Fidelity | E*TRADE | |

Monthly Fee | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

|

Account Types | Brokerage, Retirement, Wealth Management | Brokerage, Retirement |

Savings APY | 3.94% | 4.00% |

Minimum Deposit | $0 – $2M

No minimum for Fidelity Go® and brokerage, $500,000 for Fidelity® Wealth Management, $2 million for Fidelity Private Wealth Management®

| $0 |

Best For | Technical Traders, High Net Worth, Financial Planning | Beginners, Traders |

Read Review | Read Review |

Fidelity vs E-Trade: Compare Investing Features

Fidelity stands out for its extensive selection of mutual funds, including fee-free options, and a comprehensive retirement product lineup. It also provides innovative tools like Fidelity Go, a robo-advisor.

Fidelity's platform is feature-rich, with advanced research tools, educational resources, and access to professional advisory services.

E-Trade | Fidelity | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Bonds & CDs, Margin, Fractional Shares | Stocks, Options, Margin, ETFs, Bonds & CDs, Precious metals, Crypto, Mutual Funds |

Automated Investing | Yes | Yes |

Paper Trading | Yes | No |

Tax Loss Harvesting | Yes | No |

IPO Access | Yes | Yes |

Dedicated Advisor | Yes (Through Morgan Stanley) | Yes |

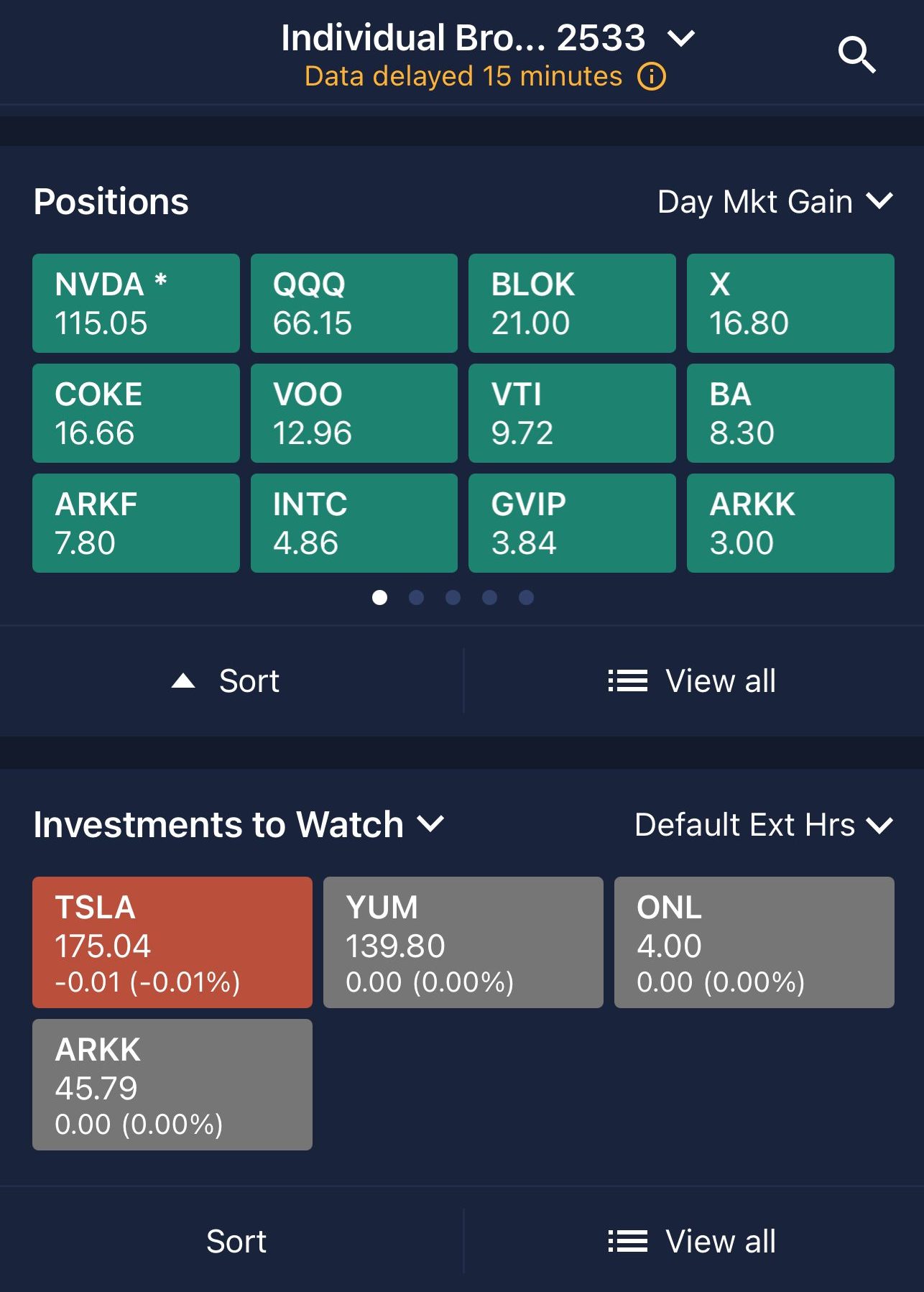

ETRADE is distinguished by its extensive trading tools.

The platform's flexibility is evident in its ability to cater to different trading styles, whether one is focused on day trading, swing trading, or long-term investing.

-

Self Investing And Trading Options

There is no winner here, as both Fidelity and E*TRADE offer a wide range of investing features, including advanced charts and tools for investors.

Fidelity excels in providing a broad array of investment options, including stocks, ETFs, mutual funds, options, and bonds, along with sophisticated research tools and analytics.

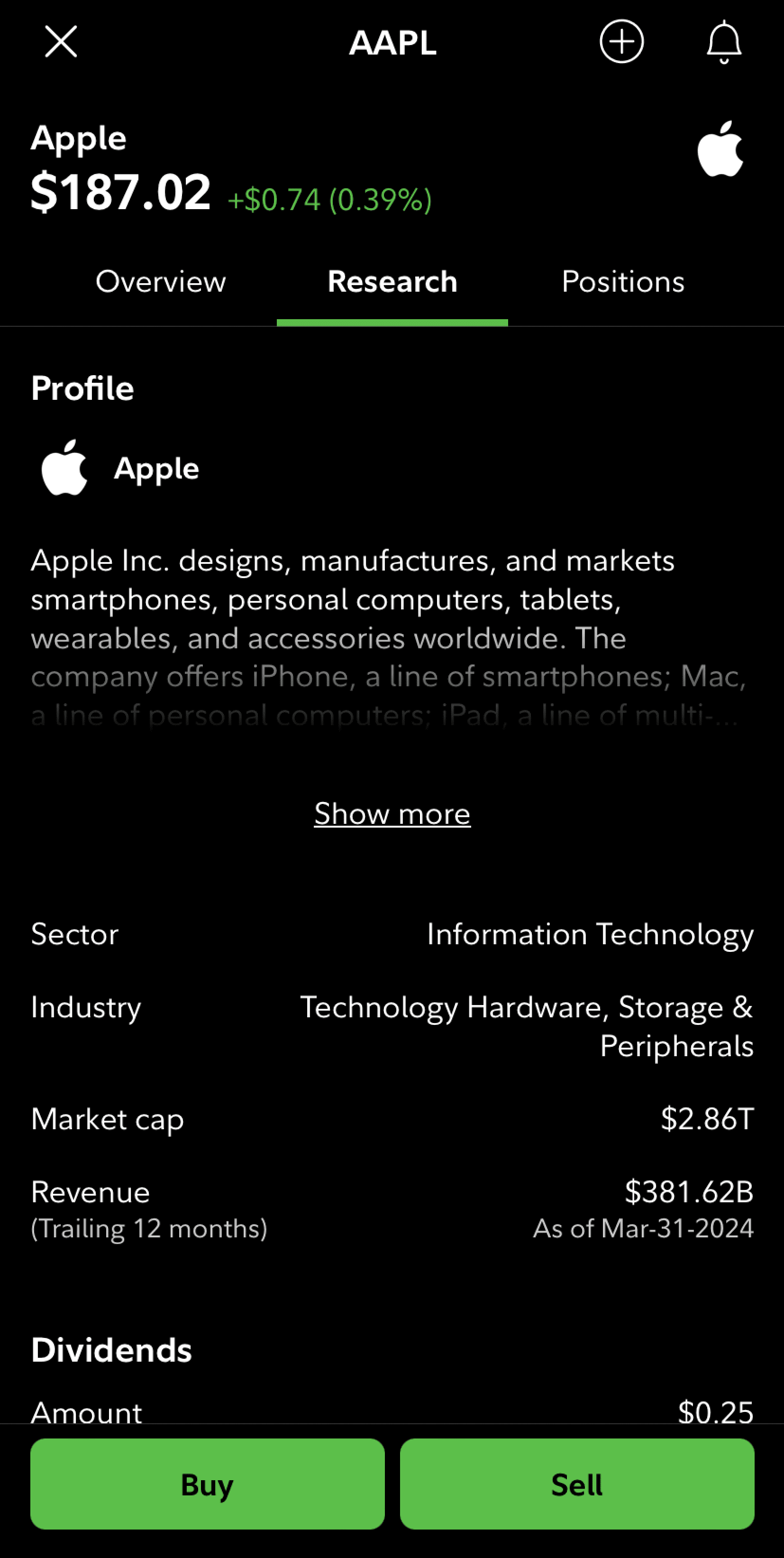

For fundamental traders, Fidelity provides an extensive suite of research tools that go beyond basic stock information. Users can access in-depth financial statements, analyst ratings, earnings reports, and valuation metrics for individual companies.

For those interested in technical analysis, Fidelity offers tools like advanced charting with customizable indicators, including moving averages, RSI, MACD, and Bollinger Bands.

E*TRADE shines in its flexibility and depth of research tools, particularly for those engaged in active trading.

The platform's advanced charting capabilities allow users to perform in-depth technical analysis, with customizable indicators and pattern recognition features that help traders identify potential market opportunities.

-

Automated Investing

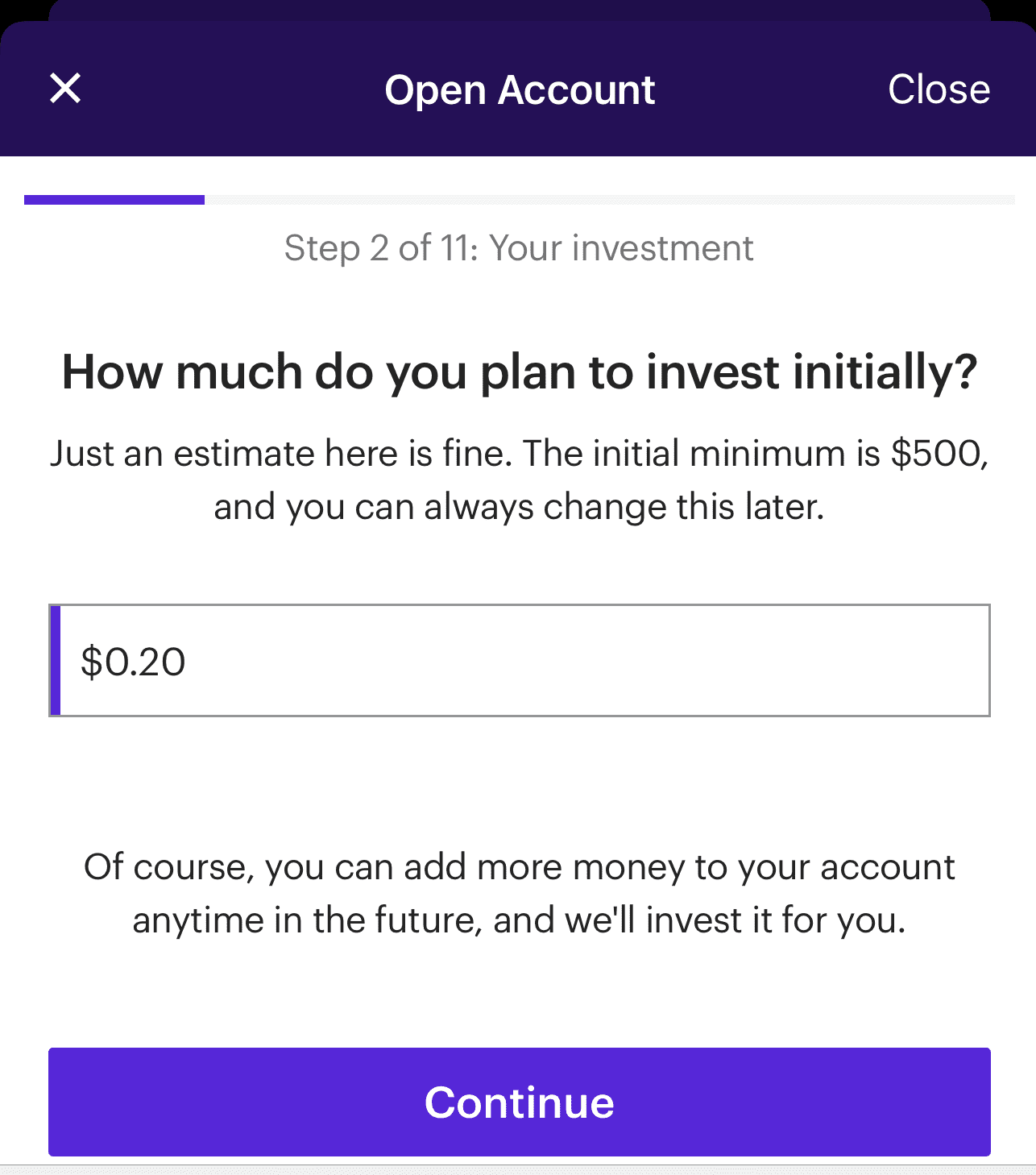

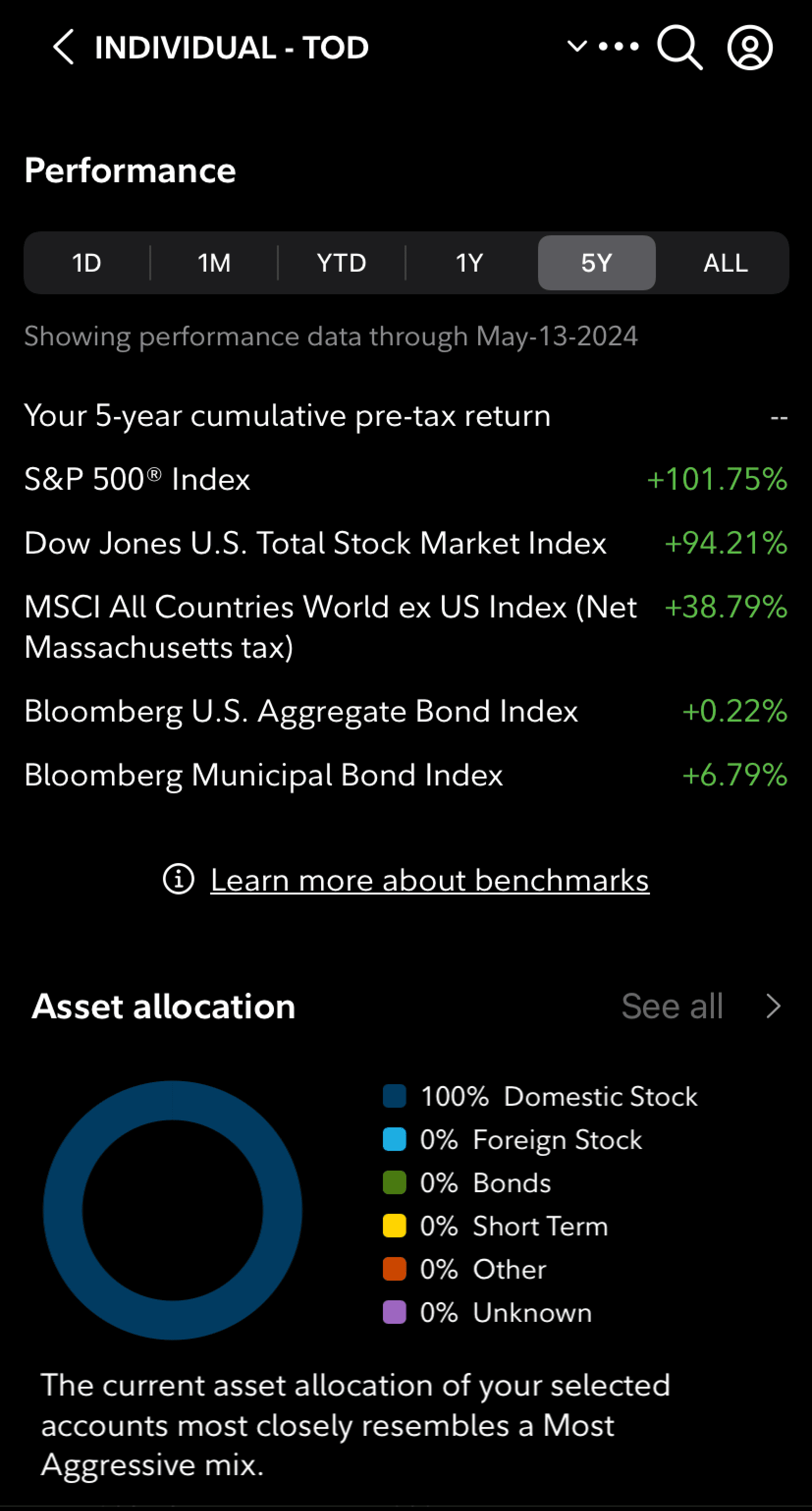

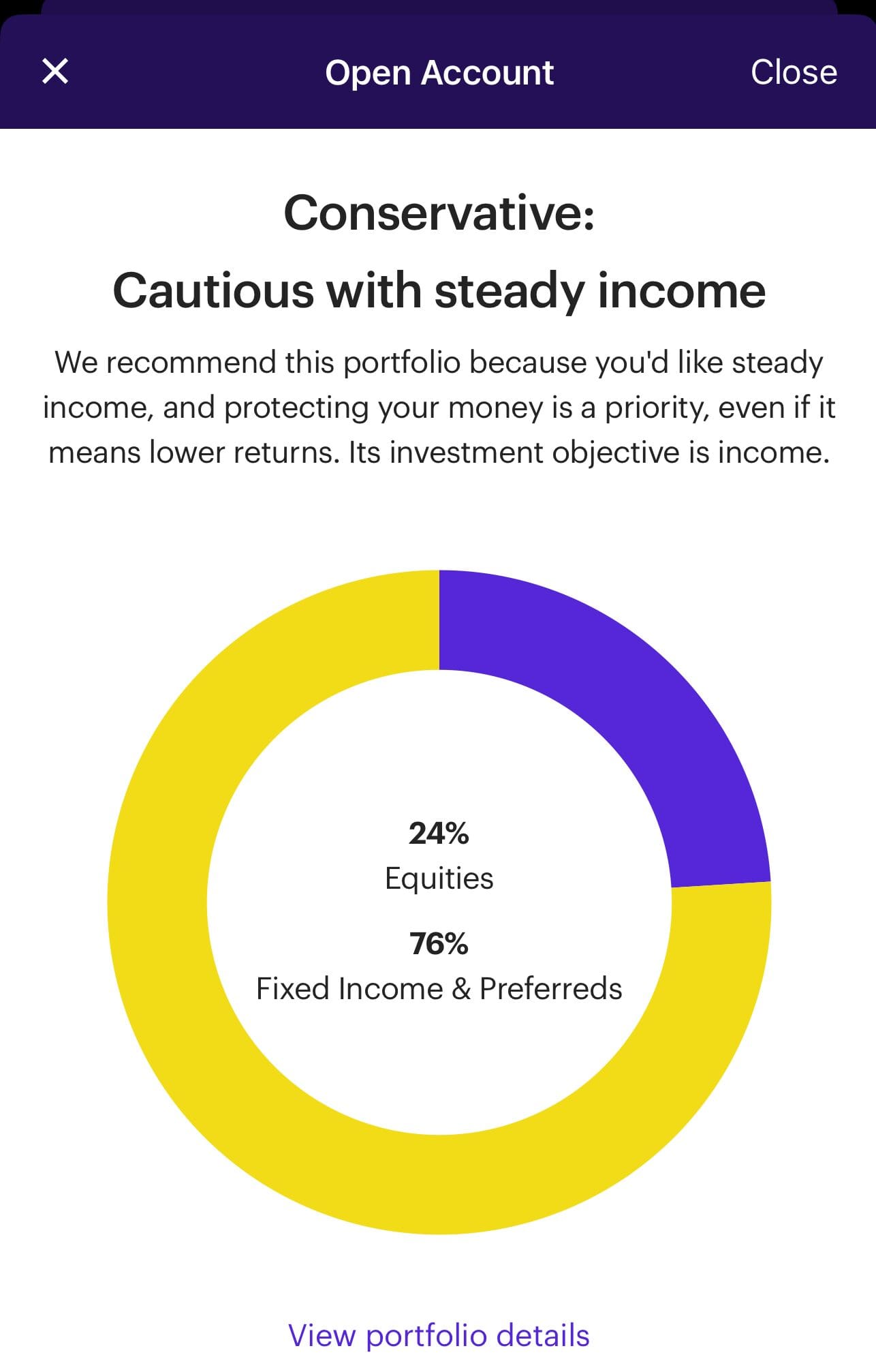

E*TRADE Core Portfolios is an automated investing service designed to simplify portfolio management through a robo-advisor.

It starts with an investor completing a questionnaire to determine their risk tolerance, investment goals, and time horizon.

Based on the responses, Core Portfolios constructs a diversified portfolio primarily composed of ETFs tailored to the investor’s profile.

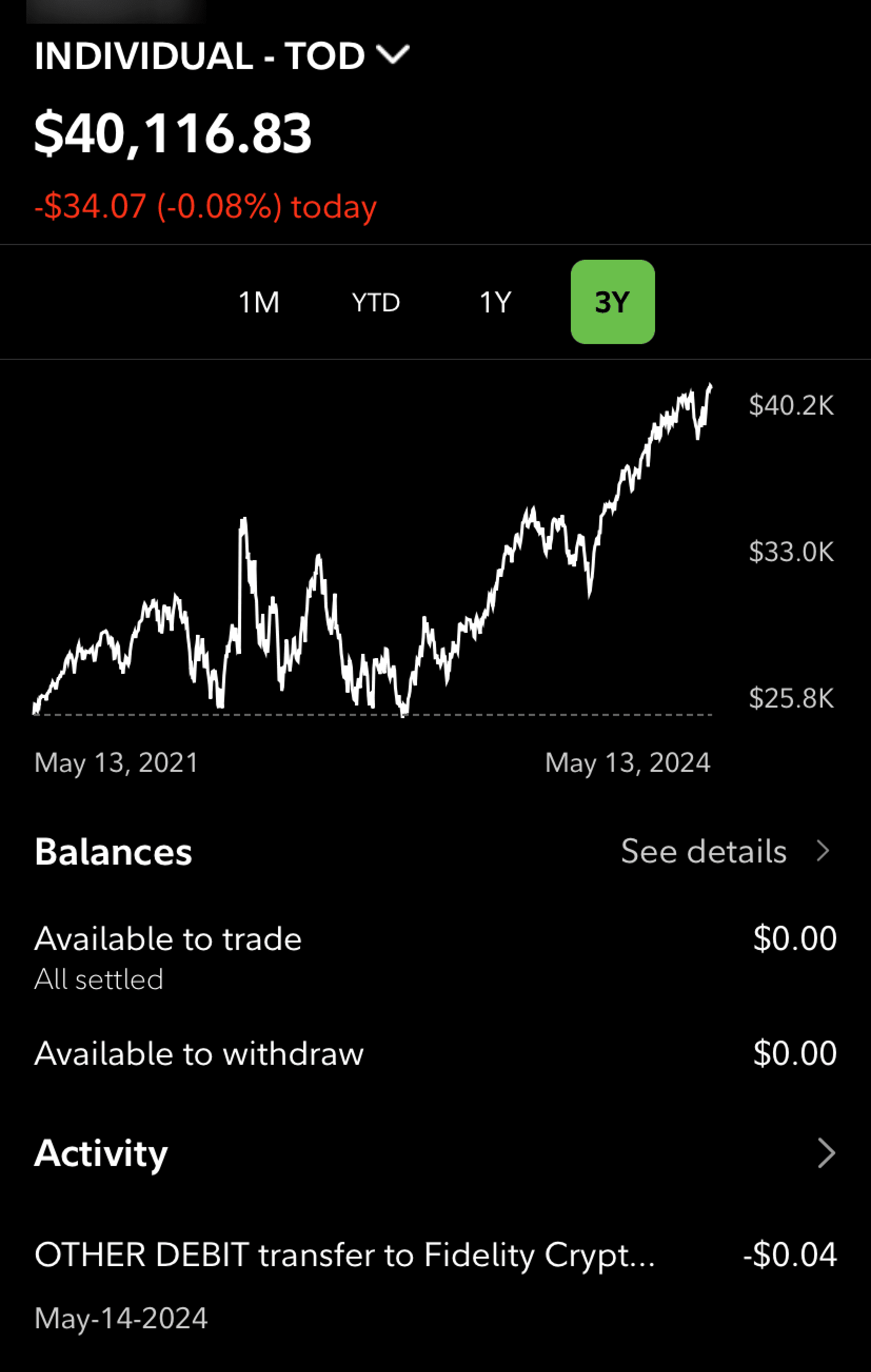

Similarly, Fidelity has its own robo-advisor, Fidelity Go.

Fidelity Go builds and manages a diversified portfolio tailored to the investor's goals and risk tolerance. It leverages low-cost Fidelity Flex mutual funds, which carry no expense ratios, to construct portfolios.

One key feature of both robo advisors is automatic rebalancing. As market conditions change, the portfolio is adjusted to maintain the target asset allocation, ensuring that the investment strategy remains aligned with the investor's goals.

One of the main advantages of the Core Portfolio is the tax loss harvesting feature, which is not available with Fidelity.

Fidelity Go is better for smaller investors. If you want to manage a high amount with a robo advisor, E-Trade Core Portfolio annual advisory fee of 0.30% is lower than Fidelity – 0.35% (0% under $25,000).

-

Retirement Accounts

Fidelity is our winner here as it provides more comprehensive and well-supported retirement planning environment, ideal for those who want detailed planning and a wide range of investment options.

Fidelity offers a broad range of retirement account options, including Traditional, Roth, and Rollover IRAs, as well as SEP and SIMPLE IRAs for the self-employed. Fidelity's retirement accounts are supported by extensive planning tools, educational resources, and access to professional advice.

The platform also provides comprehensive retirement calculators and the ability to consult with advisors for personalized retirement strategies.

ETRADE, while also offering a variety of retirement accounts, excels in providing options that cater to more specialized needs. In addition to Traditional and Roth IRAs, ETRADE offers Rollover IRAs, Beneficiary IRAs, and IRAs specifically designed for minors.

One unique offering is the ETRADE Complete IRA, which is tailored for investors aged 59½ or older, providing immediate access to IRA savings with features like a free debit card and online bill payment.

However, it lacks the depth of retirement planning tools and advisory services that Fidelity offers.

-

Fees

There is no clear winner here as their structure are quite similar for most products.

Fidelity generally excels in offering lower fees across a broader range of services, especially with its zero-expense-ratio mutual funds and no-cost advisory service for smaller accounts.

E*TRADE matches Fidelity in many areas but offers potential savings for active options traders through its tiered pricing.

Fidelity | E-Trade | |

|---|---|---|

Fees | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

|

Fidelity and E-trade offers $0 commissions on online stock, ETF, and mutual fund trades, with options contracts costing $0.65 per contract.

When it comes to Robo Advisory, Fidelity is cheaper for a small portfolio of up to $25,000, while E-trade is cheaper if you manage a high amount.

-

Cash Management And Savings Rates

When it comes to banking options, E-trade offers more appealing options on our opinion, especially due to checking account various options and higher savings rates,

Fidelity Cash APY | E*TRADE Premium Savings | |

|---|---|---|

Savings APY | 3.94% | 4.00% |

ETRADE offers comprehensive cash management through its Max-Rate Checking and Premium Savings accounts, both managed by Morgan Stanley Private Bank.

These accounts feature competitive savings rates, unlimited online wire transfers, mobile check deposits, and nationwide ATM fee refunds.

Fidelity’s Cash Management Account stands out for its flexibility and comprehensive features. For those looking for pure savings, Fidelity offers the FDIC Insured Deposit Sweep Program, but the rates are not so competitive.

However, customers can secure higher rates with Fidelity CDs or the Fidelity Government Money Market Fund.

Fidelity’s account comes with no fees or minimums and offers unlimited ATM fee reimbursements, Bill Pay, mobile check deposit, and a debit card with digital wallet compatibility.

-

Wealth Management Options

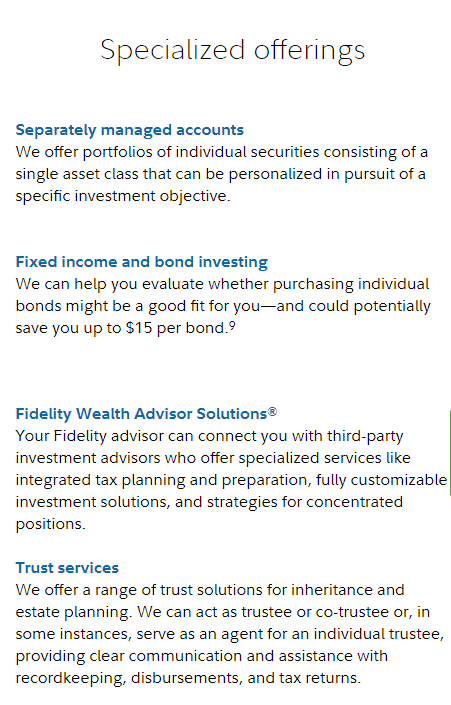

Fidelity is our winner when it comes to wealth management, as it offers two main tiers of wealth management services: Wealth Management and Private Wealth Management.

- Wealth Management, designed for clients with a minimum of $500,000 in investable assets, provides a dedicated advisor to develop a customized financial plan covering retirement, estate planning, tax strategies, and investment management.

- Private Wealth Management is for clients with at least $2 million in managed assets or $10 million in total assets with Fidelity.

For more personalized and comprehensive management, E*TRADE clients can leverage Morgan Stanley's Private Wealth Management services, which offer a deeper level of financial planning, estate planning, and tax strategies.

These services are typically include access to financial advisors who can provide personalized guidance and geared towards high-net-worth individuals seeking in-depth financial advice and management.

Bottom Line

Fidelity excels in low-cost mutual funds, comprehensive retirement planning, and personalized wealth management, while ETRADE stands out with its advanced research tools, flexible automated investing options, and competitive savings accounts.

The choice between them depends on whether you prioritize cost-effective, long-term planning with personalized advice (Fidelity) or active trading and flexible cash management (E*TRADE).

Fidelity vs. Competitors: How Does It Stack Up?

Both Schwab and Fidelity offer great options for traders, plans for wealth management, and sophisticated auto-investing platforms.

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.