Table Of Content

How to Buy GameStop Stock

Buying GameStop stock is accessible for individual investors through most online brokerage platforms.

Whether you're interested because of its recent volatility, retail investor buzz, or long-term turnaround potential, here’s a clear step-by-step approach to get started:

-

1. Choose a Brokerage That Offers GME Stock

To buy GameStop (ticker symbol: GME), you'll first need a brokerage account that supports U.S. stock trading.

Most mainstream platforms — such as Fidelity, Robinhood, E*TRADE, and Merrill Edge — offer access to GameStop shares listed on the NYSE.

These platforms not only offer commission-free trading but also provide tools such as analyst insights, price alerts, and historical performance charts.

Broker | Annual Fees | Best For |

|---|---|---|

E-Trade | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| Options & Futures Trading |

Interactive Brokers | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% | Professional Trading Tools |

Fidelity | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| Retirement Account Investing |

Vanguard | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | Low-Cost ETF Investors |

J.P. Morgan Self Investing | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | Chase Bank Customers |

Charles Schwab | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | Advanced Trading Tools |

Merrill Edge | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Bank of America Clients |

For example, if you're using Robinhood, you can easily track GameStop’s real-time movement and view community sentiment before making a decision.

- The Smart Investor Tip

Look for a broker that offers extended-hours trading, especially for volatile stocks like GameStop. This can give you a better chance to act on news or price swings that occur outside of normal market hours

-

2. Set Up and Fund Your Brokerage Account

Once you’ve selected a brokerage, complete the onboarding process by submitting your ID and linking a bank account. After verification, transfer funds based on how many shares of GME you want to buy.

Let’s say GME is trading at $14.50 per share — if you're planning to invest $435, you could purchase around 30 shares. Some platforms, like Fidelity or Schwab, also offer fractional shares, letting you invest with as little as $5.

This flexibility is useful if you're building a diversified portfolio or just testing out your first stock investment.

-

3. Understand GameStop’s Investment Story

Before you invest in GameStop, it’s important to understand what you’re buying into. GameStop has gone through dramatic changes — shifting from a struggling brick-and-mortar retailer to a digital transformation story boosted by retail investors on Reddit’s WallStreetBets.

Research should include:

GameStop’s recent quarterly earnings and cash flow trends

Its evolving business model, such as moves into NFTs and digital gaming

Leadership changes, like the hiring of Ryan Cohen and Amazon veterans

Volatility risks driven by short interest and meme stock momentum

You can explore in-depth analyses on investing.com or SeekingAlpha, which offer financial metrics, earnings breakdowns, and forward-looking commentary.

-

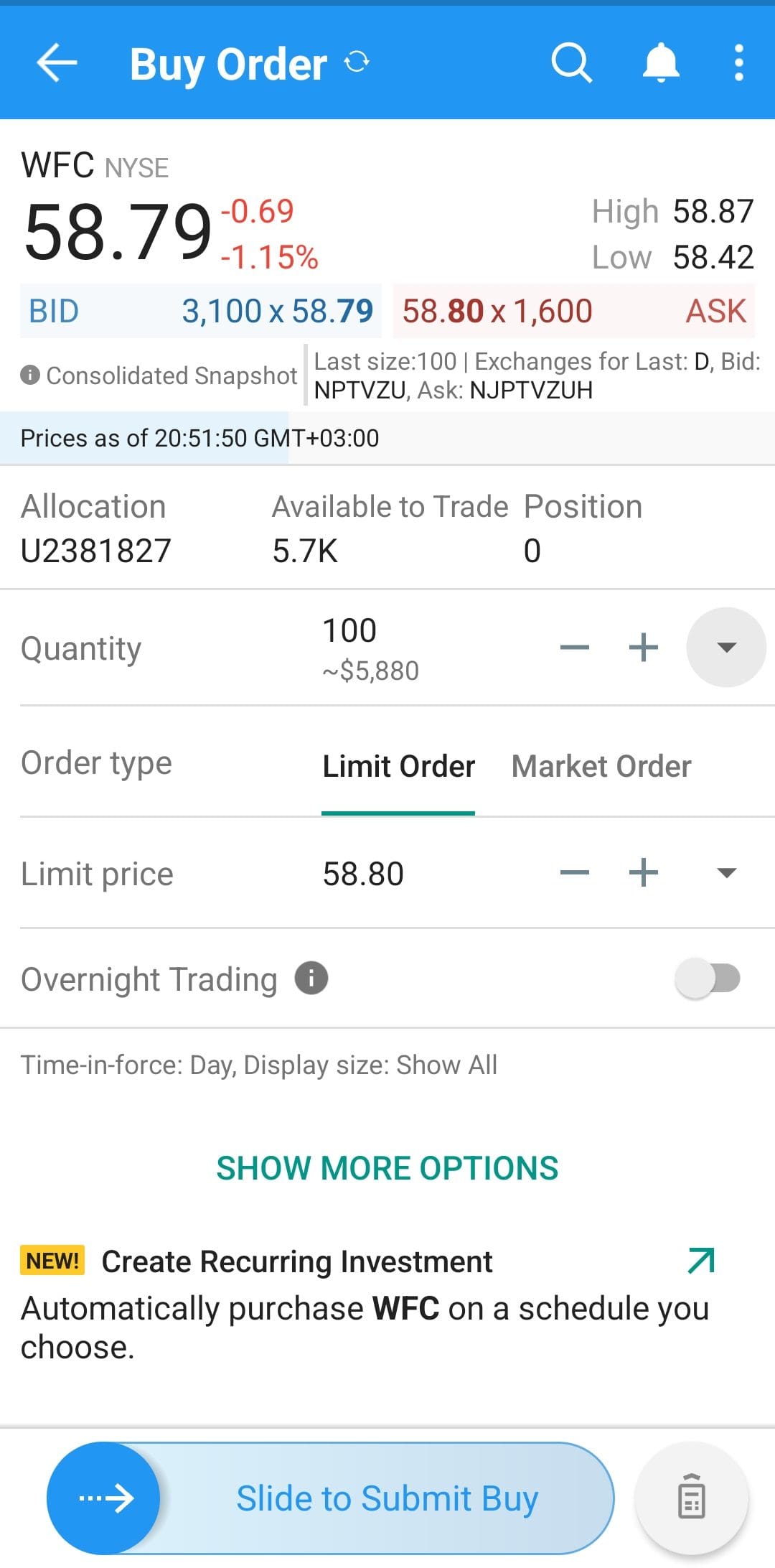

4. Place a Buy Order

Log into your account, search for “GME,” and enter a buy order. You’ll typically have two main options:

Market Order: Executes instantly at the current price

Limit Order: Executes only if the price falls to a specific amount you choose

For example, if GME is trading at $15 but you only want to buy if it drops to $13, you can set a limit order and wait for that condition to be met.

This is helpful if you're aiming to control your entry price in a highly volatile stock like GameStop.

-

5. Track Your Investment and Stay Informed

After you’ve purchased GME shares, keep an eye on the company’s developments and broader market reactions. GameStop’s stock has historically been highly reactive to social media trends, executive updates, and earnings calls.

Many brokers allow you to:

Set price alerts and watchlists

Follow analyst ratings and news updates

Review recent SEC filings or earnings calls

For instance, if GameStop announces a partnership or product pivot, you may want to reassess your investment thesis based on how the market responds.

Because of its volatility, GameStop may suit traders looking for short-term movement as well as speculative investors who believe in a longer-term turnaround.

- The Smart Investor Tip

Set up Google Alerts for “GameStop earnings,” “Ryan Cohen,” or “GME stock news” so you’re notified when major updates happen — it’s a simple way to stay ahead without constantly checking the news.

How to Buy GameStop Stock Indirectly

If buying GameStop shares directly doesn’t align with your goals—whether due to volatility concerns, a preference for diversification, or limited capital—you can still gain exposure through indirect strategies.

Here are a few options that can offer exposure to GameStop while managing risk more effectively:

-

Invest in ETFs That Hold GameStop

A practical way to invest in GameStop without buying individual shares is through exchange-traded funds (ETFs) that include GME as part of their portfolio.

While GameStop isn’t a top holding in most ETFs, it appears in several small-cap or meme-stock-focused funds.

For example, the SPDR S&P Retail ETF (XRT) holds GameStop as part of its equal-weight retail basket, meaning you're getting exposure without betting heavily on one company.

Another example is the Roundhill MEME ETF (MEME), which targets high-social-interest stocks, often including GameStop.

-

Use Mutual Funds or Robo-Advisors with Small-Cap Exposure

You may also gain passive exposure to GameStop through mutual funds or robo-advisors that invest in small-cap equities.

While GME won’t typically be a top holding, it can be part of a diversified fund aligned with your risk profile.

For example, certain small-cap mutual funds or growth-oriented index portfolios might include GameStop as a minor holding—especially if the fund tracks indexes like the Russell 2000.

Robo-advisors like Betterment or SoFi Invest may allocate a portion of your portfolio to such indexes based on your preferences.

Rovo Advisor | Annual Fees | Minimum Deposit |

|---|---|---|

Wealthfront | 0.25% | $500 |

Betterment | 0.25%

$4 monthly for $0 – $20K balance, 0.25% annually for $20K – $1M balance, 0.15% annually for $1M – $2M balance, 0.10% annually for +$2M balance | $10 |

Acorns | Monthly: $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

| $0 |

Schwab Intelligent Portfolios | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | $5,000 |

Vanguard Digital Advisor® | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | $100 |

E*TRADE Core Portfolios | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| $500 |

Merrill Guided Investing | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $1,000 |

-

Follow Hedge Funds and Institutional Investors

Another indirect approach is to track hedge funds or institutions that own GameStop shares and consider mirroring parts of their broader portfolios.

For instance, Ryan Cohen, who played a key role in GameStop’s leadership transformation, has taken activist positions in multiple companies, including Bed Bath & Beyond and Nordstrom.

By examining 13F filings from firms like RC Ventures or funds that specialize in distressed or turnaround plays, you can gain insights into other high-conviction bets they’re making.

This strategy allows you to benefit from GameStop’s momentum while exploring related opportunities through a similar investment lens.

Websites like WhaleWisdom or GuruFocus help track institutional holdings and changes in real time.

Buying GameStop Stock: Pros & Cons

GameStop offers a unique mix of retail turnaround potential and high volatility. Here are key advantages and risks to consider first:

Pros | Cons |

|---|---|

Rapid gains during surges | High volatility risk |

Strong retail brand | Uncertain long-term strategy |

Focused turnaround leadership | Heavy short interest exposure |

Loyal investor community | No dividends or income potential |

- Potential for Rapid Gains

GameStop has seen explosive price moves due to retail investor momentum, which can lead to quick profits during short-term rallies.

- Strong Brand Recognition

Despite challenges, GameStop remains a recognizable name in gaming and retail, giving it potential for revival with the right strategy.

- Leadership with Turnaround Focus

The company brought in Ryan Cohen and other tech veterans to lead its digital transformation, signaling a serious pivot.

- Community and Investor Support

A strong base of retail investors frequently rallies around GME, creating support levels and social-driven spikes in price.

- Extreme Price Volatility

GameStop’s stock can swing dramatically within a single day, which increases the risk for buy-and-hold investors or beginners.

- Uncertain Business Model

Its shift from physical retail to e-commerce is still evolving, and profitability remains a major concern for analysts.

- Short Interest Risks

Heavy short interest creates volatility but also risk of price crashes once the hype subsides or short squeezes fail.

- Minimal Dividends or Income

Unlike stable dividend-paying stocks, GameStop doesn’t offer regular income, which limits its appeal for income-focused investors.

FAQ

There's no specific minimum, but you’ll need enough to cover at least one share or a fractional amount, depending on the broker. Always check for account minimums or funding thresholds.

Yes, GME can be purchased in a self-directed IRA through brokers that support equity investing in retirement accounts. Just ensure your risk tolerance fits the stock’s volatility.

Yes, GameStop is considered a meme stock because of its popularity on social media and forums like Reddit’s WallStreetBets. This status contributes to its price volatility.

GME’s price is influenced by retail investor activity, short interest, earnings reports, and market sentiment. Viral news and online trends can cause sudden surges or drops.

Yes, international investors can access GME through global brokers that offer U.S. stock trading. Currency conversion fees and tax implications may apply.

No, GameStop does not currently pay dividends. It reinvests its capital into business restructuring and growth initiatives.

GameStop is generally considered a high-risk stock due to its volatility, shifting business model, and reliance on retail investor sentiment.

You can check short interest data on platforms like MarketWatch, Yahoo Finance, or FINRA. These figures can give insight into potential price squeezes.

Some brokers allow you to schedule recurring purchases of GME on a weekly or monthly basis, particularly if they support fractional shares.

There’s no guaranteed “best” time, but many investors prefer to buy during dips or after earnings announcements. Research and patience are key due to the stock’s volatility.

Yes, GameStop has an active options market, allowing for calls, puts, and advanced strategies. However, options trading carries high risk and requires approval from your broker.