Table Of Content

How to Buy Costco Stock

Investing in Costco (ticker symbol: COST) can be a smart move if you’re looking for long-term exposure to a well-established retail giant with a loyal customer base and consistent growth.

Here’s how to get started:

-

1. Choose a Brokerage Platform

To buy Costco stock, begin by selecting a reputable brokerage that offers access to Nasdaq-listed stocks.

Popular platforms like Fidelity, Charles Schwab, Robinhood, Webull and Ally Invest make it easy to trade COST shares.

Broker | Annual Fees | Best For |

|---|---|---|

E-Trade | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| Options & Futures Trading |

Interactive Brokers | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% | Professional Trading Tools |

Fidelity | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| Retirement Account Investing |

Vanguard | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | Low-Cost ETF Investors |

J.P. Morgan Self Investing | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | Chase Bank Customers |

Charles Schwab | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | Advanced Trading Tools |

Merrill Edge | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Bank of America Clients |

Many brokers now offer commission-free trades and intuitive mobile apps, which are especially helpful if you want to monitor your investment on the go.

Also, some platforms, like Fidelity and Schwab, support fractional shares, allowing you to invest in smaller amounts.

-

2. Open and Fund Your Account

Once you’ve selected a broker, create your broker account by submitting your personal and financial information, including your Social Security number and employment status.

Don't forget to link your bank account and deposit funds to get started.

For example, let’s say you want to invest $2,000 in Costco stock. Once the funds are available, you can decide whether to buy nearly 3 full shares or diversify with fractional shares alongside other stocks.

-

3. Research Costco’s Business Before Buying

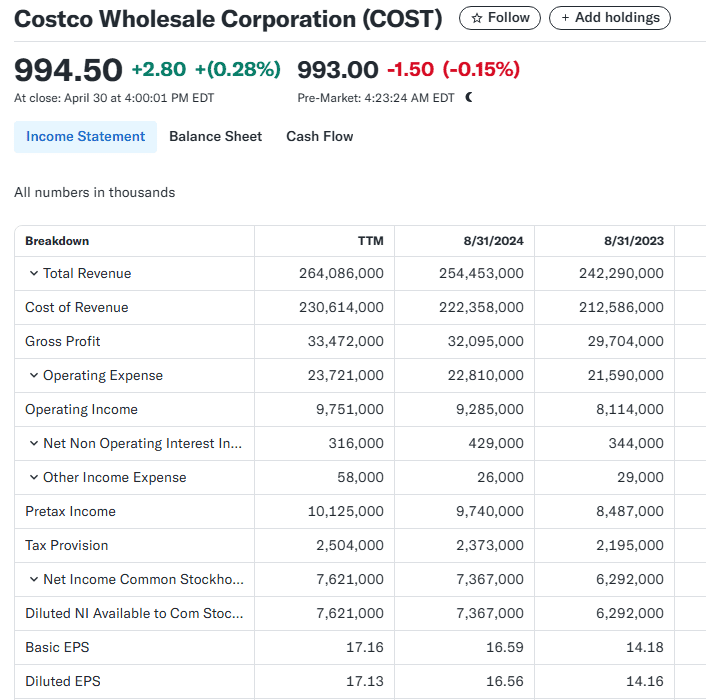

Before investing, it’s essential to understand Costco’s core strengths. The company operates a membership-based warehouse model known for high renewal rates, efficient operations, and steady revenue from both product sales and annual memberships.

Key areas to research include:

Costco’s financial health — look at revenue growth, profit margins, and free cash flow

Competitive advantages — such as bulk pricing, store brand (Kirkland), and loyal customer base

Market performance compared to peers like Walmart (WMT) or Target (TGT)

For in-depth analysis, resources like investing.com and Yahoo Finance provide detailed breakdowns of Costco’s earnings, valuation ratios, and growth forecasts.

-

4. Place a Buy Order

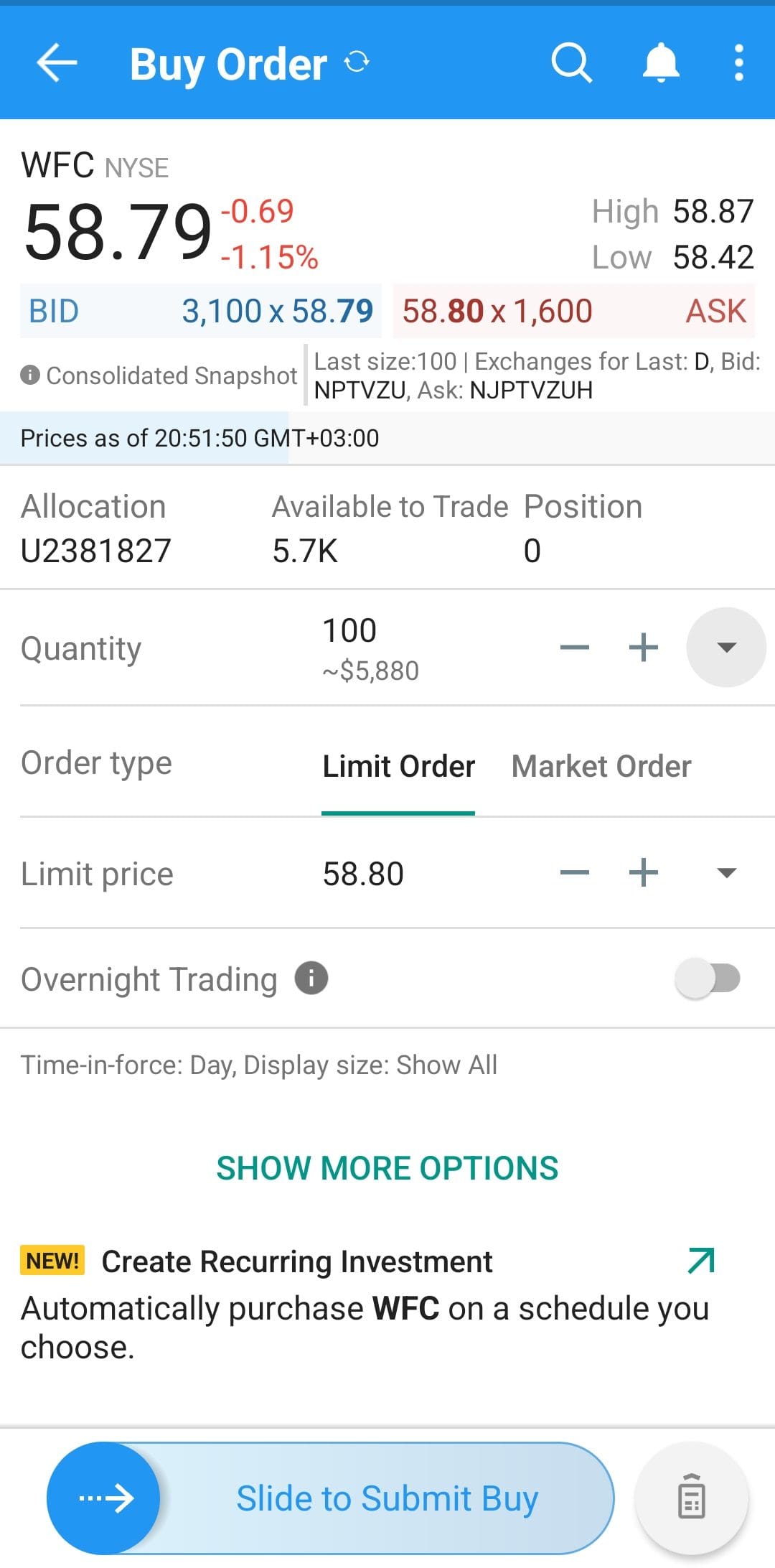

Once you've done your research, log into your brokerage account, search for Costco using the symbol COST, and place a buy order. You'll typically choose between two order types:

Market order – Buys immediately at the current market price

Limit order – Executes only if the stock reaches a specific price you're comfortable paying

If you believe Costco stock may dip slightly after earnings, you might place a limit order at $700 instead of buying at the current market price. This gives you more control over the entry point.

-

5. Monitor and Manage Your Investment

After purchasing Costco shares, regularly monitor your investment. This includes tracking quarterly earnings, same-store sales reports, membership trends, and broader retail sector news.

Most platforms allow you to set alerts, view analyst ratings, and track key performance updates.

How to Invest in Costco Indirectly

If you’re interested in Costco but prefer a broader or more passive investing approach, there are several indirect ways to gain exposure:

-

Invest in ETFs That Hold Costco Stock

One of the most accessible ways to gain exposure to Costco is through exchange-traded funds (ETFs) that include it as a top holding.

This can be a great choice if you want to invest in Costco while also spreading risk across multiple companies.

For instance, the Vanguard Consumer Staples ETF (VDC) and the SPDR S&P 500 ETF Trust (SPY) both include Costco as a significant component.

VDC focuses on major retailers and consumer product companies, while SPY provides exposure to the broader U.S. market.

-

Choose Mutual Funds with Costco Exposure

Actively managed mutual funds can also offer partial exposure to Costco while giving professional fund managers the reins.

These funds often include high-performing retail giants as part of a broader portfolio.

For example, the Fidelity Contrafund (FCNTX) and the T. Rowe Price Blue Chip Growth Fund (TRBCX) both hold Costco among their top positions.

These funds typically favor companies with strong fundamentals, recurring revenue, and consistent earnings growth — traits Costco is known for.

-

Use Robo-Advisors That Include Costco in ETF Allocations

Robo-advisors like Betterment, Wealthfront, and Schwab Intelligent Portfolios often use diversified ETF strategies to match your risk profile.

Many of these ETFs—especially those tracking the S&P 500 or consumer staples—include Costco stock.

This is ideal if you prefer a hands-off approach and want to automate your investing.

You’ll still benefit from Costco’s stability and earnings potential without selecting individual stocks.

Rovo Advisor | Annual Fees | Minimum Deposit |

|---|---|---|

Wealthfront | 0.25% | $500 |

Betterment | 0.25%

$4 monthly for $0 – $20K balance, 0.25% annually for $20K – $1M balance, 0.15% annually for $1M – $2M balance, 0.10% annually for +$2M balance | $10 |

Acorns | Monthly: $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $0 |

Schwab Intelligent Portfolios | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $5,000 |

Vanguard Digital Advisor® | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | $100 |

E*TRADE Core Portfolios | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $500 |

Merrill Guided Investing | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $1,000 |

-

Mirror Costco’s Business Model with Related Stocks

If you like Costco’s value-driven approach, you might consider other consumer-focused stocks with similar models. These companies share traits like bulk sales, private labels, or essential product offerings.

Walmart (WMT) – Operates Sam’s Club, a direct warehouse competitor. Also excels at low prices and high sales volume.

Target (TGT) – Strong private labels and customer loyalty, with a focus on everyday essentials at competitive prices.

Dollar General (DG) – Appeals to budget-conscious shoppers with low prices and fast-moving consumer goods, much like Costco’s strategy.

Buying Costco Stock: Pros & Cons

Costco stock offers long-term growth potential, but it's not ideal for every investor. Here are key benefits and drawbacks to weigh.

- Consistent Business Model:

Costco’s membership-driven model creates recurring revenue and customer loyalty, helping it weather economic downturns better than most retailers.

- Strong Fundamentals

With a high return on equity, growing revenue, and minimal debt, Costco has remained financially stable over decades.

- Dividend Growth

Costco pays a modest quarterly dividend and has issued occasional special dividends, rewarding long-term shareholders.

- Global Expansion Potential

New warehouse openings in markets like China and Australia may support long-term revenue growth.

- High Stock Price

COST trades at a premium compared to many retailers, making it harder for new investors without fractional shares to enter.

- Low Dividend Yield

Although reliable, the yield is relatively low, which may not appeal to income-focused investors.

- Thin Margins

As a warehouse retailer, Costco relies on volume rather than high markups, making it sensitive to supply chain costs.

- Dependence on Membership Fees

A significant portion of profits comes from memberships. A dip in renewal rates could hurt earnings.

FAQ

Costco’s steady growth and simple business model make it a solid long-term option for new investors looking for a reliable retail stock.

Yes, platforms like Fidelity, Robinhood, and Schwab allow recurring investments into Costco, ideal for dollar-cost averaging strategies.

You can start with as little as $1 using fractional shares if your brokerage supports it, making the stock accessible even at high prices.

No, Costco does not currently offer a direct stock purchase plan. You'll need to buy through a brokerage account.

Monitoring Costco quarterly during earnings season or when big retail trends hit the news is usually enough for long-term investors.

Like all stocks, Costco can decline during a market crash, but its focus on essentials and membership loyalty may provide relative stability.

Yes, international investors can buy Costco stock through brokers that offer access to U.S. exchanges, though fees and rules may vary.

While it pays a modest dividend, Costco occasionally issues large special dividends, offering potential extra income for long-term holders.

Yes, many brokers allow you to buy and hold Costco in a custodial account, making it a solid teaching tool for young investors.

Costco often trades at a premium due to its strong fundamentals and loyal customer base, but investors see it as a quality growth stock.