Table Of Content

Is It Safe to Buy Ethereum on Gemini?

Yes, Gemini is considered one of the safest platforms to buy Ethereum.

It is regulated by the New York State Department of Financial Services (NYDFS) and implements strong security measures such as cold storage, two-factor authentication, and insurance for digital assets.

How to Buy Ethereum on Gemini in 4 Simple Steps

Buying Ethereum on Gemini can be easy once you understand the process. Here’s a step-by-step guide for Gemini users.

Step 1: How Ethereum Fits Into Your Investment Strategy

Before purchasing, it's important to determine how Ethereum aligns with your broader financial goals and risk tolerance. Some investors view Ethereum as a long-term store of value, while others see it as a vehicle for DeFi exposure.

Understand ETH's volatility: Ethereum's price can fluctuate significantly, so be prepared for short-term swings.

Evaluate your time horizon: Decide if you plan to hold Ethereum for months, years, or trade more actively.

Align with portfolio goals: Make sure adding ETH complements your broader investment diversification strategy.

By carefully evaluating Ethereum's role in your portfolio, you can make a more informed purchase decision and minimize emotional trading later.

Step 2: Fund Your Gemini Account

You’ll need to deposit U.S. dollars (or other accepted currencies) into your Gemini account before making a purchase. Gemini offers multiple funding methods that cater to different preferences.

Bank transfer (ACH): Ideal for U.S. residents; usually free but may take a few days.

Wire transfer: Faster funding for larger purchases but may involve bank fees.

Debit card payments: Instant, but Gemini charges a convenience fee for card transactions.

Choosing the right funding method ensures you’re ready to buy at the right moment without unnecessary delays or extra costs.

Step 3: Choose How Much Ethereum to Buy

Once your account is funded, decide the amount of Ethereum you want to purchase. Gemini allows both fractional and full ETH purchases, offering flexibility for all budgets.

Use Gemini’s price calculator: Quickly see how much ETH you’ll receive for a set dollar amount.

Consider dollar-cost averaging: Spread purchases over time to minimize the impact of price volatility.

Stay within budget: It's tempting to invest more during hype cycles, but stick to your plan.

Being deliberate about your investment size can help prevent overexposure to market fluctuations and keep your risk manageable.

- The Smart Investor Tip

Consider splitting your intended investment into smaller buys rather than making one large purchase. This tactic can help reduce the risk of poor market timing.

Step 4: Place and Secure Your Ethereum Order

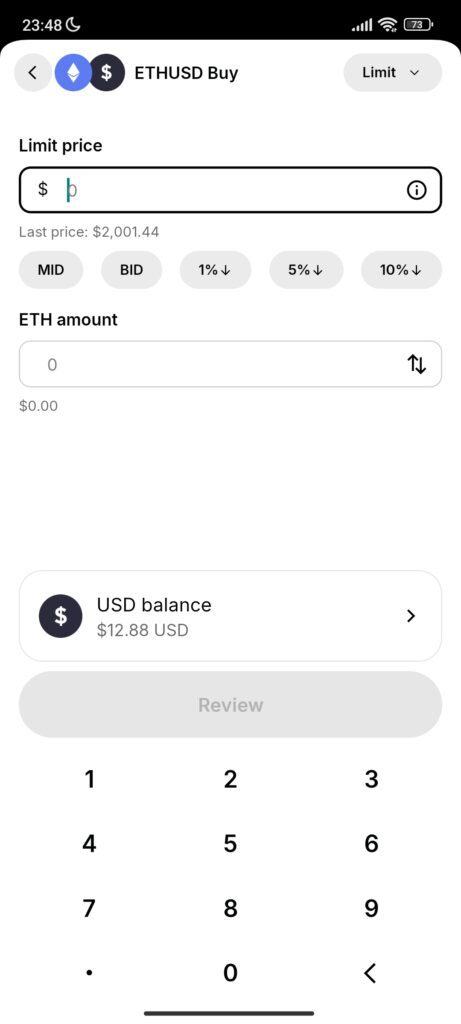

Now it’s time to execute your trade. Gemini offers several buying options depending on how involved you want to be in the buying process.

Instant buy: Purchase Ethereum immediately at the current market rate.

Limit orders: Set a price where you want to buy; ideal if you expect short-term dips.

Recurring buys: Automate purchases on a schedule to build your position gradually.

After buying, consider transferring your ETH to a private wallet for added security, especially if you're planning to hold long-term.

Mistakes To Avoid When Buying Ethereum on Gemini

Buying Ethereum on Gemini is simple, but small mistakes can lead to unnecessary costs or security risks. Here’s what to watch out for.

Skipping account security settings: Not enabling two-factor authentication can leave your account vulnerable to unauthorized access.

Ignoring transaction fees: Using debit cards or instant purchases without checking fees can quietly eat into your investment.

Buying without a strategy: Jumping in based on hype without a plan can result in poor timing and regretful selling.

Leaving Ethereum on the exchange: Keeping large amounts on Gemini long-term without transferring to a private wallet increases exposure to platform risks.

By being mindful of these issues, you can avoid common pitfalls, protect your investment, and make your Ethereum journey on Gemini much smoother.

Alternative Places To Buy Ethereum For US Residents

While Gemini is a solid choice, several other beginner friendly crypto platforms make it easy for U.S. residents to buy Ethereum.

Coinbase: User-friendly for beginners, but fees can be higher compared to other exchanges.

Kraken: Offers low-fee trading and a strong reputation for security and transparency.

Crypto.com: Features promotional rewards and cashback for purchases, but the app interface can be overwhelming for new users.

Binance.US: Known for low trading fees and a wide crypto selection, but has fewer features than its global counterpart.

Each platform has its strengths, so it’s worth comparing options to find the one that best fits your needs, preferences, and trading style.

FAQ

Gemini does not currently support credit card purchases. You can use a debit card, bank transfer (ACH), or wire transfer to fund your account.

Yes, Gemini requires full identity verification due to regulatory compliance. This includes submitting government-issued ID and completing a KYC process.

Gemini operates 24/7, allowing you to buy Ethereum anytime, including weekends and holidays, as crypto markets never close.

Yes, Gemini allows recurring buys, letting you set up daily, weekly, or monthly purchases to build your ETH position automatically over time.

Gemini lets you buy fractions of Ethereum. The minimum is typically around $5 worth of ETH, making it accessible for all budgets.

Yes, Gemini applies a small network fee when you withdraw Ethereum to an external wallet, based on current blockchain congestion.

You can leave Ethereum on Gemini’s insured platform, but for added control and long-term safety, many users move their crypto to private wallets.

Gemini’s fees are transparent but can vary between instant purchases and ActiveTrader. Always check the fee structure before confirming your buy.

Yes, Gemini’s mobile app fully supports Ethereum purchases, giving you flexibility to invest on-the-go with your smartphone.

Gemini offers a clean, beginner-friendly interface while also providing advanced tools for experienced traders, making it a good platform for all levels.