Table Of Content

Buying crypto with a credit card offers speed and convenience, but it also comes with higher fees and risks. This guide covers the full process, pros, cons, and safer alternatives.

How to Buy Crypto With a Credit Card: Step By Step

Buying crypto with a credit card is fast and convenient, but each step requires careful attention to avoid high fees or declined transactions.

Step 1: Choose a Trusted Crypto Exchange

Start by selecting a reliable platform that supports credit card purchases.

Popular choices include Coinbase, Binance, and Crypto.com, which offer secure infrastructure and a range of supported assets.

Check regional support: Some exchanges don’t allow credit card payments in certain countries due to regulations.

Look for verified partners: Platforms like Binance often use providers like Simplex or MoonPay to process card payments securely.

Compare fees and limits: Credit card purchases often include processing fees between 2%–5%, depending on the provider.

Choosing a well-established exchange reduces your risk of fraud and ensures compliance with KYC rules. You should also review platform reviews and payment policies before proceeding.

Exchange | Credit Card Fee | Daily Purchase Limit | Card Partners |

|---|---|---|---|

Binance | 3.5% (via Simplex) | $5,000 | Visa, Mastercard |

Coinbase | Up to 3.99% | $3,000 | Visa, Mastercard |

Crypto.com | 2.99% | $25,000 | Visa, Mastercard |

KuCoin | 3% (varies) | $5,000 | Visa |

Step 2: Set Up and Verify Your Account

Once you've picked a platform, you'll need to register and complete identity verification. This is a required step to comply with anti-money laundering laws.

Provide personal info: You’ll typically enter your name, address, and phone number.

Submit ID verification: Upload a government-issued ID, like a passport or driver’s license, to pass KYC.

Enable two-factor authentication (2FA): For added security, set up 2FA via SMS or apps like Google Authenticator.

Verification may take anywhere from a few minutes to several hours. Make sure your documents are clear and valid to avoid delays in approval.

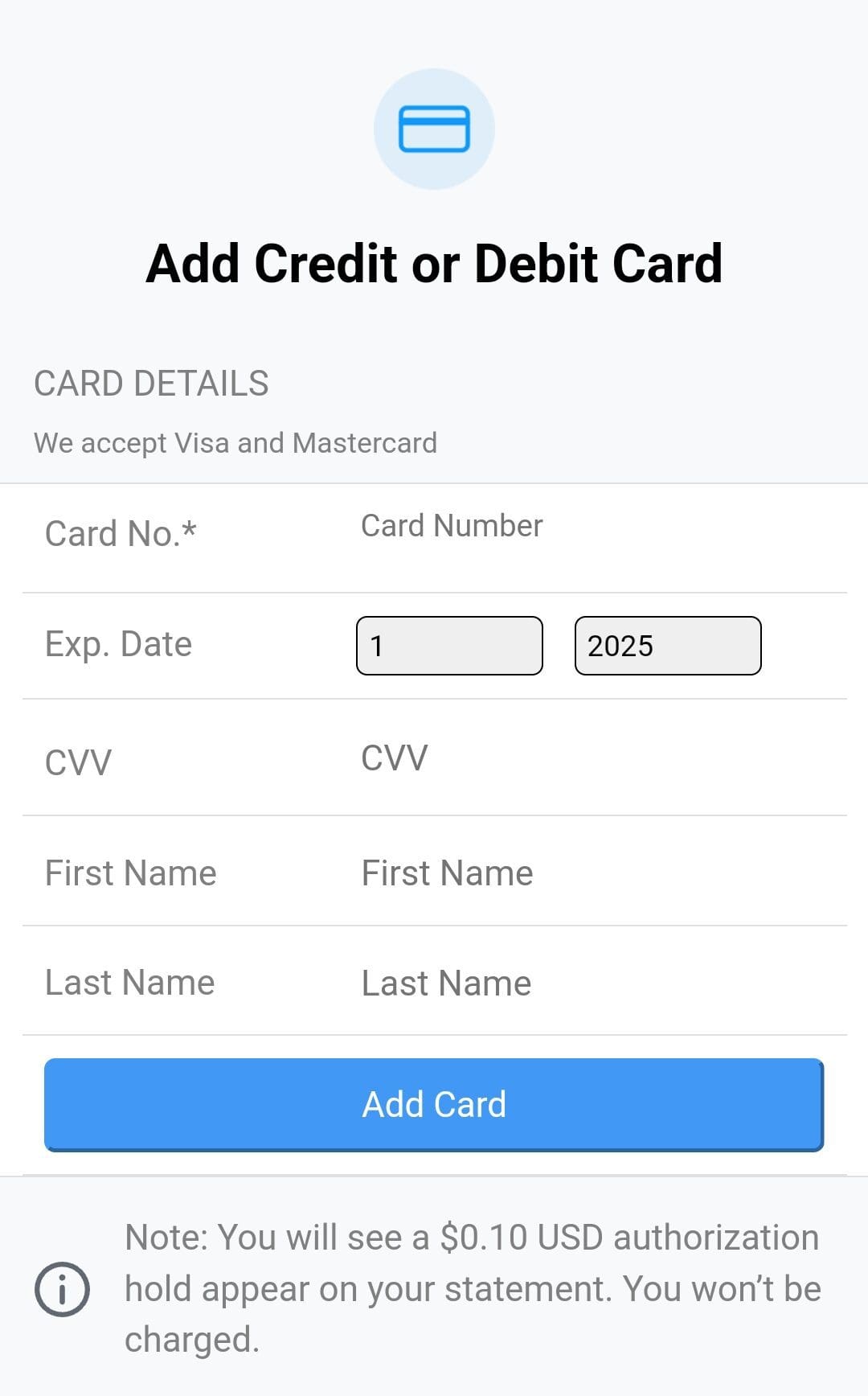

Step 3: Link and Authorize Your Credit Card

Next, connect your credit card to the exchange and confirm ownership. This process is crucial for both security and transaction authorization.

Enter card details: Include the card number, expiration date, CVV, and billing address.

Complete authorization: Some platforms perform a small test charge that you’ll need to confirm.

Check with your bank: Inform your bank of the transaction to prevent it from being flagged or declined.

Because credit card issuers may classify crypto purchases as cash advances, you should confirm with your bank to avoid unexpected interest charges.

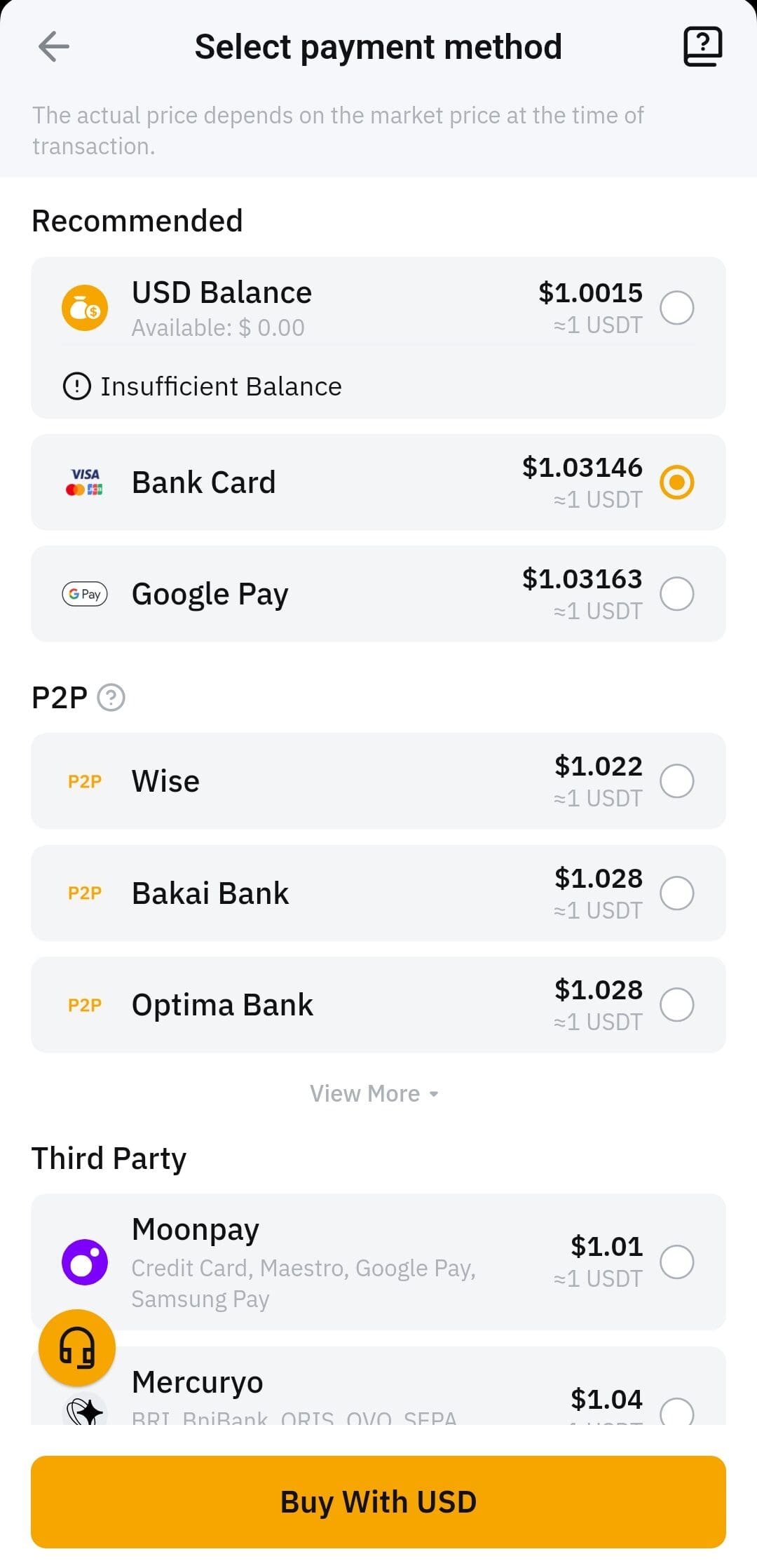

Step 4: Select Your Crypto and Payment Amount

Now it’s time to choose the cryptocurrency you want to buy and enter the amount in either USD or your local currency.

Choose a coin: Bitcoin, Ethereum, and USDT are commonly supported in card transactions.

Input purchase amount: Most platforms show a live quote including fees before final confirmation.

Review network and processing fees: These are often included in the final quote but can vary based on market activity.

Always double-check the exchange rate, as it can fluctuate in real time. Some platforms allow you to lock in the rate for a few minutes during checkout.

Step 5: Confirm Purchase and Store Your Crypto

After reviewing your order, confirm the transaction. Your crypto will usually arrive in your exchange wallet within minutes.

Check your wallet balance: It should update shortly after the transaction is approved.

Transfer to a private wallet: If you're planning long-term storage, consider moving assets to a non-custodial wallet.

Keep transaction receipts: Save confirmation emails or screenshots for tax or support issues.

As a result, it’s important to track your transaction history and be cautious of phishing scams or fake support channels post-purchase.

What Are the Fees for Buying Crypto With a Credit Card?

Buying crypto with a credit card often incurs higher fees compared to other payment methods.

Most exchanges charge processing fees ranging from 2% to 5%, and your credit card issuer may treat the transaction as a cash advance, triggering additional charges and higher interest rates.

There may also be currency conversion fees depending on your card’s default currency. As a result, while convenient, credit card purchases can significantly reduce your crypto's actual value.

Pros & Cons of Using a Credit Card for Crypto Purchases

Using a credit card to buy crypto is quick and easy, but it also comes with notable costs and risks.

Pros | Cons |

|---|---|

Fast and convenient | High processing and cash advance fees |

Accepted by many exchanges | Not supported by all banks or regions |

Instant access to crypto | Risk of debt and overspending |

Possible rewards or cashback | Limited long-term cost efficiency |

- Fast Transactions

Most purchases settle within minutes, making it ideal for seizing quick market opportunities.

- Convenient Access

You don’t need to preload your account—just link your card and buy instantly.

- Widely Accepted on Major Platforms

Exchanges like Binance, Coinbase, and Crypto.com support cards from major networks like Visa and Mastercard.

- Rewards and Cashback

Some credit cards offer cashback or crypto rewards, which can slightly offset fees.

- High Processing Fees

Credit card transactions often include third-party processor fees of up to 5%.

- Cash Advance Charges

Many card issuers classify crypto purchases as cash advances, triggering additional interest and fees.

- Risk of Overspending

Because you’re using borrowed funds, it’s easy to invest more than you can afford to lose.

- Not Supported Everywhere

Some countries or banks restrict or block crypto-related credit card transactions altogether.

Alternatives to Buying Crypto With a Credit Card

If you’re concerned about fees or security, several other payment methods offer better value or fewer restrictions.

Bank Transfer (ACH or SEPA): Often the cheapest option with lower fees, although it may take 1–3 business days to complete.

Crypto-to-Crypto Exchange: Trade other coins you already own for new assets on platforms like Binance or Uniswap without touching fiat.

Debit Card Purchases: Typically comes with lower fees than credit cards, and doesn’t trigger cash advance penalties.

Peer-to-Peer (P2P) Marketplaces: Platforms like Binance P2P or Paxful allow direct trades with sellers, often offering more payment flexibility.

E-Wallets (PayPal, Apple Pay): Some exchanges support these digital wallets, which can be faster than bank transfers and safer than card use.

These options vary in speed, cost, and regional availability, so it’s important to evaluate based on your location and urgency.

FAQ

Some cards offer cashback or rewards, but many issuers exclude crypto purchases from earning points or perks.

Banks may block crypto-related transactions for security reasons or due to internal policies against digital asset purchases.

Yes, as long as you're using a reputable exchange app with proper security features like 2FA and HTTPS encryption.

Yes, many issuers classify crypto purchases as cash advances, triggering fees and interest from the day of the transaction.

Some exchanges accept them, but many require cards that support 3D Secure authentication for verification.

Disputing a crypto purchase may lead to a frozen account, especially if the funds were already delivered.

Yes, exchanges typically cap daily and monthly amounts for card-based transactions based on user verification levels.

No, some platforms only support bank transfers or crypto deposits due to cost and regulatory complexity.

No, they’re linked to your identity through KYC and your bank records, so they’re not anonymous.

It can if you carry a high balance or exceed your credit limit, which may impact your utilization ratio.