| ||

|---|---|---|

Coinbase | eToro | |

Supported Coins | +250 | +25 |

Spot Trading Fees | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | 1% |

Future Trading Fees | 0.40% – 0.60%

0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.04%.

| $3–$5 per action |

Our Rating |

(4.5/5) |

(4.4/5) |

Read Review | Read Review |

Coinbase vs. eToro: Compare The Best Features

If you're wondering whether Coinbase or eToro is the better choice for crypto trading and investing, it really depends on what features matter most to you.

Both platforms bring something different to the table, so let’s break it down side-by-side to help you make the right call.

-

Ease of Use & Mobile App Experience

Coinbase offers one of the simplest experiences in the crypto world. Its app mirrors the website's clean layout, allowing beginners to buy Bitcoin or explore NFTs with just a few taps.

A first-time user could easily set up an account, link a bank, and buy crypto in under 10 minutes.

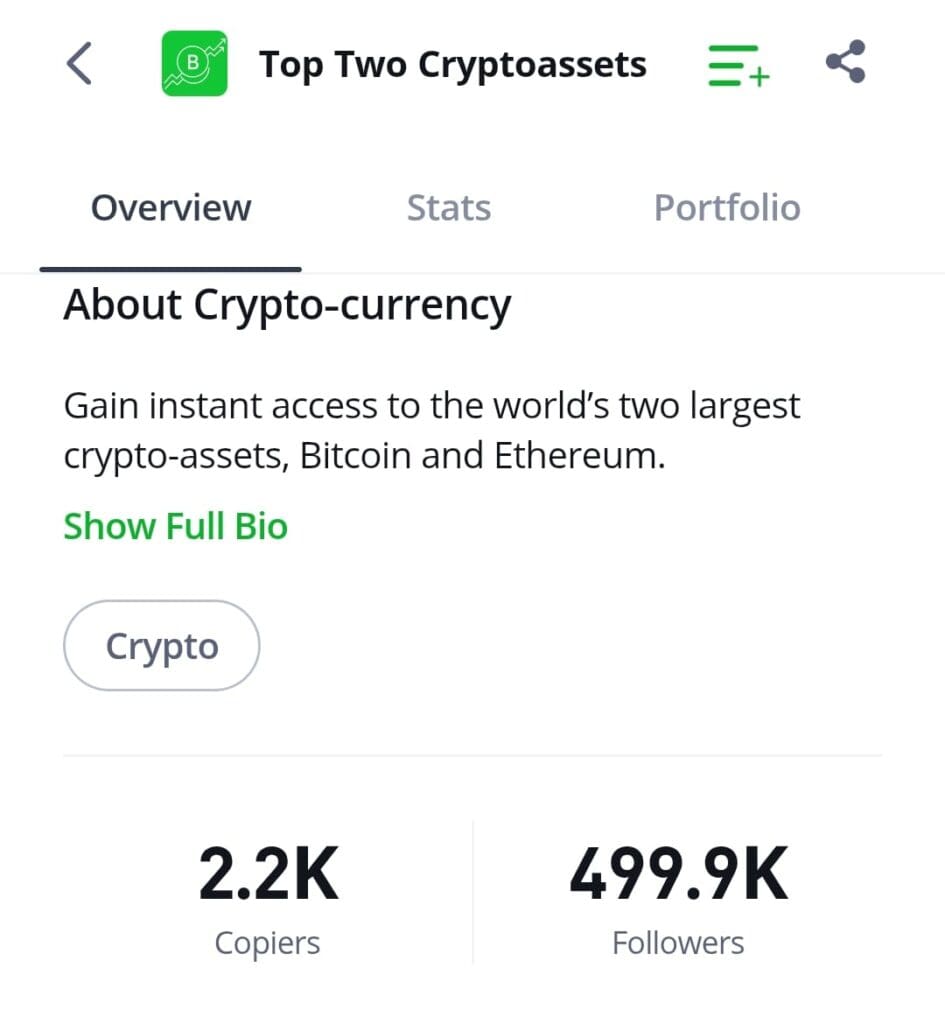

eToro also shines with a beginner-friendly app, but focuses more on multi-asset management.

Users can copy top crypto traders with one click through CopyTrader, which combines crypto, stocks, and ETFs in one place, eliminating the need to switch apps.

Overall, Coinbase is best for pure crypto simplicity, but eToro wins if you want to combine crypto with stocks and social investing easily.

-

Cryptocurrency Selection

Coinbase supports +250 cryptocurrencies, including Bitcoin, Ethereum, Cardano, and many DeFi tokens.

It also enables NFT trading through its native marketplace, offering broader exposure to altcoins and blockchain projects.

eToro offers a more limited crypto selection with +25 coins. International users get access to all coins (U.S. investors are more limited), but there are still fewer options than Coinbase's offering.

-

DApps and Web3 Integration

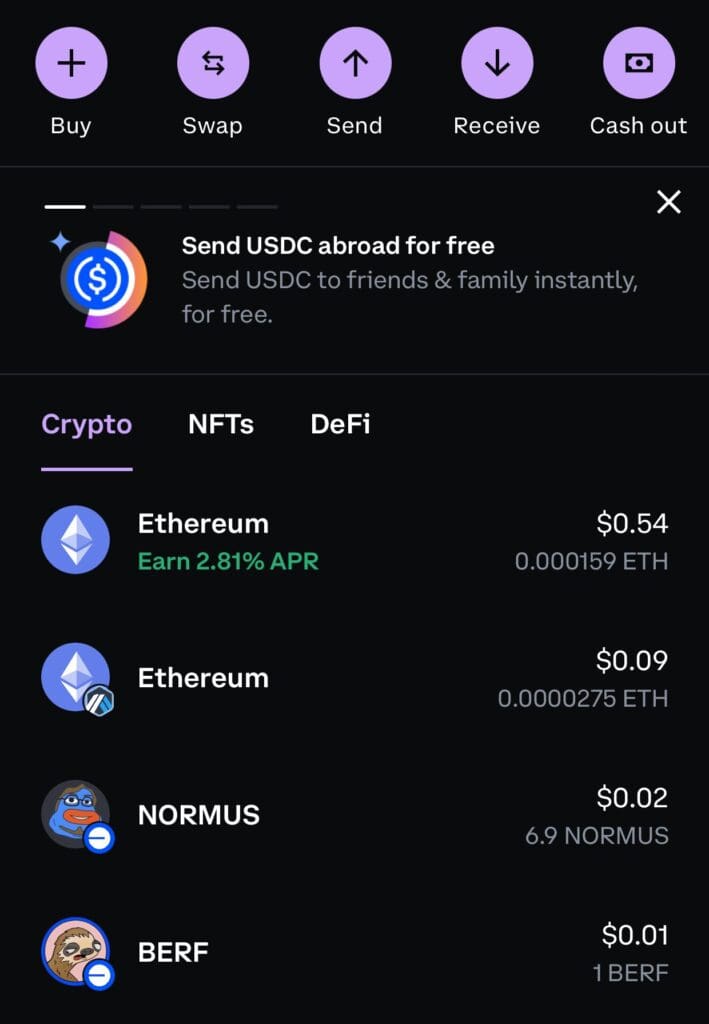

Coinbase is the clear choice for users wanting to dive into Web3, DeFi, and NFT ecosystems.

Coinbase offers deep Web3 integration through its standalone Coinbase Wallet, allowing users to access DeFi apps, stake crypto, and trade NFTs on chains like Ethereum and Solana.

You can, for instance, connect directly to a DeFi app like Uniswap in just a few taps.

eToro offers the eToro Money Wallet for storage, but it lacks real DApp access and Web3 features. You cannot stake, lend, or interact with decentralized apps through eToro.

-

Trading Crypto Features & Experience

For serious traders, Coinbase Advanced Trade offers professional tools like real-time TradingView charts, limit and stop orders, and lower fees based on volume.

Futures and margin trading are also available for users wanting higher leverage and fast execution.

eToro focuses less on technical trading and more on social features. Users can copy experienced traders using CopyTrader or invest in thematic Smart Portfolios managed by experts.

However, it lacks real-time market depth tools and complex order types, such as stop-limits, for crypto.

-

Staking Options and Rewards

When it comes to staking, Coinbase offers a broader range of staking assets and potentially higher rewards, while eToro provides a more straightforward, automated staking experience with tier-based benefits.

Coinbase offers staking for assets like Ethereum (ETH), Solana (SOL), and Cosmos (ATOM). Users can stake directly through the platform, and Coinbase One subscribers receive boosted rewards.

However, Coinbase retains a commission on staking rewards, which can be as high as 35%.

eToro provides staking for cryptocurrencies including Ethereum (ETH), Solana (SOL), Polkadot (DOT), and Cosmos (ATOM).

Rewards are automatically distributed monthly and investors 45%-90% of staking yields, depending on the user's eToro Club tier.

-

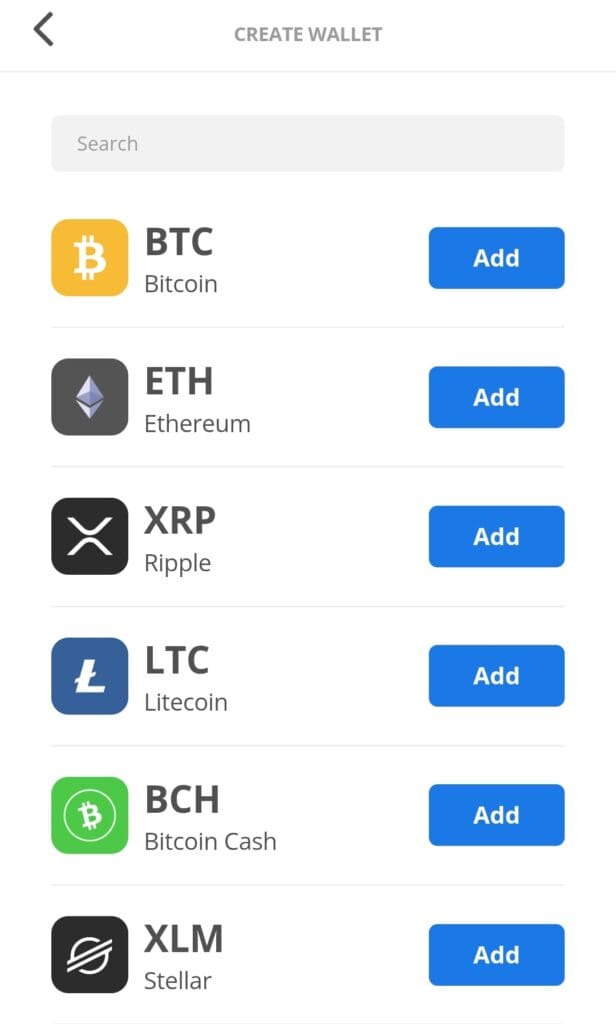

Wallet Options

Coinbase offers the Coinbase Wallet, a self-custody wallet supporting a wide range of cryptocurrencies and NFTs. It allows users to interact with decentralized apps (dApps), stake assets, and manage DeFi positions.

The wallet includes features like passkey backups and smart wallet functionalities.

eToro provides the eToro Money crypto wallet, a secure, multi-crypto wallet for storing and transferring cryptocurrencies. While it ensures safety and ease of use, it lacks support for dApps and DeFi interactions.

Overall, Coinbase Wallet offers more comprehensive features for users interested in DeFi and NFTs, whereas eToro's wallet is suitable for straightforward crypto storage and transfers.

-

Trading Bots and Automation

Coinbase supports integration with automated trading platforms and offers a built-in grid trading bot within its Advanced Trade interface. Users can also connect third-party bots via API for strategy automation.

However, eToro does not natively support trading bots. Third-party platforms like airSlate offer automation tools that are compatible with eToro, although they are not officially integrated.

Which Investors May Prefer Coinbase Exchange?

Coinbase is a strong choice for investors who prioritize simplicity, security, and broad access to cryptocurrencies. It is especially ideal for:

New Crypto Investors: The simple interface and educational tools make it easy to start with Bitcoin or Ethereum.

NFT and Web3 Enthusiasts: Coinbase Wallet offers seamless access to DeFi apps and NFT marketplaces.

Passive Earners: Those interested in staking can easily earn crypto rewards on holdings like Ethereum and Cardano.

Security-Conscious Users: With cold storage, insurance, and open-source security innovations, Coinbase strongly emphasizes user protection.

Overall, Coinbase is best for users wanting a secure, beginner-friendly entry point into the crypto world with growth potential toward advanced trading.

Which Investors May Prefer eToro Crypto?

eToro is an excellent option for investors who want a multi-asset experience and appreciate community-driven features. It works best for:

Social Traders: Those who want to copy experienced investors with the CopyTrader feature.

Multi-Asset Investors: Users who want to trade not just crypto but also stocks, ETFs, and commodities from one account.

Beginner Investors: With a $100,000 virtual trading account, eToro is perfect for practicing and building confidence risk-free.

Passive Portfolio Builders: Those who prefer investing in Smart Portfolios managed by professionals.

eToro shines for users who want exposure to various markets while leveraging social and thematic investing tools.

Bottom Line: Which Platform Excels Where?

Coinbase excels at offering a secure, beginner-friendly crypto trading platform with strong Web3 integration and staking rewards. It’s ideal for pure crypto enthusiasts.

Meanwhile, eToro dominates for users seeking a broader investment experience, combining crypto, stocks, and copy trading into one easy-to-use platform.

Choosing between them comes down to whether you want a focused crypto journey (Coinbase) or a diversified, social investing experience (eToro).