Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

E-Trade | Webull | |

Monthly Fee | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $0

May be charge specific fees for trading such as stock options, futures, transfers etc

|

Account Types | Brokerage, Retirement | Brokerage, Retirement |

Savings APY | 3.50% | 5.00% |

Minimum Deposit | $0 | $0 |

Best For | Beginners, Traders, Robo Advisor | Advanced Traders, Active Investors |

Read Review | Read Review |

Webull vs E*TRADE: Compare Investing Features

When it comes to investing features, Webull's offerings are limited compared to ETRADE.

Webull does not support mutual funds, bonds, futures, or forex trading, and lacks some investing tools such as tax harvesting, which may be a drawback for more experienced investors seeking a broader range of asset classes and deeper asset exploration.

In contrast, ETRADE, with its integration with Morgan Stanley, not only provides an extensive array of investment options but also more appealing banking services.

Webull focusing on a mobile-first experience that appeals primarily to beginner and intermediate investors. The platform’s sleek, minimalist design simplifies trading for newcomers while offering features like paper trading and a vibrant community-driven experience.

E*TRADE | Webull | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | 10,000 US stocks and ETFs. |

Investing Types | Stocks, Options, Futures, ETFs, Bonds, Mutual Funds | Stocks, Options, Futures, ETFs, OTC, Margin, Fractional Shares |

Financial Planning | No | No |

Automated Investing | Yes | Yes |

Paper Trading | Yes | Yes |

Tax Loss Harvesting | Yes | No |

IPO Access | Yes | Yes |

-

Self Investing And Trading Options

Etrade is our winner when it comes to investing options.

ETRADE’s unique benefits lie in its extensive range of investment options and advanced portfolio management features, while Webull’s strengths are in its user-friendly interface, fractional shares, and superior charting capabilities.

TRADE stands out with its comprehensive access to numerous exchanges, offering thousands of ETFs, stocks, bonds, futures, and options. This breadth of asset classes allows investors to diversify their portfolios significantly.

E*TRADE also provides IPO access, robust web and desktop platforms, extensive research tools.

Additional features include portfolio rebalancing, portfolio movers, watchlists, and stock earnings reports make it ideal for seasoned investors seeking advanced tools and diverse investment options.

Webull's self-investing platform allows users to trade a variety of financial instruments including stocks, options, index options, futures, ETFs, and OTC stocks.

Webull, on the other hand, also offers a compelling suite of self-investing features but with a focus on simplicity and accessibility. It provides fractional shares, which allows investors to buy smaller portions of expensive stocks.

Additionally, Webull offers trading on margin, IPO access, portfolio movers, and watchlists, ensuring that users have essential tools for effective self-investing.

-

Managing Retirement Accounts

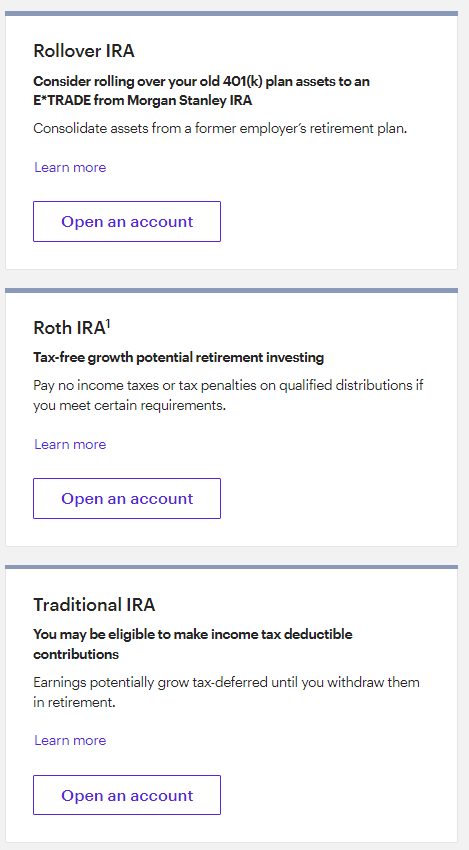

Both E*TRADE and Webull offer the basic retirement accounts such as Traditional and Roth IRA, but E*TRADE offers much more options for a different types of customers.

E*TRADE offers diverse retirement accounts including Roth and Traditional IRAs, Rollover IRAs, Inherited IRAs, Complete IRAs for those over 59½, and IRAs for minors.

Additionally, E*TRADE features the Complete IRA, specifically designed for investors over 59½ years old.

This account provides immediate access to IRA savings with anytime withdrawals, requiring no delays or forms. It also includes a free debit card and online bill payment services, enhancing convenience for retirees managing their finances.

Webull offers a variety of retirement account options to help pave the way to financial freedom in your golden years. There are no special benefits as you can find with Robinhood.

With a Webull IRA, you can choose between Traditional, Roth, and Rollover IRAs, all with no account minimums or fees.

Your investments can grow tax-deferred (Traditional) or enjoy tax-free withdrawals (Roth).

-

Automated Investing

ETRADE, with its extensive history and integration with Morgan Stanley, offers a sophisticated automated investing solution through its Core Portfolios robo-advisor.

This service provides a comprehensive and personalized investment strategy tailored to individual goals and risk tolerance.

Core Portfolio's annual advisory fee is 0.30%, and it manages diversified portfolios of ETFs, regularly rebalancing them to maintain the desired asset allocation. The platform also incorporates human oversight, ensuring a blend of automation and professional expertise.

Webull Smart Advisor offers a streamlined and personalized automated investing experience designed to simplify the investment process.

With a low minimum investment of $100, it provides a practical entry point for new investors. The annual advisory fee is 0.20%

Once the risk assessment is completed, Webull Smart Advisor generates a customized portfolio primarily composed of ETFs, balancing risk allocation to match the user’s risk profile.

The portfolio is managed automatically, with regular rebalancing to maintain the desired asset allocation based on market conditions.

-

Fees

ETRADE offers $0 commissions on online stock, ETF, and mutual fund trades, with options contracts costing $0.65 per contract (reduced to $0.50 with higher trading volume). OTC stock trades cost $6.95, reduced to $4.95 with frequent trading.

Etrade Core Portfolio | Webull | |

|---|---|---|

Robo Advisor Annual Advisory Fee | 0.30% | 0.20% |

Webull does not charge fees for options trading, and both platforms have various other service fees. Also, Webull’s margin interest rates are more competitive.

-

Cash Management And Savings Rates

Webull High-Yield Cash Management offers an impressive 5.00% APY on uninvested cash within your Webull account, with no need for a new account, no fees, and no minimum balance.

However, it doesn't offer checking account features as you can get with Etrade.

Etrade Premium Savings | Webull | |

|---|---|---|

Savings APY | 3.50% | 5.00% |

ETRADE provides a comprehensive cash management service through its ETRADE Max-Rate Checking and Premium Savings accounts with competitive savings rate.

Managed by Morgan Stanley Private Bank, E*TRADE offers two checking accounts: Max-Rate Checking and Standard Checking. Both provide unlimited online wire transfers, money transfers, mobile check deposits, and nationwide ATM fee refunds. They feature Coverdraft Protection and integrated account views

Etrade: Which Features Are Unique?

Here are some of the features that investors can find only with Etrade:

-

Tax Loss Harvesting

ETRADE offers tax loss harvesting for clients using Core Portfolios. This feature automatically harvests tax losses during portfolio rebalancing by strategically selling securities at a loss to offset taxable gains.

The robo-advisor handles these transactions and purchases replacement securities in the same asset classes to maintain target preferences.

While tax loss harvesting is not unique, ETRADE stands out by offering this service with a minimum investment of just $500, whereas other platforms typically reserve it for clients with high-value portfolios.

Webull: Which Features Are Unique?

Here are some of the features that investors can find only with Webull:

-

Create And Track Savings Goal

Creating and tracking a savings goal with Webull leverages their High-Yield Cash Management features to help you efficiently reach your financial objectives.

Customers can set savings targets and specify their purpose within the Webull app, whether it's for an emergency fund, a major purchase, or another financial goal.

Then you can track your savings in real-time through the Webull app, providing an overview of your contributions, current balance, and progress toward your goal.

Bottom Line

ETRADE is best suited for investors looking for a comprehensive array of investment options and sophisticated tools, and this is also our choice. From retiremet plans to analysis options, Etrade wins.

In contrast, Webull is designed to appeal to beginners and intermediate investors who favor a mobile-first approach. It's app design is one of most appealing we've seen and in addition to the low fees it charges, it has its own benefits.

Compare E-Trade Side By Side

Schwab is our pick for long-term investors, wealth management, or retirement. E-Trade may be better for traders and cash management.

Vanguard is our pick for long-term investors, wealth management, or retirement, while E-Trade may be better for traders active investors

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

Compare Webull Side By Side

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Webull offers user-friendly tools and perfect app design, while IBKR is best suited for more experienced investors and global market access.

Interactive Brokers vs. Webull: Compare Brokerage Account Options

Webull suits experienced traders with great app design and charting tools, while Stash is ideal for those starting their investment journey

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity