Table Of Content

Bitcoin, the world's most recognized cryptocurrency, continues to attract investors seeking a decentralized and borderless asset.

Gemini, founded by the Winklevoss twins, is a regulated U.S.-based crypto exchange known for its strong emphasis on security and compliance.

It offers a simple platform for buying Bitcoin and other digital assets, making it accessible to even beginners.

Is It Safe to Buy Bitcoin on Gemini?

Yes, Gemini is considered one of the safest places to buy Bitcoin.

It is regulated by the New York State Department of Financial Services (NYDFS) and maintains industry-leading security practices, including cold storage of most customer funds and insurance coverage for digital assets in hot wallets

How to Buy Bitcoin on Gemini In 4 Simple Steps

Before you start, make sure you have completed account setup and identity verification on Gemini.

Step 1: Explore Bitcoin Investing & Match It to Your Strategy

Before purchasing, understand how Bitcoin fits into your overall investment plan. Bitcoin's price can be highly volatile, therefore it’s crucial to match your goals with your risk tolerance.

Evaluate Your Time Horizon: Based on your financial objectives, decide whether you’re investing for the short term or the long term.

Assess Your Risk Tolerance: Bitcoin prices can swing sharply; therefore, it is key to invest only what you can afford to lose.

Research Bitcoin's Role: Some use Bitcoin for diversification, while others see it as a hedge against inflation.

By understanding these factors, you can invest more confidently and avoid making impulsive decisions when market conditions shift.

Step 2: Deposit Funds into Your Gemini Account

After planning your strategy, the next step is to fund your Gemini account. Gemini supports deposits in U.S. dollars through ACH transfers, wire transfers, and debit cards.

Choose a Deposit Method: ACH transfers are free but may take a few days, while wire transfers are faster but may incur fees.

Set a Budget: Plan how much you want to deposit, taking into account your initial investment size and transaction fees.

Wait for Confirmation: Funds may take time to clear, therefore it's wise to wait until your balance is fully available before trading.

Funding your account in advance helps you act quickly when the Bitcoin price reaches a level you are comfortable buying at.

Step 3: Find Bitcoin on the Gemini Platform

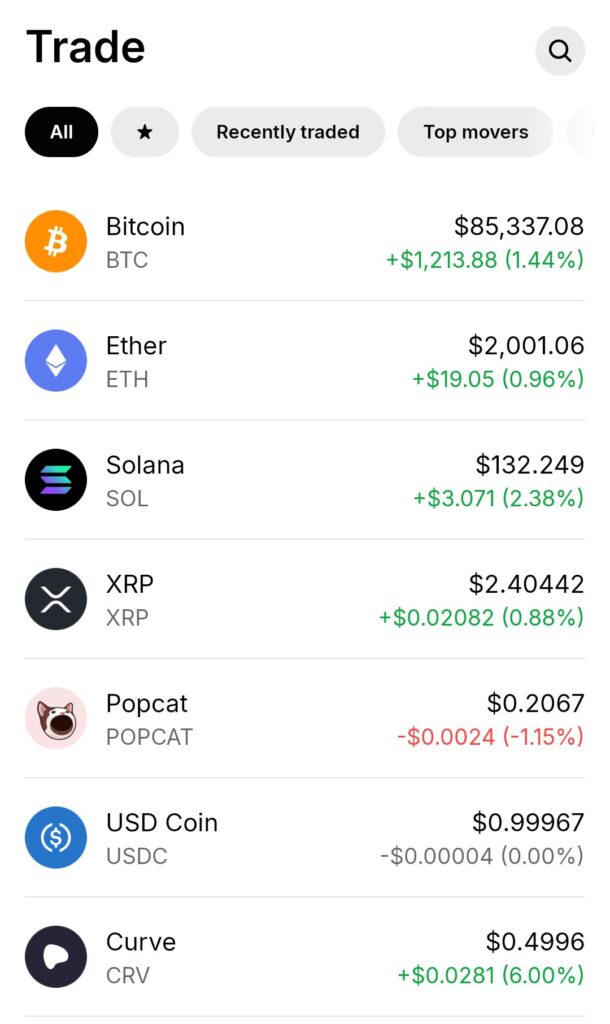

Once your account is funded, you can easily locate Bitcoin among Gemini's asset listings. The platform is designed to be beginner-friendly but also offers advanced features for experienced users.

Use the Search Bar: Simply type “Bitcoin” or “BTC” into the Gemini search tool to find it instantly.

Review the Bitcoin Profile: Gemini provides real-time prices, market stats, and project information for Bitcoin.

Check Current Market Conditions: Look at Bitcoin’s latest chart to gauge if you are buying during a dip or a surge.

Taking a moment to review the asset page ensures you are making a more informed purchase decision rather than rushing into the trade.

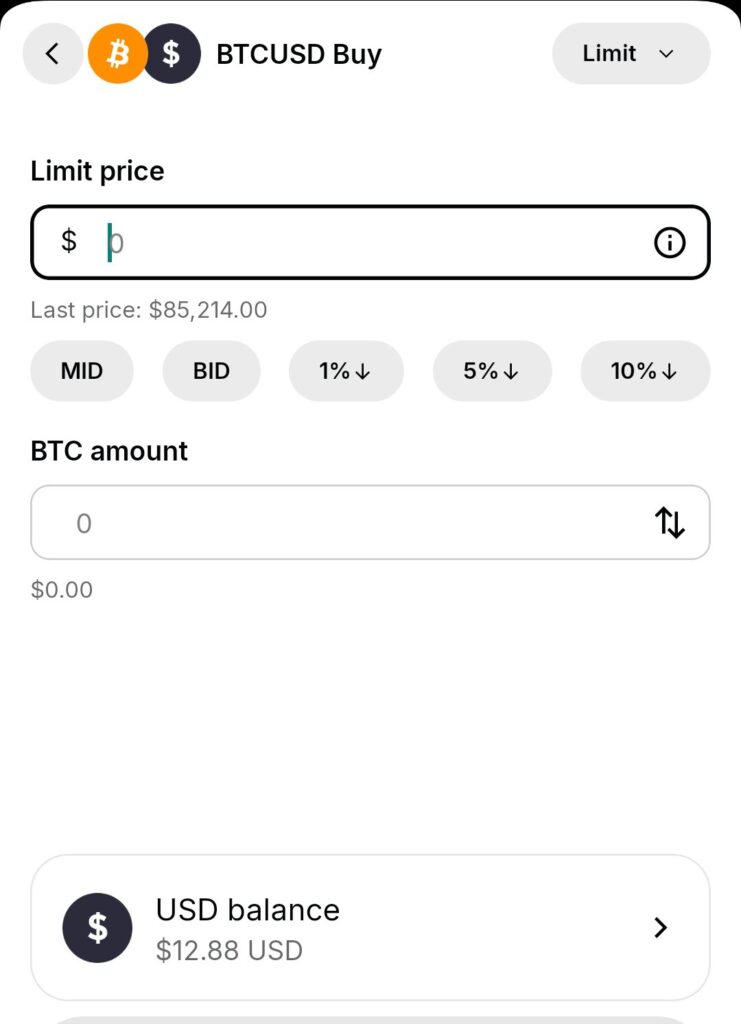

Step 4: Place Your Bitcoin Buy Order

Finally, you’re ready to buy Bitcoin on Gemini. The platform allows you to choose between market orders, limit orders, and recurring purchases depending on your strategy.

Choose an Order Type: A market order buys Bitcoin at the best available price, while a limit order lets you set a specific price.

Set Purchase Amount: You can invest as little as $5, therefore Bitcoin is accessible even for smaller budgets.

Confirm the Order: Double-check your order details before submitting because crypto transactions are typically irreversible.

By carefully placing and reviewing your order, you ensure you buy Bitcoin securely and according to your investing goals.

Mistakes To Avoid When Buying Bitcoin on Gemini

Entering the Bitcoin market on Gemini is straightforward, but certain mistakes can cost you if you're not careful.

Skipping Strategy Planning: Buying without a long-term or short-term strategy may lead to emotional decision-making during volatility.

Ignoring Fees: Although Gemini is transparent, using features like Gemini Instant Buy can involve higher fees compared to ActiveTrader.

Using Only Market Orders: Placing a market order during high volatility can result in unexpected price slippage and overpaying.

Neglecting Security Practices: Leaving Bitcoin on an exchange without enabling two-factor authentication increases the risk of hacks.

Therefore, planning carefully, checking fee structures, and securing your holdings can greatly improve your Bitcoin buying experience.

Alternative Places To Buy Bitcoin For U.S. Residents

While Gemini is a trusted platform, other options may better fit your needs depending on your preferences for fees, speed, and features.

Coinbase: Popular for beginners because of its user-friendly design, although fees can be higher than advanced platforms.

Kraken: Appeals to security-conscious users and those looking for competitive fees on both small and large Bitcoin transactions.

Cash App: Ideal for simple Bitcoin purchases directly from your phone, but it has limited features compared to a full crypto exchange.

Binance.US: Known for its low trading fees and a wider variety of cryptocurrencies, but the interface may be overwhelming for first-time users.

Exploring these alternatives can help you find the best platform with your experience level and investment strategy.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

FAQ

Yes, Gemini allows instant Bitcoin purchases through its mobile app and desktop platform. However, using the “Instant Buy” option usually comes with slightly higher fees.

Gemini supports recurring buys where you can automate Bitcoin purchases daily, weekly, or monthly. This can help you dollar-cost average into the market over time.

You can buy as little as $5 worth of Bitcoin on Gemini, making it accessible for new investors who want to start small.

Yes, Gemini imposes daily and monthly withdrawal limits, depending on your account verification level. Always check your limits before large transactions.

Yes, after purchasing Bitcoin, you can transfer it to an external wallet. Gemini encourages using external wallets for enhanced security.

Gemini charges transaction fees based on your order size and platform choice. Using Gemini ActiveTrader can help lower your trading costs.

Bitcoin stored in Gemini’s hot wallet is insured against certain types of breaches, but once you transfer Bitcoin to a private wallet, the insurance does not apply.

No, Gemini requires full identity verification under regulatory guidelines before allowing you to buy Bitcoin or any other crypto asset.

If you cancel a limit order before it fills, no funds are lost. However, market orders cannot be canceled once submitted, so review carefully before confirming.

Gemini operates in several countries outside the U.S., but availability varies. You’ll need to check if your country is supported when signing up.