Table Of Content

Is It Safe To Buy Bitcoin on MEXC?

Bitcoin (BTC) is the world's first decentralized digital currency, offering a limited supply and high liquidity, making it a popular investment choice.

MEXC is a fast-growing crypto exchange known for a wide selection of coins, competitive trading fees, and user-friendly features. However, MEXC is not available in the United States.

It is generally considered safe to buy Bitcoin on MEXC, thanks to its strong security practices like multi-signature wallets and anti-phishing measures.

However, users should still apply personal security best practices, such as enabling two-factor authentication (2FA) and using cold storage for larger holdings.

How to Buy Bitcoin on MEXC in 4 Simple Steps

Getting started with Bitcoin on MEXC is easier than many expect. Here’s how you can do it in four straightforward steps:

Step 1: Match Bitcoin Investing to Your Strategy

Before you buy, it's essential to determine if Bitcoin aligns with your financial goals and risk tolerance. Bitcoin can be volatile, but it also offers growth opportunities.

Understand Bitcoin’s Role: Bitcoin is often treated as a hedge against inflation or a long-term store of value.

Set a Time Horizon: Some investors hold Bitcoin for years, while others trade based on short-term price movements.

Assess Risk Appetite: Crypto prices can fluctuate rapidly, so it's critical only to invest money you can afford to lose.

To build a confident investment plan, you should also explore Bitcoin's past performance and stay up-to-date on market trends.

- The Smart Investor Tip

Take a moment to review your overall financial situation. In order to avoid impulsive buys, outline whether you plan to hold Bitcoin long-term or trade based on short-term market movements.

Step 2: Fund Your MEXC Account

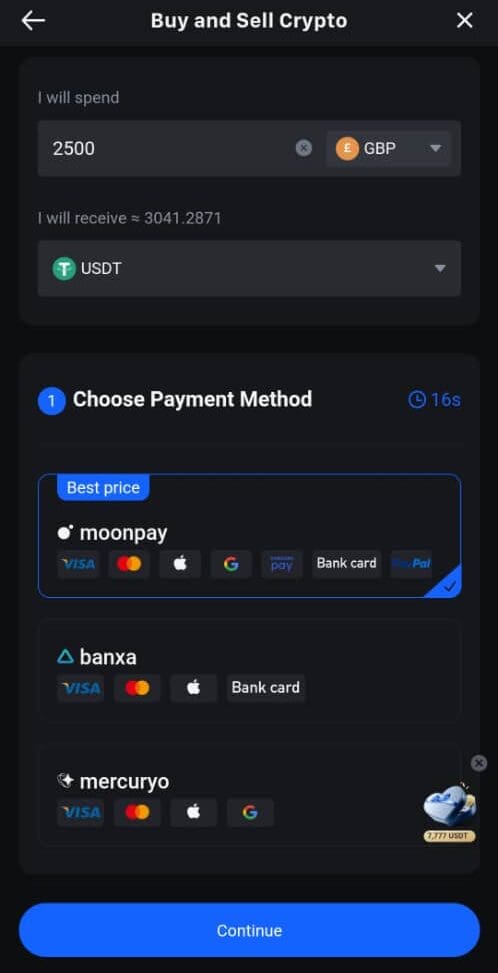

To buy Bitcoin, you’ll first need to deposit money or other crypto assets into your MEXC account. MEXC supports multiple funding methods.

Use Fiat Deposit Options: Depending on your region, you can deposit using bank transfers or third-party services like Simplex.

Transfer Crypto: If you already hold crypto elsewhere, transfer it to your MEXC wallet to fund your Bitcoin purchase.

Consider Fees: Different payment methods may have varying fees, so review the costs carefully before confirming your deposit.

Because MEXC sometimes offers deposit bonuses or fee discounts during promotions, it’s smart to check their announcements page before making a move.

Step 3: Place a Bitcoin Buy Order

Once your account is funded, you’re ready to place an order to buy Bitcoin. MEXC offers several order types to suit different needs.

Use a Market Order: Buy Bitcoin instantly at the current market price for quick execution.

Consider a Limit Order: Set a specific price at which you want to buy, ideal for strategic entry points.

Check Order Confirmation: Always review the amount and price before confirming your order to avoid errors.

Because Bitcoin prices can move quickly, limit orders are often used by strategic investors who want more control over their entry price.

Step 4: Secure Your Bitcoin Post-Purchase

After buying Bitcoin, protecting your new asset is critical. While MEXC is a trusted platform, self-custody offers additional layers of security.

Transfer to a Private Wallet: Use a hardware wallet like Ledger or Trezor to store Bitcoin offline.

Enable Security Features: Activate 2FA, anti-phishing codes, and withdrawal whitelists on your MEXC account.

Stay Informed: Follow trusted crypto news outlets to keep updated on any security vulnerabilities or platform updates.

As a result, taking these steps ensures that your Bitcoin remains safe, giving you greater peace of mind for the long haul.

- The Smart Investor Tip

Transfer Bitcoin you don't plan to actively trade into a hardware wallet, because relying solely on exchange storage increases your exposure to hacking risks.

Mistakes To Avoid When Buying Bitcoin on MEXC

Buying Bitcoin on MEXC can be straightforward, but some mistakes can cost you money or security. Here’s how to steer clear:

Skipping Research: Jumping in without understanding Bitcoin's risks or recent market trends can lead to panic decisions.

Ignoring Fees: Not checking deposit, trading, or withdrawal fees can eat into your profits without you realizing it.

Not Setting Security Measures: Forgetting to enable 2FA, withdrawal whitelists, or using weak passwords puts your Bitcoin at risk.

Buying at Peak Hype: FOMO (fear of missing out) can push you to buy at unsustainable prices, leading to immediate losses.

Therefore, it’s crucial to approach your Bitcoin investment on MEXC with a well-researched, secure, and calm strategy.

Alternative Places to Buy Bitcoin for U.S. Residents

While MEXC offers a broad coin selection, U.S. residents should consider other platforms, as MEXC is restricted in the U.S. due to regulatory reasons:

Coinbase Is Ideal for beginners due to its simple interface, regulated environment, and easy fiat on-ramps.

Kraken: Known for strong security and advanced trading options, great for serious investors.

Gemini: Offers strong regulatory compliance and an insured hot wallet for storing crypto.

Binance.US: Provides low fees and a wide selection of cryptocurrencies, although slightly limited compared to Binance global.

Cash App: Suitable for small Bitcoin purchases directly from a mobile app, though fees can be higher.

As a result, you have several reliable options if you prefer platforms more specifically tailored to U.S. regulations or your investment style.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

FAQ

No, MEXC services are restricted in the U.S. due to regulatory reasons, so U.S. residents should explore alternatives.

MEXC allows small crypto-to-crypto trades without full KYC, but identity verification is required for fiat deposits, withdrawals, and larger limits.

Yes, MEXC offers a mobile app on both iOS and Android, allowing users to buy Bitcoin, manage portfolios, and trade securely on the go.

Currently, MEXC does not offer automatic recurring Bitcoin purchases, so you must place manual buy orders each time you want to invest.

MEXC supports bank transfers, debit/credit card purchases via third-party providers, and crypto deposits for buying Bitcoin.

Yes, MEXC charges trading fees around 0.1% per transaction, and additional charges may apply for fiat deposits via third-party services.

Yes, you can buy small fractions of Bitcoin on MEXC — even as little as $10 worth — making it accessible for all budgets.

Crypto-to-crypto purchases usually settle instantly, but fiat-based buys via third parties can take a few minutes to several hours.

MEXC provides an exchange wallet for temporary storage, but it’s highly recommended to transfer Bitcoin to a private wallet for better security.