How to Invest in Coinbase Stock: A Step-by-Step Guide

Coinbase Global Inc. (COIN) is one of the most prominent cryptocurrency exchanges in the U.S. and is publicly traded on the Nasdaq.

If you're looking to invest in Coinbase stock, whether because you believe in the growth of crypto adoption or the company's expanding services, here’s a step-by-step guide — complete with practical examples and tools to help you get started.

-

1. Choose a Brokerage

To invest in Coinbase, you’ll need access to a brokerage platform that allows trading of U.S. stocks listed on the Nasdaq, where Coinbase trades under the ticker COIN.

Popular brokers like Fidelity, Robinhood, and Charles Schwab support Coinbase stock with no trading commissions. But your choice shouldn’t depend on fees alone.

[elementor-template id=”211350″]

Look for platforms that offer research reports, real-time price alerts, and strong mobile usability.

-

2. Open and Fund Your Brokerage Account

After selecting a brokerage, you’ll need to create an account, which usually includes uploading your ID, linking a bank account, and selecting your account type — such as an individual taxable account or a Roth IRA if you're investing long-term.

Once your account is funded, you can invest in Coinbase — even if the stock price is above your initial deposit.

For example, if COIN is trading at $160 but you only have $100, you can still purchase fractional shares on platforms like Robinhood and Fidelity.

-

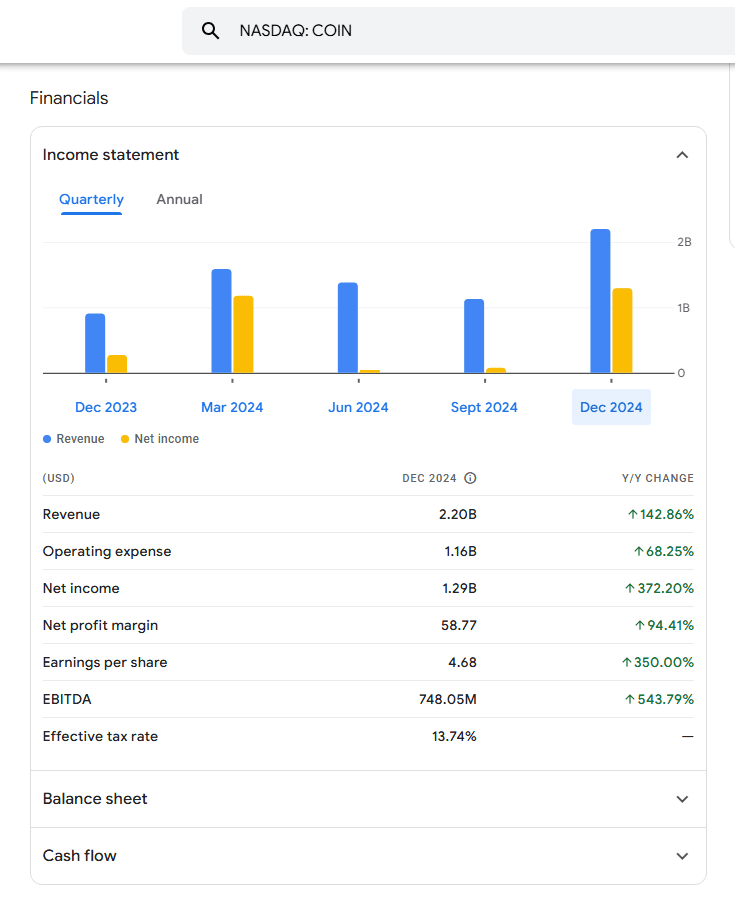

3. Research Coinbase’s Business Model and Risks

Before investing, it’s critical to understand what drives Coinbase’s stock price.

While it earns fees from crypto trades, its performance also depends heavily on broader crypto market activity, regulatory developments, and user engagement on its platform.

Here are a few areas to research:

Crypto market cycles – COIN tends to rise and fall alongside major coins like Bitcoin and Ethereum.

Regulatory challenges – Coinbase has faced scrutiny from the SEC, which could affect future earnings.

New product launches – Tools like Coinbase Advanced and institutional services may impact long-term revenue.

User activity – Look for trends in trading volume and monthly transacting users, especially in earnings reports.

For example, after Coinbase added support for staking and expanded to derivatives trading, investor sentiment briefly improved — until a regulatory warning caused volatility again.

-

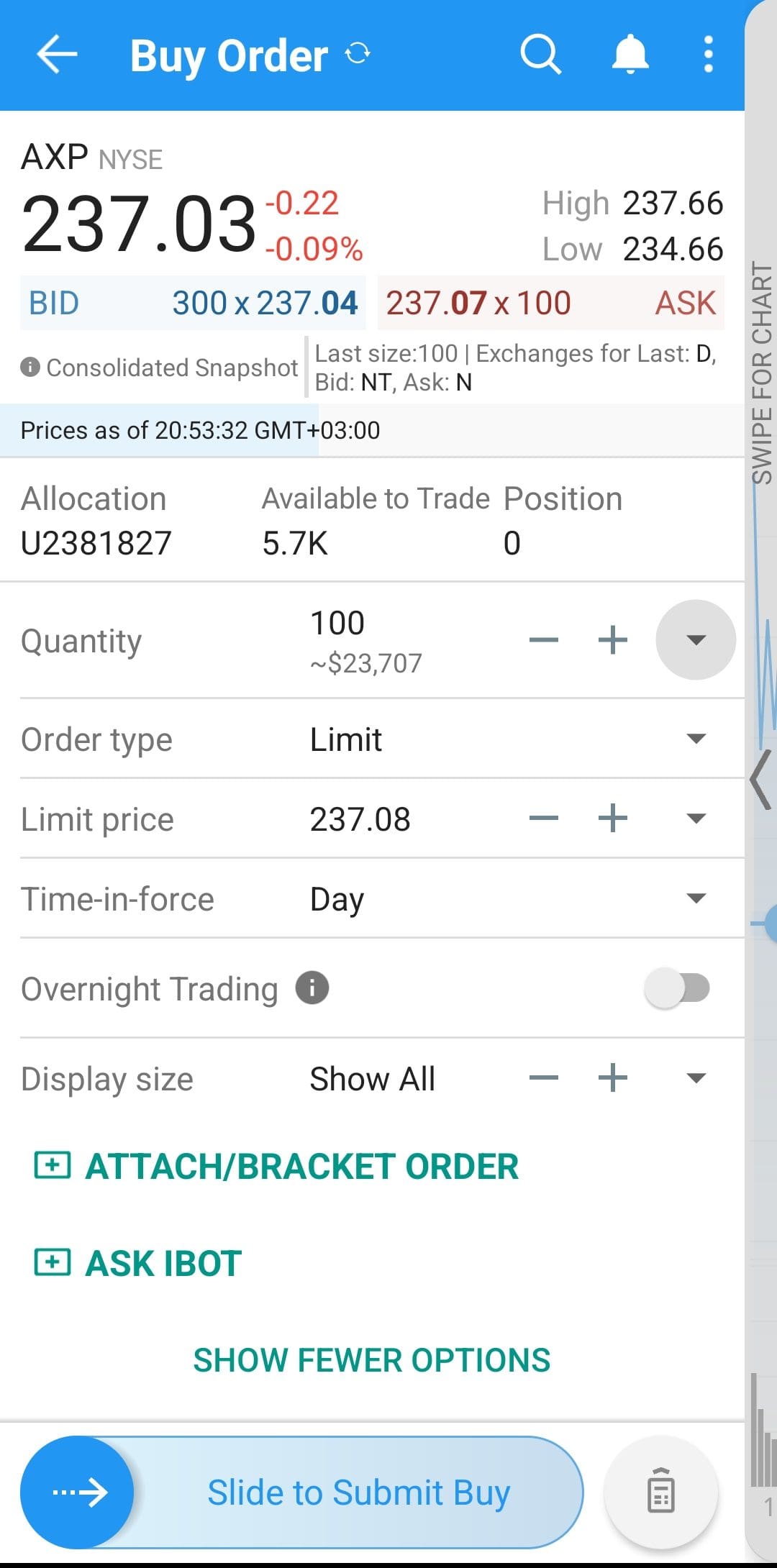

4. Place Your Order for Coinbase Stock

Once you’ve done your research and are ready to invest, log into your broker, search for COIN, and decide how you want to place your order. Here are your main options:

Market Order – Executes immediately at the current market price

Limit Order – Executes only if COIN hits a price you specify

Recurring Investment – Automatically invests a fixed dollar amount at regular intervals

Let’s say you expect COIN to drop after an upcoming regulatory hearing — instead of buying at $160 now, you could place a limit order at $145 to catch a dip.

Ways to Invest in Coinbase Without Buying the Stock

Investing directly in Coinbase (ticker: COIN) isn’t the only way to benefit from the company’s role in the cryptocurrency ecosystem.

If you’re looking for more diversification or want to reduce your exposure to crypto market swings, there are several indirect investment strategies that still offer exposure to Coinbase’s growth potential.

-

Invest in ETFs That Include Coinbase

One of the most accessible ways to invest in Coinbase indirectly is through exchange-traded funds (ETFs) that include COIN as part of their holdings.

These ETFs often focus on tech, fintech, or crypto-related themes, giving you diversified exposure across the broader digital asset space.

For example:

ARK Fintech Innovation ETF (ARKF) includes Coinbase among its top holdings and focuses on financial disruption

Global X Blockchain ETF (BKCH) holds Coinbase and other blockchain infrastructure companies

Bitwise Crypto Industry Innovators ETF (BITQ) provides exposure to firms actively involved in crypto, including Coinbase and Galaxy Digital

This approach is useful if you want to benefit from Coinbase’s performance but also spread risk across other companies shaping the digital finance space.

-

Invest in Crypto-Linked Stocks That Benefit from Coinbase’s Ecosystem

Another way to invest around Coinbase is by holding shares in companies that support or complement the cryptocurrency infrastructure.

These companies don’t compete directly with Coinbase, but they benefit when crypto interest — and Coinbase trading volume — rises.

Examples include:

Marathon Digital Holdings, which mines Bitcoin and indirectly supports demand on Coinbase

Nvidia, whose chips power blockchain mining and crypto-related computing

This strategy is especially relevant if you believe the broader crypto ecosystem will grow — not just trading platforms like Coinbase, but also the hardware, financial rails, and energy infrastructure supporting it.

-

Use Robo-Advisors or Mutual Funds with Coinbase Exposure

If you prefer a passive or automated approach, many robo-advisors and mutual funds now include exposure to crypto-related companies, including Coinbase, through ETFs and managed portfolios.

For example:

Wealthfront offers crypto-themed ETF portfolios that may hold BITQ or ARKF

Betterment allows customization of portfolios with thematic exposure, including crypto innovation

Some actively managed funds like BlackRock’s iShares Future Innovators ETF (LFIV) have included Coinbase in past filings

This route is ideal if you want long-term Coinbase exposure without actively monitoring the market or timing trades. Robo-advisors rebalance automatically and align with your risk profile.

[elementor-template id=”206505″]

Pros and Cons of Indirect Coinbase Investment

While indirect investing in Coinbase can reduce single-stock risk, it also comes with trade-offs that are worth considering.

- Exposure to Crypto Without Owning Coins

Coinbase offers a way to invest in the crypto economy without directly holding volatile assets like Bitcoin or Ethereum.

- Strong Brand and Market Position

As one of the largest U.S.-based crypto exchanges, Coinbase benefits from name recognition, regulatory compliance, and a large user base.

- Revenue Growth During Bull Markets

When crypto trading activity increases, Coinbase often sees a spike in revenue from transaction fees and platform usage.

- Diversifying Into Digital Finance

Investing in Coinbase allows exposure to a fast-growing industry that blends fintech, blockchain, and decentralized finance.

- High Volatility and Market Sensitivity

Coinbase stock is closely tied to crypto prices, which means it can rise or fall sharply based on sentiment or news.

- Regulatory Uncertainty

Ongoing investigations and legal battles with U.S. regulators like the SEC can impact Coinbase’s operations and stock price.

- Heavy Reliance on Trading Fees

A large portion of Coinbase’s revenue comes from transaction fees, which may decline as competition increases or volumes drop.

- Not Yet Profitable Consistently

Despite periods of strong revenue, Coinbase has struggled to maintain consistent profitability due to market cycles and high operating costs.