Table Of Content

What Is eToro Copy Trading?

eToro Copy Trading is a social trading feature that allows users to automatically replicate the positions of top-performing traders in real time.

This tool is designed for those who want exposure to trading strategies without actively managing trades themselves.

By selecting a trader to follow, your account mirrors their moves proportionally, including entry and exit points. It’s especially popular among beginners or passive investors looking to learn or diversify.

According to eToro, over 30 million users have joined the platform, with Copy Trading being one of its most popular offerings.

How to Set Up Copy Trading on eToro

To make the most of eToro’s Copy Trading, it’s essential to approach setup with a strategy. Here’s how to do it right:

1. Start With a Clear Investing Goal

Before choosing traders to copy, define your objective. Are you aiming for steady long-term growth, short-term gains, or exposure to specific sectors like crypto or tech?

Your goal should guide how much risk you’re comfortable with and what kind of traders to look for. For example, growth-focused investors may want to follow traders with a strong track record in tech stocks, while income-focused users might prioritize those with stable portfolios and lower risk scores.

Examples of goal alignment:

Conservative investors may prefer diversified portfolios with low drawdowns.

Aggressive traders might follow high-risk, high-reward crypto-focused profiles.

Passive investors may want consistent performers with low turnover and less activity.

2. Explore and Filter Top Traders on eToro

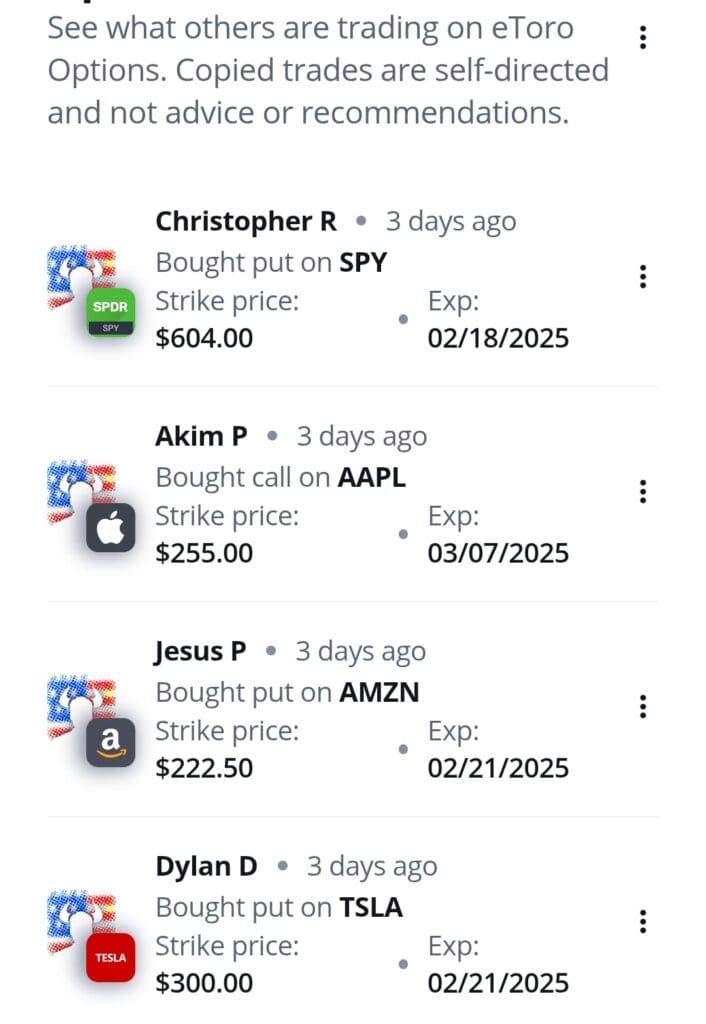

Use eToro’s “Copy People” section to search and filter traders based on performance, risk score, portfolio composition, and trading activity.

You can sort traders by 12-month returns, average holding time, risk score, and even by country or assets they invest in. Also, read their bio, strategies, and recent posts to better understand their approach.

Filters you can apply:

Performance: Choose traders with consistent monthly/annual gains over time.

Risk Score: A range of 3–6 is ideal for balanced risk.

Assets Traded: Make sure their portfolio matches your interests (e.g., U.S. equities, crypto, ETFs).

Active Months: Look for traders with at least 12 months of history to reduce surprises.

Allocate Funds and Set Copy Parameters

Once you’ve chosen a trader, click “Copy” and set your investment amount — the minimum is usually $200 per trader. You’ll also see the option to copy open trades or only new ones.

Additionally, eToro lets you set a stop-loss to limit your risk. For example, you can choose to stop copying if your investment drops by 20%. You can always pause or adjust your allocation later.

Helpful options to enable:

Copy Open Trades: Ideal if you trust their current positions.

Only New Trades: Good if you want to mirror future actions only.

Stop Copying: You can exit or rebalance anytime without penalty.

Add More Funds: Increase exposure to successful traders with additional capital.

4. Track Performance and Rebalance Regularly

Your work doesn’t end after copying. You should periodically review each trader’s performance, especially during market shifts.

eToro provides a breakdown of your copy investments, showing gains, asset allocation, and risk. If a trader changes strategies or starts underperforming, don’t hesitate to pause copying or reallocate to someone else. Successful copy trading requires some oversight.

Things to review monthly:

Profitability Trends: Consistent performance or signs of volatility?

Portfolio Shifts: Did they switch from stocks to crypto or vice versa?

Communication: Do they post insights or remain inactive?

By staying involved, you ensure your copy trading stays aligned with your original investment goals.

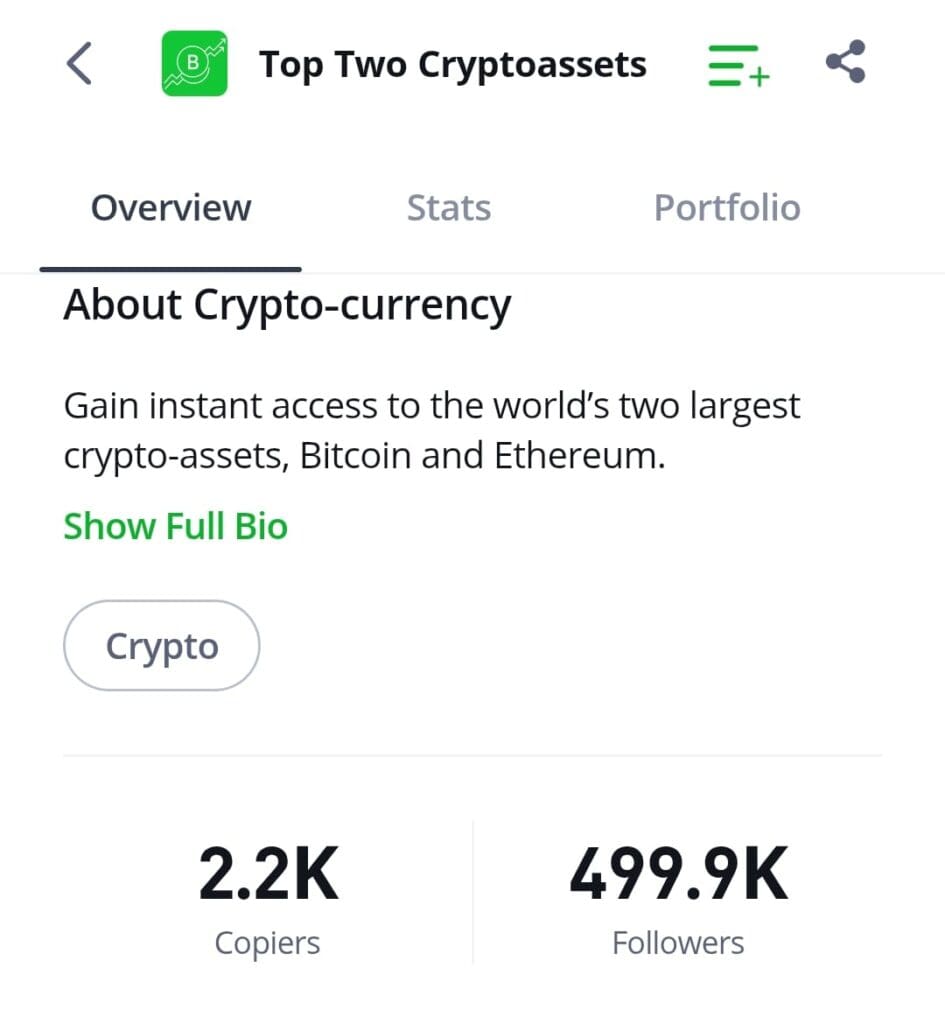

eToro CopyTrader vs. Smart Portfolios

CopyTrader lets you mirror the trades of individual investors in real time, offering flexibility and personalization based on your preferences.

In contrast, Smart Portfolios (formerly CopyPortfolios) are curated by eToro’s investment team and focus on specific themes or sectors, like tech or crypto.

While CopyTrader is ideal for following real traders with proven records, Smart Portfolios offer a more hands-off, diversified approach.

Here's how they compare:

How to Choose the Best Traders to Copy

To copy trade successfully, you need to assess a trader’s track record, strategy, and risk profile carefully.

Review Performance Over Time: Look for consistent gains over at least one to two years rather than short bursts of high returns. For example, a trader who performed well across bull and bear markets may indicate better risk control.

Check Risk Scores: eToro assigns a risk score (1 to 10) to each trader. Aim for a range between 3 and 6 for balanced performance without extreme volatility.

Diversify Across Strategies: Copying multiple traders in different sectors or asset classes (e.g., one in crypto, another in stocks) can help you spread risk.

Monitor Their Activity and Communication: Active traders who explain their moves often give better transparency. Frequent updates suggest engagement and strategic thinking.

Study Portfolio Composition: A trader heavily concentrated in one or two assets might be riskier. Balanced portfolios with varied assets show more strategic planning.

Pros and Cons of eToro Copy Trading

Copy Trading can be useful for beginners and hands-off investors, but it still carries risks and limitations.

- Potential for Herding Behavior

Beginner-Friendly Entry Point: It allows new investors to participate in markets without in-depth experience.

- Time-Efficient Strategy

You don’t need to research or manage trades manually — the system mirrors chosen traders for you.

- Transparency and Data Access

You can review each trader’s portfolio, performance stats, and past trades before copying them.

- Built-In Risk Management

eToro allows you to set stop-loss limits, pause copying, or remove funds at any time.

- Past Performance Doesn’t Guarantee Future Returns

Even top-ranked traders can have losing streaks, especially in volatile markets.

- Limited Strategy Control

You can't customize specific trades — you're copying their entire portfolio, including their risk tolerance.

- Over-Reliance on Individuals

If a copied trader stops trading or changes strategy, it may impact your portfolio unexpectedly.

- Potential for Herding Behavior

Popular traders may attract too many followers, diluting performance or prompting irrational trading patterns.