Fidelity | Webull | |

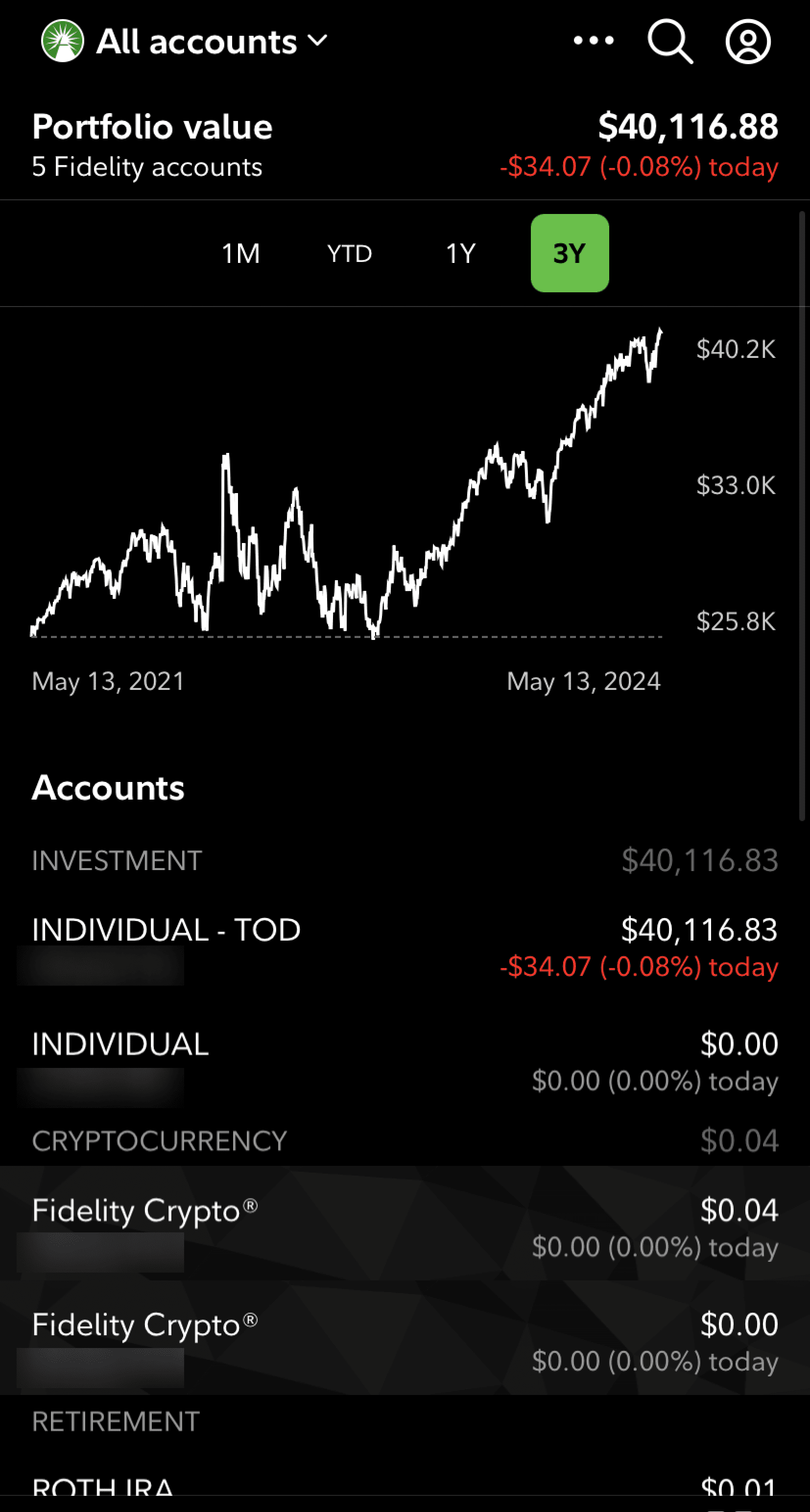

Monthly Fee | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| $0

May be charge specific fees for trading such as stock options, futures, transfers etc

|

Account Types | Brokerage, Retirement, Wealth Management | Brokerage, Retirement |

Savings APY | 3.89%

| 5.00% |

Minimum Deposit | $0 – $2M

No minimum for Fidelity Go® and brokerage, $500,000 for Fidelity® Wealth Management, $2 million for Fidelity Private Wealth Management®

| $0 |

Best For | Technical Traders, High Net Worth, Financial Planning | Advanced Traders, Active Investors |

Read Review | Read Review |

Fidelity vs Webull: Compare Investing Features

While Fidelity surpasses Webull in terms of retirement planning, mutual funds, and access to professional financial advice, Webull outperforms Fidelity in providing advanced tools for active trading and real-time market analysis.

Webull | Fidelity | |

|---|---|---|

Investing Options | 10,000 US stocks and ETFs. | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, Futures, ETFs, OTC, Margin, Fractional Shares | Stocks, Options, Margin, ETFs, Bonds & CDs, Precious metals, Crypto, Mutual Funds |

Automated Investing | Yes | Yes |

Paper Trading | Yes | No |

IPO Access | Yes | Yes |

Dedicated Advisor | No | Yes |

Fidelity is better for long-term investors and those looking for a more traditional brokerage experience with comprehensive support, while Webull caters to traders who prioritize advanced technical analysis and a streamlined, fee-free trading experience.

-

Self Investing And Trading Options

Fidelity is our winner for long-term investors looking for a broad range of investment options.

Webull, on the other hand, may be better for traders and those who want an excellent user interface and charting.

Fidelity excels in providing a broad array of investment options, including stocks, ETFs, mutual funds, options, and bonds, along with sophisticated research tools and analytics.

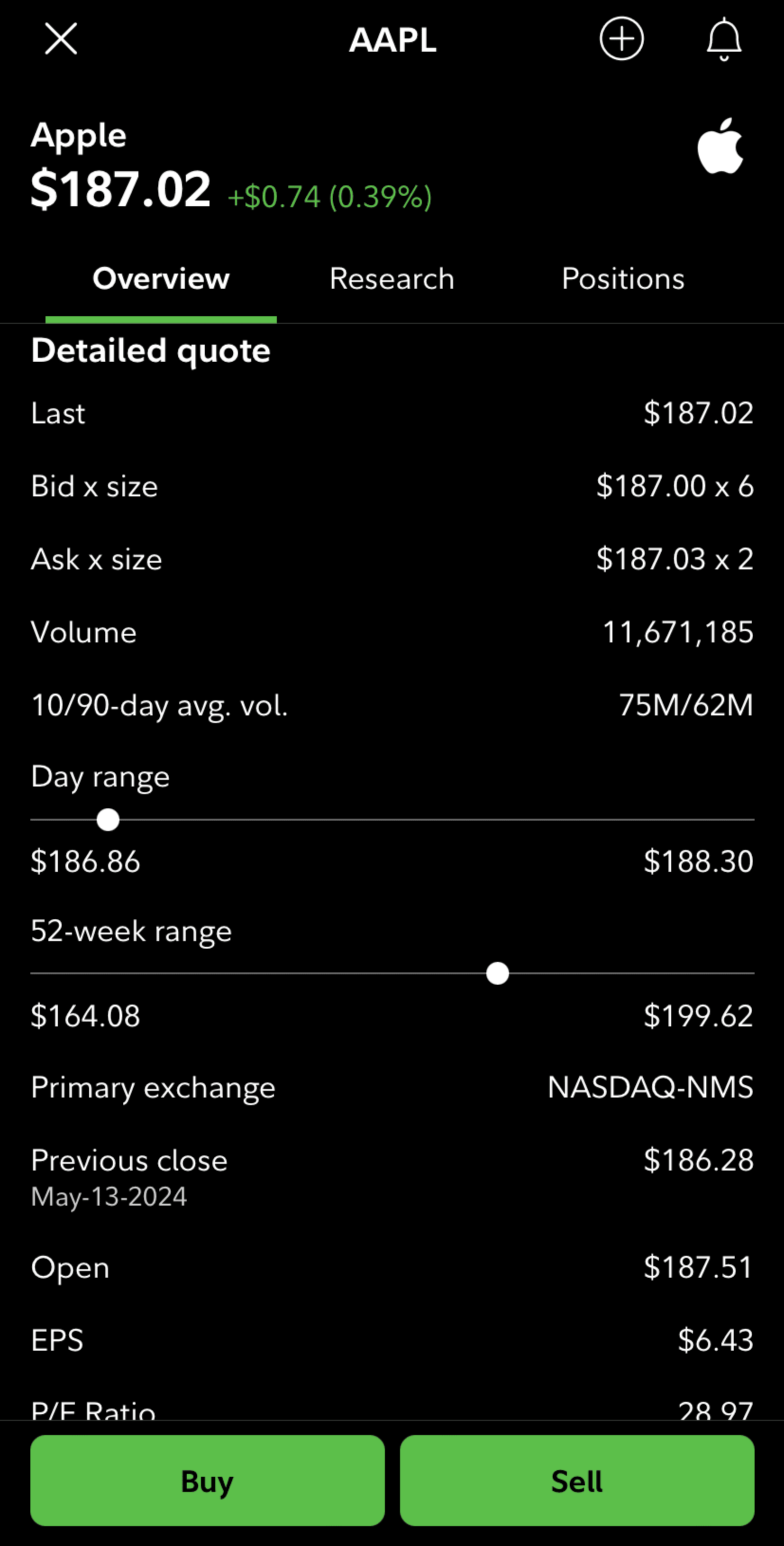

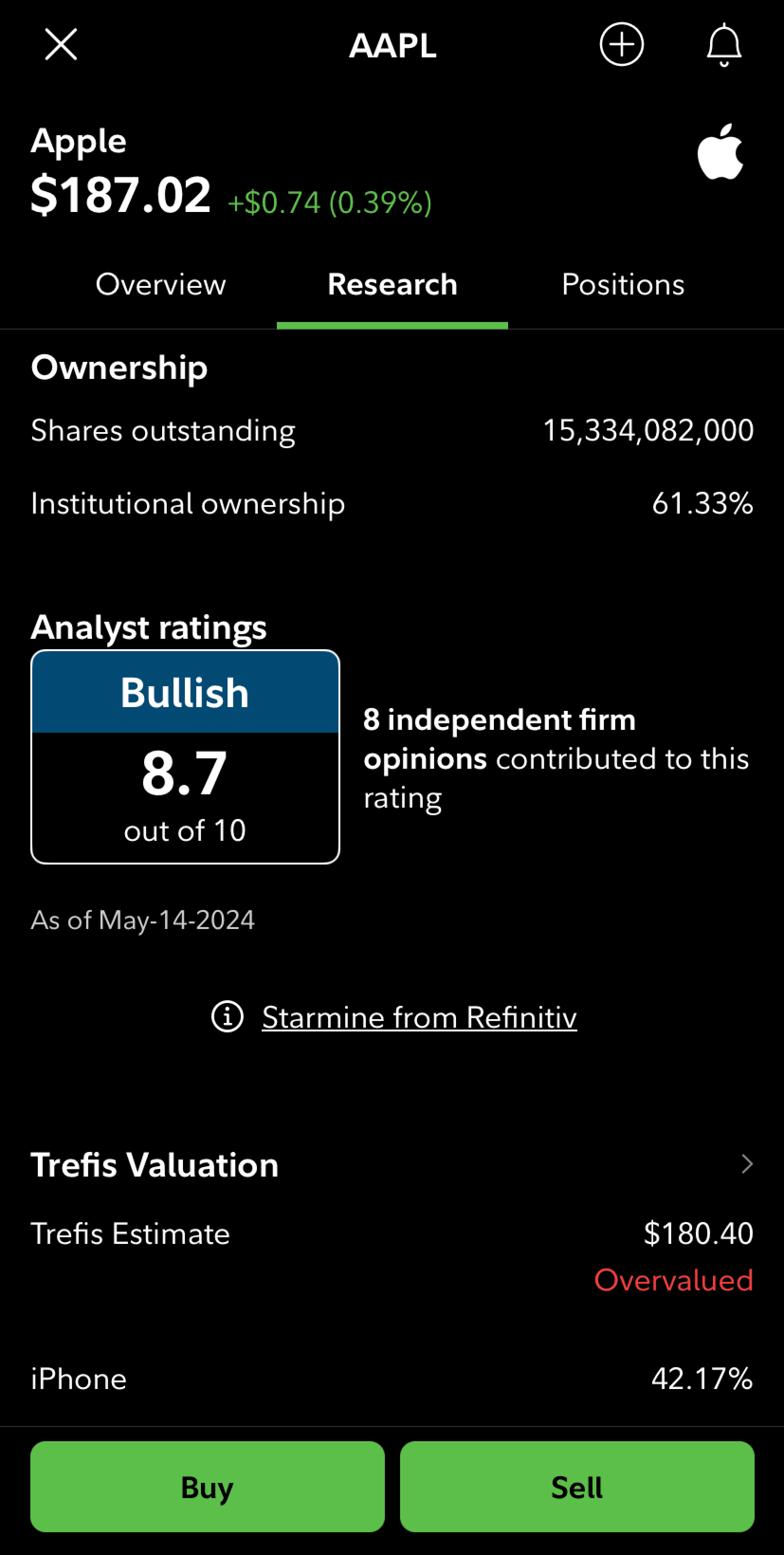

For fundamental traders, Fidelity provides an extensive suite of research tools that go beyond basic stock information. Users can access in-depth financial statements, analyst ratings, earnings reports, and valuation metrics for individual companies.

For those interested in technical analysis, Fidelity offers tools like advanced charting with customizable indicators, including moving averages, RSI, MACD, and Bollinger Bands.

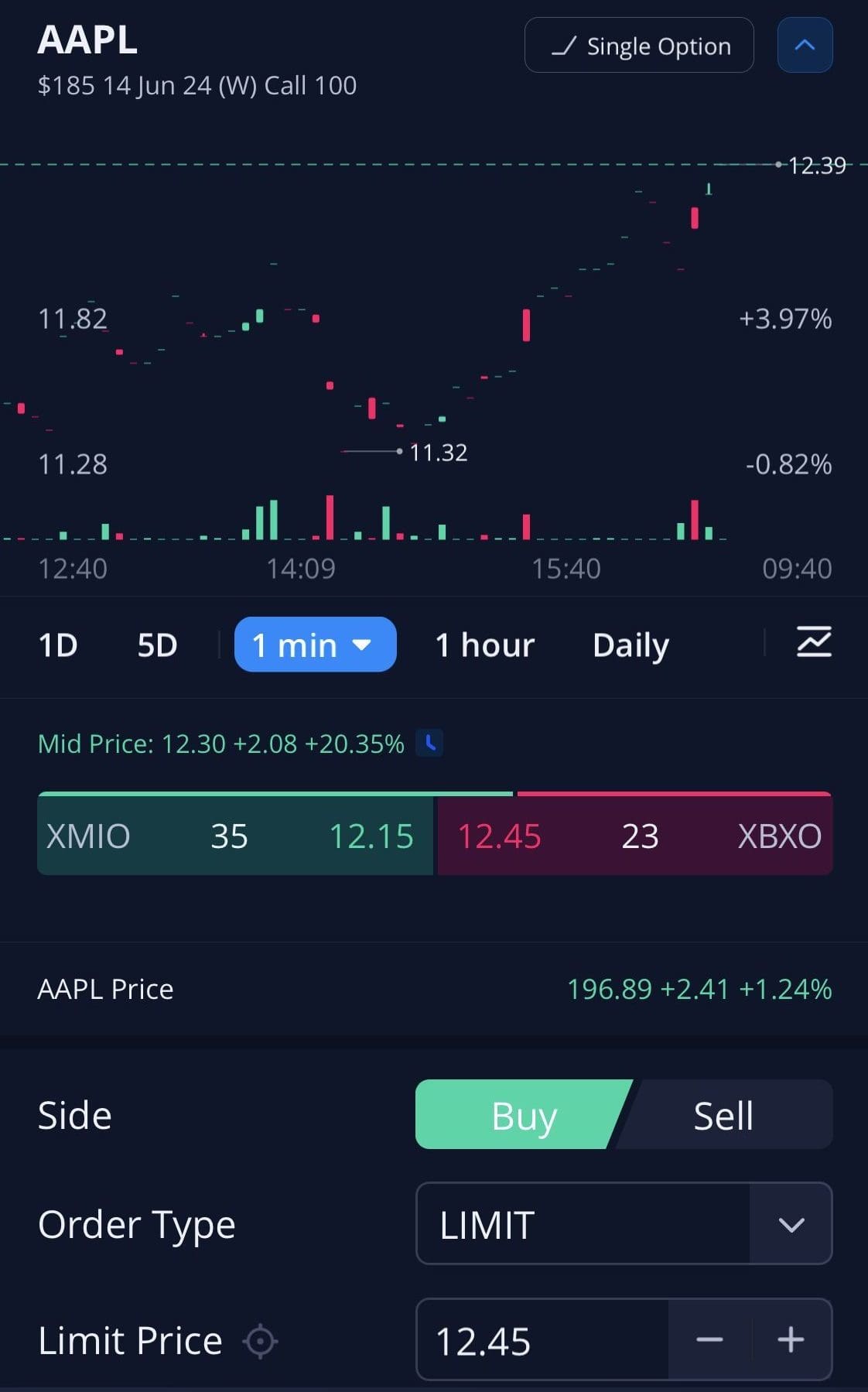

Webull, on the other hand, is a more modern, tech-driven platform that appeals to active traders and those interested in options and cryptocurrencies.

It surpasses Fidelity in its charting capabilities, offering advanced, customizable tools that are highly valued by technical traders.

Its fractional share trading and recent addition of futures trading provide flexibility for traders with smaller accounts or those looking to leverage more sophisticated strategies.

However, Webull lacks mutual funds and in-depth financial advice, which Fidelity provides in abundance.

-

Automated Investing

When it comes to a robo advisor, Fidelity is our choice as it offers a cheaper choices for small accounts and online advisor options for high net individuals.

Fidelity Go, Fidelity's robo-advisor, excels in providing a hands-off, managed investment approach tailored to individual needs.

Fidelity Go builds and manages a diversified portfolio tailored to the investor's goals and risk tolerance. It leverages low-cost Fidelity Flex mutual funds, which carry no expense ratios, to construct portfolios.

Fidelity Go offers a tiered structure – there advisory fee is 0.35% (0% under $25,000), while Webull robo advisor fee is 0.20%. However, Fidelity fee includes an access to Fidelity’s team of advisors, providing a blend of automated management with the option for human guidance.

Webull’s robo-advisor, Webull Smart Advisor, is more focused on providing an automated, low-cost solution for investors with a higher tolerance for risk and those who prefer minimal intervention.

While it lacks the personalized advisor access that Fidelity Go offers, Webull Smart Advisor provides flexibility with the ability to switch portfolios every three months, catering to investors who prefer a more dynamic approach.

-

Retirement Accounts

Fidelity comes out on top in retirement planning, offering a more comprehensive and well-supported environment.

Fidelity is a leader in retirement account options, providing a comprehensive suite that includes Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs. Fidelity's retirement offerings are designed for a wide range of investors, from individuals planning for retirement to self-employed professionals.

Fidelity also offers extensive educational resources and access to professional advice.

While Webull lacks the depth of Fidelity’s retirement planning tools and professional advisory services, it provides a more straightforward and cost-effective option for those who are comfortable managing their own retirement investments, including Traditional, Roth, and Rollover IRAs.

-

Fees

Fidelity offers $0 commissions on online stock, ETF, and mutual fund trades, with options contracts costing $0.65 per contract.

Additionally, Webull does not charge any inactivity fees or account maintenance fees, making it ideal for both frequent traders and those who may not trade as often. Lastly, Webull’s margin interest rates are more competitive.

There is also a slight difference in fees when it comes to robo advisor:

Fidelity Go | Webull Smart Advisor | |

|---|---|---|

Robo Advisor Annual Advisory Fee | 0.35% (0% under $25,000) | 0.20% |

-

Cash Management And Savings Rates

Webull offers much higher savings rates than Fidelity but fewer options for money management.

Webull High-Yield Cash Management offers an impressive 5.00% APY on uninvested cash within your Webull account, with no need for a new account, no fees, and no minimum balance.

Fidelity Cash APY | Webull | |

|---|---|---|

Savings APY | 3.89%

| 5.00% |

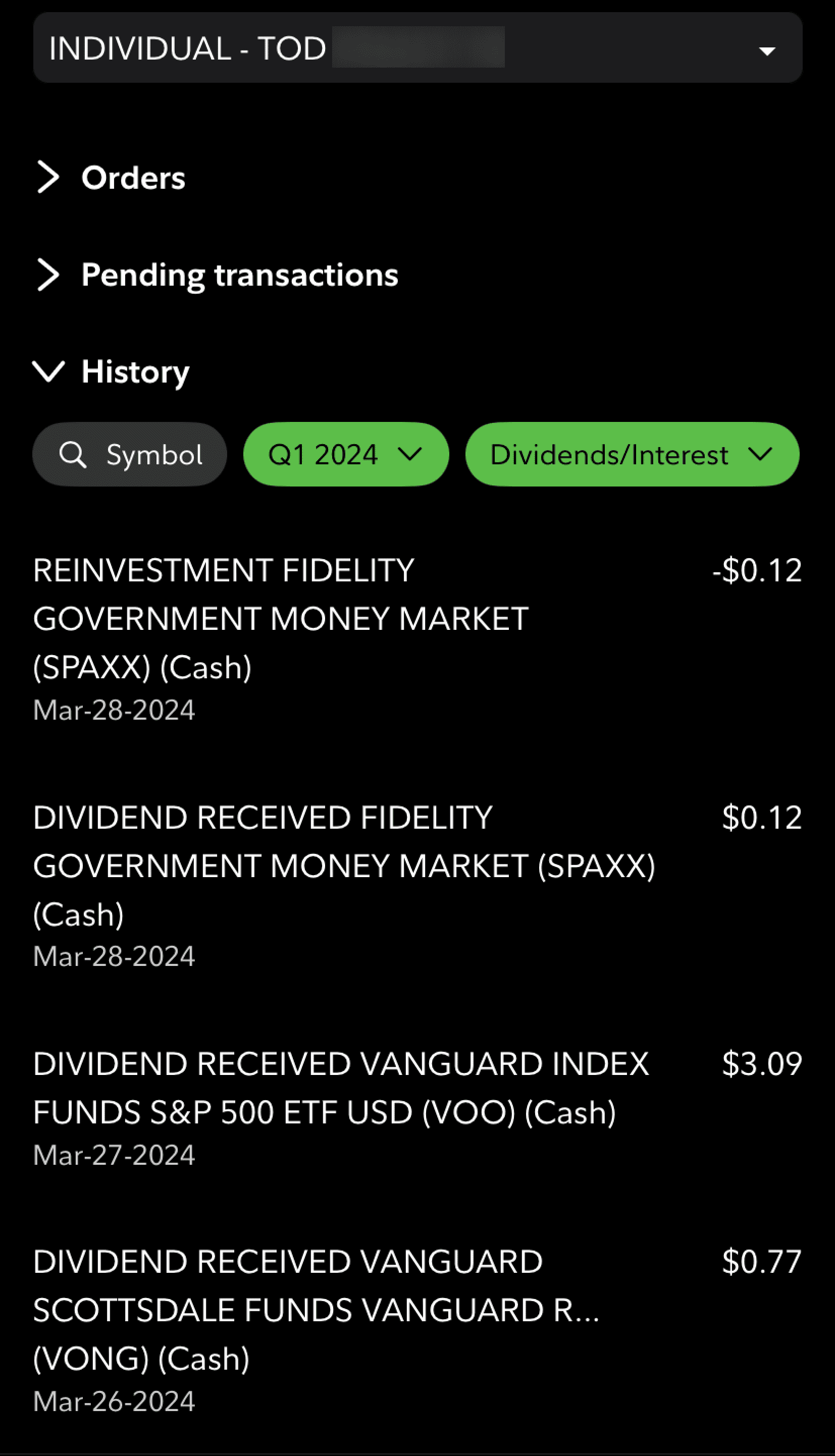

Fidelity’s Cash Management Account is integrated into its broader financial ecosystem, offering users FDIC-insured deposits through the Deposit Sweep Program, but the rates are quite low.

However, customers can secure higher rates with Fidelity CDs or the Fidelity Government Money Market Fund.

Fidelity’s account also includes features like unlimited ATM fee reimbursements, bill pay, mobile check deposits, and a debit card, making it a versatile and comprehensive option for managing everyday finances alongside investments.

Only Fidelity Offers Wealth Management Options

Fidelity distinguishes itself by offering comprehensive wealth management services that cater to investors seeking personalized financial planning and professional portfolio management.

Unlike many other platforms, including Webull, Fidelity provides a range of wealth management options designed to address the full financial picture of its clients.

These services include one-on-one guidance with a dedicated financial advisor who works closely with clients to develop a customized financial plan.

This plan covers various aspects of wealth management, including retirement planning, estate planning, tax strategies, and investment management.

Fidelity offers two tiers of wealth management services: general Wealth Management, available to clients with $500,000 or more in assets, and Private Wealth Management, which is tailored for high-net-worth individuals with $2 million or more in managed assets.

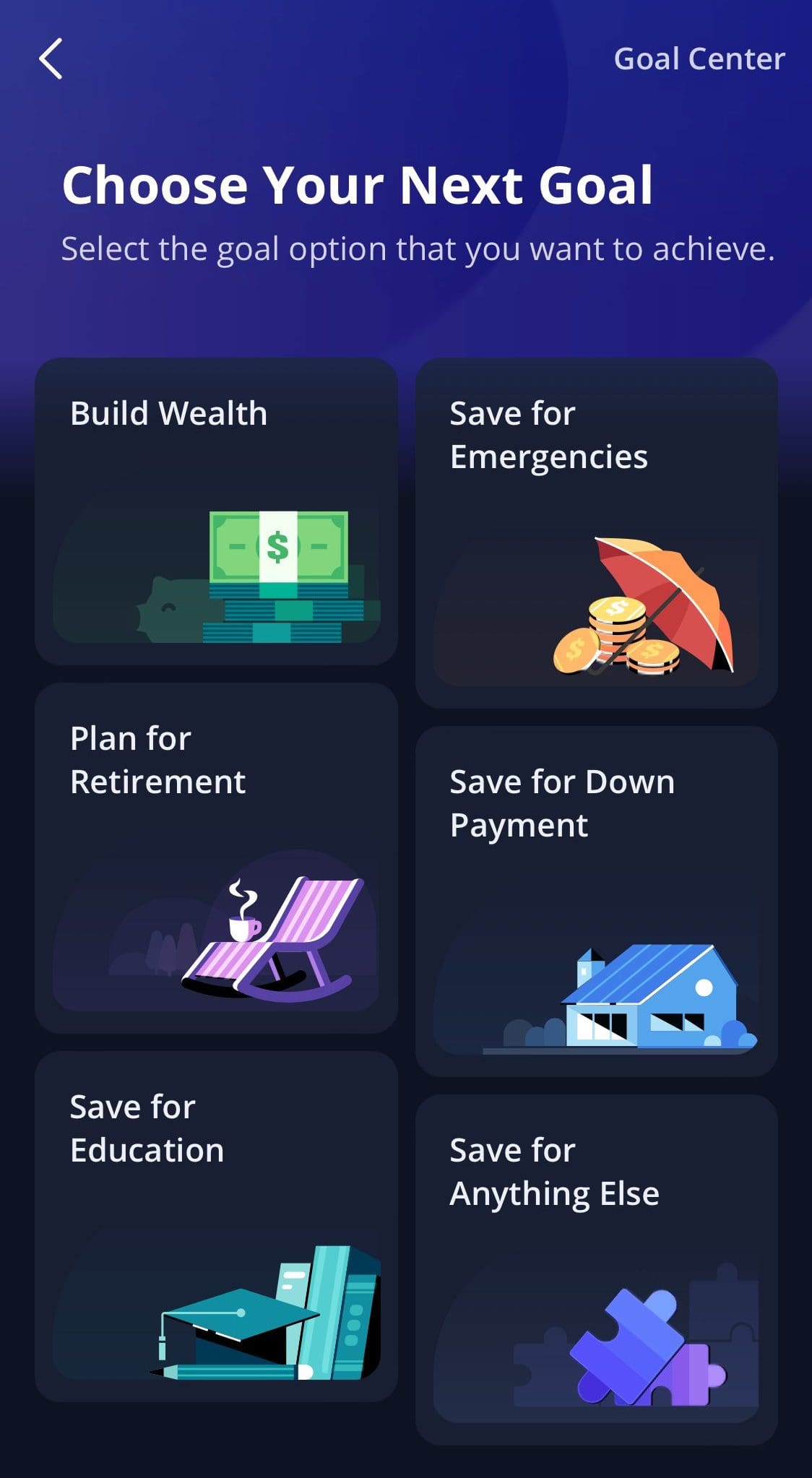

Create And Track Financial Goals With Webull

Webull offers users to create and track financial goals directly within the platform.

This feature, known as the Savings Goal tool, is designed to help users systematically save and invest toward specific financial objectives, whether it's building an emergency fund, saving for a major purchase, or achieving a particular investment milestone.

The process is straightforward: users set a financial goal, define the amount they wish to save, and establish a timeline for achieving it.

Webull then provides clear visibility into the progress of these goals, allowing users to track their savings and see how close they are to reaching their targets.

Bottom Line

Fidelity excels in comprehensive investment options, wealth management, and retirement planning, making it ideal for those seeking a well-rounded, advisor-supported experience. Its broad range of services, including personalized financial planning, sets it apart.

Webull, however, is better suited for active traders and tech-savvy investors who value low fees and great user interafce, advanced trading tools, and goal-tracking features.

Fidelity vs. Competitors: How Does It Stack Up?

Both Schwab and Fidelity offer great options for traders, plans for wealth management, and sophisticated auto-investing platforms.

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Fidelity in retirement planning and personalized wealth management, while E-Trade stands out with its research tools and competitive savings rates

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.

Compare Webull Side By Side

Webull offers user-friendly tools and perfect app design, while IBKR is best suited for more experienced investors and global market access.

Interactive Brokers vs. Webull: Compare Brokerage Account Options

Webull suits experienced traders with great app design and charting tools, while Stash is ideal for those starting their investment journey

ETRADE is best for a comprehensive array of investment options, while Webull app design and charting is one of the most appealing we've seen

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity