Table Of Content

Gold demand hit all time high in 2025, driven largely by retail investors and central banks increasing their holdings.

According to the World Gold Council, individuals increasingly turned to physical gold as a store of value during inflation and market volatility.

But while most buyers use dealers, some wonder: can you walk into a bank and buy a gold bar?

Let’s break it down.

Do Banks Sell Gold Bars?

Yes — some banks sell gold bars, but it depends on where you live.

In many countries, especially in Europe, Asia, and the Middle East, buying gold from a bank is normal. Swiss banks like UBS or Credit Suisse, for example, sell gold bars directly to clients.

Banks in India, Canada, and the UAE also offer gold through branches or partnerships with refineries.

In the U.S., however, most banks do not sell physical gold bars. Instead, they offer gold-backed investment options like ETFs, IRAs, or managed portfolios.

If a U.S. bank offers gold bars at all, it’s typically through a third-party partner — not as a retail product. So while it’s possible, most buyers find better selection and pricing from specialized gold dealers.

Which Banks Sell Gold Bars? A List of Top Institutions

The experience of buying gold from a bank varies by region. Here’s a breakdown of banks known for offering physical gold, and what to expect from each:

-

International Banks That Offer Gold Bars

Bank | Country | Gold Offered | Notes |

|---|---|---|---|

UBS | Switzerland | 1g to 1kg bars | Available online & in-branch. High trust, moderate premiums. |

Credit Suisse | Switzerland | Branded gold bars | Requires account, often sold via partner platforms. |

Emirates NBD | UAE | Small bars (5g, 10g, etc.) | In-branch sales for clients only. |

ICICI Bank | India | Gold bars and coins | Common during festivals. Higher premiums than dealers. |

RBC (Royal Bank of Canada) | Canada | Gold bars and coins via partners | Available through online banking in some cases. |

-

What About U.S. Banks?

In the United States, banks like Wells Fargo, Bank of America, and Chase do not sell gold bars to retail clients. They may offer:

Gold-backed investment funds (ETFs, mutual funds)

Gold IRA services through custodians

If you're in the U.S., you’ll likely need to go through a gold dealer instead.

What Type of Gold Can Be Purchased?

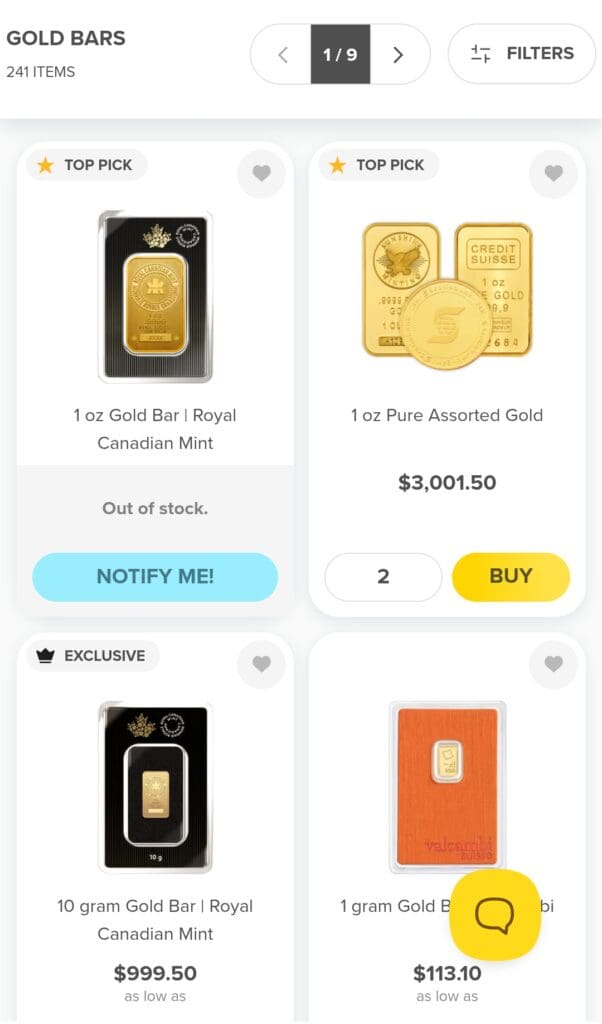

When buying gold from a bank, the selection is usually limited to standard, investment-grade bullion — not collectibles or specialty items. Most institutions that sell physical gold focus on bars produced by well-known refineries.

You can typically expect:

Minted bars in sizes like 1g, 5g, 10g, 1 oz, 100g, and 1 kg

High-purity (.999 or .9999) bars sealed in tamper-evident assay packaging

Brands like PAMP Suisse, Valcambi, or Credit Suisse, depending on the region and bank partnerships

Banks rarely sell coins or niche formats. Their offerings are tailored to long-term investors seeking secure, standardized bullion. If you're looking for more variety — such as fractional coins or collectible pieces — a dedicated gold dealer is a better source.

Comparison: Buying Gold from a Bank vs. a Dealer

When deciding between a bank and a gold dealer, it’s important to understand the trade-offs in pricing, availability, and convenience.

The table below breaks down the key differences to help you choose the option that best fits your goals.

Feature | Bank | Gold Dealer (Online or Local) |

|---|---|---|

Availability | Limited (mainly international) | Widely available, any state/country |

Selection | Mostly bars, few sizes | Bars, coins, rounds, various sizes |

Premiums | Moderate to high | Low to moderate (can shop around) |

Transparency | Often opaque | Clear pricing, visible spot vs. premium |

Authentication | Very high (banks use refineries) | High, but varies by seller |

Convenience | Appointment or account required | Buy anytime, online or in-store |

Can You Sell Gold Bars Back to a Bank?

In most cases, banks do not buy back gold bars from customers — even if they originally sold them.

While a few international banks (like UBS or ICICI) may accept returns from clients under specific conditions, most banks are not structured to resell secondhand gold. Their model is built around new, sealed bullion from approved refineries.

If you're looking to sell, a more flexible option to sell your gold is working with a gold dealer or peer-to-peer platform. Many online dealers offer transparent buyback programs and even lock-in pricing when you initiate a sale.

Advantages & Disadvantages of Buying Gold from a Bank

While banks can offer a sense of security and legitimacy, buying gold bars through them isn't always the most efficient or cost-effective option. Here’s a look at the key pros and cons:

- Trusted Source

Banks are well-established institutions, and their gold products often come from top-tier mints like PAMP or Credit Suisse.

- High Authenticity Assurance

Gold sold through banks typically includes sealed assay packaging, ensuring purity and weight.

- No Third-Party Risk

Unlike some online dealers, you’re dealing directly with a regulated financial entity.

- Limited Availability

In many countries (especially the U.S.), most banks don’t offer physical gold at all.

- Higher Premiums

Gold from banks often comes with additional fees for handling, packaging, or account requirements.

- Less Selection & Flexibility

Banks rarely offer collectible coins, fractional sizes, or deals on secondary market products.

Taxes on Gold Bought from a Bank

When you buy gold bars from a bank, you're still subject to the same tax rules as you would be when buying from a dealer.

In the U.S., gold is considered a collectible, and capital gains taxes apply if you sell it for a profit. The maximum long-term capital gains tax rate for collectibles is typically 28%, but this depends on your income and holding period.

In some states or countries, sales tax may also apply at the time of purchase. Always check your local tax laws, as some regions offer exemptions for investment-grade bullion while others do not.

FAQ

No — most banks don’t sell physical gold. In the U.S., almost all retail gold purchases happen through dealers, not traditional banks.

Yes, in most cases. Banks that sell gold often require you to be an existing client or use private banking services.

Not necessarily. Banks and dealers often source from the same refineries. What differs is availability, service, and pricing.

Most banks only accept wire transfers for gold purchases — unlike many dealers who accept credit cards or eChecks.

(Related: Buying gold with a brokerage account)

1 oz or 10g bars are popular starting points. They’re easier to resell and don’t require as large of an upfront investment.

A dealer sells gold to retail buyers. A bullion bank deals in wholesale gold, often with central banks or large institutions.

Not always. Large purchases may trigger reporting thresholds, but this varies by country and payment method.