While the global crypto market is full of exchanges offering various features, not all of them operate under strict U.S. regulations.

Here at The Smart Investor, we’ve carefully rated and reviewed the best crypto trading platforms that cater specifically to U.S. users.

Here’s a concise summary of our top picks:

Platform | Coins | Spot Trading Fee | U.S. Status | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | Available

Not available in New York. Some services, like web based trading platform, margin trading and staking, are also restricted for U.S. users. Despite these limitations, U.S. users can still use the Crypto.com Visa Card, earn rewards, and trade through the mobile app.

| All-in-One Crypto Services |

|---|---|---|---|---|

Binance.US | +120 | 0.10%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0.04%. Users who pay fees using Binance Coin (BNB) receive a 25% discount | Available

In 46 states, not including New York, Texas, Hawaii, and Vermont. Some advanced features like margin trading, futures, and the full range of staking options are unavailable | Active Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Available

In 46 states, not including New York, Texas, Hawaii, and North Carolina. Some advanced features like staking options are unavailable | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Available

Fully available in all 50 U.S. states. Derivatives trading and Staking Pro are currently unavailable in the U.S., and the Gemini Earn lending program was shut down due to legal issues with the SEC. | Compliance & Regulation |

Robinhood | +20 | $0 | Available | Fee-Free Trading |

Cash App | 1 (Bitcoin) | $0 | Available | Bitcoin-Only Investors |

In this guide, we break down the best crypto trading platforms for Americans, helping you trade confidently while staying compliant with U.S. laws. Let’s dive in.

Coinbase Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%.

-

Overview

- FAQ

- Platform at a Glance

Coinbase is one of the best crypto exchanges for U.S. residents, offering a platform that is fully compliant and regulated within the United States. As one of the largest U.S.-based exchanges, Coinbase adheres to strict regulations.

For U.S. residents, Coinbase offers a wide range of cryptocurrencies, including popular assets like Bitcoin (BTC), Ethereum (ETH), and USD Coin (USDC), along with various altcoins and stablecoins.

Coinbase is also a great choice for beginners due to its simple and intuitive interface, making it easy for new users to buy, sell, and store crypto securely.

Additionally, for more experienced traders, Coinbase Advanced Trade provides access to advanced tools like real-time charts and lower trading fees based on your 30-day volume.

Coinbase also offers access to staking rewards and easy funding options with bank accounts, debit cards, and PayPal, ensuring a seamless experience for users in the U.S.

What is the minimum amount I can trade on Coinbase?

The minimum trade amount on Coinbase is $1, making it accessible for users with smaller budgets.

Is Coinbase regulated?

Yes, Coinbase is fully regulated in the U.S. and complies with KYC and AML regulations to ensure a secure and legal platform for users.

Can I earn crypto on Coinbase?

Yes, you can earn cryptocurrency by participating in Coinbase Earn, where you watch videos and complete quizzes to earn crypto rewards.

Can I use Coinbase for retirement accounts?

Coinbase does not directly offer retirement accounts, but you can access crypto through services like Alto CryptoIRA, which allows you to invest in crypto assets within a self-directed IRA. Check with Alto for eligibility and fees.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Higher Fees |

User-Friendly Interface | Limited Advanced Features for Experienced Traders |

Strong Security Features | Customer Support Challenges |

Regulatory Compliance | Limited Privacy |

Mobile and Desktop Accessibility | Crypto Withdrawal Network Fees |

Educational Resource |

Crypto.com Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

- Platform at a Glance

Crypto.com is a fully compliant and regulated crypto exchange in the U.S., making it a secure and trusted choice for American traders and investors.

With support for 350+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and major altcoins, Crypto.com offers one of the largest selections of digital assets for U.S. users.

The Crypto.com mobile app is the main trading platform for U.S. retail investors, providing a seamless experience for buying, selling, and managing crypto. It also integrates features like Crypto Earn, Supercharger rewards, and the Crypto.com Visa Card, which offers up to 5% cashback in CRO.

Fiat deposits and withdrawals are supported via ACH, wire transfers, and SEPA, making it easy for U.S. users to fund their accounts.

However, margin and futures trading are not available for U.S. retail users, and the web-based Crypto.com Exchange is limited to institutional investors.

Is Crypto.com available in New York?

No, Crypto.com is not available to residents of New York due to state regulations.

How long do fiat withdrawals take on Crypto.com?

Fiat withdrawals typically take 1-5 business days, depending on the method used.

How does the Crypto.com Visa Card work?

The Crypto.com Visa Card allows users to spend crypto and earn cashback rewards (up to 5%) in CRO. Higher rewards are available for those who stake more CRO.

What is the Crypto.com Trading Arena?

The Trading Arena is a feature where users can compete in trading competitions to win crypto rewards and prizes.

Pros | Cons |

|---|---|

Wide Selection of Cryptocurrencies | Limited Access for U.S. Users |

Competitive Trading Fees | High Fees for Credit/Debit Card Purchases |

Strong Security & Compliance | Crypto Withdrawals Can Be Expensive |

Feature-Rich Ecosystem | No Staking for U.S. Users |

Seamless Mobile Experience | |

Institutional-Grade Storage & Trading |

Gemini Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%.

-

Overview

- FAQ

- Platform at a Glance

Founded in 2014, Gemini is licensed in all 50 U.S. states and operates under the strict oversight of the New York State Department of Financial Services (NYSDFS). This makes it one of the most compliant and trusted crypto platforms in the U.S.

For U.S. traders, Gemini’s ActiveTrader platform provides lower trading fees, high-speed execution, and advanced charting tools, making it ideal for both active traders and long-term investors.

Security is a major advantage of Gemini, as it is SOC 2 Type 2 and ISO 27001 certified, ensuring institutional-grade protection. It offers two-factor authentication (2FA), withdrawal whitelisting, insured hot wallets, and offline cold storage to keep funds safe.

For those interested in NFTs, Gemini owns Nifty Gateway, providing a secure way to buy, sell, and store digital collectibles.

How do I deposit money into Gemini?

You can deposit fiat money using ACH transfers, wire transfers, or debit cards. Crypto deposits are also available. ACH and wire transfers are free, but debit card deposits have a fee.

Does Gemini offer a credit card?

Yes, the Gemini Credit Card allows users to earn up to 3% cashback in crypto on purchases with no annual fees. Rewards are instantly converted into the cryptocurrency of your choice.

Does Gemini have customer support?

Yes, Gemini provides email and chat support, but it does not offer live phone support, which some users find inconvenient.

Is Gemini regulated by the SEC?

Gemini is regulated by the NYSDFS (New York State Department of Financial Services) but has had legal issues with the SEC regarding its Earn program.

Does Gemini charge inactivity fees?

No, Gemini does not charge inactivity fees. However, storing assets on the exchange does not generate interest, so some users prefer to transfer funds to external wallets.

Can I stake my crypto on Gemini?

Yes, Gemini supports staking for Ethereum (ETH) and Polygon (MATIC). Solana (SOL) is also available for non-U.S. users. However, Gemini’s staking rewards are lower than other exchanges and charges a 15% staking fee.

Can I use Gemini for crypto lending?

No, Gemini’s Earn program was shut down due to regulatory issues, and users are no longer able to lend crypto for interest. Other lending platforms, like Nexo or BlockFi, offer similar services, but always research risks before lending crypto.

How long do Gemini withdrawals take?

Crypto withdrawals are usually processed within minutes, depending on network congestion. Fiat withdrawals via ACH take 4-6 business days, while wire transfers are typically completed within 24 hours.

What happens if I send crypto to the wrong address on Gemini?

Unfortunately, crypto transactions are irreversible. If you send funds to the wrong address, Gemini cannot recover them, so always double-check wallet addresses before sending crypto.

Pros | Cons |

|---|---|

Strong Security & Compliance | High Trading Fees |

Available in All 50 U.S. States | Limited Crypto Selection Compared to Competitors |

Beginner & Advanced Trading Options | Limited Staking Options |

NFT & Web3 Integration | Mixed Customer Support Reputation |

Crypto Rewards Credit Card | Complicated Fee Structure |

Institutional-Grade Storage & Trading |

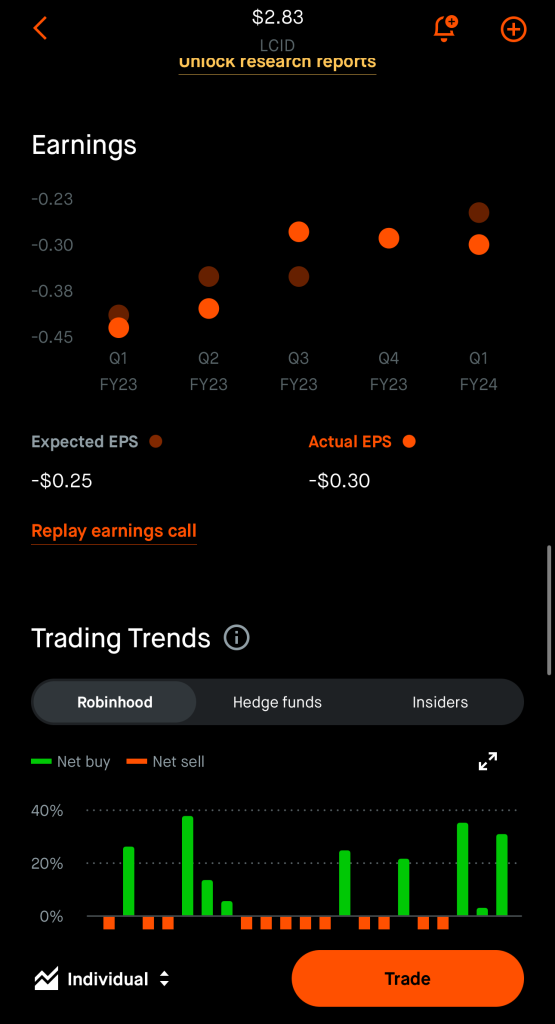

Robinhood

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

- Platform at a Glance

Robinhood stands out as one of the best crypto exchanges for U.S. residents, offering a fully regulated and compliant platform for trading digital assets.

One of Robinhood’s biggest advantages is its commission-free trading model, allowing users to buy and sell popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and several others without paying additional fees.

U.S. residents benefit from features like instant deposits, a dedicated Robinhood crypto wallet for secure storage and transfers, and Robinhood Connect, which enables easy funding and interaction with decentralized applications (dApps).

For U.S. investors seeking a user-friendly, cost-effective, and legally compliant way to trade cryptocurrencies, Robinhood is one of the best options available.

Does Robinhood offer a crypto wallet?

Yes, Robinhood provides a crypto wallet that allows users to send, receive, and store their digital assets securely.

Can I withdraw cryptocurrency from Robinhood?

Yes, Robinhood allows crypto withdrawals to external wallets through its Robinhood Crypto Wallet feature.

What is Robinhood Connect?

Robinhood Connect is a feature that allows users to fund their crypto wallets with USDC and interact with decentralized applications (dApps).

How secure is Robinhood Crypto?

Robinhood uses industry-standard security measures like two-factor authentication (2FA) and encryption to protect user accounts and funds.

Pros | Cons |

|---|---|

Fractional Shares, Crypto Access | Lacking Mutual Funds and Bonds |

Advanced Charting And Research Tools

| No Automated Investing |

Robinhood Gold Features | No Advisory Services |

IPO Access | Reliability Issues |

Manage Retirement Accounts |

Binance.US Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

- Platform at a Glance

As a U.S.compliant exchange, Binance.US is registered with the Financial Crimes Enforcement Network (FinCEN) and follows regulations required by U.S. authorities. .

One of the standout features of Binance.US is its low trading fees, with maker/taker fees starting at 0.10%, which are among the most competitive in the industry. The platform also offers zero-fee trading for Bitcoin and Ethereum on select pairs.

Binance.US supports over 120 cryptocurrencies and provides a staking feature for over 20 coins.

Despite some limitations—like the absence of futures and margin trading – Binance.US’s low fees, user-friendly interface, and regulatory compliance make it a strong platform for U.S. residents looking for a reliable and secure crypto exchange.

Is Binance.US available in all U.S. states?

No, Binance.US is unavailable in states like New York, Texas, and Hawaii due to regulatory restrictions.

Can I use Binance.US to buy crypto with a credit card?

No, Binance.US does not support purchasing crypto with a credit card, but you can use ACH transfers, debit cards, or crypto deposits.

How long does account verification take?

Account verification can take anywhere from a few days to a week, depending on the volume and the clarity of the documents provided.

Does Binance.US offer margin or futures trading?

No, Binance.US currently does not offer margin or futures trading. It only supports spot trading.

How do I withdraw funds from Binance.US?

You can withdraw funds via ACH, wire transfer, or by sending cryptocurrencies to an external wallet.

Can I use Binance.US for margin trading?

No, Binance.US does not offer margin trading, which means you can’t trade with leverage. If you’re looking for margin trading, you may want to consider other platforms like Kraken or Gemini.

How long does it take to verify my Binance.US account?

Account verification can take anywhere from a few days to a week, depending on the volume of applications and the accuracy of the information provided. Be sure to upload clear images of your ID to avoid delays.

What is the minimum deposit required on Binance.US?

The minimum deposit varies based on the payment method. For ACH transfers, there’s no minimum deposit, while debit card deposits may have different requirements. However, cryptocurrency deposits have no minimum.

Are my assets safe on Binance.US?

Binance.US uses industry-standard security measures, such as two-factor authentication (2FA) and cold storage for most of its assets. The platform has never been hacked, and your U.S. dollar deposits are FDIC-insured up to $250,000.

What’s the difference between Binance and Binance.US?

Binance.US is the U.S. version of Binance, created to comply with U.S. regulations. While both offer similar features, Binance.US has fewer cryptocurrencies and lacks certain services like margin trading and futures trading that are available on Binance.

Pros | Cons |

|---|---|

Low Trading Fees | No Margin or Futures Trading |

Wide Selection of Cryptocurrencies | Slow Verification Process |

Staking Rewards | Lack of NFT and Web3 Features |

High Security Standards | Regulatory Scrutiny |

Advanced Trading Features | Limited Customer Support |

User-Friendly Mobile App |

The Importance of Regulation: What Makes a Crypto Exchange Legal in the U.S.?

Crypto exchanges operating in the U.S. must comply with strict regulatory frameworks to ensure security, transparency, and consumer protection.

To be legally recognized, exchanges must register with FinCEN (Financial Crimes Enforcement Network) as a Money Services Business (MSB) and adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Additionally, some exchanges comply with Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) guidelines, especially if they offer securities or derivatives like futures trading.

State-level regulations also play a role, with exchanges needing licenses in certain states, such as the New York BitLicense.

Choosing a regulated exchange ensures legal protection, secure asset storage, and adherence to financial laws, reducing risks associated with fraud and hacking.

U.S. Residents: How To Choose a Crypto Exchange?

Choosing the right crypto exchange as a U.S. resident requires careful consideration of security, fees, regulatory compliance, and available features:

- Regulatory Compliance

Ensure the exchange is registered with FinCEN and follows AML (Anti-Money Laundering) and KYC (Know Your Customer) policies.

Exchanges operating in certain states, like New York, may also require a BitLicense, which adds an extra layer of compliance and security.

- Security Measures

Look for exchanges with strong security features, such as two-factor authentication (2FA), cold storage for funds, and insurance policies for digital assets. Avoid platforms with a history of security breaches.

- Fees & Trading Costs

Compare trading fees, withdrawal costs, and deposit fees. Some exchanges, like Binance.US and Kraken, offer low-cost trading, while platforms like Coinbase may have higher fees but provide an easier user experience.

- Supported Cryptocurrencies

If you want access to a diverse portfolio, choose an exchange that supports a wide range of cryptocurrencies, not just Bitcoin and Ethereum.

- User Experience & Customer Support

For beginners, exchanges with an intuitive interface like Coinbase or Gemini are ideal. Ensure the platform offers responsive customer support in case of issues.

- Payment Methods & Fiat Support

Some exchanges allow direct deposits via bank transfers, credit/debit cards, PayPal, or Apple Pay, while others may have limited options. Choose an exchange that supports your preferred payment method and offers fast withdrawals.

- Liquidity & Trading Volume

Higher liquidity means better price execution and tighter bid-ask spreads. Major platforms like Kraken, Binance.US, and Coinbase tend to have high trading volumes, making it easier to execute large trades efficiently.

- Additional Features (Staking, Rewards, & DeFi Integration)

Some exchanges offer staking rewards, crypto lending, and DeFi access. If you want to earn passive income or explore decentralized finance, choose an exchange that provides these options, such as Crypto.com or Gemini Earn.

How To Open An Crypto Account As A U.S. Residents?

Opening a crypto trading account in the U.S. is a straightforward process, but it requires compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Follow these steps to get started:

1. Choose a Regulated Crypto Exchange

Select a platform that is legally compliant in the U.S., such as Coinbase, Kraken, Binance.US, or Gemini. Ensure it aligns with your trading needs, such as fees, security, and available cryptocurrencies.

2. Sign Up & Verify Your Identity

Create an account using your email and phone number. Most exchanges require government-issued ID (passport or driver’s license) and sometimes proof of address for KYC verification.

3. Secure Your Account

Enable two-factor authentication (2FA) and set up strong passwords to protect your funds.

4. Fund Your Account

Deposit money via bank transfer, debit card, ACH, or wire transfer to start trading. Some platforms also accept PayPal or Apple Pay.

5. Start Trading & Storing Safely

Once funded, you can buy, sell, and trade crypto. Consider transferring assets to a secure wallet for long-term storage.

Crypto Exchange Fees: What to Watch Out For

Crypto exchanges charge various fees that can impact your overall trading costs. Understanding these fees is crucial to making cost-effective trades. Here’s what to watch out for:

- Trading Fees (Maker & Taker Fees)

Most exchanges use a maker-taker fee model, where:

- Maker fees apply when you provide liquidity by placing limit orders.

- Taker fees apply when you take liquidity by executing market orders.

Typically, taker fees are higher than maker fees, ranging from 0.1% to 0.5% per trade depending on the platform.

- Deposit & Withdrawal Fees

- Fiat Deposits: Some platforms charge fees for depositing USD via bank transfer, wire, or debit/credit cards. ACH transfers are usually free, while card deposits can cost 2-4%.

- Crypto Withdrawals: Exchanges charge varying fees for sending crypto to external wallets, which depend on the network (e.g., Bitcoin or Ethereum).

- Spread Fees & Hidden Costs

Some exchanges, like Robinhood and PayPal, do not charge direct trading fees but add a markup to the asset price (spread). This can increase costs unknowingly for traders.

- Inactivity & Account Fees

A few platforms charge fees for dormant accounts or low-balance holdings. Always check the exchange’s terms.

- Staking & Lending Fees

If you stake crypto to earn rewards, some exchanges take a percentage of your staking earnings.

FAQ

Yes, most exchanges require government-issued ID and sometimes proof of address to comply with KYC laws.

No, most regulated exchanges require identity verification, but decentralized exchanges (DEXs) allow trading without KYC.

Most exchanges accept bank transfers (ACH/wire), debit/credit cards, PayPal, and sometimes Apple Pay.

Yes, some platforms like Coinbase, Kraken, and Crypto.com offer staking, but rewards may vary.

Yes, but many exchanges charge high fees (2-4%) for card transactions. Bank transfers are usually cheaper.