E*TRADE

Monthly Fee

Minimum Deposit

Our Rating

APY Cash Account

-

Overview

- FAQ

E*TRADE is an online brokerage platform that allows individuals to invest in stocks, bonds, mutual funds, ETFs, and other financial instruments. It has been around for many years and it has long been considered one of the most popular online brokerages. With $0 commissions, it offers a well rounded trading experience that will satisfy most investors.

From the complete newbie who can benefit from the vast selection of educational resources to the strong trading platform that draws the experienced trader, this platform is a full service and reliable broker with a mixture of easy to use, yet very insightful tools.

So, in this review, we’ll get into the details of what makes Etrade one of the best platforms and where there are some areas that may determine that is not the right choice for you.

What types of accounts does E*TRADE offer?

E*TRADE offers various account types, including individual and joint brokerage accounts, retirement accounts (IRAs), custodial accounts, and business accounts like solo 401(k) and SEP IRAs.

Does E*TRADE offer managed portfolios?

Yes, E*TRADE offers several managed portfolio options, including Core, Blend, Dedicated, and Fixed Income Portfolios, each with different minimum balances and advisory fees.

What types of securities can I trade on E*TRADE?

E*TRADE allows trading in stocks, ETFs, mutual funds, options, bonds, and futures. However, it does not support forex or cryptocurrency trading.

What is the Power E*TRADE platform?

Power E*TRADE is an advanced trading platform offering tools like advanced charting, risk analysis, and complex options trading. It is designed for active and experienced traders.

Does E*TRADE have an account closure fee?

E*TRADE does not charge an annual or inactivity fee, but there is a $75 fee for fully transferring an account out.

How can I contact E*TRADE customer service?

E*TRADE customer service can be reached via phone, email, and live chat. The service is available 24/7, though response times may vary.

What educational resources does E*TRADE provide?

E*TRADE offers a range of educational resources, including webinars, articles, courses, and videos to help investors improve their knowledge and strategies.

Can I trade cryptocurrency on E*TRADE?

No, E*TRADE does not offer cryptocurrency trading.

Pros | Cons |

|---|---|

No Commissions for Stocks and ETFs | No Fractional Shares |

Wide Range of Investment Options | No Cryptocurrency Trading or Forex Trading |

Advanced Trading Tools | Higher Fees for Account Transfers |

Competitive Savings And Checking | $1K Minimum Balance For Real-Time Data |

Automated Investing Based On Questionnaire |

E*TRADE Features I Mostly Liked

Here are the key features that I found most appealing in E*TRADE:

-

The Core Portfolios

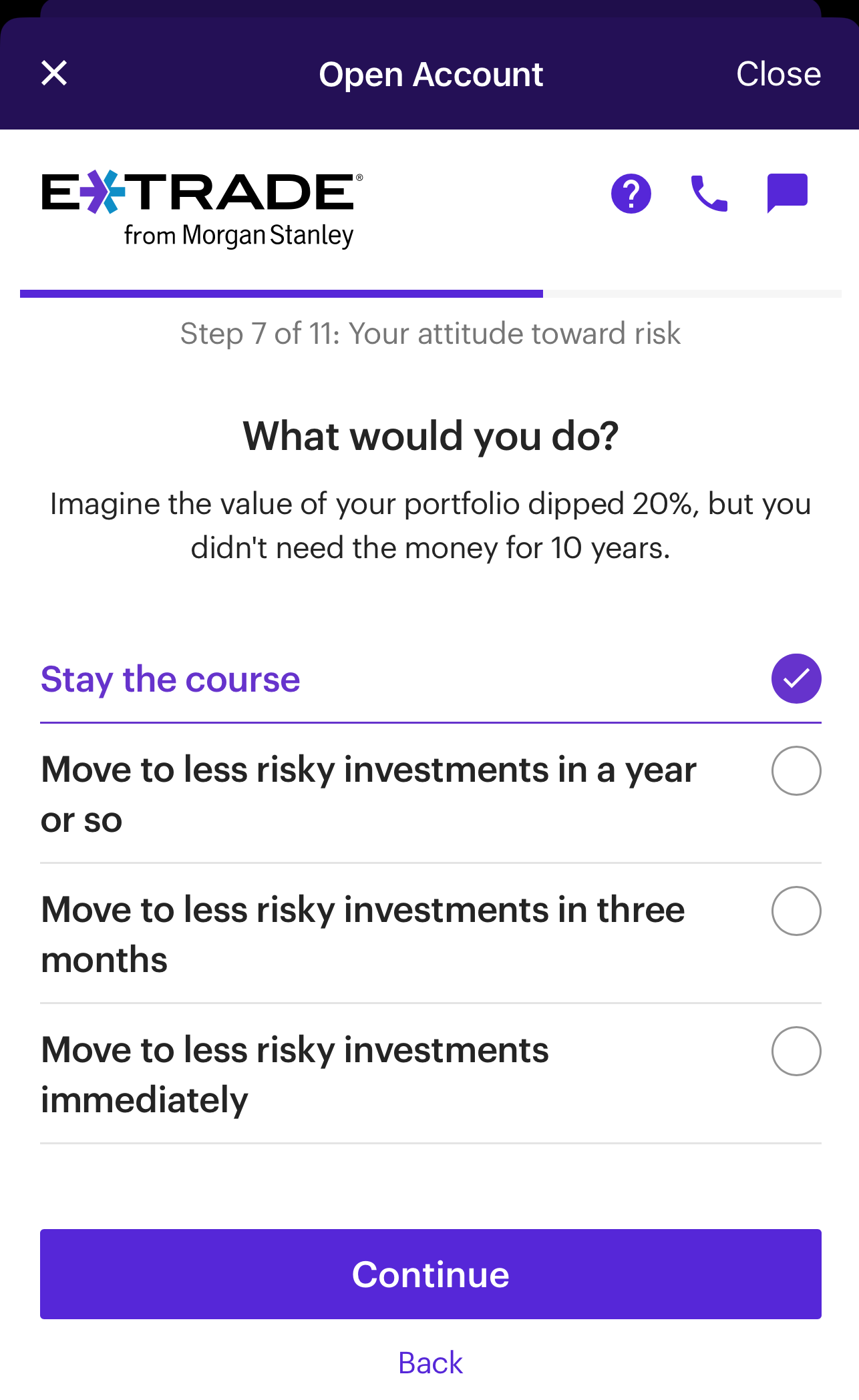

One of the key features of Etrade is the automated investment management with Core Portfolios. This pairs expert input with automated technology that takes care of my day to day investing.

However, what I really liked is that when my goals change, this feature makes it easy to adjust my strategy.

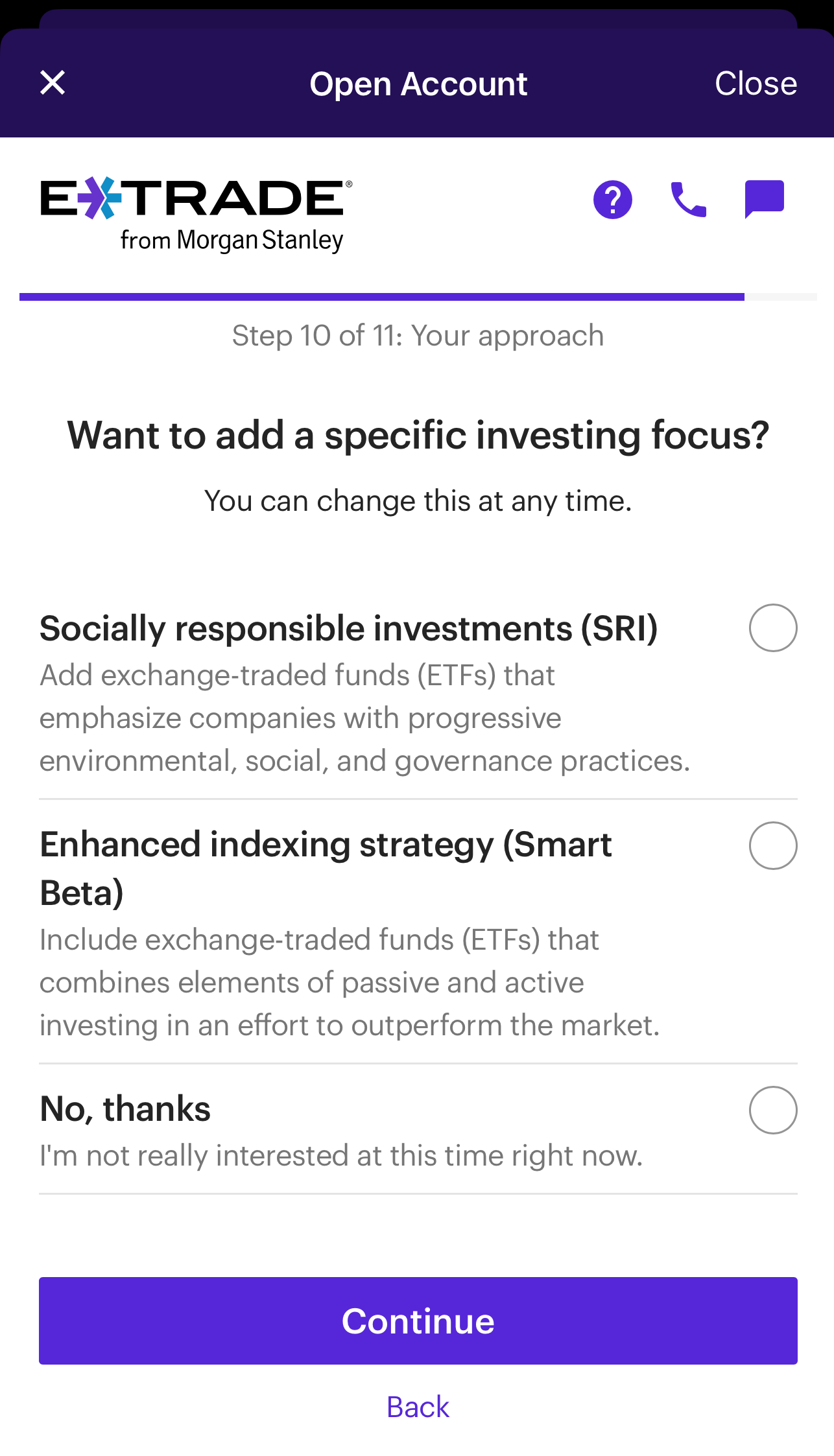

The Core Portfolios creates a plan that is customized to my goals. As you can see in the screenshot above, I just needed to answer a couple of questions and Etrade handles the rest. I can even specify a focus for my investing, including socially responsible investing.

Once my Core Portfolio set up was complete, I could relax knowing that Etrade would track my investments each day and automatically rebalance to keep everything on track to meet my goals.

The annual advisory fee of 0.30%.

-

Buy Stocks, ETFs, Bonds and Options

ETRADE's self-investing platform allows users to take control of their investments by providing a comprehensive suite of tools and resources. Investors can trade a wide range of securities, including stocks, ETFs, mutual funds, options, and bonds.

ETRADE offers two main platforms for self-investing. The basic ETRADE Web platform is ideal for everyday investors, providing essential tools and resources for managing investments.

For more active traders, the Power ETRADE platform offers advanced features such as technical analysis, customizable options chains, and risk management tools. Additionally, ETRADE's mobile apps allow for trading on the go, with many of the same functionalities as the desktop platforms.

-

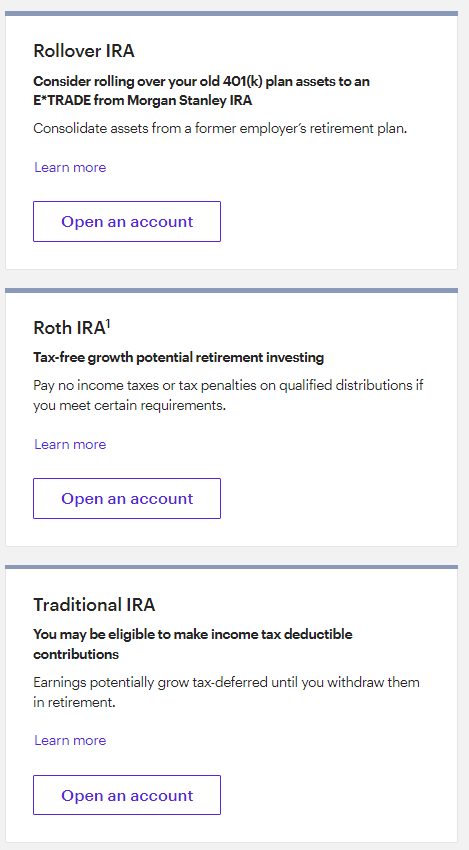

Variety of Retirement Accounts

One of the limitations of many trading platforms is that there are usually limited retirement accounts. However, Etrade has a nice selection. There are traditional and Roth IRAs, but also Rollover, Beneficiary and IRAs for minors. Etrade also has its Etrade Complete IRA.

This is designed for investors over 59 1/2 years old and it provides immediate access to IRA savings with anytime withdrawals with no delays or forms to complete. There is even a free debit card and online bill payment with this account.

There are no annual fees or account minimums with Complete IRA and you can upgrade from any existing Etrade retirement account.

-

The Premium Savings Account

Etrade clients can also access a Premium Savings Account. This is offered via Morgan Stanley Private Bank and it provides up to 10x the national average savings rate.

There are no minimum deposit requirements and you can benefit from FDIC protection for balances up to $500,000.

This account is ideal for building an emergency fund and there are some useful free tools. There are no minimum monthly account fees and I can manage my account on the go via the Etrade mobile app.

-

Impressive Resource Library

Etrade has a collection of hundreds of articles that can guide you through every stage of an investment journey.

What I found useful was that the articles are divided into sensible sections, so I didn’t need to wade through lots of newbie articles to find information that was of interest to me.

While offering some articles for complete beginners is not unusual, the fact that Etrade offers articles on more advanced investing topics makes it far more user friendly. Essentially, the resource library can take you from complete newbie to experienced trader.

-

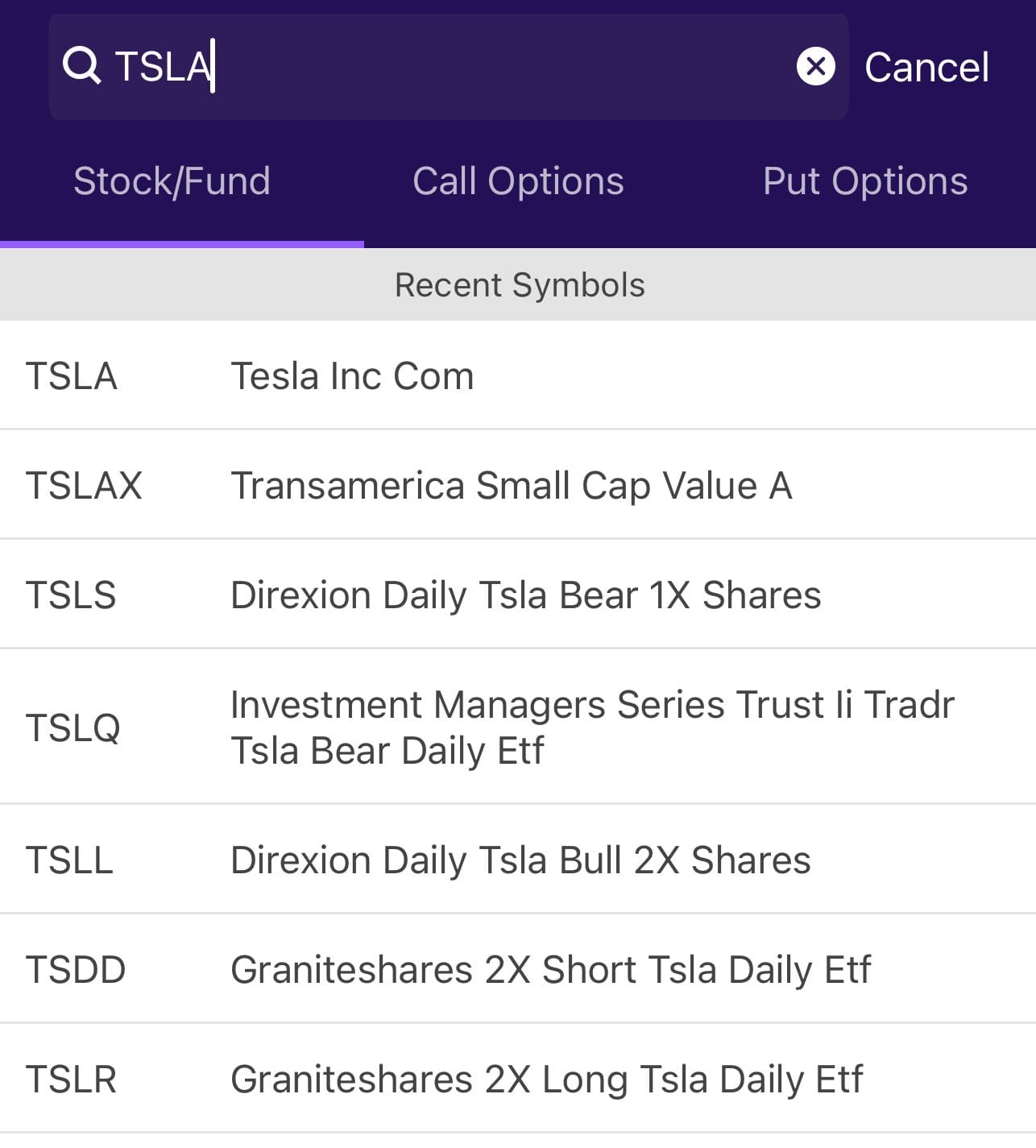

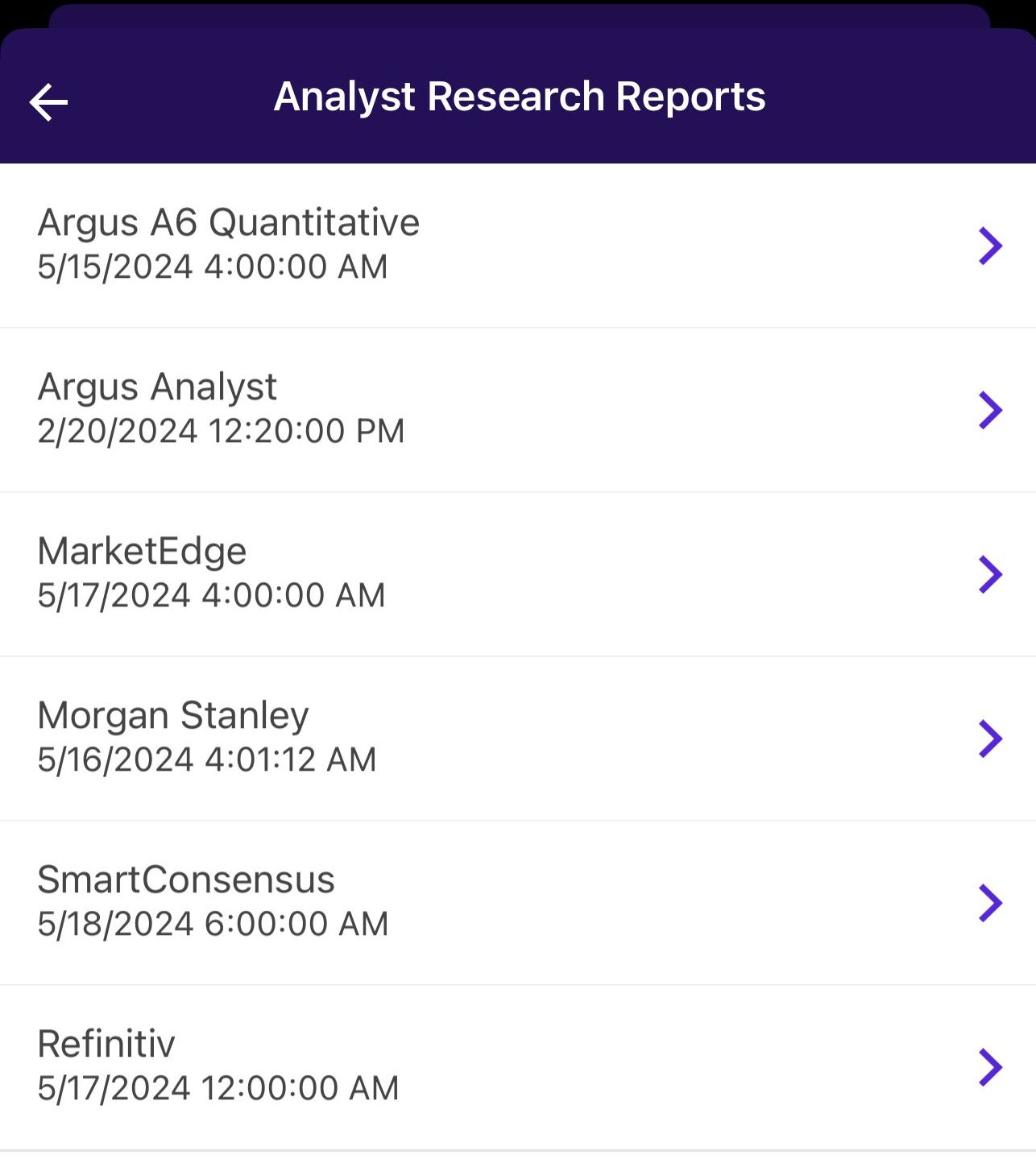

The Research Tools

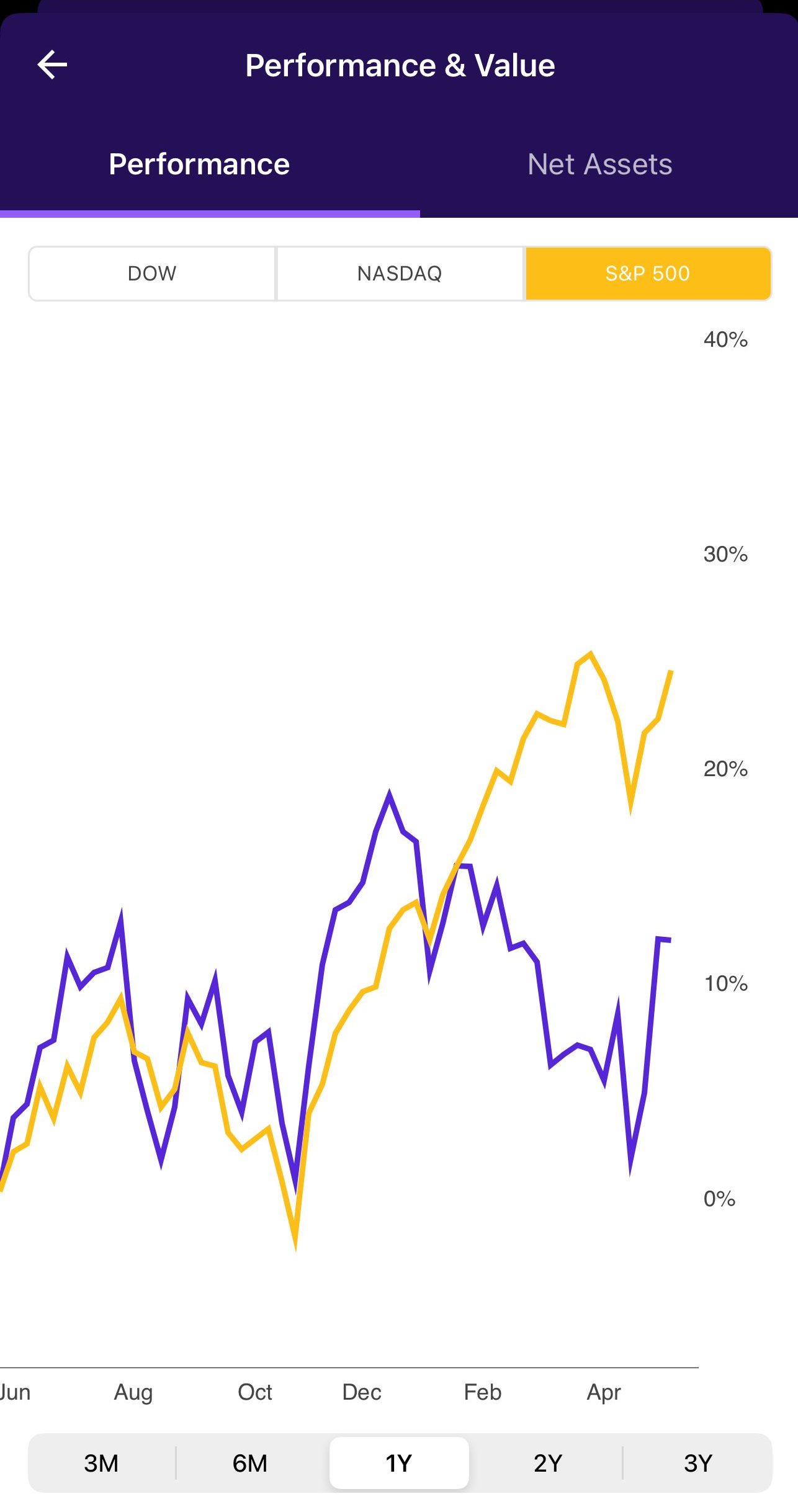

One of the features of Etrade that makes this platform stand apart from the crowd is its research tools.

I enjoyed that you can not only produce charts with technical patterns and numerous data points, but Etrade automatically provides explanations of what everything means.

As you can see in this screenshot, I found it remarkably easy to research stocks and get an overview of the company to help me decide if I want to invest.

I can also access analyst reports to get further information before I commit any funds.

-

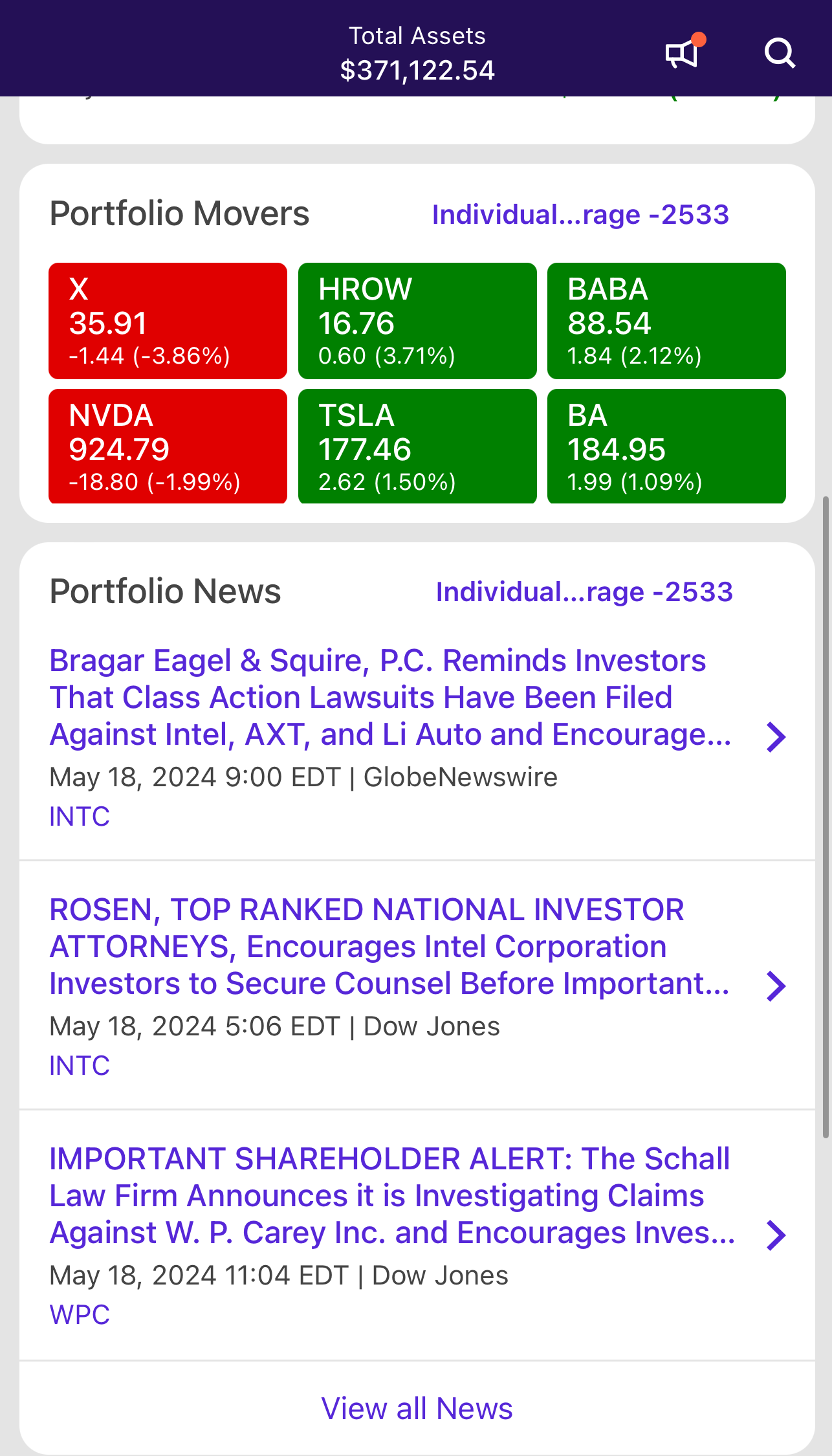

Portfolio Movers

Another feature that I really enjoyed was the “Portfolio Movers.” As you can see in this screenshot, essentially, I can see any movements or news relating to companies in my portfolio.

This was a massive time saver for me, as I didn’t need to scan through pages of investing news to find content that was relevant to me. I could immediately see pertinent details to make quick decisions about whether I want to buy, sell or hold onto my assets.

-

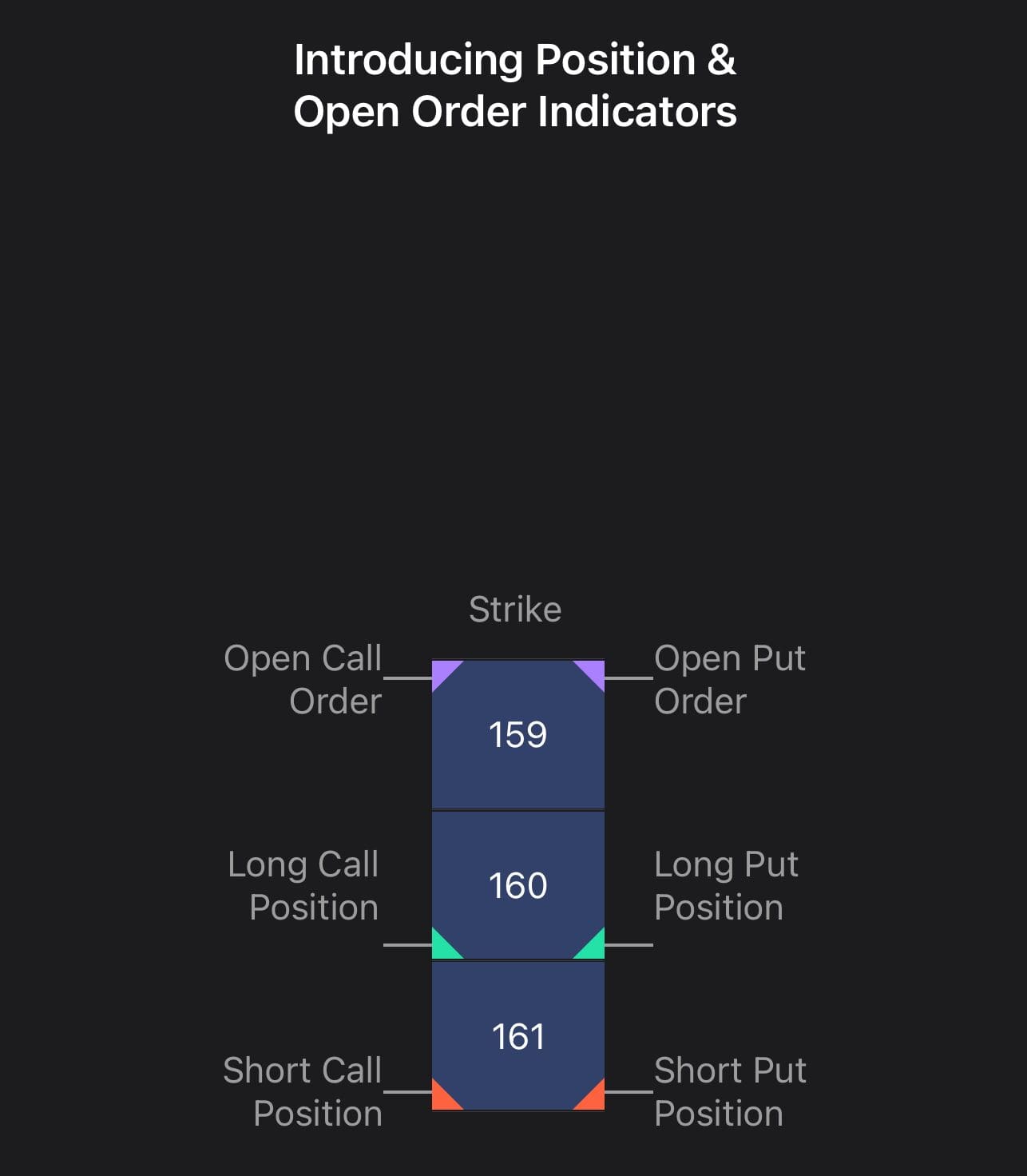

Options Open Interest

The Open Interest section of Etrade allows me insight into the level of liquidity for specific option series. I can quickly see if there is high options volume that typically indicates greater market participation.

I can see if there is heavy call buying that indicates a potential uptrend and an opportunity to invest.

Of course, newbie investors will still need to learn strategies and interpretation to make use of this feature, but for the more experienced, such as myself, this was a valuable resource.

-

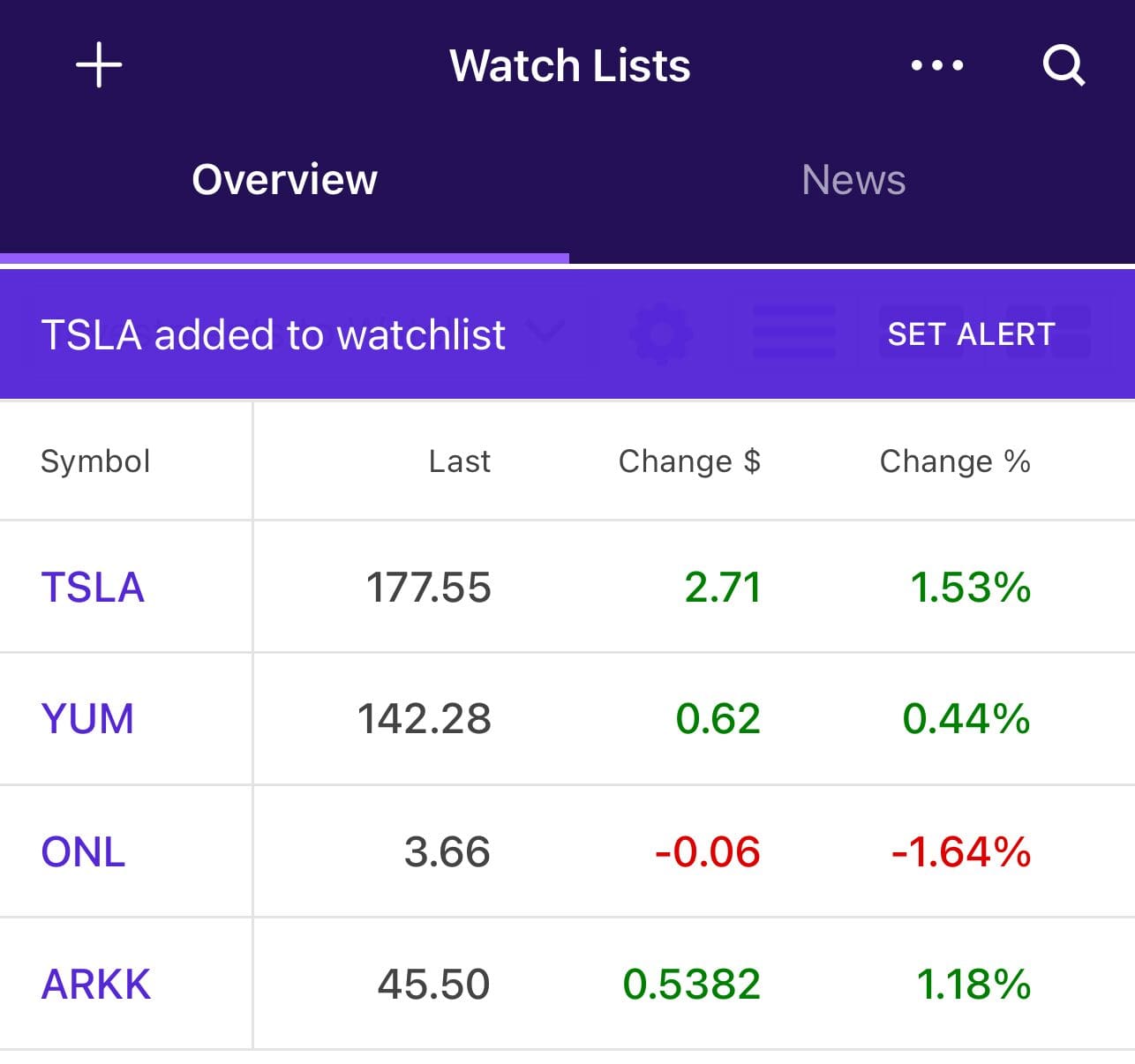

Watchlists

There are times when I’ve researched a stock or asset, but I’m not quite ready to pull the trigger and make a purchase. However, I don’t have the time or inclination to keep a paper record of these potential companies. Fortunately, Etrade has thought of this and included watchlists to its platform.

As this screenshot shows, I can simply add companies to my watchlists and then periodically check in to see what movements have occurred. I can even set alerts, so that I’ll receive a message if there are changes that meet my criteria.

The watchlist feature also includes a newsfeed, so I can see if there is any industry information that impacts these companies to help me decide if it is now a good time to invest.

Additional Features That Helped Me

Besides the main features I use regularly, there are additional features for investors:

-

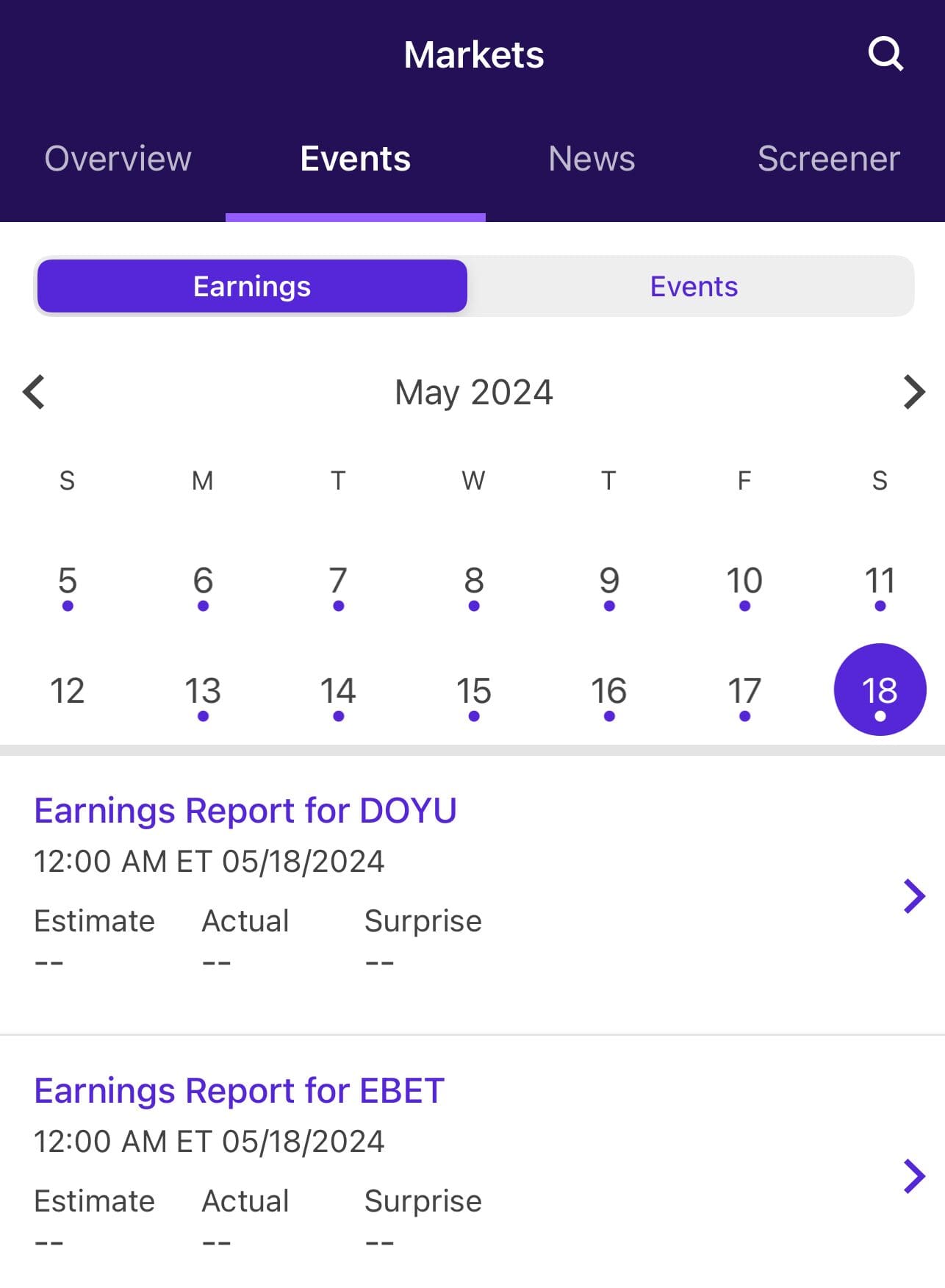

Access to Earnings Reports

Earnings reports are typically released quarterly, but it can be tricky to keep track of the dates for a variety of different companies.

However, these reports are crucial for assessing the economic health of companies. Reports include income statements, cash flow statements, balance sheets and statements of shareholder equity.

Within Etrade’s Market section, there is a Market Calendar, where I can find earnings reports for companies of interest to me.

Since this is a calendar feature, I can see upcoming reports, so I can plan my buying strategy accordingly.

-

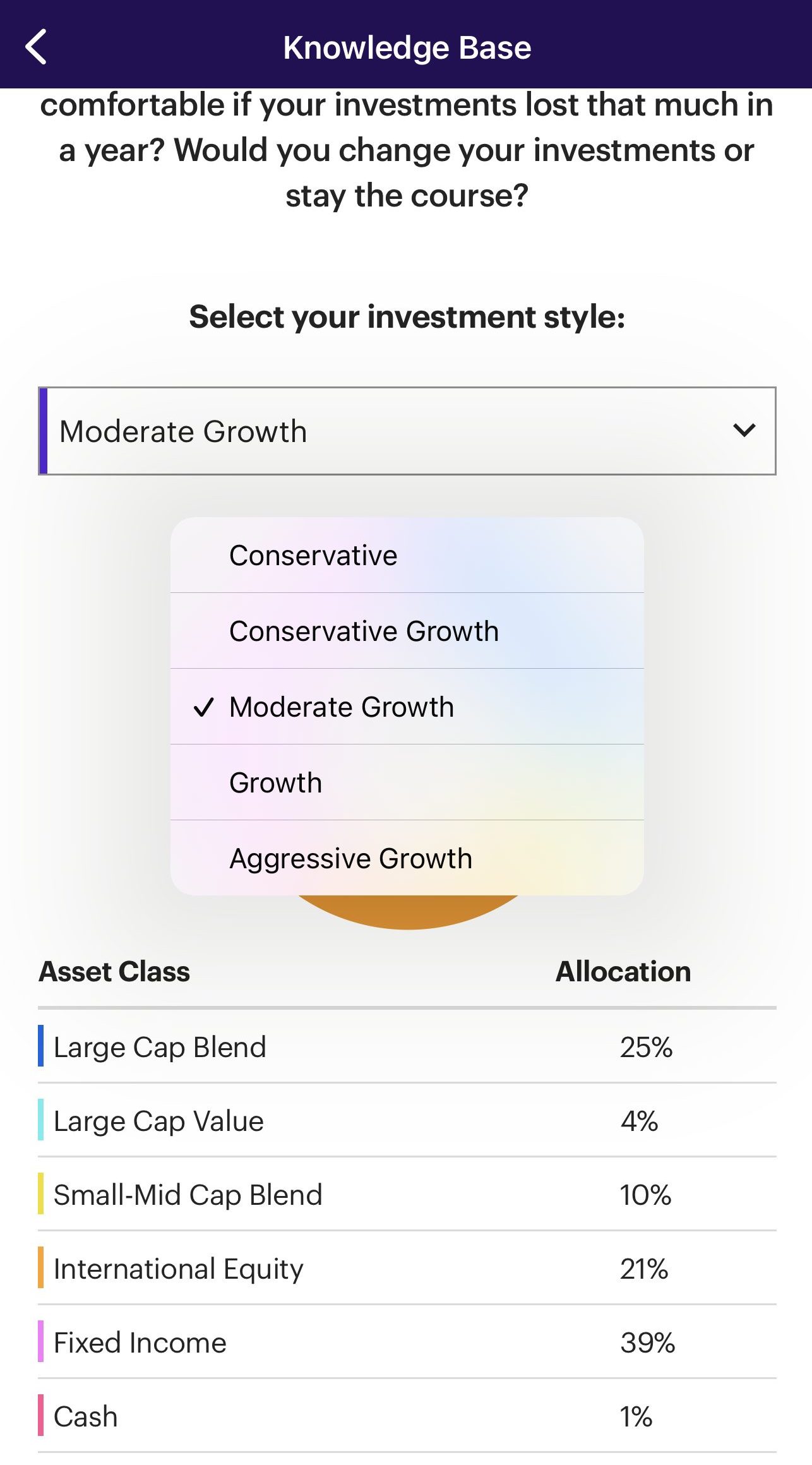

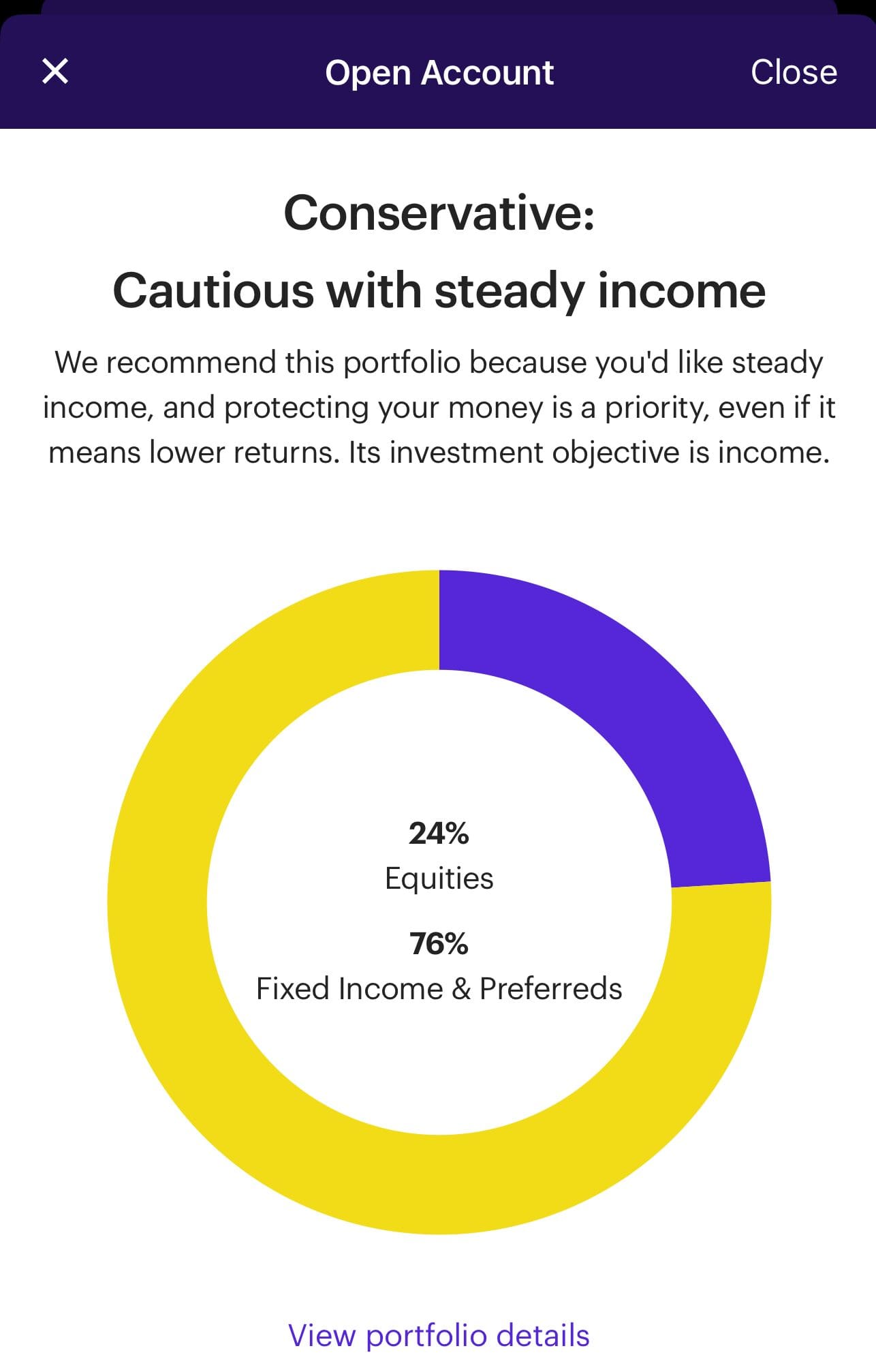

Asset Allocation By Investment Style

Another feature I found helpful was the asset allocation simulations. As you can see in the screenshot below, you simply select the investment style and can look at the recommended asset allocation.

I found this feature helpful, as I could play around with the different investment styles to work out if I preferred a more conservative or more aggressive investing style.

I thought this was useful, as it can sometimes be a little nebulous to decide whether I am a conservative or moderate investor.

By checking the asset allocations, I can see what I feel comfortable with and even adjust my portfolio a little for greater balance and potentially greater returns.

-

Portfolio Recommendations

This follows on from the previous feature, but I also found the portfolio recommendations feature helpful. Etrade uses the answers to some basic questions to create a recommended portfolio to suit my investment style.

The recommendations go much further than is typically offered with an investment platform. Not only does Etrade explain why it has recommended a particular asset allocation, but I can get predictions of portfolio growth and more detailed information.

Of course, I’m free to reject the portfolio recommendations, I can use it as a basis for my investing strategy or use it in its entirety. It’s completely up to me.

-

Portfolio Rebalancing

This is not a unique feature, but I found it helpful that Etrade has included it. Once you set your ideal asset allocation, you can monitor it yourself, but the portfolio management team is also watching it for you.

If I make deposits or withdrawals and my portfolio drifts 5% or more from my target asset allocation, it will be automatically rebalanced to help to keep my account on track.

I can also reach out to the dedicated support team if I have any queries about my portfolio balance.

This type of trigger rebalancing is far more accurate than rebalancing on a schedule, since my portfolio will not be rebalanced unnecessarily. It will only be adjusted as and when needed.

-

Tax Loss Harvesting

Etrade also offers tax loss harvesting for its clients. If I’m using the Core Portfolios, I can automatically harvest tax losses when my portfolio rebalances.

Essentially, this means that I’m strategically selling some securities at a loss to reduce the taxable income on my gains.

The robo advisor generates these transactions through its trading actions and will automatically purchase replacement securities in the same asset classes to maintain my target preferences.

While this feature is not unique, what Etrade offers with Core Portfolios is tax loss harvesting with a minimum investment of just $500. With other platforms, this feature is often reserved for clients with high value portfolios.

-

Checking Accounts

Managed by Morgan Stanley Private Bank, Etrade offers two distinct checking accounts: the Max-Rate Checking Account and the standard Checking Account.

Both accounts provide unlimited online wire transfers, money transfers, mobile check deposits, and ATM fee refunds nationwide.

They come with Coverdraft Protection for peace of mind and integrated account views that allow users to see their checking, savings, and investment accounts in one place.

The primary difference between the two accounts lies in their interest rates and fee structures. The Max-Rate Checking Account offers a competitive 2.00% APY, which is significantly higher than the national average.

However, it comes with a $15 monthly fee unless the account maintains an average monthly balance of $5,000. Also, ATM refunds on the Max-Rate account are worldwide.

-

Small Business Products

I also appreciate that Etrade offers retirement products for small businesses. Many platforms only offer personal retirement products, but Etrade has SEP IRAs for the self employed and small businesses, Simple IRAs for companies with less than 100 employees and investment only accounts.

Etrade has a variety of plans and there are lots of resources to help non profits, the self employed, trustees and business owners. The platform is transparent about the fee structures for these accounts, and the team is on hand to discuss specific needs.

-

IPO Access

Etrade allows its clients to access Initial Public Offerings or IPOs. I can access a variety of IPOs and stay up to date on the latest available offerings. I can check the New Issue Center to view a prospectus and other documents and even subscribe to receive alerts.

While there are no guarantees on IPOs, since I can only express an interest, it is nice to be able to view the potential offerings and apply for ones of interest. I’ve not yet been accepted, but hopefully soon, I’ll be able to get in at the ground floor of the latest pioneer company.

What Can Be Improved

Of course, no platform is perfect and there are a few areas where Etrade could make some improvements. These include:

-

The Low Sweep Rate

If I have uninvested cash in my Etrade account, I’ll earn just 0.01% as the default sweep rate.

This is one of the lowest rates offered by brokers and many platforms increased their rates throughout 2023, so Etrade is lagging behind.

-

No Crypto Or Forex Trading

Many people consider crypto to be an interesting way to diversify a portfolio, so it is a little disappointing that Etrade does not offer any coins or currencies.

Also, there is no foreign exchange (forex) trading available, limiting the range of investment options.

-

No Fractional Shares

Etrade does not offer fractional shares, which can limit the investment options for those with smaller budgets.

Which Type of Investor is Best Suited to E-Trade?

While Etrade holds universal appeal, there are some types of investors who are more likely to appreciate this platform.

- New investors: Etrade has a wealth of learning resources that are ideal for taking the newbie investor all the way to a seasoned trader. The platform is also quite intuitive, making it easier for beginners to get to grips with the investing basics before they start experimenting with more advanced strategies. You can even take a completely hands off approach with the Core Portfolios.

- Those Looking for Retirement Planning Assistance: If you don’t fit the standard mold for retirement accounts, Etrade could be a good option for you. There are a variety of retirement accounts including some for business owners and the self employed, and you can ask the Etrade team for additional help.

- Frequent Traders: With a low fee structure and access to plenty of research and data, Etrade is a great option for frequent traders. There are watchlists and other tools that can help you to make quick decisions to maximize your potential gains.

Compare E-Trade Side By Side

Schwab is our pick for long-term investors, wealth management, or retirement. E-Trade may be better for traders and cash management.

Vanguard is our pick for long-term investors, wealth management, or retirement, while E-Trade may be better for traders active investors

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

ETRADE is best for a comprehensive array of investment options, while Webull app design and charting is one of the most appealing we've seen

Review Brokerage Accounts

How We Rated Brokerage Accounts: Review Methodology

At The Smart Investor, we evaluated brokerage account platforms based on their overall value, features, and user experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to investors, including fees, trading tools, investment options, and security. Each platform was rated based on the following criteria:

- Fees & Commissions (20%): We prioritized commission-free trading and low-margin rates. The best platforms had zero hidden fees, while others charged for inactivity or withdrawals.

- User Experience & Interface (20%): A clean, easy-to-navigate platform with smooth execution scored highest. Some apps felt outdated or laggy, impacting the experience.

- Trading Tools & Features (30%): We favored platforms with real-time data, smart order types, and special features that support smart investing. Some lacked depth, making it harder for active traders.

- Automated Investing (10%) : The best platforms offered AI-driven portfolios, robo-advisors, and automatic rebalancing. Some lacked automation or charged high fees for managed accounts.

- Investment Options (10%): Platforms with stocks, ETFs, options, crypto, and fractional shares scored highest. A few lacked key asset classes or international access.

- Account Types (5%): The best platforms supported taxable accounts, IRAs, and custodial options. Some lacked flexibility, limiting investment strategies.

- Cash Management & Banking Features (5%): We favored platforms with high-interest cash accounts, debit cards, and seamless banking. Many lacked competitive rates or useful features.