Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

Fidelity | Merrill Edge | |

Monthly Fee | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor |

Account Types | Brokerage, Retirement, Wealth Management | Brokerage, Retirement, Wealth Management |

Savings APY | 3.89%

| 0.01% – 3.77%

|

Minimum Deposit | $0 – $2M

No minimum for Fidelity Go® and brokerage, $500,000 for Fidelity® Wealth Management, $2 million for Fidelity Private Wealth Management®

| $0 – $50,000

Merrill Edge Self-Directed Trading: $0 Merrill Guided Investing – Robo Advisor: $1,000 for growth-focused strategies OR $50,000 for income-focused strategies Merrill Guided Investing – Online Advisor : $20,000 for growth-focused strategies OR $50,000 for income-focused strategies |

Best For | Technical Traders, High Net Worth, Financial Planning | Bank of America Customers, Advanced Traders |

Read Review | Read Review |

Fidelity vs Merrill Edge: Compare Investing Features

While Fidelity offers a more extensive range of low-cost mutual funds and a better array of research tools for DIY investors, Merrill Edge provides a superior experience for Bank of America customers.

Merrill Edge | Fidelity | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, Margin, ETFs, Bonds & CDs, Mutual Funds, Margin | Stocks, Options, Margin, ETFs, Bonds & CDs, Precious metals, Crypto, Mutual Funds |

Automated Investing | Yes | Yes |

Paper Trading | No | No |

IPO Access | No | Yes |

Dedicated Advisor | Yes | Yes |

Financial Planning | No | Yes |

However, both platforms offer a broad range of tools for investors and traders on their self-directed platforms.

They offer solutions for passive investors with cutting-edge robo advisors. For high Merrill Edge provides more personalized service by consulting with an advisor.

-

Self Investing And Trading Options

There is no winner here, as both Fidelity and Merrill Edge offer a wide range of investing features, including advanced charts and tools for investors.

Fidelity's Active Trader Pro platform is also a highlight, offering advanced analytics, customizable dashboards, and real-time data for active traders.

Fidelity offers fundamental traders in-depth research tools, including financial statements, analyst ratings, and valuation metrics.

For technical analysis, it provides advanced charting with customizable indicators like moving averages, RSI, MACD, and Bollinger Bands, making it a comprehensive platform for both fundamental and technical analysis.

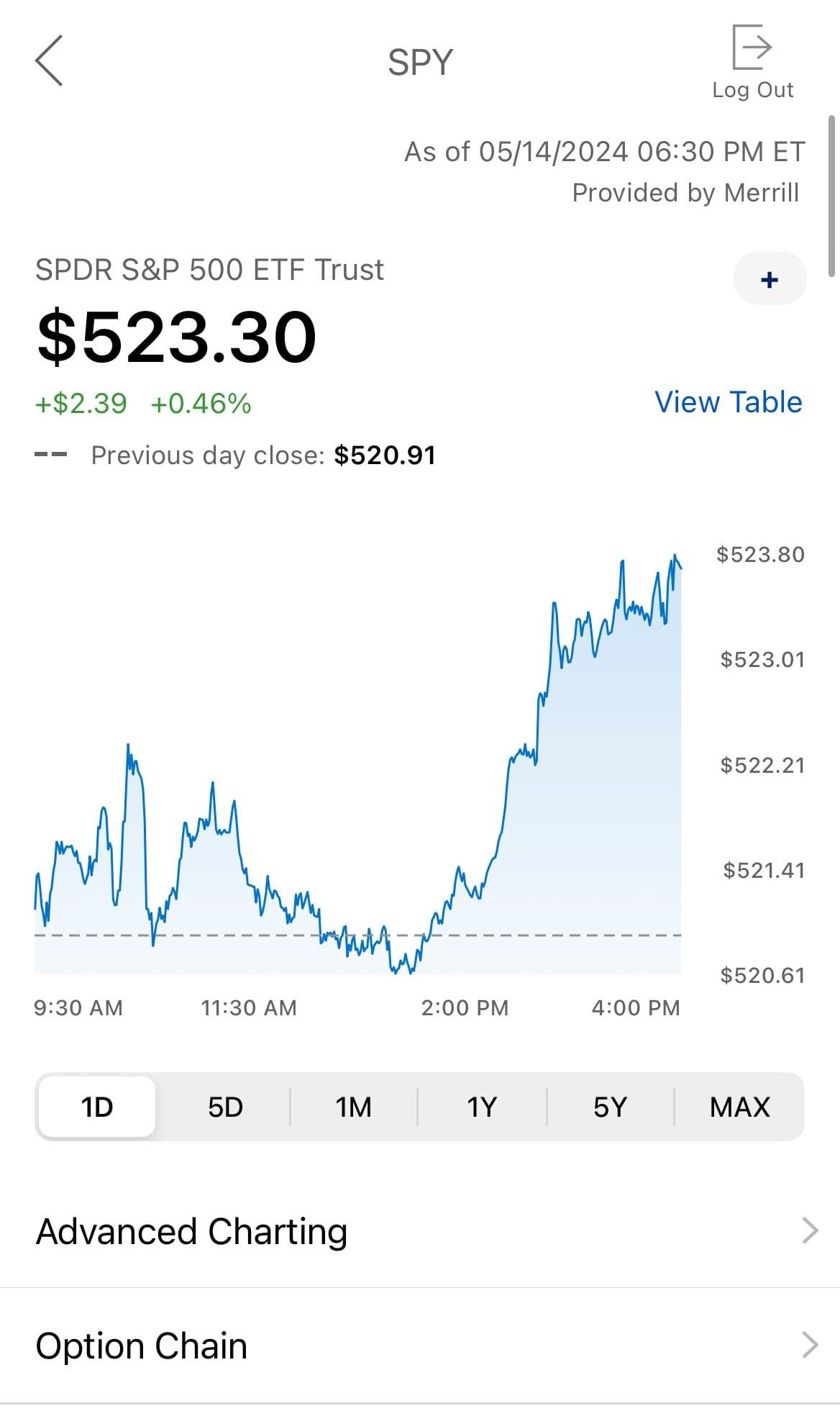

On the other hand, Merrill Edge MarketPro dashboard rivals Fidelity's with its customizable layouts and access to real-time Level II Nasdaq data, which provides deeper market insights.

MarketPro also supports advanced charting with a wide range of technical indicators, similar to Fidelity, but the integration of Level II data gives traders an edge in understanding market movements, particularly for high-volume and volatile stocks.

-

Automated Investing

Fidelity is our winner when it comkes to robo advisory due to its cost-effectiveness, especially for smaller accounts, and its seamless, low-cost access to human advisors for higher balances.

Fidelity’s robo-advisor, Fidelity Go, builds a customized portfolio based on a brief questionnaire. The portfolios are managed and rebalanced automatically, and the service is particularly appealing because it offers a tiered fee structure – 0.35% (0% under $25,000).

Additionally, Fidelity Go provides access to Fidelity’s team of advisors for those with higher balances, allowing for one-on-one consultations.

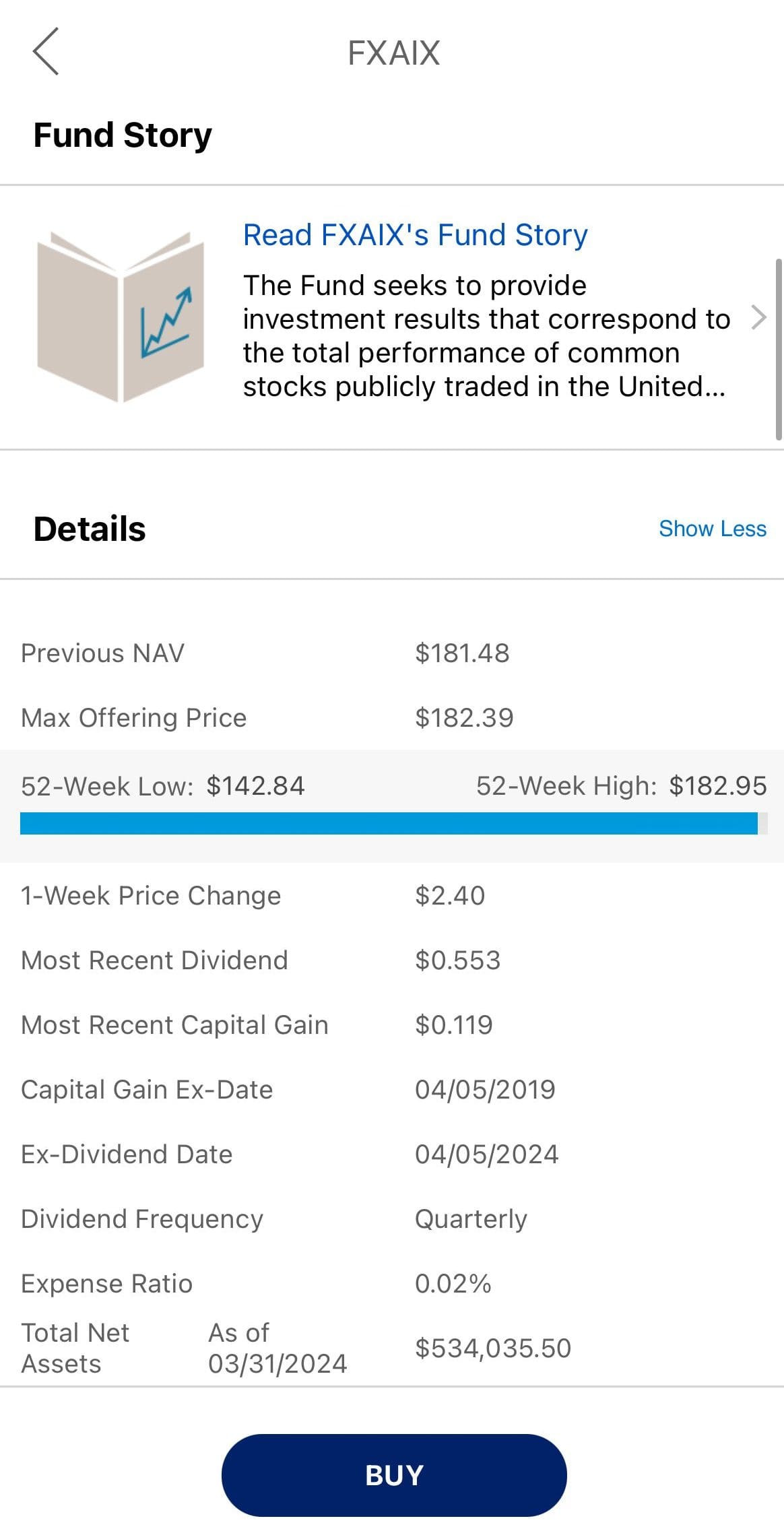

Merrill Robo Advisor offer a more integrated experience, particularly for those already using Bank of America’s services.

The basic automated service has a minimum investment of $1,000 and charges an annual fee of 0.45%, slightly higher than Fidelity Go’s fee structure.

It also offers a higher-tier service, Merrill Guided Investing with an Advisor, which requires a minimum of $20,000 and charges a 0.85% annual fee.

-

Retirement Accounts

Fidelity is our preferred choice, offering a more comprehensive and well-supported retirement planning environment.

Fidelity offers a wide range of retirement accounts, including Traditional, Roth, and Rollover IRAs, as well as SEP and SIMPLE IRAs for self-employed individuals. Extensive planning tools, educational resources, and access to professional advice enhance these accounts.

Fidelity also provides specialized accounts, such as SIMPLE IRAs for small business owners and Solo 401(k)s for self-employed individuals.

The platform also features robust retirement calculators and the opportunity to consult with advisors for personalized retirement strategies

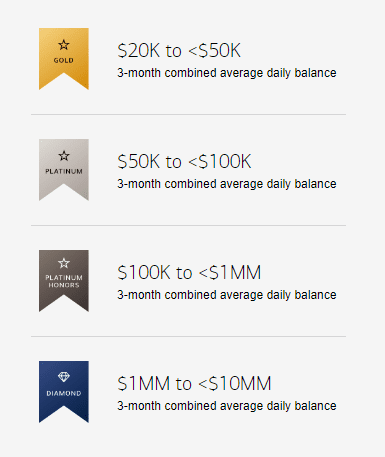

Merrill Edge, while also offering a solid range of retirement accounts, excels in its integration with Bank of America, providing additional benefits for BoA customers.

The integration with Bank of America’s Preferred Rewards program is a significant advantage for those who qualify, as it allows customers to leverage their combined balances to achieve higher rewards tiers, which can result in lower fees, higher interest rates on savings, and discounts on various banking services.

-

Fees

Fidelity offers cheaper options for Robo Advisory, but there is no significant difference when it comes to self-directed investing.

Fidelity and Merrill Edge offer $0 commissions on online stock, ETF, and mutual fund trades, and options contracts cost $0.65 per contract.

Fidelity | Merrill Edge | |

|---|---|---|

Fees | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor |

When it comes to Robo Advisory, Fidelity is cheaper for both small and large portfolios.

-

Cash Management And Savings Rates

When it comes to banking options, Fidelity options are better than Merrill Edge – unless you're a Bank Of America customer.

Fidelity’s Cash Management Account is particularly strong, offering features like a competitive interest rate on uninvested cash, no account minimums, and unlimited ATM fee reimbursements worldwide.

The account also includes check-writing capabilities, mobile check deposits, bill pay, and a debit card.

Fidelity Cash APY | Merrill Cash Account | |

|---|---|---|

Savings APY | 3.89%

| 0.01% – 3.77%

|

However, when it comes to savings, Fidelity offers the FDIC Insured Deposit Sweep Program, but the rates are not competitive.

Merrill Edge doesn't offer a stand-alone checking account – only through its integration with Bank of America.

This integration allows instant transfers, a single login for all accounts, and access to Bank of America’s extensive branch and ATM network.

-

Wealth Management Options

Fidelity is our winner when it comes to wealth management, as it offers two main tiers of wealth management services: Wealth Management and Private Wealth Management.

- Wealth Management, designed for clients with a minimum of $500,000 in investable assets, provides a dedicated advisor to develop a customized financial plan covering retirement, estate planning, tax strategies, and investment management.

- Private Wealth Management is for clients with at least $2 million in managed assets or $10 million in total assets with Fidelity.

Merrill Wealth Management offers personalized services for clients with unique financial needs, providing the opportunity to work one-on-one with a dedicated advisor.

Typically, a minimum of $250,000 in investable assets is required to access these services. Clients can choose from a full range of investment options, including stocks, ETFs, mutual funds, options, and bonds, all managed by Merrill’s investment professionals.

Additionally, clients benefit from access to Bank of America Global Research and insights, ensuring that their investment strategy is informed by expert analysis and market trends.

Bottom Line

On the bottom line, Fidelity and Merrill are quite similar in most products. Fidelity offers a but more investing options, cheaper robo advisor and more banking options, and therefore it's our winner in this comparison.

However, Merrill is a better choice for Bank of America customers due to the integration options and other benefits offered exclusively to BofA customers.

Fidelity vs. Competitors: How Does It Stack Up?

Both Schwab and Fidelity offer great options for traders, plans for wealth management, and sophisticated auto-investing platforms.

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison

Fidelity in retirement planning and personalized wealth management, while E-Trade stands out with its research tools and competitive savings rates

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.

How Merrill Edge Compares to Other Online Brokers

Vanguard may be a better option for value, long-term investors, while Merrill offers better trading options. Here's a side-by-side comparison

Vanguard vs. Merrill Edge: Which Brokerage is Right for You?

Both offer similar tools for the average investor or trader, but Merrill is better at automated investing. Here's our full comparison:

J.P. Morgan Self-Directed Investing vs. Merrill Edge: Compare Brokerage Accounts

Merrill Edge and E-trade offer great options for long and short-term investors, including robo-advisor, but there are differences.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

Merrill Edge stands out for its interface and integration with BofA, but IBKR is the ultimate winner for trading and investing. Here's why:

Interactive Brokers vs. Merrill Edge: Compare Brokerage Account Options

Schwab is our winner for investors and traders. However, the differences between brokerages are not significant. Here's our comparison: