Gold and Bitcoin are often seen as opposites—one's ancient, the other's futuristic. But investors are increasingly buying both to hedge against economic uncertainty.

With rising inflation and dollar volatility, using Bitcoin to buy gold isn’t just possible—it maybe a good move.

Can You Buy Gold with Bitcoin? How It Works

Yes, you can absolutely buy gold with Bitcoin—and it’s a growing trend. A number of online bullion dealers now accept Bitcoin and other cryptocurrencies as direct payment for physical gold.

These platforms either integrate with crypto payment processors like BitPay or offer their own built-in crypto checkout systems.

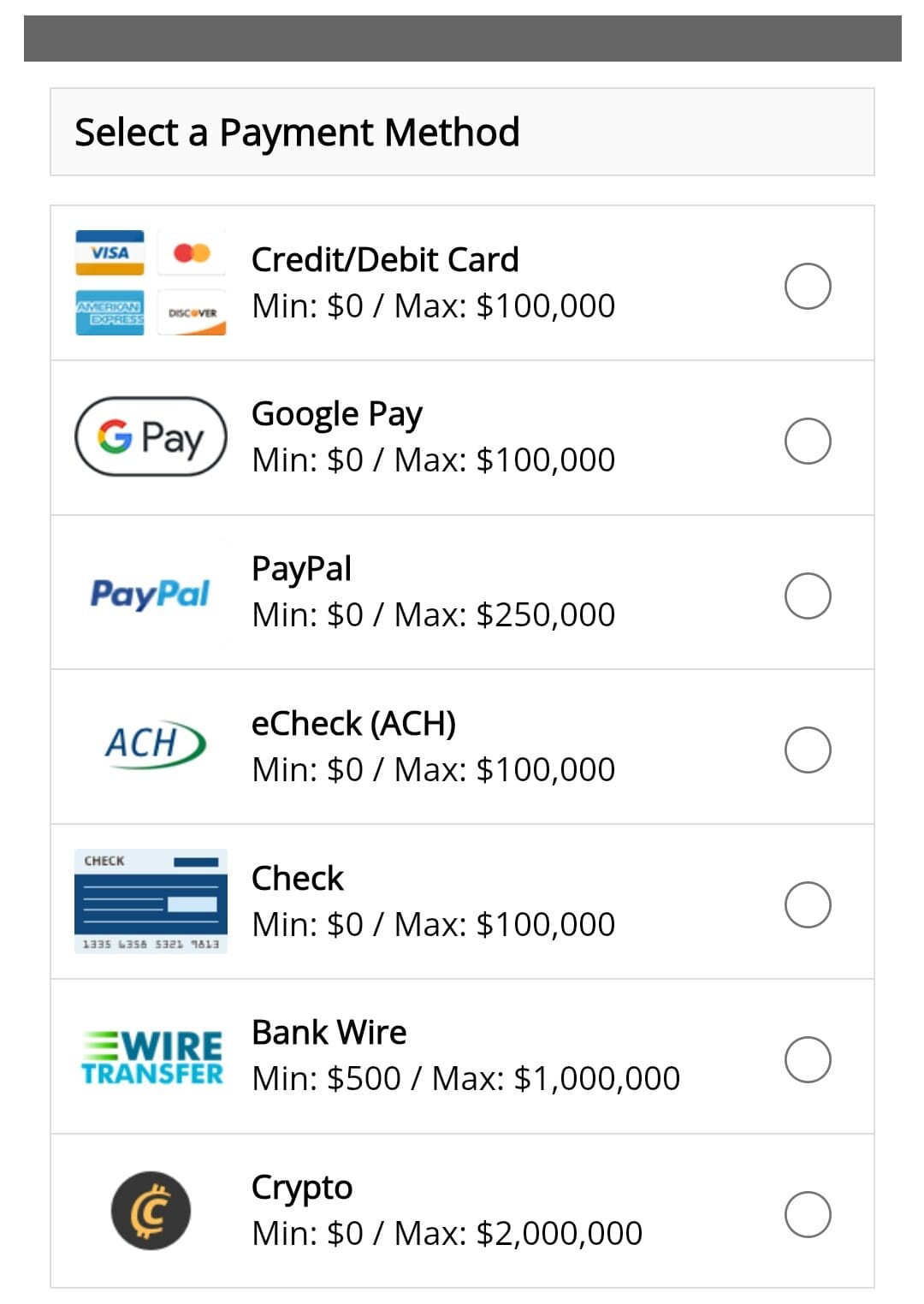

When you're ready to buy, you just browse for the gold you want—whether it's coins, bars, or something else—then choose Bitcoin as your payment method at checkout.

From there, you either scan a QR code or paste the wallet address to send your crypto.

Top Online Gold Dealers That Accept Bitcoin

Several well-known gold dealers now accept Bitcoin, making it easier for crypto holders to diversify into physical assets. Here are some of the best platforms that support Bitcoin payments for gold.

1. JM Bullion

JM Bullion is one of the most trusted names in the gold retail space, and it accepts Bitcoin through BitPay. You can purchase a wide range of gold products—from coins to bars—with BTC and other major cryptos.

They offer free shipping on orders over $199, and all orders are fully insured. Customer reviews highlight their responsive support and fast delivery.

2. APMEX

APMEX accepts Bitcoin, Ethereum, and several other cryptocurrencies via BitPay. Their selection is one of the largest online, including collectible coins and investment-grade bars.

You can choose to have your gold delivered or stored with their partner service, Citadel.

3. Bullion Exchanges

Based in New York, Bullion Exchanges lets you pay with Bitcoin and select other cryptos. They offer a sleek checkout process, competitive prices, and a wide selection of international coins and bars.

4. Bitgild

Bitgild is a Europe-based platform that focuses exclusively on buying gold and silver with cryptocurrency.

They accept Bitcoin, Litecoin, Ethereum, and even Monero. Bitgild offers worldwide shipping and discreet packaging, appealing to privacy-focused crypto holders.

Their minimal design and crypto-native approach make them a standout for international buyers.

How to Buy Gold with Bitcoin: Step-by-Step

Here’s how the process of buying gold with Bitcoin typically works, from choosing a dealer to completing the crypto transaction:

- Choose a trusted gold dealer

Pick a reputable online dealer that accepts Bitcoin—like JM Bullion, APMEX, or Bitgild. Make sure they offer the type of gold you’re looking for (coins, bars, etc.) and support your delivery or storage preference. - Browse and add gold to your cart

Select the gold products you want to buy. Most sites let you filter by weight, purity, and product type to make the search easier. - Select Bitcoin at checkout

When you’re ready to pay, choose Bitcoin (or another supported crypto) as your payment method. The site will usually redirect you to a crypto payment processor like BitPay. - Complete the crypto payment

Scan the QR code or copy the wallet address provided. Send the exact amount of Bitcoin shown—transactions usually need to be confirmed within 15–30 minutes. - Wait for confirmation

Once the payment is verified on the blockchain, the order is processed. You’ll get an email confirmation, and your gold is either shipped to you or stored (if you selected vault storage). - Track or manage your gold

If you chose shipping, you’ll receive tracking info. If you opted for storage (like with Vaultoro or APMEX Citadel), you can log in to view or manage your holdings.

Why More Investors Are Swapping Bitcoin for Gold

With crypto markets staying volatile and gold hitting new highs in 2025, many investors are cashing in their Bitcoin profits for something more stable.

Gold has a long history as a hedge during inflation and economic uncertainty, and lately, it’s looking more attractive to those who feel crypto may have peaked in the short term.

Some are also wary of regulatory crackdowns and market manipulation in crypto, pushing them toward physical assets like gold that offer more tangible security.

As a result, gold is becoming a popular “exit ramp” for long-term crypto holders.

Pros & Cons of Buying Gold with Bitcoin

Pros | Cons |

|---|---|

Avoids converting crypto to fiat (no middle step) | Crypto price volatility can impact final gold pricing |

Fast, secure transactions through blockchain | Some dealers charge higher premiums for crypto payments |

Privacy-friendly payment method | Limited refund options or cancellations after crypto payment |

Lets you lock in crypto gains into a stable asset | Fewer dealers accept Bitcoin compared to credit/bank methods |

Great for diversifying your portfolio | May trigger capital gains tax depending on the transaction |

Tax Implications of Buying Gold with Bitcoin

When you use Bitcoin to buy gold, the IRS treats it as a taxable event, just like selling your crypto for cash.

The moment you spend Bitcoin, you’re essentially “disposing” of it—so you may owe capital gains tax based on the difference between your purchase price and its market value at the time of the gold transaction.

This applies whether you’re buying gold coins, bars, or anything else. Be sure to keep records of your cost basis and sale value for tax reporting.

It’s also a good idea to consult a crypto tax advisor before making large purchases.

FAQ

Some dealers offer higher privacy when using Bitcoin, but full anonymity is rare due to shipping and compliance requirements.

Yes, it’s completely legal as long as both parties follow applicable tax and reporting laws.

Yes, you'll need a secure Bitcoin wallet to send the payment during checkout.

Some do charge a small premium to cover crypto transaction costs or volatility risks.

Many dealers also accept Ethereum, Litecoin, and stablecoins like USDC, depending on the platform.

Yes, some dealers impose purchase minimums or limits, especially for international orders or larger transactions.

Most dealers require ID for compliance, especially for high-value purchases or international shipping.

Most Bitcoin payments confirm within 10–60 minutes, after which the order is processed for shipment or storage.