Cash App Invest

Monthly Fee

Minimum Deposit

Our Rating

APY Savings

-

Overview

- FAQ

Cash App Investing is a beginner-friendly platform that allows users to trade stocks, ETFs, and Bitcoin with no commission fees.

It’s a great choice for those who already use Cash App for banking and want a simple way to invest without opening a separate account.

With just $1, you can start investing in fractional shares of over 1,800 stocks and ETFs. The app also supports Bitcoin trading, but it does not offer other cryptocurrencies.

Unlike full-service brokers, Cash App Investing lacks advanced trading tools, mutual funds, options, or futures. It also does not provide robo-advisors or investment guidance.

While its simplicity makes it appealing for new investors, experienced traders may find its limited research tools and lack of order types restrictive.

Does Cash App Investing have a trading limit?

Yes, you can place a maximum of three trades in a five-day period, which is lower than other platforms. This makes it less suitable for active traders or day traders.

Can I short stocks on Cash App Investing?

No, short selling is not supported. You can only buy stocks and ETFs, meaning you can’t profit from declining stock prices like on advanced trading platforms.

Can I trade after-hours on Cash App Investing?

No, Cash App only allows trading during regular market hours (9:30 AM – 4 PM ET, Monday-Friday). There are no extended-hours or pre-market trading options.

Does Cash App Investing offer dividends?

Yes, if you own dividend-paying stocks or ETFs, you’ll receive dividends directly into your Cash App balance. However, dividend reinvestment (DRIP) is not available, so you’ll need to manually reinvest.

Can I transfer my stocks from Cash App to another broker?

Yes, but it comes with a $75 transfer fee for full or partial account transfers. Some brokers may cover this fee if you're transferring a large balance.

Is there a minimum deposit to start investing?

No, there’s no minimum deposit required to open an investing account. You can start investing with as little as $1 using fractional shares.

Pros | Cons |

|---|---|

Commission-Free Stock & ETF Trading | Limited Investment Options |

Bitcoin Trading & Transfers | Only One Cryptocurrency (Bitcoin) |

Banking & Investing in One App | No Retirement or Specialized Accounts |

Beginner-Friendly & Simple Interface | High Non-Trading Fees |

Auto-Investing & Round-Ups | Limited Customer Support |

Regulated & Secure | Data Breach In 2022 |

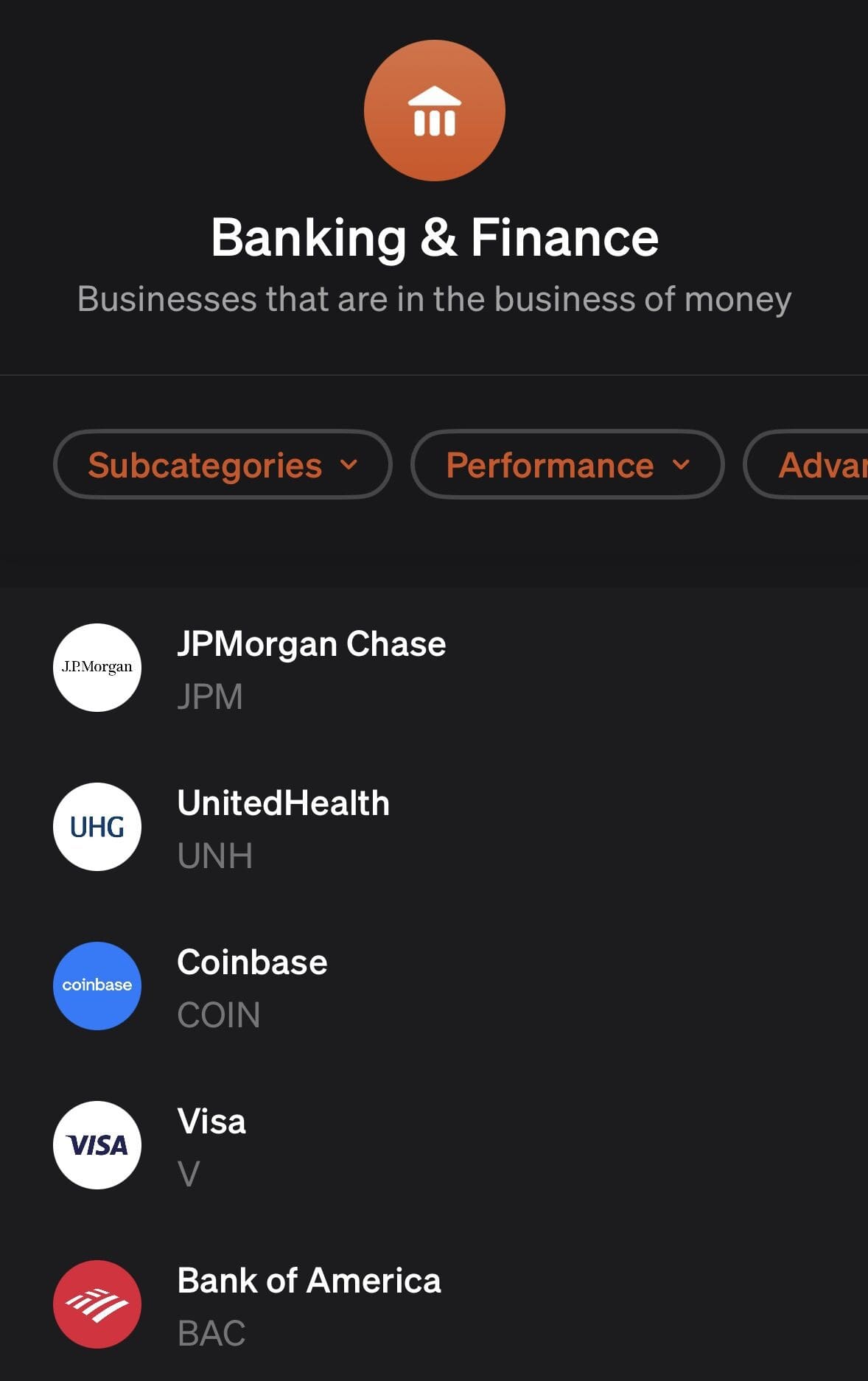

Which Assets Can Be Traded With Cash App Investing?

Cash App Investing offers a simple selection of assets, making it easy for beginners to start investing.

Here’s what you can trade on the platform:

- Stocks – Cash App Investing offers over 1,800 publicly traded stocks from companies listed on the NYSE and Nasdaq. Stocks must have a market capitalization of at least $300 million, and you can invest in fractional shares starting at $1.

- ETFs – Investors can access popular ETFs from major providers like Vanguard and iShares, including funds tracking the S&P 500 and Nasdaq 100. However, the selection is more limited compared to full-service brokerage platforms.

- Bitcoin – Bitcoin is the only cryptocurrency available on Cash App Investing. Users can buy, sell, and transfer Bitcoin to external wallets and even set up automated recurring purchases for Bitcoin investments.

What’s Not Available?

- No mutual funds, bonds, or fixed-income securities

- No options, futures, or margin trading

- No other cryptocurrencies like Ethereum or Dog

Main Features For Investors

Here are the key features that I found most appealing in Cash App:

-

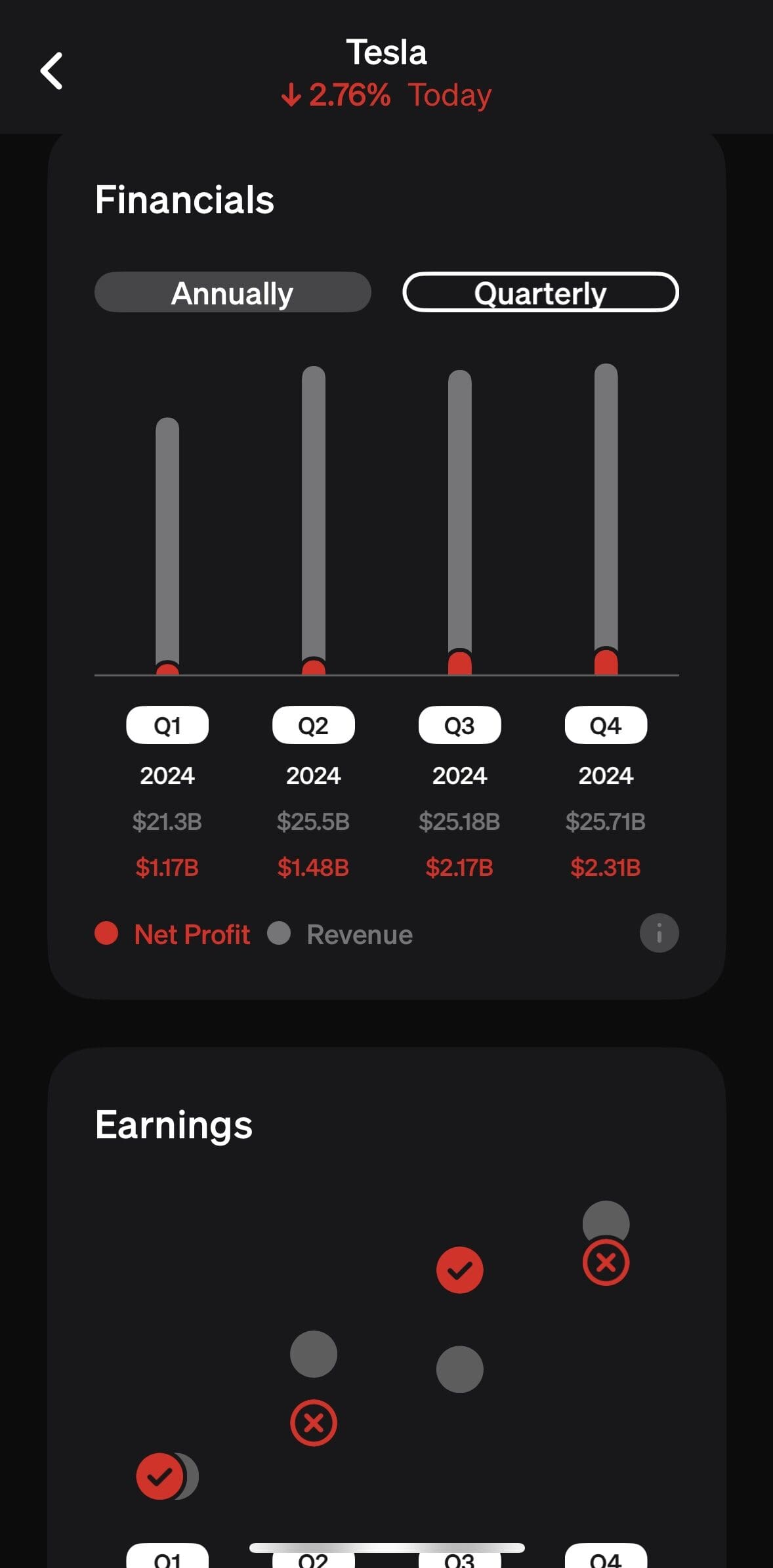

Cash App Trading Platform

Cash App Investing offers a mobile-first trading platform designed for simplicity and accessibility.

Unlike traditional brokers with complex dashboards, Cash App provides a clean, easy-to-use interface where users can quickly search for stocks, ETFs, and Bitcoin, view their performance, and make trades with just a few taps.

Users can check a stock’s historical performance over different timeframes, but the charts are simple line graphs without advanced technical indicators.

Analyst ratings give a quick snapshot of whether experts recommend buying, holding, or selling a stock.

While it’s great for beginners, active traders or those looking for advanced order types, options trading, or margin accounts may find it too basic.

If you need real-time data, detailed stock analysis, or advanced trading tools, you might prefer other investing apps

-

Bitcoin Trading and Transfers

Cash App allows users to buy, sell, and transfer Bitcoin directly from their mobile device.

Unlike other investment platforms that support multiple cryptocurrencies, Cash App focuses only on Bitcoin.

With Bitcoin trading, you can start investing with as little as $1.

Additionally, Cash App allows you to send Bitcoin to external wallets, giving you full control over your assets.

However, Cash App does charge a fee for Bitcoin transactions, which varies depending on market conditions.

-

Cash App Banking Integration

One of the biggest advantages of Cash App Investing is its seamless integration with Cash App’s banking services.

You can move money instantly between your Cash App balance and your investing account, making deposits and withdrawals fast and convenient.

Cash App also offers a free debit card, direct deposit options, and peer-to-peer payments. This means you can manage your everyday finances and investments all within the same app.

If you sell stocks or Bitcoin, the money is automatically transferred into your Cash App balance, where you can spend it, withdraw it, or reinvest it.

However, unlike other brokers, Cash App does not offer interest on uninvested cash, but you can always transfer it to Cash App savings account and get 4.00% APY.

-

Commission-Free Fractional Share Investing and ETF Trading

Cash App Investing allows users to buy and sell over 1,800 stocks and ETFs without paying trading commissions.

You can invest in full shares or fractional shares, meaning you don’t need to buy a whole share of expensive stocks. With as little as $1, you can start investing in well-known companies.

To place a trade, simply search for a stock or ETF in the app, select the amount you want to invest, and confirm your purchase.

The app also lets you schedule automatic recurring investments, helping you build your portfolio over time.

However, keep in mind that Cash App only offers a limited selection of stocks and ETFs, and it lacks advanced trading features like stop-loss orders or extended-hours trading.

-

Custodial Accounts for Minors

Cash App Investing offers free custodial accounts for minors aged 13 to 17, allowing young investors to start learning about stocks and Bitcoin.

A parent or trusted adult acts as the account sponsor, monitoring and managing the account while giving the minor some control.

Teen investors can buy and sell stocks, ETFs, and Bitcoin with as little as $1. They can also enable round-up investing, where spare change from purchases is automatically invested.

Sponsors can track account activity, set spending limits, and add extra security features to protect their child’s money.

Once the minor turns 18, they gain full control of the account.

-

Round-Up Investing: Invest Your Spare Change

Cash App Investing offers a Round-Up Investing feature, allowing you to invest small amounts effortlessly.

When you make a purchase using your Cash App debit card, the total is rounded up to the nearest dollar, and the spare change is automatically invested in stocks, ETFs, or Bitcoin.

For example, if you buy coffee for $4.50, Cash App will round it up to $5 and invest the extra $0.50 into your selected investment.

Over time, these small amounts add up, helping you build your portfolio without even thinking about it.

Round-Up Investing is a great option for beginners or those looking for a hands-off way to invest consistently.

-

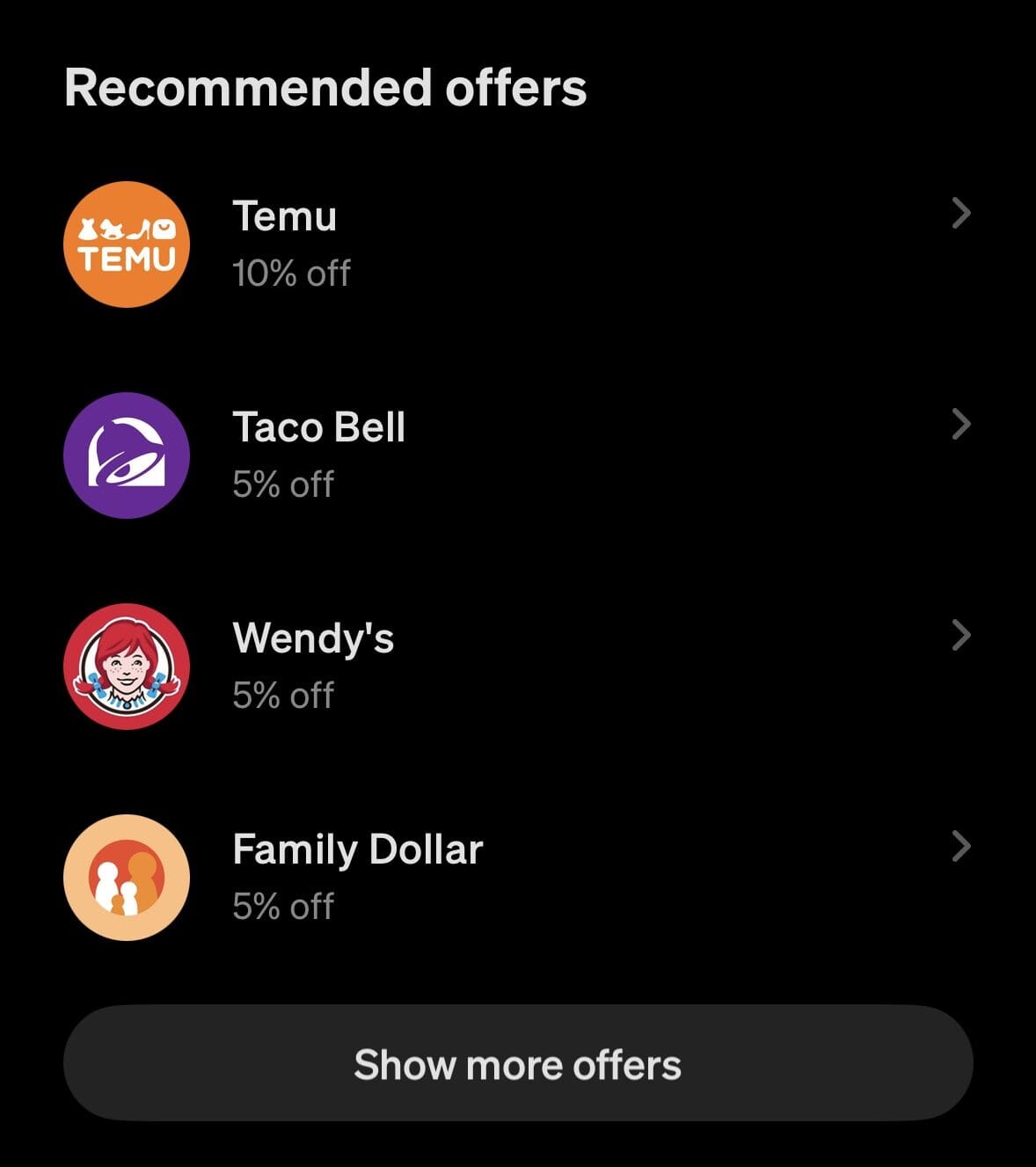

Stock & Bitcoin Boosts: Cashback in Investments

Cash App’s Boosts program offers cashback rewards when you use your Cash App debit card at select retailers.

Some Boosts allow you to earn rewards in Bitcoin or stocks instead of cash, helping you passively invest while you spend.

For example, if a participating coffee shop offers a 5% Bitcoin Boost, you’ll receive 5% of your purchase back in Bitcoin.

Similarly, stock-related Boosts deposit small amounts of selected stocks into your investing account when you make purchases.

When Cash App Investing May Be a Good Choice? When Not?

As with any financial platform, Cash App Investing isn’t the perfect fit for everyone.

Here’s a look at who might find Cash App Investing better choice and who might want to consider other options

When Cash App May Be a Good Choice | Who Should Look Elsewhere |

|---|---|

Beginner Investors | Active Traders & Day Traders |

Casual & Long-Term Investors | Options & Futures Traders |

Small Investors & Budget-Conscious Users | Crypto Investors Looking for More Coins |

Customers Interested in Banking Integration | Retirement & Long-Term Planners |

Teen Investors & Parents | Investors Who Need Advanced Research Tools |

Bitcoin-Only Investors |

3 Simple Steps to Set Up the Cash App Invest Account

Let's see the main steps when setting up an account with Cash App Invest:

-

1. Link Your Bank Account & Add Funds

Before you can invest, you’ll need to link a bank account or debit card to transfer money into Cash App.

You can do this by selecting the “Banking” tab in the app and following the steps to connect your account.

Once linked, you can deposit money to fund your investments. Deposits may take 1-3 business days to process, but you can use instant deposits for a small fee.

Our tips:

🔹 Use a bank account in your name to avoid verification issues.

🔹 Cash App does not support credit card deposits, so you’ll need to use a checking or savings account.

🔹 Keep in mind that your Cash App balance is separate from your investing balance – you’ll need to manually transfer funds to invest.

-

2. Enable Investing & Verify Your Identity

To access Cash App Investing, go to the “Investing” tab and complete the identity verification process.

Cash App will ask for your full name, date of birth, and Social Security number (SSN) to comply with SEC regulations.

Verification can take a few minutes or up to 24 hours, depending on your details.

Our tips:

🔹 You must be at least 18 years old to open an investing account.

🔹 Your SSN is required due to federal investment laws—this is standard for all brokerage accounts.

🔹 If Cash App can’t verify your identity with the provided details, you may need to upload a photo of your government-issued ID.

-

3. Start Investing

Once your account is verified, you can start buying stocks, ETFs, and Bitcoin directly from the Cash App Investing tab.

You can search for stocks by name or ticker symbol, enter the amount you want to invest, and confirm your purchase.

Our tips:

🔹 If you want to sell, your money will be transferred to your Cash App balance, which you can withdraw or reinvest.

FAQ

Yes. Cash App Investing offers commission-free trading for stocks and ETFs. However, there are small regulatory fees when selling stocks and ETFs, and Bitcoin transactions may include a service fee.

When you sell a stock or ETF, the money is deposited into your Cash App balance, not directly back into your bank account. You can use it to invest again, send money, or withdraw it to your bank.

Yes. If you have money in your Cash App balance, you can use it to buy stocks or Bitcoin without needing to transfer funds from your bank.

Cash App Investing is SIPC-insured for up to $500,000, including $250,000 for cash claims. However, SIPC does not protect against investment losses.

No, Cash App does not offer robo-advisors or financial guidance. You’ll need to do your own research before making investment decisions.

No, each user can only have one investing account linked to their Cash App profile. If you need different account types, you’ll need to look at other brokerage platforms.