| ||

|---|---|---|

Crypto.com | eToro | |

Supported Coins | +350 | N/A |

Spot Trading Fees | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | 1% |

Future Trading Fees | 0.04% – 0.06%

0.06% for taker trades and 0.04% for maker trades. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts.

| $3–$5 per action |

Our Rating |

(4.4/5) |

(4.4/5) |

Read Review | Read Review |

Compare The Best Features

When choosing between Crypto.com and eToro, it's essential to look beyond their names. Each offers a very different experience depending on whether you prioritize mobile use, crypto variety, DeFi access, or advanced features.

Let's compare them side by side to help you decide.

-

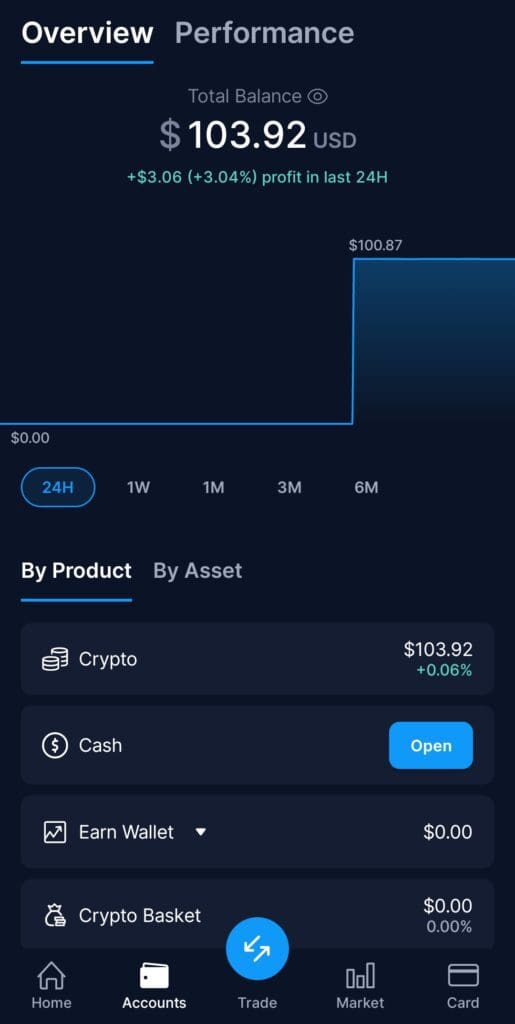

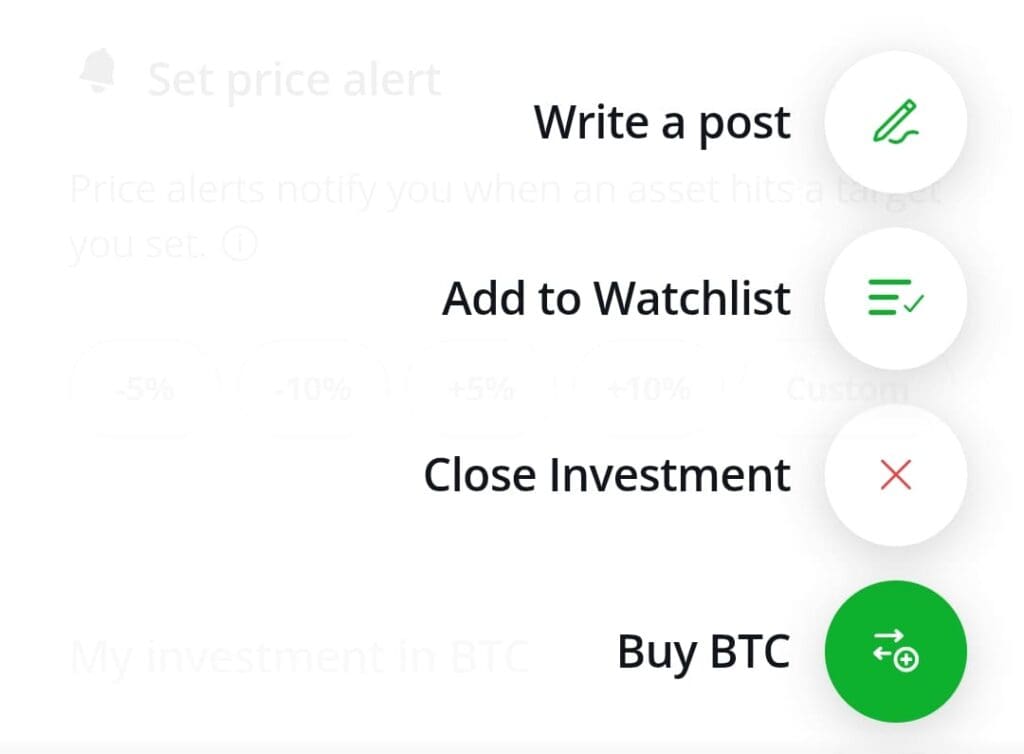

Ease of Use & Mobile App Experience

Crypto.com's intuitive app offers a seamless, mobile-first experience, enabling users to easily buy, sell, and manage +350 cryptocurrencies.

The app supports real-time alerts, price tracking, and simple portfolio management, making it ideal for both beginners and active traders who want everything at their fingertips.

Overall, for pure crypto mobility, Crypto.com wins. But if you want multi-asset investing with social features, eToro's app offers a better experience.

-

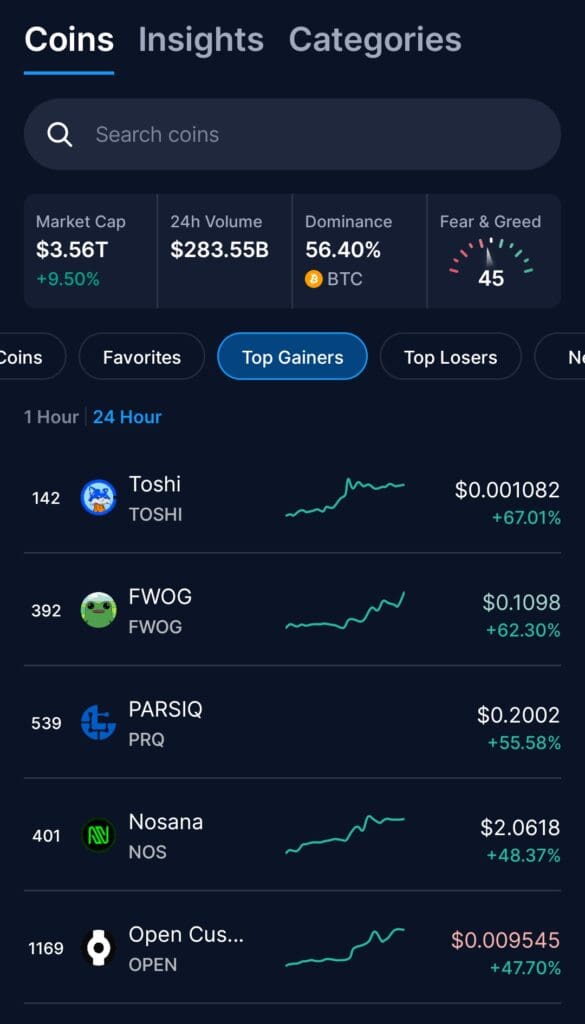

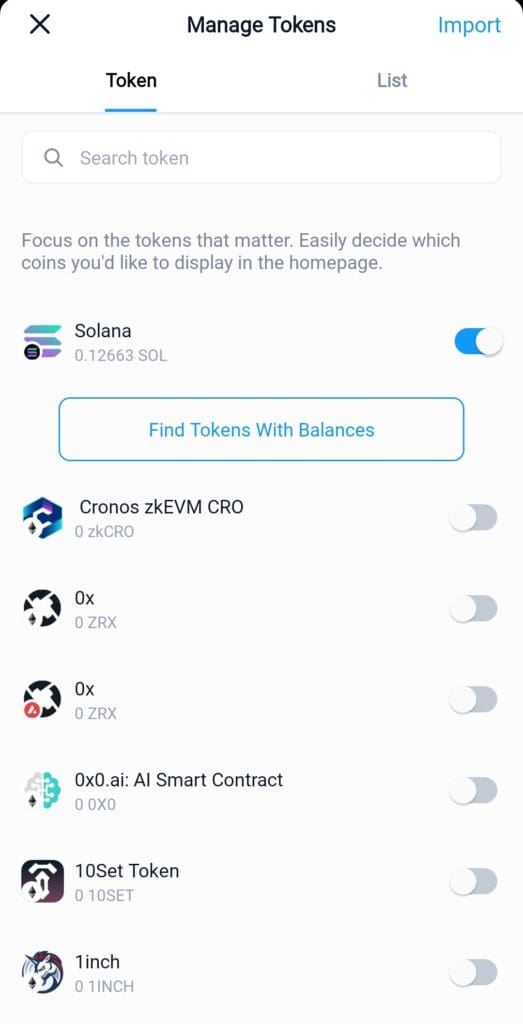

Cryptocurrency Selection

Crypto.com shines with its huge selection of +350 cryptocurrencies, covering Bitcoin, Ethereum, altcoins, stablecoins, and even NFTs.

Investors can explore niche assets or stick to blue-chip coins, while traders benefit from access to new token listings and stablecoin options like USDC and USDT.

eToro offers limited crypto options in the U.S., mainly Bitcoin, Ethereum, and Bitcoin Cash. Although international users get broader access of +25 coins, U.S. investors looking for variety will find it restrictive.

-

DApps and Web3 Integration

Crypto.com heavily invests in Web3 and DeFi ecosystems, offering an OnChain wallet that provides full asset control and direct interaction with decentralized applications (dApps).

Users can buy NFTs, explore blockchain gaming, and stake through DeFi protocols—all within the Crypto.com environment.

eToro offers no direct access to dApps or DeFi services. Users can invest in crypto assets, but they cannot participate in Web3 activities like staking or blockchain gaming directly from the platform.

-

Trading Crypto Features & Experience

Crypto.com provides a web-based Exchange (institutional-only in the U.S.) with advanced order types, real-time charts, API access for bots, and futures trading with up to 10x leverage.

Mobile users also enjoy access to the DCA bot for automated buying, the Trading Arena for competitions, and the Supercharger staking events. It’s ideal for traders who want layered tools without switching platforms.

eToro focuses on social and long-term investing. While it does not offer futures, margin trading, or advanced charting tools for crypto, its strengths lie in CopyTrader, Smart Portfolios, and access to traditional stocks and ETFs alongside crypto.

At the end of the day, for advanced trading and automation, Crypto.com is stronger. However, for easy portfolio investing and social strategies, eToro delivers a simpler experience.

-

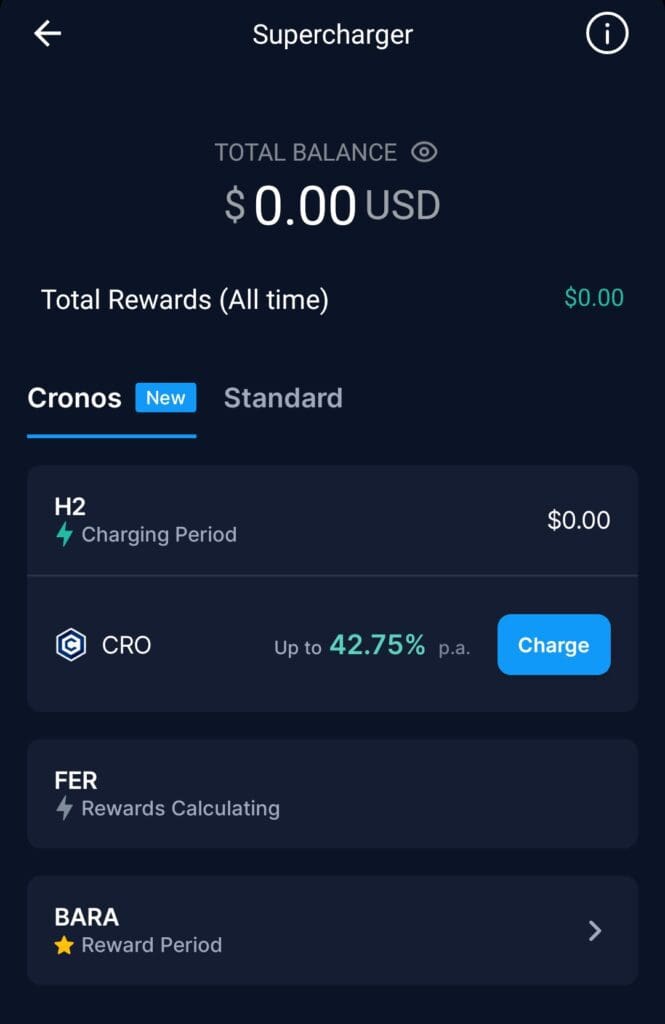

Staking Options and Rewards

Crypto.com offers staking mainly through its Supercharger program and CRO staking.

Supercharger allows users to earn free crypto rewards like Bitcoin or Ethereum by depositing CRO during a charging period, with flexible withdrawal anytime.

However, Crypto.com retains a commission on staking rewards, which usually around 20%.

eToro offers automatic staking for select cryptocurrencies, including Ethereum, Cardano, and Tron.

Rewards are automatically distributed monthly, and investors receive 45%-90% of staking yields, depending on their eToro Club tier.

In summary, for users seeking higher yields and a broader range of staking options, Crypto.com stands out. However, eToro's automated staking appeals to those preferring a hands-off approach.

-

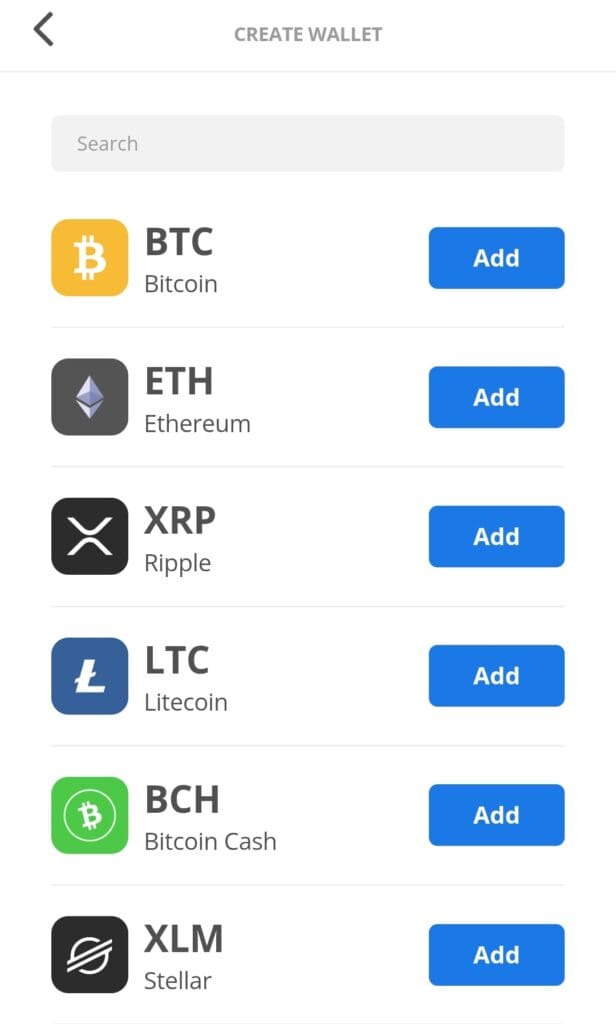

Wallet Options

Crypto.com features the Crypto.com OnChain Wallet, a non-custodial, multi-chain wallet that grants users full control over their private keys.

It supports a wide array of cryptocurrencies and integrates seamlessly with DeFi services, allowing direct interaction with decentralized applications.

On the other hand, eToro offers the eToro Money Crypto Wallet, a custodial wallet designed for ease of use. It supports major cryptocurrencies and allows users to store, send, and receive assets.

However, once crypto is transferred to this wallet, it cannot be moved back to the eToro trading platform.

-

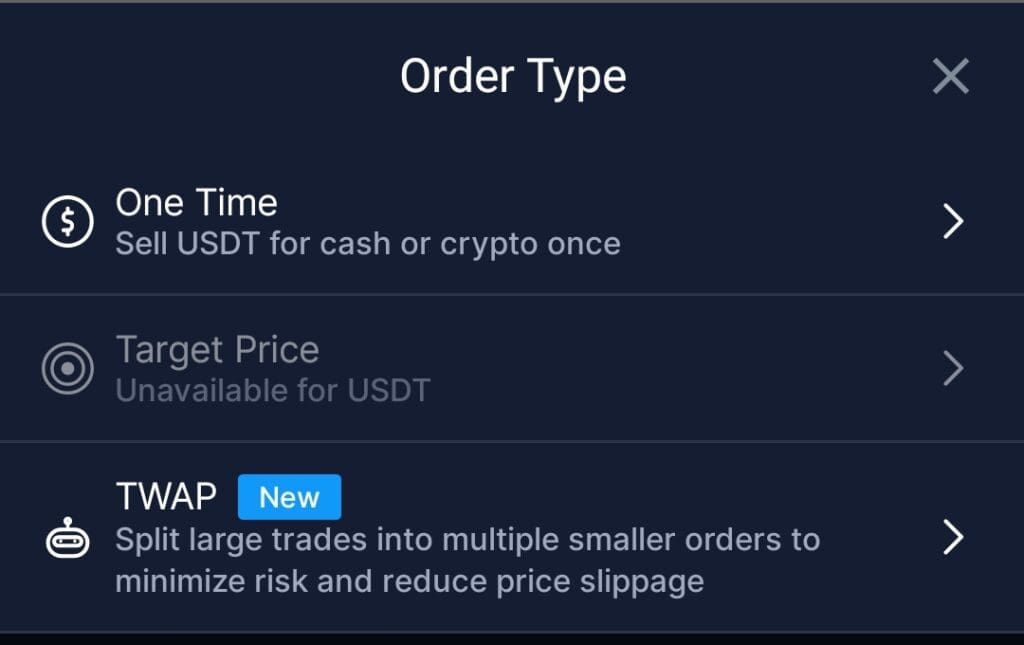

Trading Bots and Automation

Crypto.com provides built-in trading bots, including Dollar-Cost Averaging (DCA), Time-Weighted Average Price (TWAP), and Grid Trading strategies.

These tools enable users to automate trades based on specific strategies, helping them achieve consistent investment approaches and manage market volatility.

eToro does not offer native trading bots. However, third-party platforms like Stoic AI and Cindicator can be integrated to automate trading strategies on eToro.

-

Security Measures And Past Hacks

Crypto.com holds multiple security certifications, including ISO/IEC 27001:2022 and SOC 2 Type II. Implements multi-factor authentication, cold storage for all customer funds, and withdrawal whitelisting.

In 2022, reimbursed users after a $35 million hack and has since enhanced security protocols.

eToro employs two-factor authentication, SSL encryption, and segregates client funds.

In 2024, there was a data breach that exposed partial account information; no funds were lost. Subsequently, eToro strengthened its internal systems and security measures.

Which Investors May Prefer Crypto.com Exchange?

Crypto.com is a strong match for crypto-first investors who want deep market access and flexibility across Web3 and DeFi.

Mobile-First Traders: Those who want an intuitive mobile app to trade, stake, and manage crypto seamlessly while on the go.

Investors Seeking Asset Variety: With 350+ cryptocurrencies, including stablecoins and NFTs, Crypto.com suits users exploring different opportunities.

DeFi and Web3 Enthusiasts: Investors who want to access dApps, NFTs, DeFi staking, and decentralized wallets directly.

Rewards-Driven Users: Those interested in staking CRO for cashback cards, Supercharger rewards, and discounted trading fees.

Crypto.com’s feature-rich ecosystem makes it ideal for users who want more than just basic crypto trading — it opens doors to the broader blockchain economy.

Which Investors May Prefer eToro Crypto?

eToro is a smart fit for beginners and hybrid investors who want crypto exposure alongside stocks, ETFs, and social investing features.

Beginner Investors: Those who prefer a clean, simple interface without needing to manage private keys or complex wallets.

Social Traders: Users who want to copy top-performing crypto traders through the CopyTrader system with just a few clicks.

Multi-Asset Investors: Those looking to combine crypto with stocks, ETFs, and commodities in a single platform.

Hands-Off Stakers: Investors who like automatic staking rewards without actively managing lock-ups or selecting pools.

eToro is best for users who value simplicity, multi-asset access, and social engagement rather than deep crypto specialization.

Bottom Line: Which Platform Excels Where?

Crypto.com excels for serious crypto investors who want asset diversity, DeFi access, and advanced trading tools. It’s also the better choice for users who want a full blockchain experience, beyond just buying coins.

eToro shines for beginner and hybrid investors looking for a simple way to invest in crypto, stocks, and ETFs together while benefiting from copy trading and passive staking.

Choosing between them depends on whether you want in-depth crypto tools or simple investing.