Table Of Content

How to Buy Ethereum in 4 Simple Steps

Buying Ethereum can seem complex at first, but following a structured approach helps you enter the market confidently.

Step 1: Align Ethereum With Your Financial Goals

Before buying, it’s important to consider how Ethereum fits into your broader financial plan. Ethereum can offer growth potential, but it also carries volatility risk.

Assess your risk tolerance: Ethereum prices can swing sharply, therefore you should determine how much exposure fits your comfort level.

Identify your investment horizon: If you plan to hold long term, Ethereum’s future technology upgrades might offer value.

Balance your portfolio: Avoid over-concentration by diversifying with stocks, bonds, or other crypto assets alongside Ethereum.

Taking time to match Ethereum to your financial goals helps avoid impulsive decisions and creates a solid foundation for investing.

- The Smart Investor Tip

Revisit your financial plan every few months after buying Ethereum. Crypto markets evolve fast, and adjusting your goals keeps your strategy relevant.

Step 2: Choose a Reliable Crypto Exchange

Selecting a trustworthy exchange ensures your Ethereum purchase process is safe and efficient. There are many platforms, but not all are equal.

Look for strong security features: Prioritize exchanges offering two-factor authentication (2FA) and cold storage solutions.

Check trading fees: Platforms like Coinbase or Kraken charge different transaction fees, therefore comparing costs is wise.

Evaluate ease of use: A simple interface like Gemini or Crypto.com can make a big difference, especially for beginners.

Choosing the right exchange not only simplifies your experience but also minimizes risks like hacking or hidden costs.

- The Smart Investor Tip

Test small transactions first when using a new exchange. Sending and buying a small amount helps verify everything works smoothly before committing larger funds.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

Step 3: Fund Your Account Securely

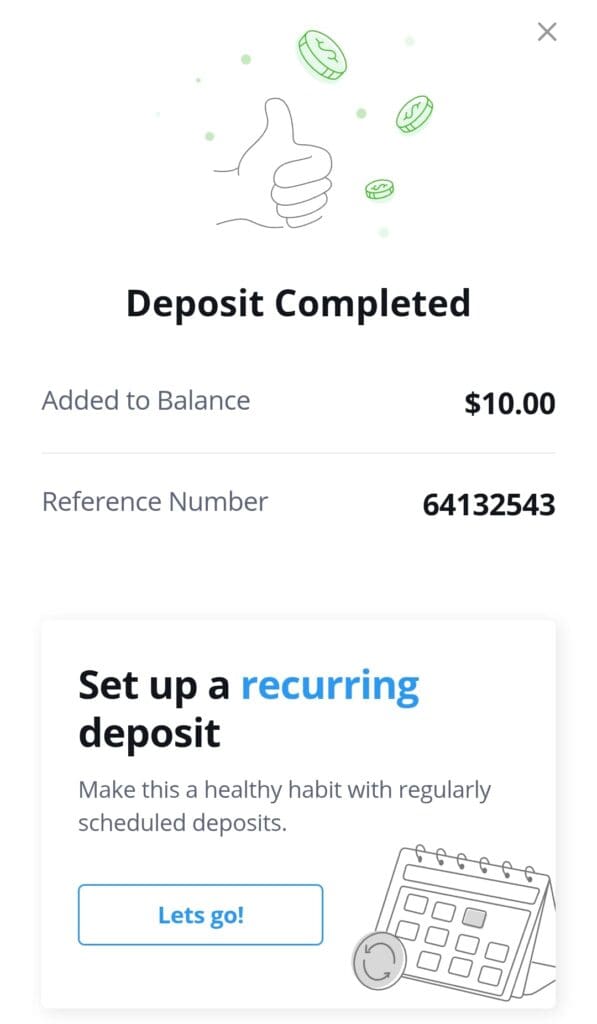

Once you select an exchange, the next step is adding funds to your account. Different funding methods offer varying speeds and costs.

Use bank transfers for large deposits: Although slower, they often have lower fees compared to debit cards.

Consider using a debit card: It enables instant purchases but usually comes with higher transaction fees.

Be cautious with credit cards: Some banks treat crypto buys as cash advances, therefore adding extra costs and risks.

Funding your account carefully helps you manage fees and ensures that your funds are ready for Ethereum purchases without unnecessary delays.

Step 4: Buy Ethereum and Choose Your Storage Method

With funds ready, you can now buy Ethereum and decide where to store it for maximum security.

Buy directly from the exchange: Use market or limit orders to purchase Ethereum based on your preferred price.

Use a private wallet for storage: Hardware wallets like Ledger or Trezor offer higher security than leaving coins on exchanges.

Consider custodial wallets: If you prefer convenience, some platforms offer managed wallets, but be aware of potential custody risks.

Buying is only half the process; where you store your Ethereum matters greatly in order to protect it from theft or exchange failures.

Smart Strategies for Buying Ethereum

Buying Ethereum isn’t just about timing the market; it’s about following smart practices that reduce risks and maximize potential returns.

Start with small amounts: Begin with a manageable investment because crypto markets are volatile, and it's better to learn with smaller stakes.

Use limit orders: Instead of buying instantly, use limit orders to target specific price points in order to avoid overpaying.

Keep track of fees: Trading fees, withdrawal fees, and network gas fees can add up, therefore monitor your total costs carefully.

Stay updated on Ethereum developments: Major upgrades like Ethereum 2.0 affect price trends and usage, so staying informed can improve your strategy.

Avoid emotional trading: Price swings are common; therefore sticking to your plan helps avoid buying high or selling low out of fear.

Applying these simple yet effective tips positions you for smarter decision-making, especially in a fast-moving market like Ethereum.

How to Store Ethereum Securely After Buying

Once you buy Ethereum, it is crucial to secure it properly to avoid hacks or losses. You can store it on the exchange for convenience, but for better security, using a non-custodial wallet is recommended.

Hardware wallets like Ledger or Trezor offer top-tier protection by keeping your private keys offline. Alternatively, a reputable software wallet like MetaMask balances usability with decent security.

No matter which method you choose, always back up your recovery phrases in order to safeguard against device loss or failure.

Platform | Supported Coins | Swap Fee | MetaMask Wallet | +16 | 0.875% |

|---|---|---|

Coinbase Wallet | +3,000 | 1% |

Trust Wallet | +5,000 | 0%

Users still need to pay blockchain network fees (gas fees) and potential liquidity provider fees when swapping assets |

Ledger Hardware Wallet | +5,000 | About 0.25%

The Swap service is facilitated by third-party providers such as Changelly and ParaSwap, each with their own fee structures. For instance, Changelly charges a transaction fee of approximately 0.25%. |

Exodus Wallet | +300 | 0%

Users still need to pay blockchain network fees (gas fees) and potential liquidity provider fees when swapping assets |

Crypto.com OnChain | +1,000 | 0.3% |

Best Places to Buy Ethereum Easily

Choosing the right platform to buy Ethereum impacts your fees, speed, and overall security when entering the crypto market.

Coinbase: Ideal for beginners because it offers a simple interface and strong regulatory compliance.

Kraken: Known for low fees and strong security measures, therefore great for larger purchases.

Gemini: Offers excellent custody services and insurance protections, which can be appealing to conservative investors.

Crypto.com: Also provides a wide range of crypto products, including staking options alongside straightforward Ethereum purchases.

Binance US: Suitable for active traders because it offers competitive fees and advanced trading features for Ethereum.

Selecting the right platform ensures your Ethereum buying experience is smooth, cost-effective, and aligned with your needs.

FAQ

Some decentralized platforms allow purchases without ID verification, but most major exchanges require KYC (Know Your Customer) compliance. This helps prevent fraud and complies with global regulations.

Hardware wallets like Ledger and Trezor are ideal for maximum security. Alternatively, software wallets like MetaMask or Trust Wallet offer more convenience for everyday use.

Buying Ethereum from reputable exchanges is generally safe if you follow good security practices like enabling two-factor authentication. However, the value of Ethereum can fluctuate significantly, so investment risks remain.

Most exchanges accept bank transfers, debit cards, credit cards, and sometimes PayPal. Each payment method has different fees and processing times, so choose what fits your needs.

A bank account is the most common way to fund an exchange account. However, you can also use peer-to-peer platforms, crypto ATMs, or stablecoins if you prefer not to link a bank.

Some financial advisors and crypto-focused wealth managers offer Ethereum investment options. However, traditional advisors may not yet offer direct crypto purchases, so check their specific services.

Buying Ethereum can take just a few minutes if you use instant purchase options. If you fund your account via bank transfer first, it might take 1–3 business days depending on your bank.