Getting started with cryptocurrency can feel overwhelming—especially with so many exchanges and apps out there.

At The Smart Investor, we’ve rated and reviewed the top crypto platforms to help beginners find the best options. Here's the summary:

Platform | Coins | Spot Trading Fee | U.S. Status | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | Available

Not available in New York. Some services, like web based trading platform, margin trading and staking, are also restricted for U.S. users. Despite these limitations, U.S. users can still use the Crypto.com Visa Card, earn rewards, and trade through the mobile app.

| Earning Rewards |

|---|---|---|---|---|

Bitget | +800 | 0.10%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0.02%. Using Bitget's native token, BGB, to pay trading fees offers a 20% discount /span> | Not Available | Beginner-Friendly Options |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Available

In 46 states, not including New York, Texas, Hawaii, and North Carolina. Some advanced features like staking options are unavailable | User-Friendly Interface |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Available

Fully available in all 50 U.S. states. Derivatives trading and Staking Pro are currently unavailable in the U.S., and the Gemini Earn lending program was shut down due to legal issues with the SEC. | Security and Regulatory Compliance |

Cash App | 1 (Bitcoin) | $0 | Available | Bitcoin |

We focused on ease of use, security, low fees, and essential features like simple buying, selling, and storage.

In this guide, we break down the best crypto apps for beginners based on real-world testing and expert insights.

Coinbase Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%.

-

Overview

- FAQ

- Platform at a Glance

Coinbase is one of the most popular cryptocurrency exchanges and is highly regarded as a great option for beginners looking to enter the world of crypto.

With its user-friendly interface, Coinbase makes it easy for new users to buy, sell, and store cryptocurrencies like Bitcoin, Ethereum, and Dogecoin.

The platform’s design is simple and intuitive, so even those without any prior experience can quickly understand how to navigate and complete transactions.

In addition to its beginner-friendly interface and educational tools, Coinbase offers easy funding options like linking a bank account, debit card, or PayPal. The platform also provides instant purchases for those who want to quickly get started with crypto.

Coinbase also offers excellent security measures, including two-factor authentication (2FA) and cold storage for the majority of user funds, which is crucial for those new to crypto and concerned about security.

The platform even offers insurance for crypto stored on its platform, providing an added layer of protection.

How can I fund my Coinbase account?

You can fund your Coinbase account using a bank account, debit card, PayPal, or wire transfer.

What cryptocurrencies can I trade on Coinbase?

Coinbase offers +250 cryptocurrencies, including popular coins like Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and stablecoins like USDC.

Can I trade on Coinbase if I’m not in the U.S.?

Yes, Coinbase is available in over 100 countries, though some features and cryptocurrencies may not be available in all regions.

Can I earn crypto on Coinbase?

Yes, you can earn cryptocurrency by participating in Coinbase Earn, where you watch videos and complete quizzes to earn crypto rewards.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Higher Fees |

User-Friendly Interface | Limited Advanced Features for Experienced Traders |

Strong Security Features | Customer Support Challenges |

Regulatory Compliance | Limited Privacy |

Mobile and Desktop Accessibility | Crypto Withdrawal Network Fees |

Educational Resource |

Crypto.com Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

- Platform at a Glance

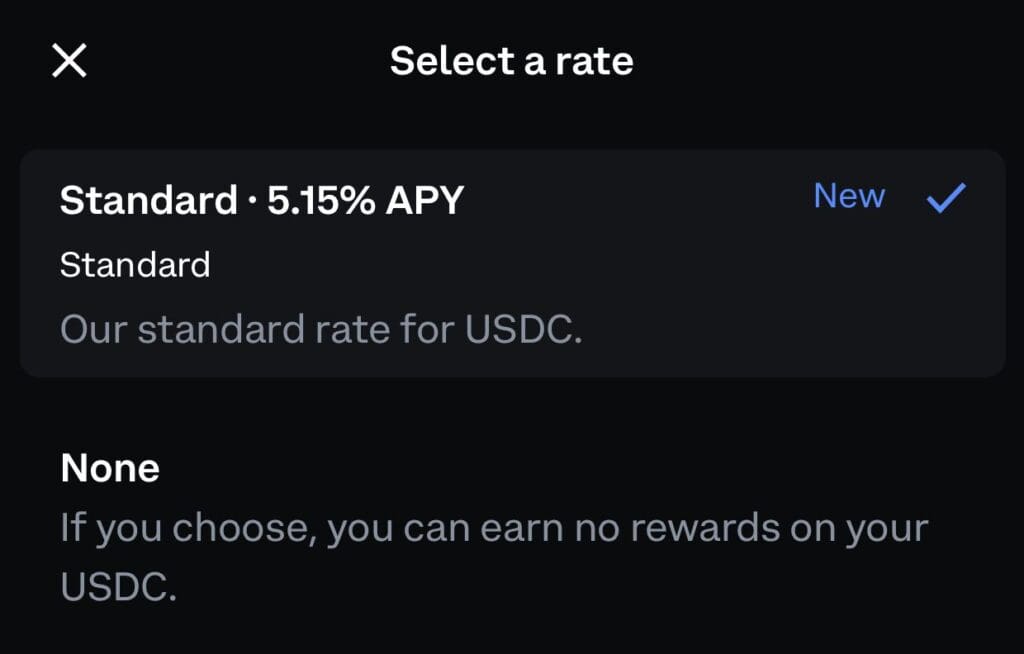

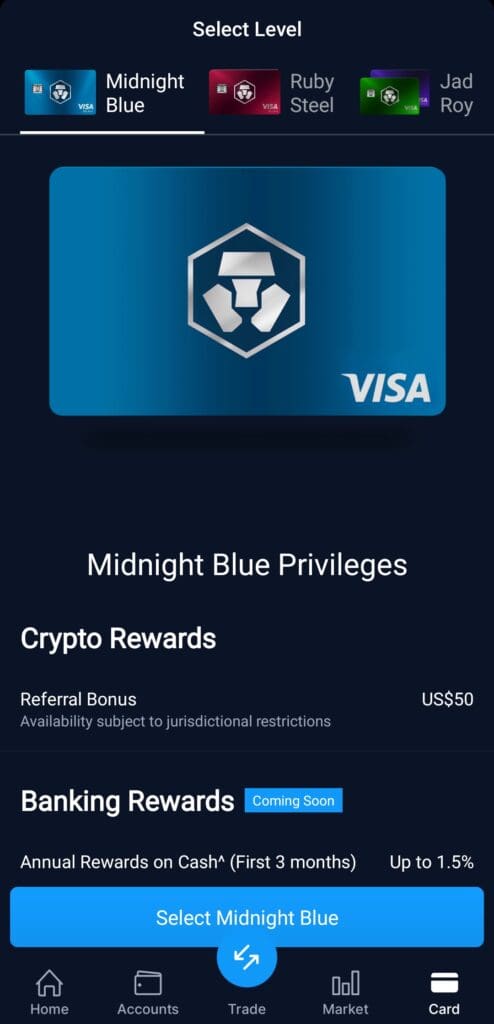

Crypto.com is a beginner-friendly cryptocurrency platform offering a simple and secure way to buy, sell, and manage digital assets.

It supports 350+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and stablecoins like USDC. The platform is designed with ease of use in mind, making it an excellent choice for those new to crypto investing.

One of Crypto.com’s standout features is its highly-rated mobile app, which allows users to buy crypto with a few taps, track market prices, and set price alerts. Unlike more complex exchanges, Crypto.com simplifies the experience by integrating a crypto wallet, trading features, and rewards all in one app.

While the fees for credit/debit card purchases are high (2.99%), users can avoid extra costs by funding their accounts via bank transfer (ACH or SEPA).

Crypto.com uses two-factor authentication (2FA), cold storage, and withdrawal whitelisting to keep funds safe. It’s also regulated in multiple countries, adding trust for new investors.

Does Crypto.com offer staking?

Staking is no longer available for U.S. users, but international users can still stake CRO and other assets for rewards.

Does Crypto.com offer margin trading?

Yes, but margin trading (up to 10x leverage) is not available for U.S. retail users—only international traders can access it.

Has Crypto.com ever been hacked?

Yes, in January 2022, Crypto.com was hacked for $35 million, but all affected users were fully reimbursed, and security measures were upgraded.

How do I deposit money into Crypto.com?

You can deposit funds via bank transfer (ACH, SEPA, wire transfer), credit/debit card, or by sending cryptocurrency from another wallet.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Limited Access for U.S. Users |

Competitive Trading Fees | High Fees for Credit/Debit Card Purchases |

Strong Security & Compliance | Crypto Withdrawals Can Be Expensive |

Feature-Rich Ecosystem | No Staking for U.S. Users |

Seamless Mobile Experience | |

Institutional-Grade Storage & Trading |

Bitget Crypto Exchange

U.S. Status

Not Available

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

- Platform at a Glance

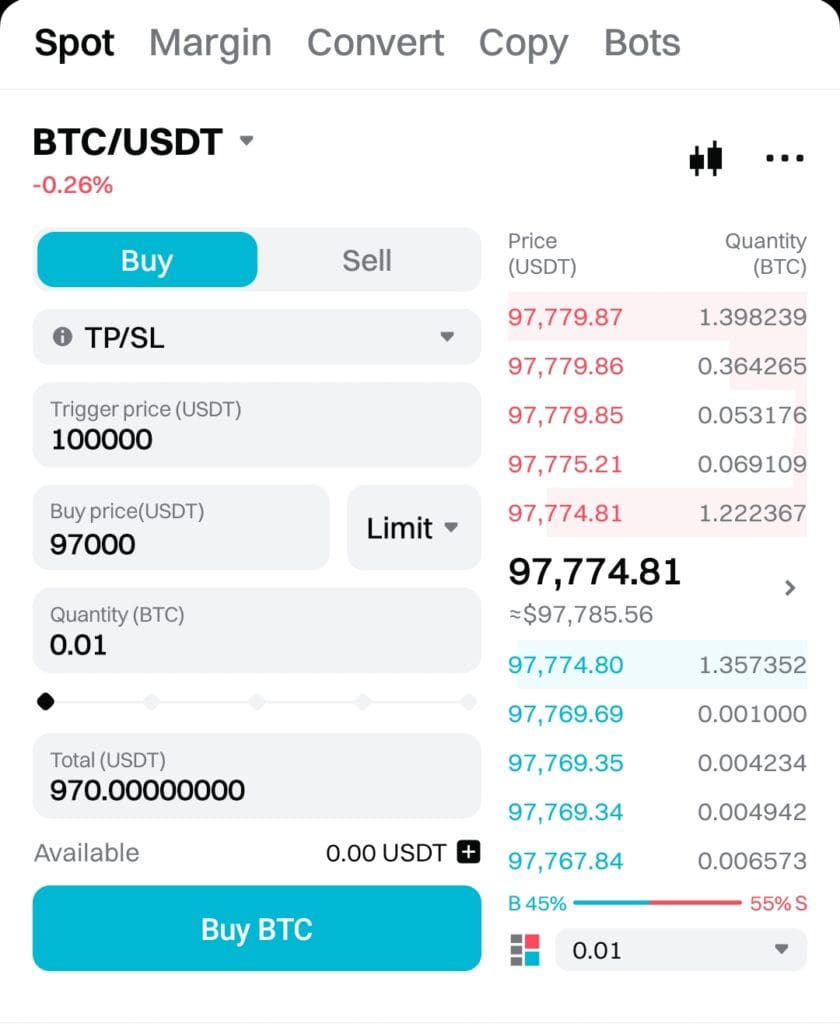

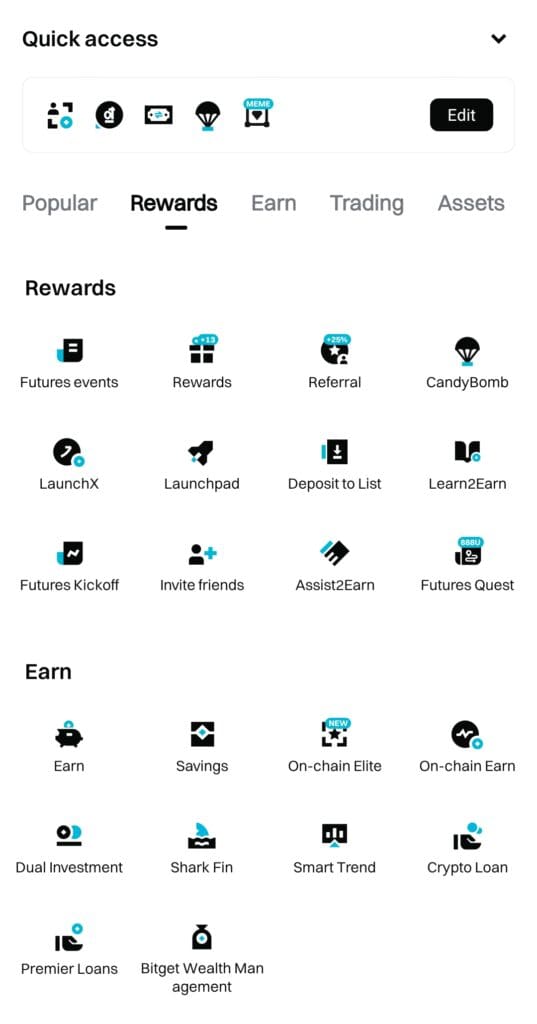

Bitget is an ideal crypto app for beginners due to its user-friendly interface and range of helpful features designed to simplify the trading process.

Bitget supports a wide range of cryptocurrencies, including popular options like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), so users can easily get started with the most established coins.

The platform offers spot trading with low fees (0.10% for both maker and taker orders), making it affordable for beginners to start trading without incurring high costs.

For those just getting started, the copy trading feature is a standout. This allows beginners to follow and replicate the strategies of experienced traders.

Bitget’s staking feature allows you to earn passive income by staking certain cryptocurrencies, adding another way for beginners to earn rewards while holding their assets.

What cryptocurrencies can I trade on Bitget?

Bitget supports over 800 cryptocurrencies, including major coins like Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), as well as altcoins and stablecoins.

Does Bitget offer fiat deposits?

Yes, Bitget allows fiat deposits through methods like SEPA, bank transfers, and credit/debit cards for users in supported countries.

Is Bitget safe to use?

Bitget uses top-notch security measures such as two-factor authentication (2FA), encryption, and a $400 million protection fund to safeguard user assets.

Is Bitget beginner-friendly?

Yes, Bitget offers an easy-to-use interface and features like copy trading, which makes it accessible for beginners looking to get into crypto trading.

Does Bitget support NFTs?

No, Bitget currently does not offer NFT trading or support for Web3 features, focusing mainly on crypto-to-crypto trading.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Limited Availability in the U.S. |

Low Fees | No NFT or Web3 Support |

High Leverage Options | Customer Support Delays |

Copy Trading | Complex for Beginners |

Robust Security Features |

Cash App Invest

Monthly Fee

Minimum Deposit

Our Rating

APY Savings

-

Overview

- FAQ

- Platform at a Glance

Unlike other crypto exchanges that may feel overwhelming with complex charts and multiple trading pairs, Cash App keeps things straightforward—perfect for those new to cryptocurrency investing.

One of its biggest advantages is that you can start with as little as $1, making it easy for beginners to get involved in Bitcoin investing without a large upfront commitment.

Additionally, Cash App allows users to transfer Bitcoin to external wallets, which is a feature that platforms like Robinhood don’t offer.

Cash App’s banking and investing integration also makes it ideal for those who want an all-in-one financial app. You can seamlessly move money between your Cash App balance and investing account, making deposits and withdrawals easy.

However, it does not offer other cryptocurrencies like Ethereum or Dogecoin, and the research tools are limited compared to exchanges like Coinbase or Binance.

Is Bitcoin purchased on Cash App insured?

No, Bitcoin is not insured by SIPC or FDIC, meaning there is no protection if Cash App experiences financial issues.

Does Cash App charge fees for buying or selling Bitcoin?

Yes, Cash App charges a service fee and an additional fee based on market volatility at the time of your transaction.

Does Cash App offer a Bitcoin wallet?

Yes, Cash App includes a built-in Bitcoin wallet, allowing you to store and transfer BTC.

Can I stake Bitcoin on Cash App?

No, Cash App does not support staking or earning interest on Bitcoin holdings.

Can I transfer Bitcoin from Cash App to an external wallet?

Yes, Cash App allows you to send Bitcoin to external wallets, giving you full control over your crypto assets.

Pros | Cons |

|---|---|

Commission-Free Stock & ETF Trading | Limited Investment Options |

Bitcoin Trading & Transfers | Only One Cryptocurrency (Bitcoin) |

Banking & Investing in One App | No Retirement or Specialized Accounts |

Beginner-Friendly & Simple Interface | High Non-Trading Fees |

Auto-Investing & Round-Ups | Limited Customer Support |

Regulated & Secure | Data Breach In 2022 |

Gemini Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%.

-

Overview

- FAQ

- Platform at a Glance

Gemini is one of the best cryptocurrency apps for beginners, offering a secure, easy-to-use, and fully regulated platform for buying, selling, and storing digital assets. Founded in 2014 by the Winklevoss twins, Gemini is a U.S.-based exchange available in all 50 states and over 60 countries worldwide.

The Gemini app and web platform make it easy to buy crypto with fiat money, set up recurring purchases, and track your portfolio. For users looking for more advanced features, Gemini’s ActiveTrader platform provides lower fees, fast execution, and professional trading tools.

Unlike some platforms, Gemini is fully regulated by the New York Department of Financial Services (NYSDFS), giving beginners peace of mind.

Gemini also offers crypto staking, a crypto rewards credit card, and an NFT marketplace through Nifty Gateway, allowing beginners to explore different aspects of the crypto space in a secure environment.

However, trading fees on the basic platform are higher than some competitors.

Does Gemini charge inactivity fees?

No, Gemini does not charge inactivity fees. However, storing assets on the exchange does not generate interest, so some users prefer to transfer funds to external wallets.

Can I stake my crypto on Gemini?

Yes, Gemini supports staking for Ethereum (ETH) and Polygon (MATIC). Solana (SOL) is also available for non-U.S. users. However, Gemini’s staking rewards are lower than other exchanges and charges a 15% staking fee.

Can I use Gemini for crypto lending?

No, Gemini’s Earn program was shut down due to regulatory issues, and users are no longer able to lend crypto for interest. Other lending platforms, like Nexo or BlockFi, offer similar services, but always research risks before lending crypto.

How long do Gemini withdrawals take?

Crypto withdrawals are usually processed within minutes, depending on network congestion. Fiat withdrawals via ACH take 4-6 business days, while wire transfers are typically completed within 24 hours.

What happens if I send crypto to the wrong address on Gemini?

Unfortunately, crypto transactions are irreversible. If you send funds to the wrong address, Gemini cannot recover them, so always double-check wallet addresses before sending crypto.

Does Gemini have customer support?

Yes, Gemini provides email and chat support, but it does not offer live phone support, which some users find inconvenient.

How do I deposit money into Gemini?

You can deposit fiat money using ACH transfers, wire transfers, or debit cards. Crypto deposits are also available. ACH and wire transfers are free, but debit card deposits have a fee.

What cryptocurrencies can I trade on Gemini?

Gemini offers over 150 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and stablecoins like Gemini Dollar (GUSD) and USD Coin (USDC).

Can I buy NFTs on Gemini?

Yes, Gemini owns Nifty Gateway, an NFT marketplace where users can buy, sell, and store NFTs securely using fiat or crypto.

Pros | Cons |

|---|---|

Strong Security & Compliance | High Trading Fees |

Available in All 50 U.S. States | Limited Crypto Selection Compared to Competitors |

Beginner & Advanced Trading Options | Limited Staking Options |

NFT & Web3 Integration | Mixed Customer Support Reputation |

Crypto Rewards Credit Card | Complicated Fee Structure |

Institutional-Grade Storage & Trading |

How Beginners Should Choose A Crypto App?

Choosing the right crypto app as a beginner can be overwhelming, but focusing on a few key features can make the process much easier. Here are seven essential factors to consider:

- Ease of Use – A beginner-friendly crypto app should have a simple, intuitive interface that makes buying, selling, and managing crypto effortless. Look for apps with a clean design, guided onboarding, and one-click trading options.

- Security & Trustworthiness – Security is critical in crypto. Choose a platform that offers two-factor authentication (2FA), encryption, cold storage for funds, and insurance on deposits. Also, check if the exchange has a strong security record with no history of major hacks.

- Low Fees & Transparent Pricing – Beginners should avoid high trading fees and hidden costs. Look for platforms that offer low or zero trading fees, reasonable withdrawal fees, and clear pricing structures.

- Supported Cryptocurrencies – Make sure the app supports the top cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), along with any altcoins you may want to invest in later.

- Payment & Withdrawal Methods – A good crypto app should allow easy deposits and withdrawals via bank transfer, debit/credit card, PayPal, or even Apple Pay. Ensure the withdrawal process is fast and hassle-free.

- Educational Resources – For beginners, apps with learning tools, tutorials, and market analysis can be valuable. Some platforms even offer demo trading accounts.

- Customer Support – Since crypto markets run 24/7, having fast and reliable customer support (live chat, phone, or email) is essential for solving issues quickly.

By focusing on these factors, beginners can find a safe, easy-to-use, and cost-effective crypto app to start their journey with confidence.

10 Crypto Definitions to Understand Before Start With Crypto App

Before diving into a crypto app, it's important to understand key terms that will help you navigate the world of cryptocurrency with confidence.

Here are 10 essential crypto definitions every beginner should know:

- Exchange – A crypto exchange is a platform where you can buy, sell, and trade cryptocurrencies. Examples include Binance, Coinbase, and Crypto.com.

- Wallet – A tool for storing your crypto assets. Hot wallets (online) are convenient but less secure, while cold wallets (offline) offer better protection.

- Private Key – A secret code that allows you to access and control your cryptocurrency. If you lose it, you lose access to your funds.

- Public Key – Like an account number, it’s used to receive crypto transactions. It’s safe to share.

- Gas Fees – A fee paid to process transactions on a blockchain, common in Ethereum-based transactions.

- Staking – Earning rewards by locking up your crypto to support a blockchain network.

- DeFi (Decentralized Finance) – A financial system built on blockchain that removes banks as intermediaries. Includes lending, borrowing, and staking.

- Blockchain – A decentralized digital ledger that records all cryptocurrency transactions across a network. It ensures security, transparency, and immutability.

- NFT (Non-Fungible Token) – A unique digital asset stored on the blockchain, used for art, gaming, and collectibles.

- Web3 – The decentralized version of the internet, where users control their data, identity, and assets using blockchain technology.

How To Open An Crypto Account As A Beginner?

Getting started with cryptocurrency is easier than you think.

Follow these simple steps to open a crypto account and start trading in minutes:

1. Choose a Crypto App or Exchange

Pick a beginner-friendly platform like Coinbase, Crypto.com, or Gemini that offers easy navigation, strong security, and low fees.

2. Sign Up & Create an Account

Go to the app or exchange’s website or download their mobile app. Click “Sign Up” and enter your email, password, and basic details.

3. Verify Your Identity (KYC Process)

Most regulated exchanges require Know Your Customer (KYC) verification for security. You'll need to upload a government-issued ID (passport, driver’s license) and a selfie to confirm your identity. Some platforms may also ask for proof of address.

4. Secure Your Account

Enable two-factor authentication (2FA) for extra protection. This adds a second verification step whenever you log in or make transactions.

5. Deposit Funds

Fund your account using a bank transfer, credit/debit card, or PayPal (depending on the platform). Some exchanges also allow deposits in crypto.

6. Buy Your First Crypto

Once your funds are available, navigate to the “Buy/Sell” section, choose a cryptocurrency (e.g., Bitcoin or Ethereum), enter the amount, and confirm your purchase.

Crypto Trading Fees: What to Watch Out For

When trading crypto, fees can quickly add up, so understanding the different types is essential. Here are the key fees to watch out for:

- Trading Fees (Maker & Taker Fees) – Most exchanges charge a percentage per trade (e.g., 0.1%–1%). Maker fees (lower) apply when placing limit orders, while taker fees (higher) apply when executing market orders.

- Spread Fees – Some platforms don’t charge direct trading fees but instead make money through spreads. This means you buy at a slightly higher price and sell at a slightly lower price, reducing your profit.

- Deposit & Withdrawal Fees – Many exchanges charge fees for depositing and withdrawing funds. Bank transfers are often cheaper than credit/debit cards, and crypto withdrawals vary based on network fees.

- Network Fees (Blockchain Transaction Fees) – When withdrawing crypto, you pay blockchain network fees that fluctuate based on demand. Ethereum, for example, tends to have higher gas fees than other blockchains.

- Instant Buy/Sell Fees – Some beginner-friendly exchanges, like Coinbase, charge higher fees for instant buy/sell transactions compared to trading on their main exchange.

- Inactivity Fees – A few platforms charge a fee if your account is inactive for a long period. Always check the platform’s policies to avoid unnecessary charges.

- Conversion & Foreign Exchange Fees – If you're depositing or withdrawing in a currency different from the platform’s default, you may face conversion fees. Using a local exchange can help minimize this.

FAQ

Look for an exchange with a user-friendly interface, low fees, strong security, and multiple deposit options like credit cards and bank transfers.

You can deposit funds using a bank transfer, credit/debit card, PayPal, or even other cryptocurrencies, depending on the exchange.

A crypto wallet stores your digital assets. While exchanges offer wallets, a private wallet (hardware or software) gives you more control and security.

Staking allows you to earn rewards by holding and “locking up” certain cryptocurrencies to support the network.

Bitcoin (BTC) and Ethereum (ETH) are great starting points due to their stability and widespread use.