Table Of Content

What Features to Look for in a Mutual Fund Screener?

A good mutual fund screener should help you narrow down your options based on your strategy, preferences, and financial goals.

Flexible Filters: To tailor your search, you can choose from criteria like fund category, performance history, risk level, expense ratio, and fund family.

Benchmark Comparison: Look for tools that let you compare fund returns to relevant indexes, such as the S&P 500 or bond benchmarks.

Manager and Fund Details: Access data on manager tenure, fund inception date, asset allocation, and turnover ratio to assess stability.

Fee Transparency: Screeners should clearly display all costs, including front- or back-end loads, redemption fees, and ongoing expense ratios.

Interactive Charts and Data: Visualize past returns, volatility, and sector exposure to evaluate how the fund behaves in various market conditions.

Fund Rankings or Ratings: Some platforms include third-party rankings or star ratings that can help you quickly identify top-performing or lower-risk funds.

Choosing a screener with these capabilities helps you filter smarter, not harder—saving time while increasing confidence in your fund selections.

Best Mutual Fund Screeners For Investors

These top-rated mutual fund screeners provide reliable tools for evaluating performance, risk, and fit for your portfolio strategy.

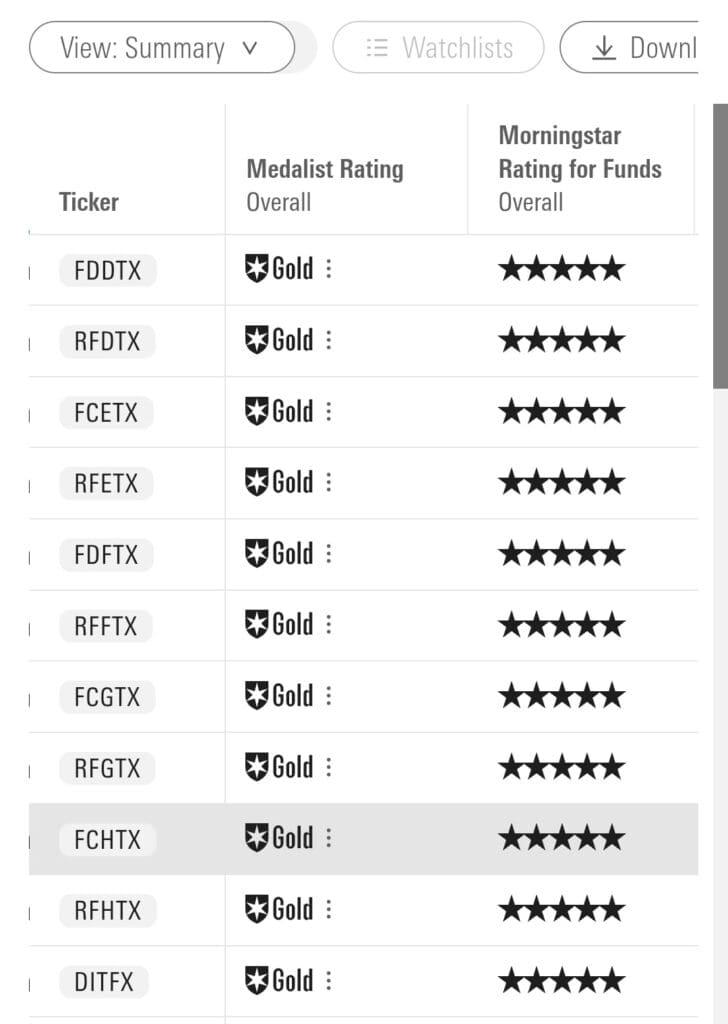

1. Morningstar Fund Screener

Morningstar is one of the most trusted names in mutual fund research, offering robust tools for both casual and professional investors. Its screener stands out due to Morningstar’s proprietary ratings and fund analyst reports.

Morningstar Ratings: Screen funds using the well-known star rating system based on past performance and risk-adjusted returns.

In-Depth Data: Access fund strategy, top holdings, turnover ratio, and analyst commentary.

Premium Insights: With a Morningstar Premium subscription, you unlock advanced screeners and forward-looking analyst ratings.

Morningstar’s screener is ideal if you want deep insights and third-party evaluations.

2. Charles Schwab Mutual Fund Screener

Charles Schwab’s mutual fund screener is powerful for account holders. It offers thousands of no-transaction-fee (NTF) funds and deep analysis tools, tailored for investors looking to act quickly on research.

Fee Filters: Easily screen Schwab OneSource NTF funds or compare load vs. no-load funds.

Fund Comparison Tool: Compare multiple funds side-by-side on risk, return, and expenses.

Integration with Accounts: You can directly invest in selected funds from your Schwab brokerage account.

Although full access requires a Schwab account, it provides great value to active investors.

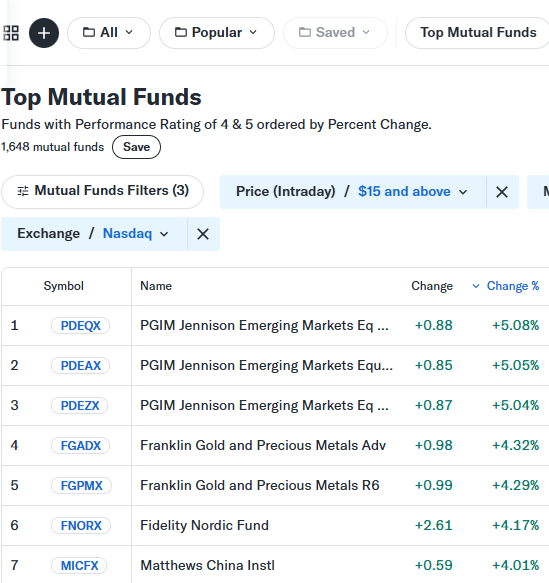

3. Yahoo Finance Mutual Fund Screener

Yahoo Finance offers a user-friendly screener that helps new and seasoned investors compare mutual funds based on performance, risk, and fund family. It is completely free and accessible without registration.

Customizable Filters: You can filter by category, top holdings, expense ratio, and risk level to find funds that suit your investment goals.

Performance Charts and Stats: View historical returns and benchmark comparisons over different timeframes.

Easy-to-Navigate Interface: Data is cleanly presented, making it great for beginners seeking clarity.

Although it lacks advanced analytical tools, Yahoo Finance is a good starting point for basic mutual fund research.

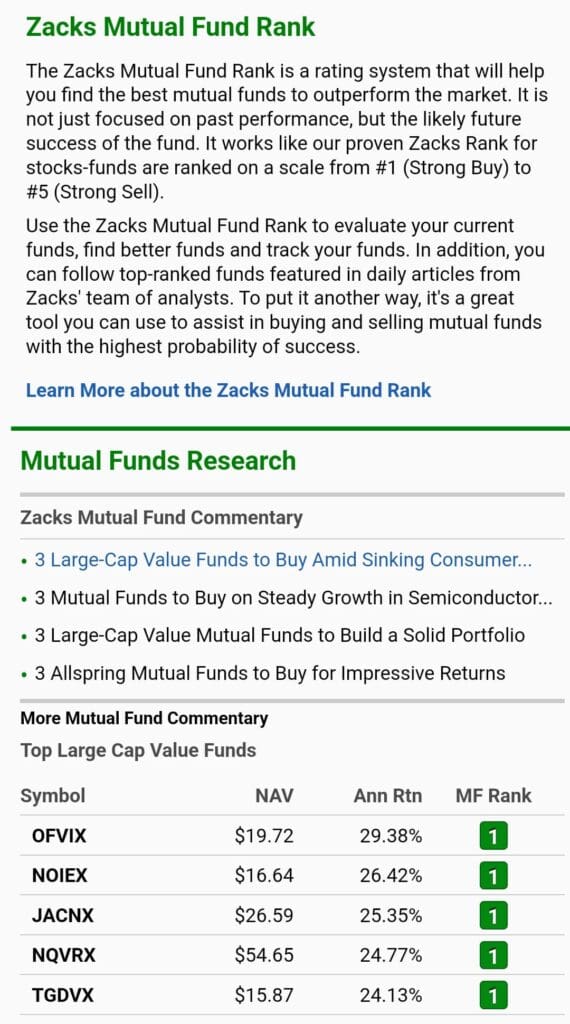

4. Zacks Mutual Fund Screener

Zacks offers a powerful screener with a focus on momentum and performance metrics. It's designed for data-driven investors who want to evaluate funds based on rankings and style performance.

Zacks Rank for Funds: Sort funds using Zacks’ proprietary ranking system based on expected outperformance.

Detailed Style Boxes: Visual tools categorize funds by market cap and investment style.

Screen for Risk Metrics: Include filters for beta, Sharpe ratio, and standard deviation.

Free users can access basic filters, while premium users benefit from exclusive rankings and fund reports.

5. Vanguard Mutual Fund Screener

Vanguard’s screener best suits long-term investors who want low-cost, index-focused mutual funds. While it's limited to Vanguard brokerage clients, the depth of data for each fund is strong.

Low-Cost Focus: Screen Vanguard’s low-expense-ratio funds with performance and benchmark tracking.

Retirement-Oriented Filters: Narrow by retirement target date, income objective, or bond duration.

Simple Layout: Ideal for Vanguard investors who want an efficient way to build a diversified portfolio.

Though limited to its own funds, it’s a top pick for passive investors.

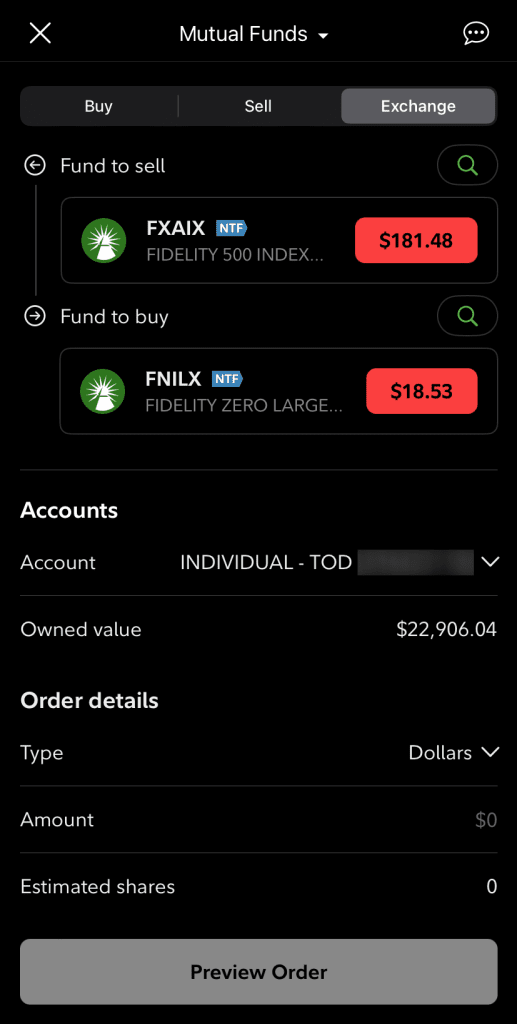

6. Fidelity Mutual Fund Screener

Fidelity offers one of the most comprehensive mutual fund screeners, covering over 10,000 funds including both Fidelity and non-Fidelity options. The interface supports deep customization for advanced research.

Advanced Filters: Screen by sector exposure, fund manager tenure, minimum investment, and more.

Fund Picks and Rankings: Access Fidelity’s own fund scorecard and third-party research tools.

Interactive Comparison Tools: Compare returns, fees, and volatility across selected funds in chart form.

This screener is ideal for investors who want broad access and advanced screening tools in one place.

How to Use a Mutual Fund Screener

Mutual fund screeners help you filter and evaluate funds that match your investment goals, risk tolerance, and financial timeline.

Start with a Goal: Decide whether you're seeking growth, income, capital preservation, or a combination to guide your screening.

Set Key Criteria: Filter funds by category, performance history, expense ratio, risk level, and minimum investment requirements.

Use Style and Sector Filters: Target funds based on asset allocation, market cap exposure, or sector themes like tech or healthcare.

Compare Performance Benchmarks: Assess how each fund performs against indexes like the S&P 500 over one, three, or five-year periods.

Check Fund Manager Tenure: A consistent manager often indicates stable strategy execution, especially for actively managed funds.

Save or Export Results: Save fund lists or export them for deeper research or discussion with an advisor.

Using a screener streamlines fund selection by focusing only on what truly matters to your strategy. It allows you to avoid information overload and make informed decisions based on relevant criteria.

FAQ

Yes, many screeners include filters for retirement goals, such as target-date funds or income-generating funds, making them useful for long-term planning.

Absolutely. Most screeners allow you to filter specifically for index funds based on tracking index, expense ratio, and fund category.

Some advanced screeners like Morningstar or Fidelity let you filter for ESG (Environmental, Social, Governance) or socially responsible investing preferences.

Yes, key filters usually include expense ratios, front-end loads, and redemption fees, which are essential when evaluating cost efficiency.

Ratings from providers like Morningstar or Zacks offer useful insights, but they should be used alongside other data like past performance and risk metrics.

Yes, platforms like Fidelity and Zacks allow screening for international or global mutual funds across various regions and sectors.

Some tools like Yahoo Finance are fully accessible without registration, while others require free or premium account setup.

Several platforms, including Fidelity and Yahoo Finance, offer responsive or app-based versions, allowing investors to screen on the go.

Most premium tools allow you to save custom screen templates for future use, which is helpful for ongoing portfolio monitoring.

It depends on the platform. Some update data daily, while others may lag a few days, especially on performance or holdings data.