Robo-advisors are a kind of financial advisers that provide online financial advice or portfolio with minimal human intervention.

They became popular when people began searching for inexpensive but convenient automated opportunities.

They can also give you access to services once reserved for the ultra-wealthy investors. You can now get your own financial planner or create tax-loss harvesting strategies. These, and so much more, attract investors to use robo-advisors.

Finding the best robo-advisors for you will depend on your financial situation and needs, and opening a robo-advisor account is quick and easy.

However, top robo-advisors have three top features: low fees, low initial investment, and a comprehensive portfolio management service.

Here are The Smart Investor select's pick for robo advisors:

Schwab Intelligent Portfolios

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

One of the standout aspects of Schwab Intelligent Portfolios is that it requires no advisory fees, making it a cost-effective option for those looking to grow their wealth without incurring additional expenses.

Investors can start with a minimum investment of $5,000, allowing access to a diversified portfolio built from over 50 low-cost ETFs.

Additionally, Schwab Intelligent Portfolios offers tax-loss harvesting, which can help minimize your tax liability by strategically selling investments at a loss to offset gains.

For those looking for more personalized service, Schwab also offers Intelligent Portfolios Premium, which combines automated investing with access to a certified financial planner for a one-time planning fee and a monthly advisory fee.

Acorns

Monthly Fee

Minimum Deposit

Our Rating

Savings Rate APY

-

Overview

- Platform Screenshots

Acorns focuses on automated investing, making it perfect for those who don’t have the time or knowledge to actively manage their investments.

Acorns offers pre-built, diversified portfolios based on your financial goals and risk tolerance, so you don’t need to worry about choosing individual stocks or managing complex strategies.

The app automatically allocates your money across a mix of assets like stocks and bonds, adjusting the portfolio to match your needs.

For retirement-focused investors, Acorns Later provides automated management of IRAs (Roth, Traditional, or SEP).

In addition to its standard investment accounts, Acorns offers Acorns Premium, which includes a 3% IRA match on eligible contributions

Fidelity Go

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

Fidelity Go is a great choice for investors looking for a reliable and user-friendly robo-advisor. You just need to answer a few questions, and Fidelity Go takes care of the rest, including rebalancing your portfolio automatically as the market shifts.

For investors with balances under $25,000, there are no advisory fees, which makes it very affordable. Even if your balance is higher, the fee is just 0.35%, which includes access to financial advisors for personalized guidance.

Additionally, if you want even more customization or advanced management, Fidelity offers other automated investing options like Fidelity Managed FidFolios℠, which allows for thematic investing and more personalized strategies.

Wealthfront

Annual Advisory Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

Wealthfront is a popular robo-advisor platform that offers a hands-off approach to investing. It's designed to be user-friendly and accessible, making it a great option for investors of all levels.

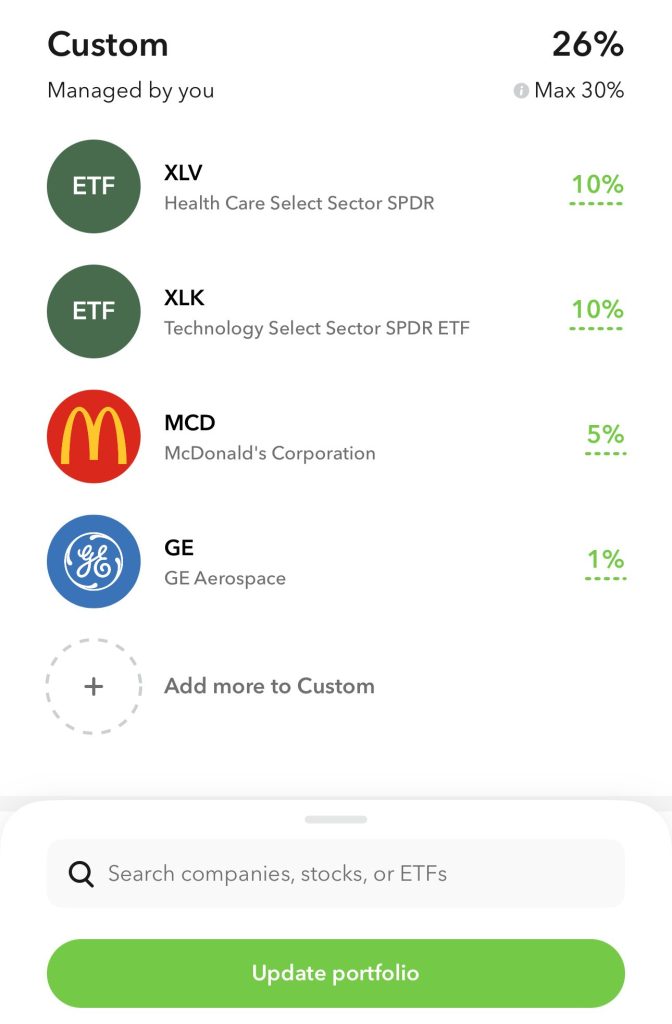

Wealthfront’s customization options allow you to tailor your portfolio by selecting from hundreds of ETFs or opting for specialized portfolios like socially responsible investing or direct indexing (for larger accounts). This flexibility makes it a great fit for investors who want the effi

.ciency of automation but still want some control over their portfolio.

One of the standout features is daily tax-loss harvesting, which can help investors minimize their tax liability by strategically selling assets at a loss to offset gains. Wealthfront also offers goal-based planning through its Path tool.

Vanguard Digital Advisor®

Monthly Fee

Minimum Deposit

Our Rating

Vanguard Cash APY

-

Overview

- Platform Screenshots

Vanguard Digital Advisor® is built around Vanguard's low-cost index funds, which helps you keep fees down while staying invested in a diversified range of stocks and bonds.

One of the standout features is its goal-oriented approach. Whether you’re saving for retirement or another long-term goal, Vanguard Digital Advisor® adjusts your portfolio to keep you on track.

It automatically rebalances your investments, ensuring your portfolio stays aligned with your goals over time.

Vanguard Digital Advisor® also offers a variety of investment strategies, including socially responsible investing and impact investing.

If you want more personalized guidance, Vanguard also offers the Personal Advisor service, which combines the robo-advisor's technology with professional advice from human advisors.

E*TRADE Core Portfolios

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

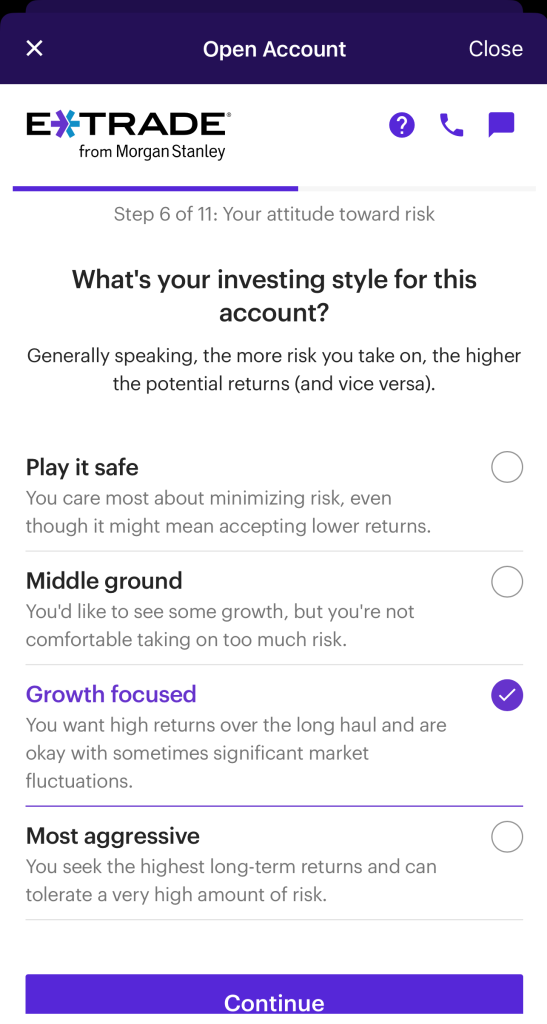

- Platform Screenshots

With a minimum investment of $500, E*TRADE Core Portfolios is accessible to a broad range of investors, looking to to create a personalized investment plan based on their goals, timeline, and risk tolerance.

Investors can choose between a standard portfolio or a socially responsible portfolio, which is perfect for investors looking to make a positive impact with their money. Both portfolios are diversified across low-cost ETFs, keeping fees in check while offering broad market exposure.

In addition to the standard ETRADE Core Portfolios, ETRADE also offers a premium version called E*TRADE Core Portfolios Premium. This version provides access to additional features, such as personalized tax loss harvesting and portfolio rebalancing

Pros | Cons |

|---|---|

No Commissions for Stocks and ETFs | No Fractional Shares |

Wide Range of Investment Options | No Cryptocurrency Trading or Forex Trading |

Advanced Trading Tools | Higher Fees for Account Transfers |

Competitive Savings And Checking | $1K Minimum Balance For Real-Time Data |

Automated Investing Based On Questionnaire |

Merrill Guided Investing

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- Platform Screenshots

Merrill Guided Investing is an excellent option for investors seeking a robo-advisor because it combines automation with professional oversight.

The platform offers a tailored investment approach, where your portfolio is built and managed based on your financial goals, risk tolerance, and time horizon.

The platform automatically rebalances your portfolio to ensure it stays aligned with your objectives, and a diversification across a variety of assets, helping to mitigate risk.

You can set your goals (such as retirement or saving for a big purchase) and the system handles the rest, continuously adjusting your investments to stay on track.

In addition to the standard Merrill Guided Investing, Merrill Edge also offers a premium version called Merrill Guided Investing Premium.

Pros | Cons |

|---|---|

Extended Range of Investment Possibilities | No International Clients Accepted |

Bonus For Opening a New Trading Account | Demo Trading Unavailable |

Impressive Customer Service | Fees and Services |

Impressive Trading Education Services | Limited Options For Cryptocurrency |

Easy to Open a New Account |

How to Choose a Broker for Your Roth IRA?

Choosing the right broker for your Roth IRA is important for building a secure financial future. Here’s a simple guide to help you pick the best option:

- Low Fees

Look for brokers with minimal fees, like no account maintenance fees or trading commissions. Over time, fees can eat into your earnings, so keeping them low means more of your money stays invested.

- Investment Choices

Some brokers offer a wide range of investments like stocks, bonds, ETFs, and mutual funds. Make sure they offer the types of investments that match your goals, whether you prefer low-risk or high-growth options.

- User-Friendly Platform

If you’re new to investing, choose a broker with an easy-to-use website or app. You want to quickly find the information you need, make trades easily, and understand how your investments are performing.

- Educational Resources

Many brokers provide free educational tools like webinars, articles, or tutorials. These are helpful if you want to learn more about retirement planning, investing strategies, or the stock market in general.

- Roth IRA Account Features

Some brokers offer perks specifically for Roth IRAs, such as contribution reminders or automatic rebalancing. Features like these can help keep your retirement plan on track.

- Customer Support

Strong customer service is a must. Look for brokers with easy access to support, whether through phone, chat, or email, especially if you’re unsure about managing your account.

Robo-Advisors vs. DIY Investing: Which is Right for You?

Robo-advisors are ideal for hands-off investors or beginners, offering automated, goal-based portfolios with low fees.

DIY investing suits those with the time and knowledge to actively manage their own portfolios, offering full control but requiring more effort and research

Feature | Robo-Advisors | Self-Directed Trading |

|---|---|---|

Control | Automated, little to no decision-making | Full control over what to buy or sell |

Effort | Low effort, “set-it-and-forget-it” | High effort, requires active involvement |

Fees | Low management fees | May have no fees for ETFs & stocks |

Learning Curve | Minimal learning needed | Great for learning by gaining experience |

Time Commitment | Minimal, designed for long-term | Requires time to research and monitor |

Investment Strategy | Long-term, steady growth | Flexible, short-term or long-term, |

Risk | Lower risk, more conservative | Higher risk, depends on decisions made |

Customization | Limited to preset portfolios based on risk tolerance | Full customization of your investment portfolio |

Best For | Hands-off approach | Beginners, active traders |

Pros & Cons Of Robo Advisors

Robo-advisors are great for some investors but may not be the best fit for everyone. Here are the pros and cons of using a robo-advisor:

Pros | Cons |

|---|---|

Easy to Use | Limited Personalization |

Automatic Rebalancing | No Control Over Investments |

Diversification | Limited Services |

Goal-Oriented |

- Easy to Use

Robo-advisors are perfect for beginners or people who don't want to spend time managing their own investments. Everything is automated, so you don’t need to be a financial expert.

- Automatic Rebalancing

They adjust your portfolio over time to keep it balanced and aligned with your goals without you having to monitor it.

- Diversification

Robo-advisors spread your investments across a variety of asset types, reducing risk by not putting all your money in one place.

- Goal-Oriented

Many platforms help you set and reach specific financial goals, like saving for retirement or a home down payment.

Cons:

- Limited Personalization

While robo-advisors tailor your portfolio to general goals and risk preferences, they lack the personalized advice you’d get from a human advisor.

- No Control Over Investments

If you enjoy picking your own stocks or want to customize your investments, robo-advisors might feel restrictive.

- Limited Services

Some robo-advisors offer only basic investment services. If you need estate planning, tax advice, or in-depth financial planning, they may not provide everything you need.

How Robo-Advisors Handle Asset Allocation and Diversification

Robo-advisors make investing easier by handling asset allocation and diversification automatically. Here's how they do it, explained in simple terms:

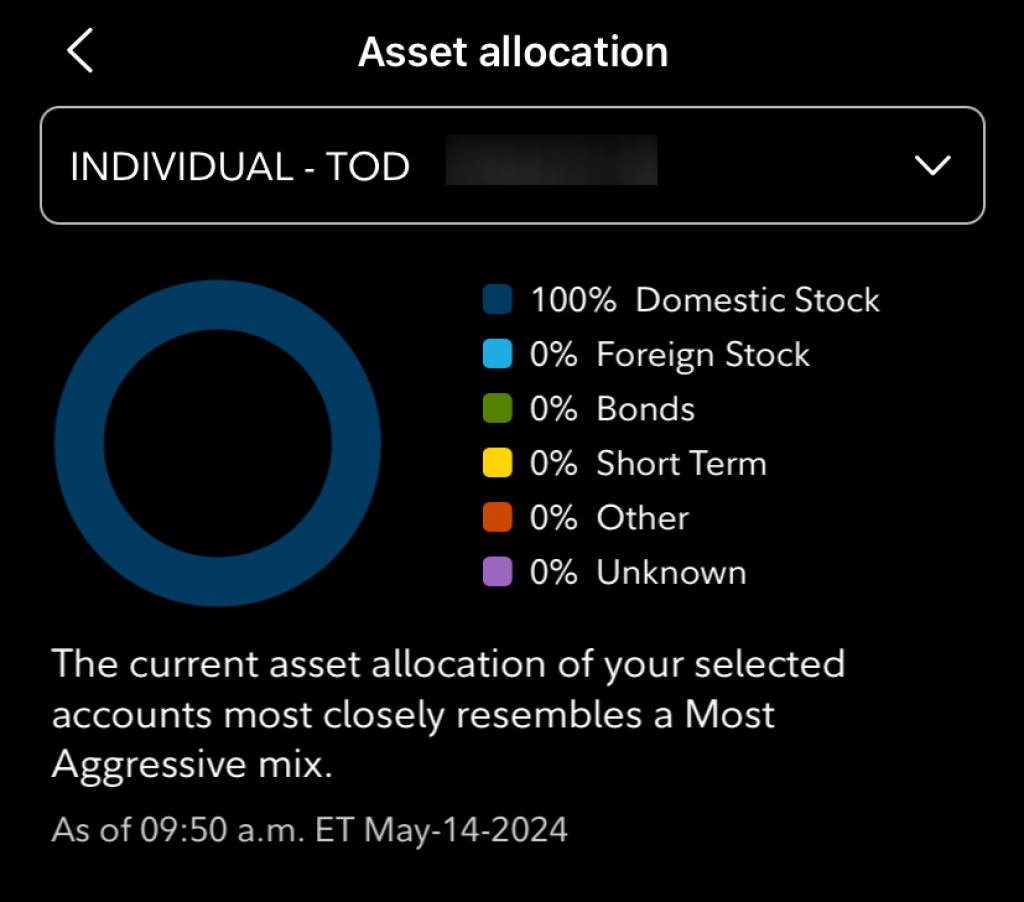

- Asset Allocation

This is the process of deciding how much of your money goes into different types of investments, like stocks, bonds, and cash. Robo-advisors do this for you based on your risk tolerance, time horizon, and goals.

For example, if you're saving for retirement in 30 years, they might suggest more stocks for growth. If you're closer to retirement, they'll include more bonds for stability.

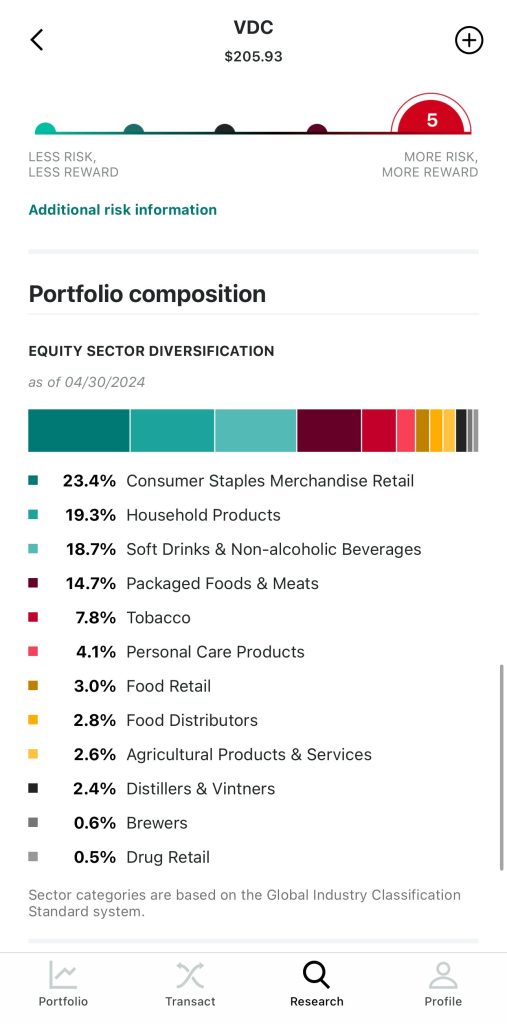

- Diversification

To spread out risk, robo-advisors invest your money across various asset types and industries. Instead of putting all your money in one stock or sector, they create a diversified portfolio that lowers your risk.

They might invest in a mix of U.S. and international stocks, government and corporate bonds, and other asset classes.

- Automatic Rebalancing

Over time, some investments grow faster than others, which can throw off your asset allocation. Robo-advisors automatically rebalance your portfolio, selling and buying assets to get back to the right mix without you having to do anything.