Table Of Content

What Makes a Good Penny Stock Screener?

Choosing the right penny stock screener can help day traders and investors uncover hidden gems in the market.

Real-Time Data Access: Timely price updates help traders spot fast-moving penny stocks and avoid lag, which leads to missed opportunities.

Custom Filters: A good screener should allow you to filter by price, volume, volatility, and sector to narrow the universe of penny stocks.

News Integration: Screeners that pull in recent headlines help users spot momentum driven by catalysts like earnings or FDA approvals.

Volume and Technical Indicators: High volume and technical breakouts often precede penny stock spikes, so screeners should include RSI, MACD, or moving averages.

Ease of Use: The interface should be user-friendly and quick to navigate — especially valuable for day traders working in fast-paced environments.

Top Free and Paid Penny Stock Screeners

Looking for the best tools to discover penny stocks? These free and paid screeners help traders filter, analyze, and act fast.

1. Yahoo Finance

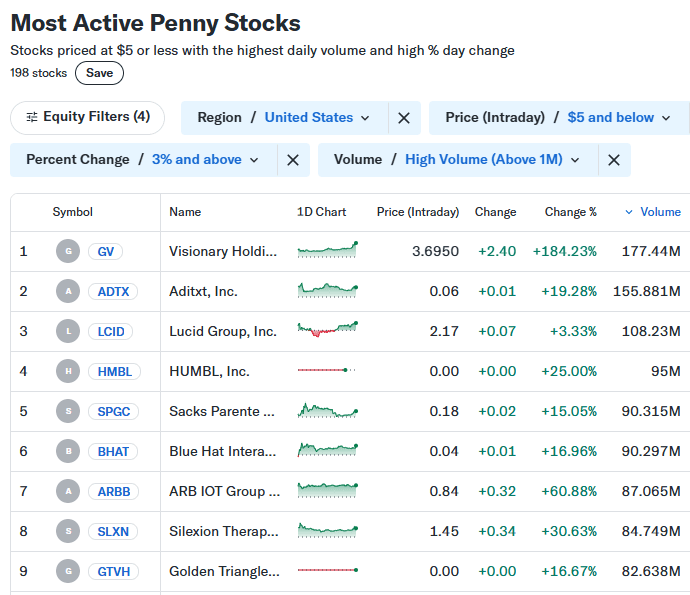

Yahoo Finance is a popular choice for penny stock traders looking for fundamental screeners and integrated research.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Its free version offers limited filters, but users can still scan stocks under $5 and check basic financials and charts.

Basic Price Filters: This feature allows users to set a price range (e.g., under $5) to find low-cost stocks across various sectors.

News & Sentiment Feed: This feed shows relevant news related to penny stocks, which is useful when trading around press releases or analyst coverage.

Charting with Technicals: Free interactive charts include indicators like RSI and MACD, helping traders analyze setups quickly.

While Yahoo Finance's free version lacks advanced real-time filtering, its Premium plans add analyst ratings, detailed historical data, and advanced screeners.

It’s a solid place to start for a trader researching under-the-radar companies.

2. TradingView

TradingView is best known for its advanced charting, but its stock screener is also a strong tool for penny stock traders.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Trading View Essential | $14.95

$108 ($9 / month) if paid annually | 30-day free trial |

Trading View Plus | $29.95

$180 ($14.95 / month) if paid annually

| 30-day free trial |

Trading View Premium | $59.95

$432 ($23.98 / month) if paid annually | 30-day free trial |

Trading View Expert | $119.95

$1,199 ($99.95 / month) if paid annually | N/A |

Trading View Ultimate | $239.95

$2,399 ($199.95 / month) if paid annually | N/A |

Even the free version allows decent customization, while paid plans offer more real-time data and alerts.

Volume-Based Filters: Screen for low-priced stocks trading above-average volume, a common setup for day trades.

Technical Signal Sorting: Filter penny stocks that are giving bullish signals based on MACD crossovers or RSI levels.

Watchlist Integration: Traders can add filtered stocks directly to watchlists and set alerts when price levels are triggered.

In a fast-paced trading session, having customizable alerts and integrated charting in one place is a big plus. TradingView stands out for technical-focused penny stock strategies.

3. Investing.com

Investing.com’s stock screener is robust and global, helping traders and investors explore penny stocks in U.S. and international markets.

Plan | Monthly Subscription |

|---|---|

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually |

The platform is entirely free, although premium features like ad removal and Pro+ research are available.

Fundamental Metrics: Screen low-priced stocks by market cap, PE ratio, or debt ratios to find undervalued companies.

Event-Based Filters: Combine penny stock criteria with earnings dates or economic events, useful for catalyst-driven strategies.

Multi-Market Access: Enables filtering of penny stocks from U.S., Canada, and other regions, expanding the opportunity set.

It’s a useful tool for investors seeking diversification beyond U.S. microcaps.

While not as customizable as Finviz or TradingView, it’s effective for scanning based on global fundamentals.

4. Finviz

Finviz is a favorite among penny stock traders due to its fast, clean screener and visual layout. The free version includes delayed data, while Elite offers real-time filtering and advanced charting.

Price and Volume Filters: Easily screen stocks under $5 with daily volume spikes, a common trait of momentum penny stocks.

Signal-Based Filters: Finviz Elite users can filter by breakout patterns, overbought/oversold levels, and gaps.

Heat Maps and Overlays: Visual tools help spot sector trends among penny stocks, like biotech surges or energy rallies.

For traders who want a quick snapshot and clear visuals, Finviz strikes a strong balance between simplicity and depth. It’s especially helpful for scanning setups before market open.

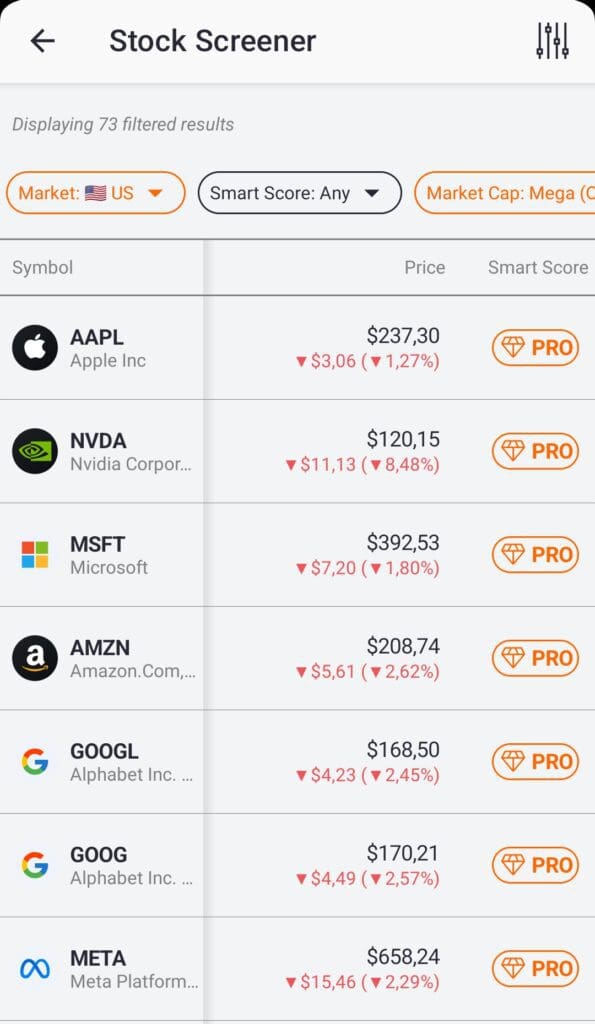

5. TipRanks

TipRanks offers a data-rich platform where investors can screen penny stocks based on analyst ratings, insider activity, and financial metrics.

The free plan includes limited filters, while the Premium version unlocks far more tools.

Analyst Ratings on Small-Caps: Traders can identify penny stocks with “Strong Buy” ratings, which may signal institutional confidence.

Insider Transactions: Allows filtering stocks where executives or board members are buying, often a bullish signal for penny stocks.

Smart Score Filter: Premium users can use TipRanks' proprietary Smart Score to evaluate overall potential based on technicals, fundamentals, and sentiment.

This screener is especially helpful for swing or long-term investors focused on microcaps with upside. However, day traders may prefer tools with real-time alerts.

6. Stock Analysis

Stock Analysis offers a straightforward screener with a clean interface, focusing on simplicity and key metrics.

While it doesn’t provide real-time charting or alerts, it excels at filtering financial data and institutional interest.

Penny Stock Price Sorting: Easily sort by stock price under $5, then filter by sectors like biotech or tech for targeted results.

Ownership & Valuation Metrics: Helps spot low-priced stocks with increasing institutional ownership, a potential sign of upcoming growth.

Earnings & Forecasts: Includes earnings projections and analyst estimates — helpful for those investing in future potential.

It’s a strong pick for long-term penny stock investors focused on fundamentals. Though not ideal for intraday action, it complements other tools that focus more on technicals.

How to Choose the Best Penny Stock Screener for Trading?

The right screener can help you quickly identify high-potential penny stocks and avoid costly traps.

Customization Options: Look for screeners that let you filter by price, volume, market cap, and indicators like RSI or MACD.

Real-Time Data: Tools with real-time or minimal-delay data help day traders catch fast moves before prices spike or crash.

Technical and Fundamental Filters: A solid screener should combine both types of filters — useful for finding breakout setups or undervalued microcaps.

Ease of Use: A clean, intuitive interface makes it easier to test filters and stay focused, especially when the market is volatile.

News and Catalyst Integration: Screeners with built-in news feeds or earnings calendars help you act quickly on catalyst-driven trades.

Choosing a screener that fits your strategy — whether technical, fundamental, or catalyst-based — is key to trading smarter.

FAQ

Yes, most platforms like TradingView, Yahoo Finance, and TipRanks offer mobile apps that support screening features with limited customization.

Only paid plans like Finviz Elite or TradingView Premium provide near real-time data. Free versions may experience a delay of several minutes.

Screeners can't guarantee safety, but filtering for high volume, strong fundamentals, and insider buying helps reduce the risk of scams.

Some platforms like Yahoo Finance and Investing.com list OTC stocks, but coverage may be limited. Finviz does not screen for OTC.

Yes, platforms like Yahoo Finance and Investing.com show relevant news for penny stocks, even in the free version.

TipRanks is known for offering insider activity filters, which can be valuable for spotting early signs of bullish interest.

Common ones include RSI, MACD, and moving averages, available on TradingView and Finviz for identifying breakout opportunities.

No. Most screeners are independent and don’t require brokerage integration, though some brokers like Fidelity or TD offer built-in tools.