Table Of Content

Can You Invest in Berkshire Hathaway?

Yes, you can invest in Berkshire Hathaway by purchasing shares of its publicly traded stock. The company trades under two ticker symbols on the New York Stock Exchange (NYSE): BRK.A and BRK.B.

BRK.A shares represent the original Class A stock and are priced significantly higher, costing hundreds of thousands of dollars per share.

BRK.B shares are the more accessible Class B version, designed for everyday investors. They offer fractional ownership and trade at a much lower price point.

Berkshire Hathaway is led by legendary investor Warren Buffett and is known for its diversified holdings, including full ownership of companies like GEICO and Dairy Queen, and major equity stakes in Apple, Coca-Cola, and Bank of America.

How to Invest in Berkshire Hathaway

Investing in Berkshire Hathaway is straightforward and available through most major brokerage platforms. Here's how to get started:

-

1. Choose a Brokerage Platform

Select a trusted broker that offers access to NYSE-listed stocks. Platforms like Interactive Brokers, Charles Schwab, and Robinhood allow you to trade both BRK.A and BRK.B shares.

Most brokers now offer commission-free trading, and many provide research tools to help you analyze Berkshire’s fundamentals.

- The Smart Investor Tip

Look for a broker that allows fractional share investing — this makes it easier to buy portions of BRK.B shares with smaller amounts of money, especially if you're just starting out or want to dollar-cost average.

Broker | Annual Fees | Best For |

|---|---|---|

E-Trade | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| Options & Futures Trading |

Interactive Brokers | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% | Professional Trading Tools |

Fidelity | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| Retirement Account Investing |

Vanguard | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | Low-Cost ETF Investors |

J.P. Morgan Self Investing | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | Chase Bank Customers |

Charles Schwab | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | Advanced Trading Tools |

Merrill Edge | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Bank of America Clients |

-

2. Open and Fund Your Account

After picking your broker, create and verify your account by submitting the required personal and financial details. Link your bank account and deposit funds to start investing.

For instance, if BRK.B is trading at $390 per share and you want to purchase 10 shares, make sure your account has at least $3,900 available.

-

3. Research Berkshire Hathaway Stock

Before investing, take time to understand Berkshire’s business model. It’s not a typical stock — it's essentially a conglomerate of many businesses and equity investments. Key areas to research include:

Performance of its core businesses (e.g., insurance, energy, railroads)

Stock portfolio holdings (e.g., Apple, Chevron)

Warren Buffett and Charlie Munger’s investment philosophy

Quarterly earnings reports and annual shareholder letters

You can find deep dives on Berkshire on platforms like Seeking Alpha, Yahoo Finance, and Morningstar.

-

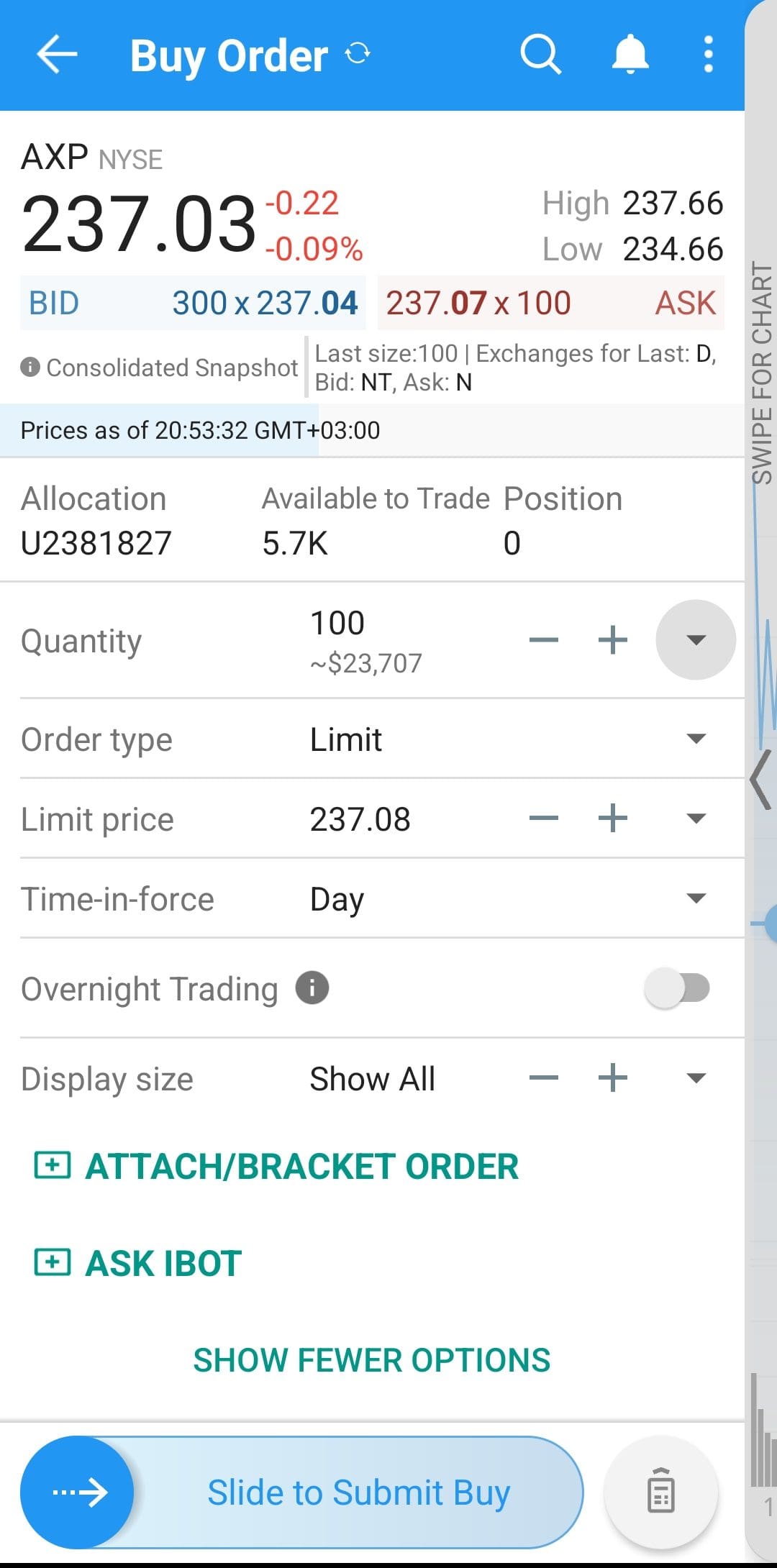

4. Place a Buy Order

Log into your brokerage account, search for BRK.B (or BRK.A, if you’re going that route), and place your buy order.

You’ll typically choose between:

Market Order: Buys immediately at the current price.

Limit Order: Buys only if the stock hits a target price you set.

- The Smart Investor Tip

If you're worried about short-term price swings, consider using a limit order instead of a market order. This gives you more control over the price you pay, especially on volatile trading days.

-

5. Monitor Your Investment

Once you’ve invested, keep track of Berkshire’s performance through earnings reports, stock portfolio updates, and broader market trends.

Most brokers allow you to set alerts, view analyst ratings, and follow key news that might affect Berkshire’s value — such as changes to its portfolio or leadership succession plans.

Since Berkshire tends to be a long-term, buy-and-hold type of stock, it’s often favored by investors seeking steady growth and diversification rather than short-term gains.

- The Smart Investor Tip

Set up news alerts or portfolio trackers that notify you of updates related to Berkshire's major holdings (like Apple or Coca-Cola), not just BRK.B itself. These companies often influence the stock’s performance.

How to Invest in Berkshire Hathaway Indirectly

If buying Berkshire Hathaway stock directly doesn’t fit your goals—or you're looking to diversify while still benefiting from its success—there are several indirect strategies to consider:

-

Invest in ETFs That Hold Berkshire Hathaway

One of the simplest ways to gain exposure to Berkshire Hathaway is through exchange-traded funds (ETFs) that include it in their holdings.

Many large-cap and value-focused ETFs feature BRK.B as a top component.

For instance, the Vanguard Value ETF (VTV) and SPDR S&P 500 ETF Trust (SPY) both hold significant positions in Berkshire Hathaway.

If you're investing in these ETFs, you're already benefiting from Berkshire's long-term growth.

-

Focus on Stocks Berkshire Already Owns

Another strategy is to invest in the same companies Berkshire Hathaway holds in its portfolio.

Warren Buffett is known for his long-term value investing philosophy, and many of Berkshire’s top holdings are household names with strong financials.

A few notable examples include:

Coca-Cola (KO) – Held since the late 1980s, this stock illustrates Berkshire’s preference for consistent dividends and global brand strength.

American Express (AXP) – A long-standing investment representing Berkshire’s belief in consumer loyalty and premium financial services.

- Apple (AAPL) – While it sold a big part of it, Berkshire still owns a significant portion of Apple.

By mirroring some of Berkshire’s top positions, you're essentially aligning your strategy with Buffett’s and potentially benefiting from similar long-term gains.

-

Consider Mutual Funds or Robo-Advisors with Berkshire Exposure

You can also gain exposure through mutual funds or automated portfolios (like robo-advisors) that include Berkshire stock.

For example, the Fidelity Contrafund (FCNTX) often includes Berkshire in its top holdings, offering actively managed exposure that can complement a long-term strategy.

Robo-advisors like Wealthfront or Betterment might also include Berkshire indirectly in their ETF allocations based on your risk tolerance.

This route is particularly helpful for investors who prefer a hands-off approach but still want exposure to high-quality companies like Berkshire.

Rovo Advisor | Annual Fees | Minimum Deposit |

|---|---|---|

Wealthfront | 0.25% | $500 |

Betterment | 0.25%

$4 monthly for $0 – $20K balance, 0.25% annually for $20K – $1M balance, 0.15% annually for $1M – $2M balance, 0.10% annually for +$2M balance | $10 |

Acorns | Monthly: $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $0 |

Schwab Intelligent Portfolios | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $5,000 |

Vanguard Digital Advisor® | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | $100 |

E*TRADE Core Portfolios | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $500 |

Merrill Guided Investing | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $1,000 |

Should You Invest in Berkshire Hathaway?

Berkshire Hathaway appeals to long-term investors seeking diversification, stability, and proven leadership—but it's not the right fit for everyone.

- Diversified Business Model

Berkshire owns a wide range of businesses across insurance, energy, transportation, and consumer goods, helping cushion sector-specific downturns.

- Strong Leadership History

Warren Buffett and Charlie Munger built Berkshire on sound investment principles, earning trust for disciplined, long-term decision-making.

- Stable Financial Position

The company carries low debt and a massive cash reserve, offering flexibility during recessions or market corrections.

- Attractive for Long-Term Growth

Berkshire consistently reinvests profits into businesses and new investments, which may compound shareholder value over time.

- No Dividend Payments

Berkshire reinvests all earnings, so investors seeking regular income won’t receive dividends.

- Limited Exposure to High-Growth Sectors

The company tends to avoid newer tech startups and emerging industries, limiting upside in those spaces.

- Uncertain Succession Planning

Buffett is almost 95 years old, raising questions about future leadership and direction.

- Slow, Steady Returns

Berkshire aims for consistent growth, but it may underperform during bull markets driven by high-risk, high-reward sectors.

FAQ

While most of its operations and stock holdings are based in the U.S., Berkshire has made select international investments. These include stakes in foreign companies and cross-border business activities, particularly in energy and industrial sectors.

Warren Buffett remains the chairman and CEO of Berkshire Hathaway. Although he’s gradually delegating responsibilities, especially to investment managers Todd Combs and Ted Weschler, he still sets the company's strategic direction.

BRK.B has undergone a stock split to improve accessibility for retail investors. However, BRK.A has never been split, as Buffett prefers to attract long-term shareholders who understand the company’s philosophy.

Berkshire’s diverse holdings and conservative management approach often make it a relatively stable option during economic downturns. It’s not immune to market swings but tends to fare better than high-growth or speculative stocks.

Berkshire owns some businesses outright, like GEICO and BNSF Railway, while also holding large stakes in publicly traded companies. This blend allows it to generate steady operating income alongside capital gains from equities.

The company looks for strong, understandable businesses with durable competitive advantages and solid management. Buffett typically avoids complex industries and prefers companies with predictable cash flows and long-term value.

Yes, BRK.B shares can be purchased through IRAs, 401(k)s, and other retirement plans offered by most brokers. BRK.A can also be held, though its high price makes it uncommon in individual retirement accounts.

Yes, the company releases quarterly and annual reports, including detailed earnings, balance sheets, and shareholder letters. These are available on its official website and through the SEC’s EDGAR database.

Berkshire owns a wide range of companies, including GEICO, Duracell, See’s Candies, BNSF Railway, and Berkshire Hathaway Energy. These businesses operate independently under the Berkshire umbrella.