Table Of Content

Buy Fractional Shares on Vanguard: How Does It Work?

Buying fractional shares on Vanguard allows you to invest in ETFs and mutual funds using a specific dollar amount rather than purchasing full shares.

This feature is ideal for building a diversified portfolio gradually, even with a small budget.

While individual stocks aren't eligible, you can set up recurring investments, reinvest dividends, and allocate funds across different asset classes.

Orders are executed based on the next available price—market price for ETFs and NAV for mutual funds—making it easy to stay consistent with long-term investing goals.

Start Investing in Fractional Shares with Vanguard

Here's how you can begin:

Choose ETFs or Mutual Funds: Vanguard allows fractional purchases of most in-house ETFs and mutual funds, which lets you invest specific dollar amounts rather than buying whole shares.

Use Dollar-Based Investing: Instead of buying by share quantity, you can enter a dollar amount when placing a buy order. This allows for precise budgeting and better diversification.

Confirm Fund Eligibility: While most Vanguard funds support fractional shares, double-check that the fund you’re interested in allows it, especially for brokerage accounts vs. retirement accounts.

Because fractional investing is tied closely to Vanguard’s focus on index and mutual funds, it’s best suited for those building long-term portfolios with consistent contributions.

Align Your Fractional Share Investments with Your Strategy

Plan how these investments contribute to your bigger financial picture.

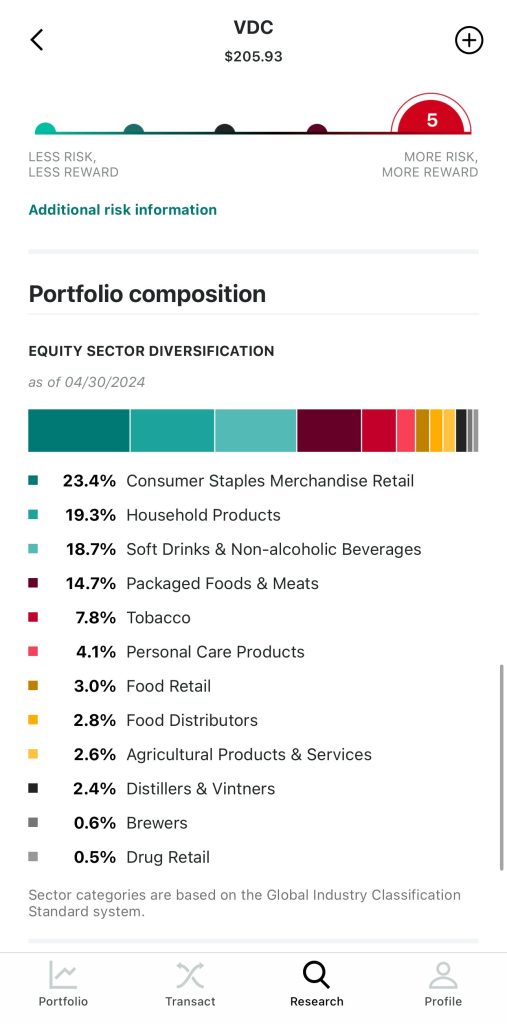

Target Specific Allocations: Use Vanguard’s portfolio tools or models to allocate dollar-based investments across different sectors or asset types.

Set Up Automatic Investments: You can automate recurring investments into ETFs or mutual funds in dollar amounts, which takes advantage of market fluctuations over time.

Monitor Risk Profiles: Vanguard’s risk assessment tools help you match your investments with your comfort level and time horizon.

By aligning your fractional share purchases with long-term goals, you can create a balanced portfolio that grows steadily over time, especially if you reinvest dividends.

Place a Fractional Share Order on Vanguard

While Vanguard doesn't support fractional stock trading, it enables fractional ETF and fund investing through dollar-based orders. Here’s how to navigate the process:

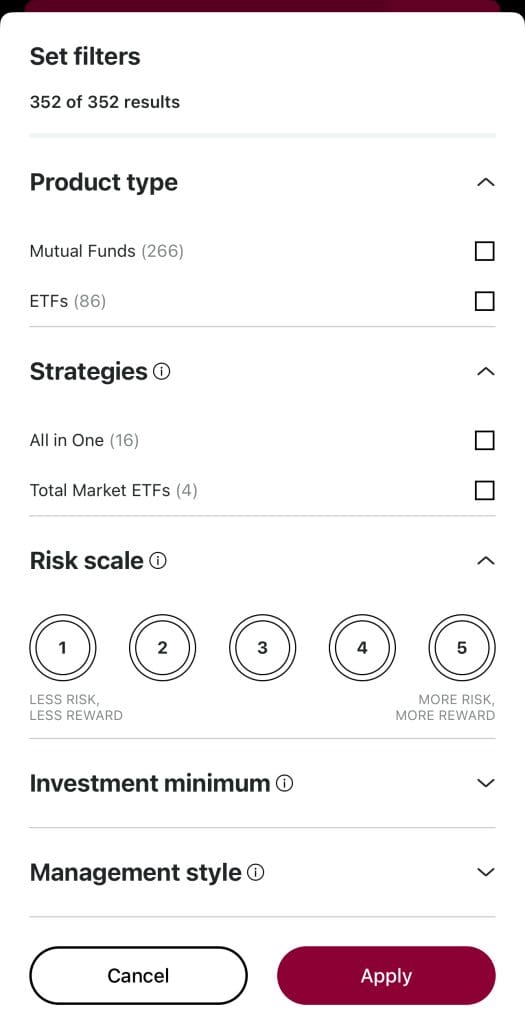

Select the Fund or ETF: Use Vanguard’s fund explorer to find suitable ETFs or mutual funds based on your goals or preferred asset class.

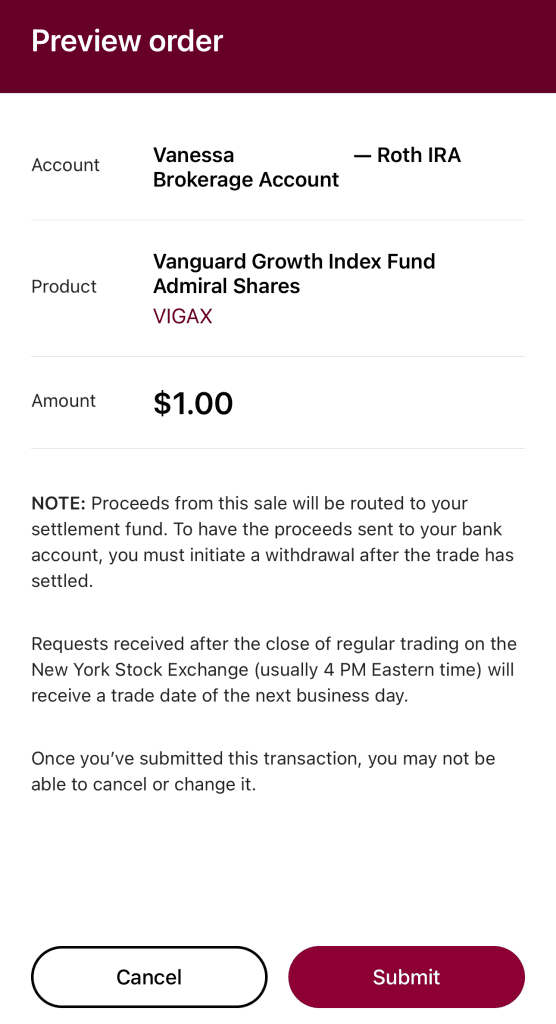

Input a Dollar Amount: On the order page, choose “buy in dollars” and enter the exact amount you want to invest—even as low as $1 for some funds.

Review and Submit: Preview the order to see the estimated number of fractional shares, then confirm and submit your trade.

This dollar-based order system is especially helpful for those with limited capital or those using regular contribution strategies, like monthly retirement investing.

Managing Your Fractional Share Holdings on Vanguard

After investing, Vanguard offers tools to help track and manage your fractional holdings, though the features are simpler than trading platforms.

View Holdings in Real Time: Your portfolio dashboard, which updates daily, shows your fractional share quantity and market value.

Reinvest Dividends Automatically: Most Vanguard funds allow automatic dividend reinvestment, which means purchasing more fractional shares over time.

Adjust Contributions Easily: You can modify the dollar amount of future contributions or pause investments without selling existing holdings.

Because Vanguard emphasizes low-cost, long-term investing, its tools are designed to support gradual growth rather than frequent trading.

Limitations of Buying Fractional Shares on Vanguard

While Vanguard makes long-term investing accessible, users should understand certain limitations regarding fractional shares.

No Fractional Individual Stocks: Vanguard does not currently offer fractional investing in individual stocks—only ETFs and mutual funds are supported.

Limited Order Flexibility: You cannot place limit orders when investing in fractional shares; orders are executed at the next available NAV or market price.

Execution Timing: ETF orders execute during market hours, but mutual fund orders are processed once per day after the market closes.

These limitations may not matter to long-term investors, but those seeking active trading flexibility or precise market timing may find the platform too restrictive.

Tax Implications of Fractional Shares

Investing in fractional shares through Vanguard can still trigger tax events, even if the investment size is small. It’s important to understand how dividends and capital gains are treated.

Dividends Are Still Taxable: Whether you own a full or partial share, any dividend distributions are reported to the IRS and must be included in your tax return.

Capital Gains Apply: Selling fractional shares for a profit may result in capital gains taxes, just like with full shares.

1099 Forms Include All Transactions: Vanguard provides annual tax forms that include income from fractional shares.

Although fractional investing makes it easier to start small, investors should still track their tax obligations closely to avoid surprises during tax season.