high savings rates | Rebalancing can be better |

Invest in individual stocks | No tax strategies to minimize tax bills |

Earn rewards when you shop with hundreds of brands | No Budgeting or personal finance tools |

Retirement Plans benefiting from tax advantages |

Stash

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

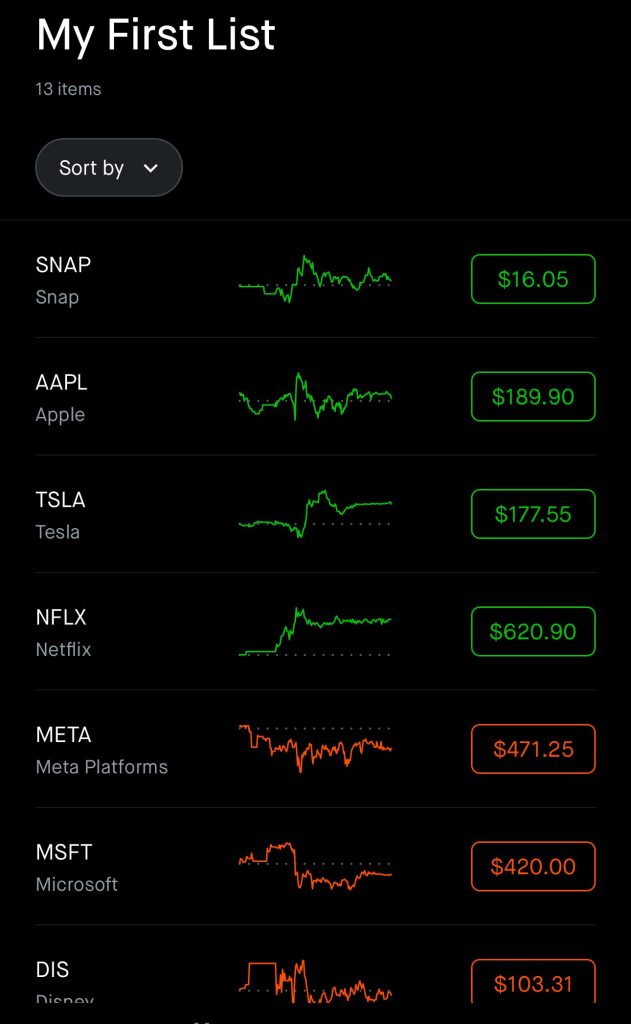

Stash is a great option for new investors who are just starting out and want an easy-to-use platform with lots of guidance.

One of its best features is that it not only lets you invest in stocks and ETFs but also teaches you how to do it along the way. The app offers personalized investment advice, helping you make smarter decisions based on your goals and risk preferences.

It also offers customizable investment portfolios. You can choose from a variety of pre-built portfolios that are designed to suit different risk tolerances and financial goals. Alternatively, you can create your own portfolio by selecting individual stocks and ETFs.

Stash provides articles, videos, and other resources to help you understand the basics of investing and make informed decisions.

Pros | Cons |

|---|---|

Good Selection of Investment Assets | No Interest on Banking Account |

Managed Portfolios | No Human Advisors |

Online Banking Account with Budgeting Tools | No Tax Loss Harvesting |

Stock Rewards with Debit Card Purchases | No Minimal Free Option |

M1 Finance

Monthly Fee

Minimum Deposit

Our Rating

M1 Savings APY

-

Overview

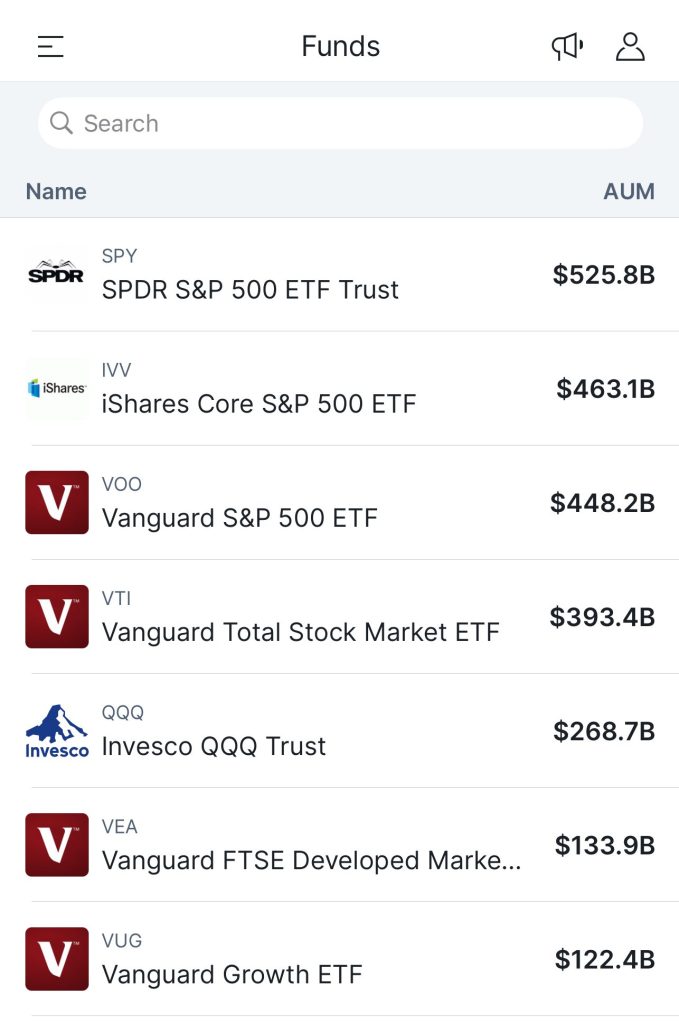

- Platform Screenshots

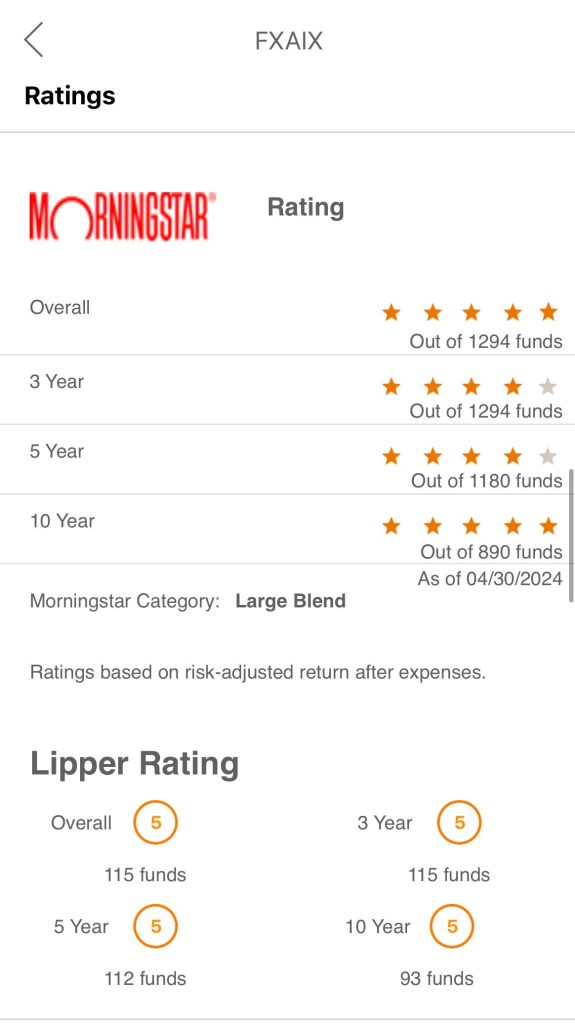

M1 Finance is a unique investment platform that offers a variety of features designed to make investing easier for beginners.

One of the standout features for beginners is the ability to invest in “pies,” which are essentially customizable portfolios that allow you to mix and match individual stocks and ETFs. You can even choose from pre-built pies designed by experts, making it easy to start investing without having to create your own portfolio from scratch.

Another key advantage for beginners is M1’s automation. Once you set up your portfolio, M1 automatically handles rebalancing and makes sure your investments stay aligned with your goals. M1 Finance also offers fractional shares, and there are no trading fees or commissions.

Pros | Cons |

|---|---|

Customization and Control | No Real-Time Trading |

No Trading Commissions | No Tax-loss harvesting |

Automation | Limited Investment Options |

Fractional Shares | Limited Account Types |

Low Minimum Investment |

How to Choose the Best Broker for Beginners?

Choosing the best broker for beginners is all about finding a platform that is easy to use, offers educational resources, and supports your financial goals. Here's a quick guide to help you pick the right broker:

- Account Minimums

Some brokers require a minimum deposit to open an account. Choose a platform with low or no minimums, so you can start investing with any amount of money.

- Low Fees

Minimize your costs by choosing a broker with low or no trading fees, especially if you plan on making smaller trades. Look for no-commission stock and ETF trading options.

- Demo Account

Some platforms offer demo accounts that allow you to practice trading without using real money. This can be a helpful feature when you're just starting out.

- User-Friendly Platform

Look for a broker with a simple, intuitive interface. The best platforms for beginners make it easy to navigate, place trades, and check your account without feeling overwhelmed.

- Educational Resources

A good broker for beginners will offer resources like tutorials, webinars, and articles to help you learn how to invest and understand the market. This helps you make informed decisions as you start.

- Customer Support

Strong customer support is crucial when you're new to investing. Look for brokers with reliable, easy-to-reach support teams, whether through phone, email, or live chat.

- Mobile App

A solid mobile app is important if you want to manage your investments on the go. Choose a broker with a well-reviewed, easy-to-use app.

Fractional Shares: Great Way To Start Small

Fractional shares are a great way for beginners to start investing without needing a lot of money. Instead of buying a full share of a stock, which can be expensive, fractional shares let you buy just a small portion.

Here’s how brokers use fractional shares to help beginners start small:

- Invest with Less Money: Fractional shares allow you to buy part of a stock for as little as $1. You don’t need to save up hundreds or thousands of dollars to invest in big companies like Apple or Amazon.

- Diversify Even with a Small Budget: Instead of putting all your money into one stock, fractional shares let you spread your investment across several companies, helping you diversify and reduce risk.

- No Need to Wait: You can start investing right away with whatever money you have. Fractional shares make it easy to get into the market and start learning.

- Reinvest Dividends: Some brokers automatically reinvest dividends by purchasing more fractional shares, which helps your investment grow over time without extra effort.

Demo Accounts: Learning to Trade Without Risk

Demo accounts are an excellent way for beginners to learn how to trade without risking real money. They let you practice investing in a simulated environment, using virtual funds to make trades and test strategies.

Here’s how demo accounts help you learn to trade:

- Practice Without Risk: With a demo account, you can make trades and test different strategies without losing any real money. This is perfect for learning how the stock market works and building confidence.

- Get Comfortable with the Platform: Demo accounts let you explore the broker’s platform, so you can learn how to place trades, check your portfolio, and use different tools, all without the pressure of real investments.

- Test Investment Strategies: You can experiment with different strategies, like day trading or long-term investing, and see how they would perform in real market conditions—without any financial consequences.

- Build Your Skills Over Time: Using a demo account helps you practice and improve your trading skills. You’ll learn how to read charts, spot trends, and make better investment decisions.

A demo account is a risk-free way for beginners to learn the ropes of investing, so you’re ready to use real money when the time comes.

Robo-Advisors vs. Self-Directed Trading: Which Is Best For Beginners?

Robo-advisors and self-directed trading offer different approaches for beginners. Robo-advisors automate everything, requiring little effort or knowledge, with low fees and long-term, lower-risk strategies—ideal for hands-off investors.

On the other hand, self-directed trading gives you full control, allowing you to pick and manage your investments, which offers learning opportunities and the potential for higher rewards but requires time, research, and a higher risk tolerance.

Feature | Robo-Advisors | Self-Directed Trading |

|---|---|---|

Control | Automated, little to no decision-making | Full control over what to buy or sell |

Effort | Low effort, “set-it-and-forget-it” | High effort, requires active involvement |

Fees | Low management fees | May have no fees for ETFs & stocks |

Learning Curve | Minimal learning needed | Great for learning by gaining experience |

Time Commitment | Minimal, designed for long-term | Requires time to research and monitor |

Investment Strategy | Long-term, steady growth | Flexible, short-term or long-term, |

Risk | Lower risk, more conservative | Higher risk, depends on decisions made |

Customization | Limited to preset portfolios based on risk tolerance | Full customization of your investment portfolio |

Best For | Hands-off approach | Beginners, active traders |

If you prefer a passive approach, go with a robo-advisor. If you want to actively learn and manage your investments, self-directed trading is the better option.