Table Of Content

Gold hit a record high of over $3,000 an ounce, and some buyers are turning to credit cards to grab their share.

But did you know some gold dealers actually charge extra for credit card purchases—sometimes up to 4% in fees? .

If you’re thinking of using a card, it’s worth knowing where it works, how it works, and whether it's even worth it.

Buying Gold with a Credit Card: Is It a Good Idea?

In most cases, buying gold with a credit card is not a smart move—especially if you can’t pay it off immediately.

Credit card purchases often come with processing fees up to 4%, which adds to your total cost.

Plus, many credit card companies treat gold purchases as cash advances, meaning higher interest rates, no grace period, and no rewards.

Unless you’re buying a small amount and paying it off right away, the risks and added costs usually outweigh any benefits.

Pros | Cons |

|---|---|

Fast, convenient checkout | Dealers may charge 3–4% in card processing fees

|

May earn credit card rewards | Often treated as a cash advance (high interest, no grace period)

|

Good for small, quick purchases | Interest charges if balance isn’t paid off right away

|

Not all dealers accept cards for large purchases

|

Which Gold Dealers Accept Credit Cards?

Many popular gold dealers accept credit cards, but not all. For example, JM Bullion, APMEX, and SD Bullion let you pay with Visa, Mastercard, and sometimes even Amex.

However, they often cap purchase limits and charge extra for credit card payments. Others, like Money Metals Exchange, accept cards for smaller orders only.

Always check the payment terms, as dealers also offer discounts for paying by wire or check instead.

Alternative Payment Methods for Buying Gold

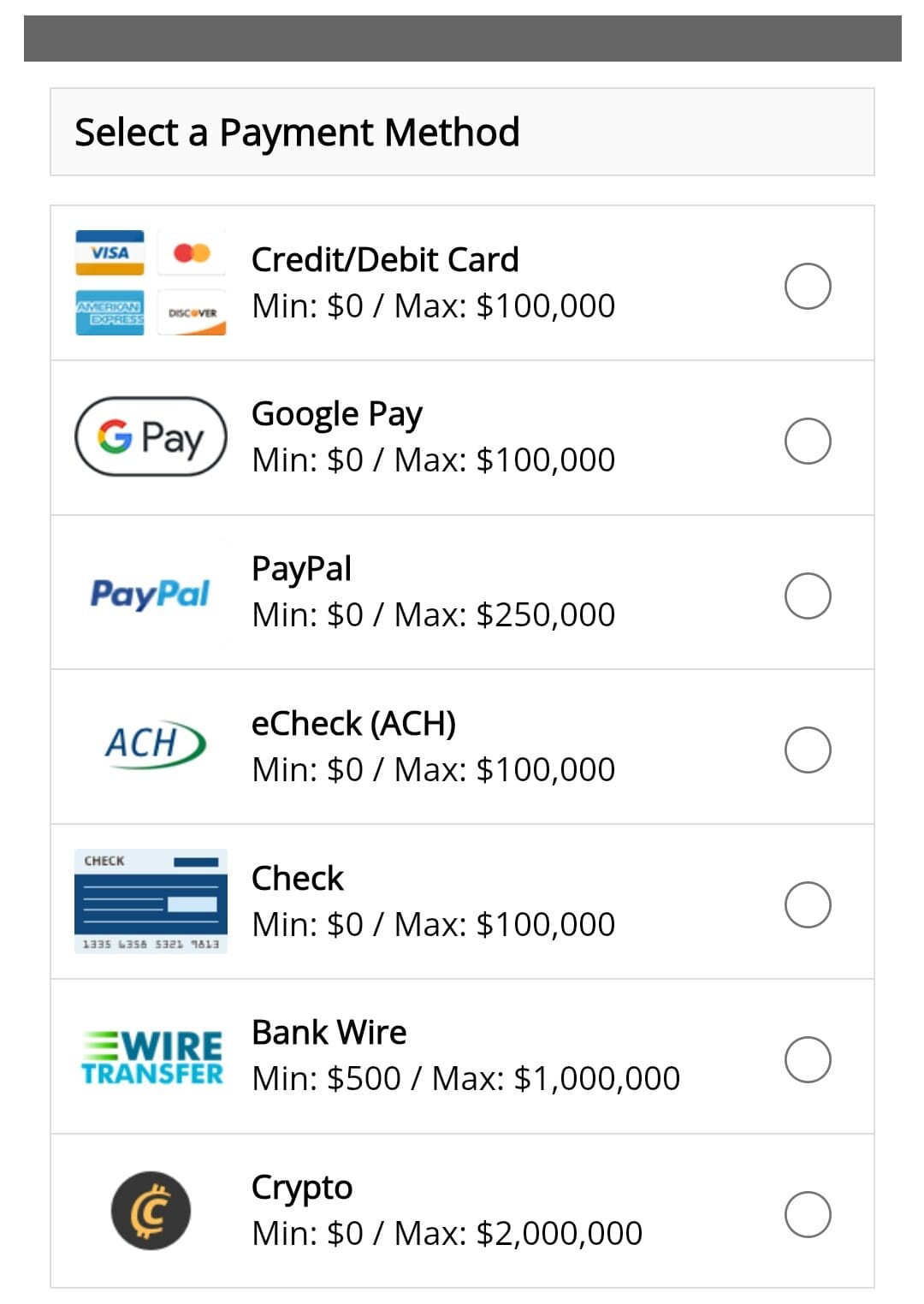

If using a credit card isn't ideal, there are several other ways to pay for gold:

Bank Wire Transfers – Preferred by most dealers for large purchases. Secure and usually comes with no added fees from the dealer.

ACH Transfers (eCheck) – Works like a digital check. Often allows for discounts and quick processing.

Debit Cards – Convenient for small orders, but may have lower purchase limits.

Paper Checks – Accepted by many dealers and often comes with a cash or “check discount,” but can take longer to clear.

PayPal – Offered by select dealers; convenient, but may come with higher fees.

Cryptocurrency – Bitcoin is accepted by some modern dealers like JM Bullion. Fast and private, but volatile and may have tax complications.

Payment Method | Dealer Fees | Purchase Limit | Best For |

|---|---|---|---|

Credit Card | Typically 3–4% processing fee | Often capped at ~$5,000 | Small, urgent online purchases |

Bank Wire | Usually no dealer fee | High – up to $100,000+ | Large, secure transactions |

ACH / eCheck | No fee; may include discount | Moderate – up to ~$25,000 | Discounted online purchases |

Paper Check | No fee; often includes discount | High – $50,000+ depending on dealer | Non-urgent orders with discounts |

Debit Card | Typically no fee | Low – ~$500 to $2,500 | Everyday or first-time buyers |

PayPal | May have 3–4% fee (some waive) | Medium – often ~$10,000 max | Convenience, PayPal users |

Cryptocurrency | Often no dealer fee, but blockchain fees apply | Varies widely – often ~$10,000–$50,000 | Privacy-focused buyers |

Which Of Them May Be The Bets Options?

If you're buying gold and want to avoid extra fees, ACH transfers and paper checks are usually the best options—they often come with dealer discounts and no added costs.

For larger purchases, bank wires are ideal due to their high limits and fast processing.

While credit cards and PayPal are convenient, they usually come with extra fees and lower purchase limits. Cryptocurrency is best for privacy-focused buyers, but it’s not widely accepted and can be volatile.

Overall, the best option depends on your purchase size, urgency, and whether you value convenience over cost savings.

Using 0% APR Credit Cards for Gold Purchases: A Smart Strategy?

Using a 0% APR credit card to buy gold can be a smart short-term strategy, but only if used responsibly. These promotional cards allow you to carry a balance without interest for a limited time, typically 12 to 18 months.

If you’re confident you can pay off the full balance before the promo ends, you could avoid interest while spreading out your payments.

However, any missed payment or delay could result in backdated interest and penalties, which would erase any potential benefits.

FAQ

Most dealers accept Visa and Mastercard. Some also accept American Express or Discover, but it’s best to check their payment policy before ordering.

Some credit cards exclude precious metal purchases from rewards. Others treat them as cash advances, which typically don’t qualify for points, cashback, or travel perks.

Yes, if you use a high percentage of your available credit or miss payments, it can increase your utilization rate and negatively impact your credit score.

Yes. Many gold dealers limit credit card transactions to around $5,000 or less to reduce risk and processing fees.

Some dealers add processing fees (usually 3–4%) at checkout. Always review payment terms carefully to avoid unexpected charges.

Business cards may offer higher spending limits and better rewards, but they still carry the same risks—fees, interest, and potential cash advance treatment.

Yes, many offer 3–4% discounts for paying via wire transfer, check, or ACH instead of credit cards to avoid processing fees.