Gemini | Robinhood | |

Supported Coins | +150 | +20 |

Spot Trading Fees | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | $0 |

Future Trading Fees | 0.02% – 0.05%

0.05% for taker trades and 0.02% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0.005%% – 0.015%. Using GT tokens to pay trading fees offers a 10% discount | |

Our Rating |

(4.2/5) |

(4.4/5) |

Read Review | Read Review |

Gemini vs Robinhood: Compare Top Crypto Features

Choosing the right crypto platform depends on what matters most to you — simplicity, variety, or advanced tools.

Gemini and Robinhood each offer a unique experience, so let's compare how they stack up in terms of ease of use, crypto selection, DApps, and trading features, using real-world examples.

-

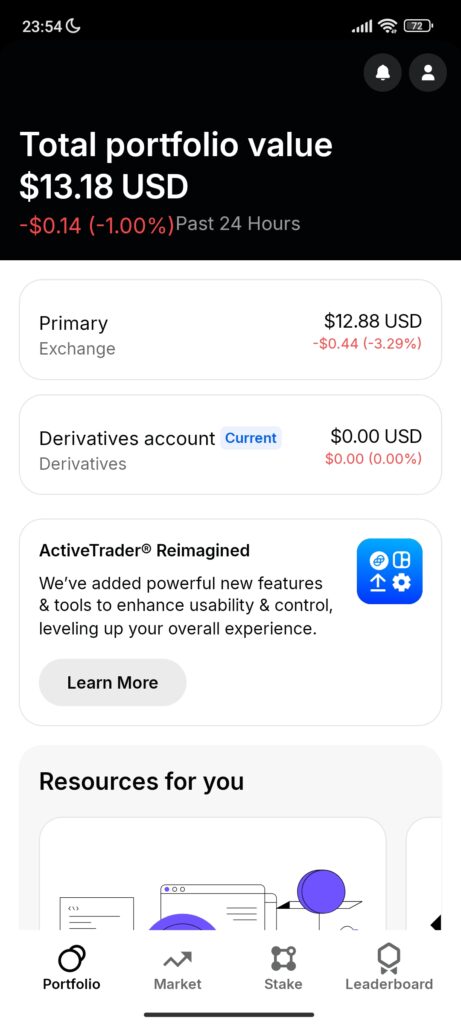

Ease of Use & Mobile App Experience

Gemini offers a clean, beginner-friendly interface for buying, selling, and staking crypto.

The app simplifies tasks like recurring purchases and portfolio tracking, and its ActiveTrader option offers advanced charts for serious investors.

Robinhood shines with an ultra-smooth mobile app that allows stock and crypto trades with just a few taps. Features like customizable watchlists, 24-hour market access, and instant price alerts make trading on the go effortless.

Overall, Robinhood edges ahead for mobile users because of its sleek, fast experience tailored for both beginners and active traders.

-

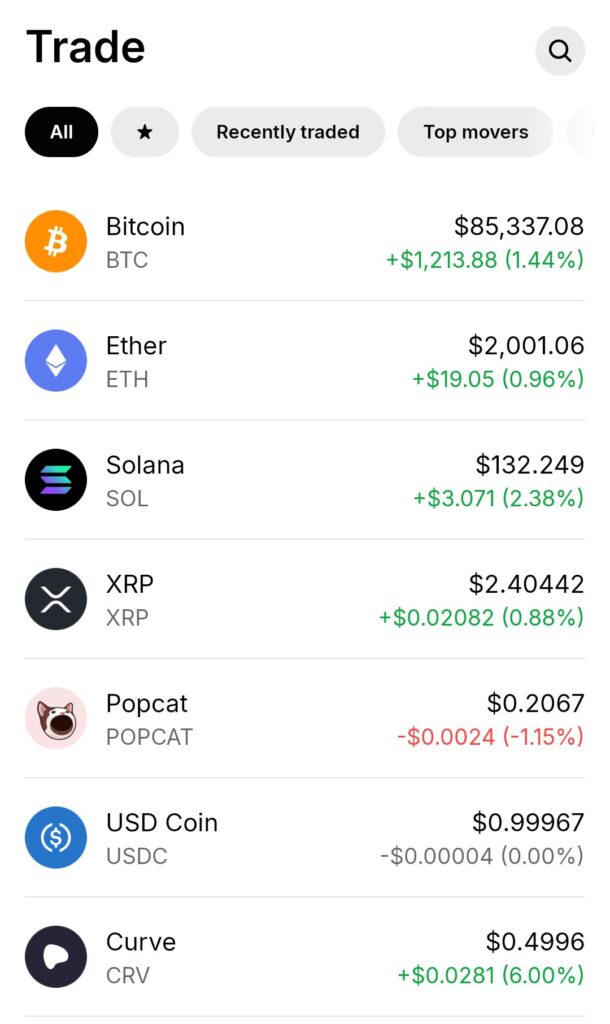

Cryptocurrency Selection

Gemini supports +150 cryptocurrencies, including Bitcoin, Ethereum, and Gemini Dollar (GUSD). It also provides access to stablecoins and a curated NFT marketplace through Nifty Gateway, appealing to diversified investors.

Robinhood focuses on major cryptos like Bitcoin, Ethereum, and Dogecoin but has a far smaller coin selection – about +20 overall (U.S. investors get limited access).

However, it offers recurring buys and free crypto trading without fees, great for casual investors.

-

Wallet Options

Gemini Provides a custodial wallet with insured hot storage and institutional-grade cold storage options. Users can store all listed assets securely within the platform.

Robinhood: Offers a self-custody wallet app supporting Ethereum, Bitcoin, Solana, and other networks. Users have full control over their private keys and can connect to decentralized applications (DApps).

-

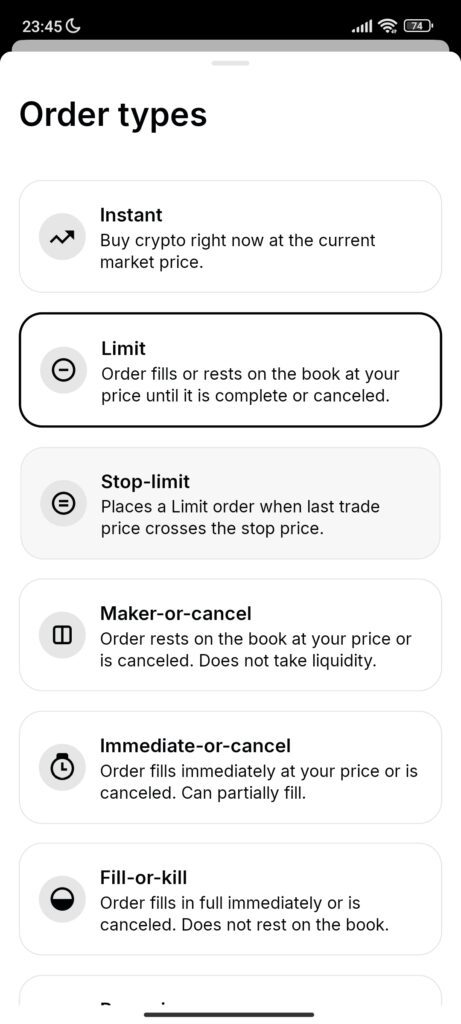

Trading Crypto Features & Experience

Gemini’s ActiveTrader platform unlocks advanced tools like limit, stop, and market orders, high-speed execution, and lower maker/taker fees

For example, an active day trader using ETH/BTC pairs benefits from precise order control and fast trades.

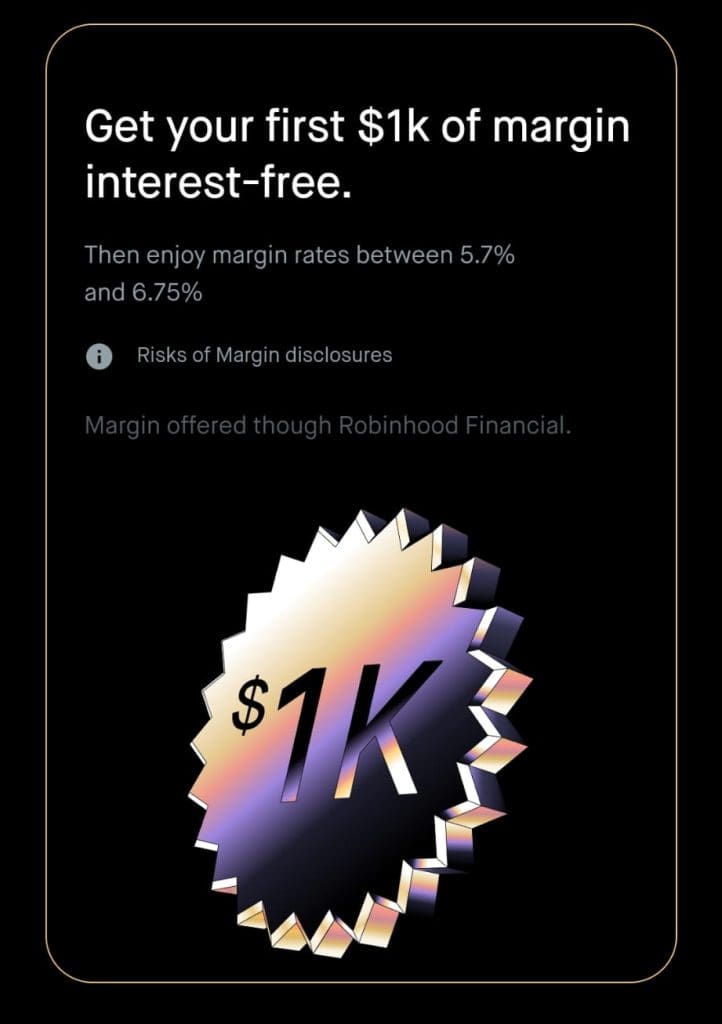

Robinhood offers advanced stock charting with technical indicators like RSI and MACD for stocks and crypto but lacks advanced crypto trading orders like limit or stop-loss directly.

However, margin trading and IPO access through Robinhood Gold add depth for stock investors.

Overall, Gemini is better suited for advanced crypto traders who need pro-level execution and flexible order types, while Robinhood remains stronger for stock-focused features.

-

Staking Options and Rewards

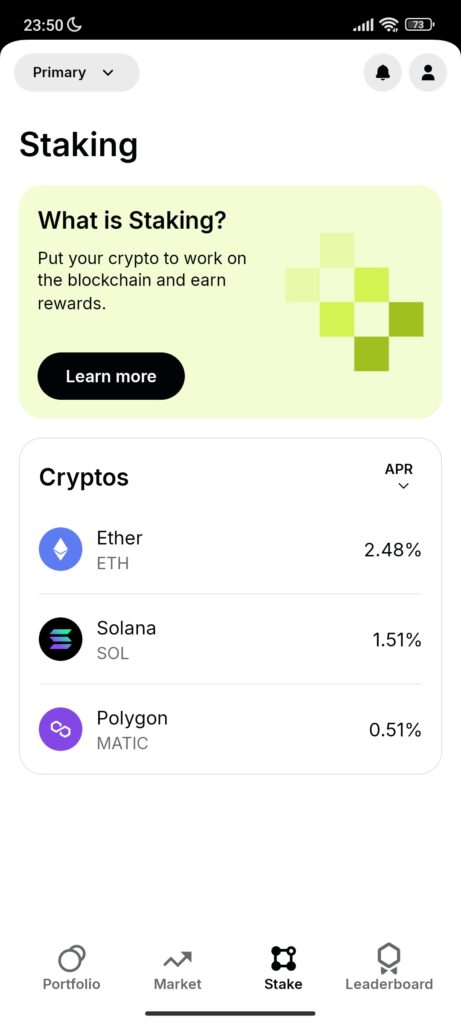

Gemini offers staking for Ethereum (ETH), Polygon (MATIC), and Solana (SOL).

The platform provides two staking options: standard staking for casual users and Staking Pro for institutional clients, which requires a minimum of 32 ETH. Gemini charges a 15% fee on staking rewards.

Robinhood has introduced staking in Europe, offering a 100% earnings match on ETH and SOL up to €10,000. However, staking is not yet available for U.S. users.

-

DApps and Web3 Integration

Gemini clearly leads for users wanting to engage with NFTs and explore basic Web3 integrations alongside traditional crypto trading.

Gemini supports Web3 integration through its Nifty Gateway platform, allowing users to buy and store NFTs securely.

Users can also interact with select blockchain apps, although the range is limited compared to full DeFi platforms.

Robinhood currently does not support direct DApps or Web3 connectivity. Users can trade and transfer crypto easily, but they cannot access DeFi staking, NFT marketplaces, or DApp browsing natively through the app.

-

Trading Bots and Automation

Gemini supports third-party trading bots through robust APIs, allowing users to automate trading strategies using platforms like GoodCrypto and Bitsgap.

Robinhood offers limited automation capabilities. While some third-party platforms like TradersPost provide automation, Robinhood lacks native support for trading bots.

-

Security Measures And Past Hacks

Gemini emphasizes security with SOC 2 Type 2 and ISO 27001 certifications. The platform stores most assets in cold storage and insures hot wallets. As of 2025, no security breaches have been reported.

Robinhood experienced a significant data breach in 2021, affecting approximately 7 million users. Since then, the company has implemented enhanced security measures, including two-factor authentication and regular security audits.

Who Should Consider Gemini Exchange?

Gemini is ideal for investors prioritizing regulation, security, and diversified crypto exposure. It's particularly suited for:

Security-Focused Investors: Those who want cold storage protection, insured hot wallets, and strict compliance with U.S. regulations.

Active Crypto Traders: Investors needing fast order execution, advanced charting, and lower fees through Gemini ActiveTrader.

Staking Enthusiasts: Users interested in earning passive rewards from staking Ethereum, Polygon, and Solana.

NFT and Web3 Participants: Those who want to engage with NFTs and blockchain apps using Nifty Gateway and basic Web3 integrations.

Gemini creates a strong environment for serious traders and long-term holders who value platform integrity and asset security.

Who Should Consider Robinhood Crypto?

Robinhood Crypto is best for investors who want simplicity, low costs, and seamless integration with stock investing. It's perfect for:

Beginner Crypto Traders: Newcomers looking for easy-to-use crypto access without complicated interfaces or steep fees.

Cost-Conscious Investors: Traders who prioritize commission-free buying and selling of crypto assets.

Mobile-First Users: Those who value fast, intuitive mobile trading, real-time alerts, and custom watchlists.

Multi-Asset Investors: Users wanting to combine stocks, ETFs, and crypto into one app for streamlined portfolio management.

Robinhood is a great starting point for investors who want straightforward crypto access along with powerful tools for managing their entire investment life.

Bottom Line

Both Gemini and Robinhood bring major strengths to the table. Gemini shines for security-focused investors, advanced crypto traders, and users who want staking and NFT access.

Meanwhile, Robinhood excels for beginners, mobile traders, and those who want zero-commission crypto investing alongside stocks.

The better choice depends on whether you prioritize deep crypto features or a simple, low-cost trading experience.