Table Of Content

With over 43 million retail accounts on its platform, Fidelity offers one of the broadest selections of gold-backed investments in the industry.

Fidelity doesn’t sell physical gold coins or bars. Instead, it gives you access to gold-related ETFs, mutual funds, mining stocks, and even gold futures (for advanced traders).

If you're already a Fidelity customer, diversifying into gold is just a few clicks away.

How to Buy Gold on Fidelity: A Step-by-Step Guide

You can’t walk into Fidelity and buy a gold bar — but you can get instant exposure to gold through ETFs, mutual funds, and mining stocks.

Each type offers unique benefits depending on your risk level and investment goals. Below, we’ll walk through how to buy each of these on Fidelity in a few simple steps.

How to Buy Gold ETFs on Fidelity

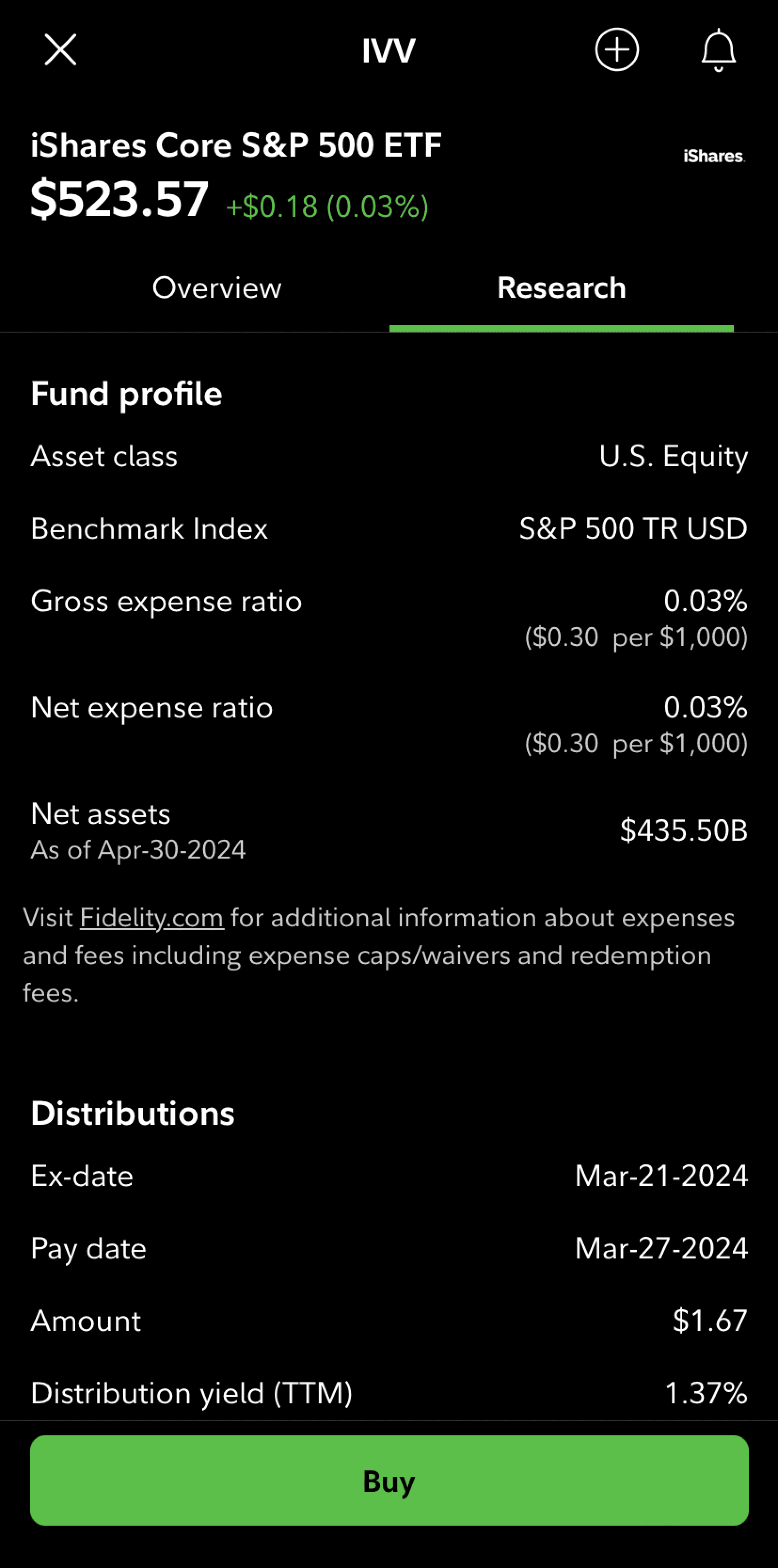

Gold ETFs offer one of the easiest ways to invest in gold on Fidelity. These funds typically track the price of gold or a basket of gold-related assets.

Once logged in to your Fidelity account, navigate to the top menu and select “Trade.” This opens the trading dashboard where you can search for securities.

-

Follow These Steps

- Enter a gold ETF symbol: In the “Symbol” field, type in a gold ETF ticker — like GLD (SPDR Gold Shares) or IAU (iShares Gold Trust). You can also use Fidelity’s ETF screener to compare performance and fees.

- Choose order type and quantity: Enter how many shares you want and select your order type (market or limit). You’ll also pick the account from which the funds will be withdrawn.

- Preview and submit the order: Double-check all the order details — especially the ticker and quantity. Then click “Preview Order” and hit “Submit” once everything looks right.

How to Buy Gold Stocks on Fidelity

Gold mining stocks can offer leveraged exposure to gold prices — but they also come with company-specific risks. Fidelity makes it easy to find and buy individual gold-related stocks.

-

Follow These Steps

- Use Fidelity’s Stock Screener: On the “Research” tab, select “Stocks” and use the screener to filter by sector. Under “Industry,” choose “Metals & Mining,” and then narrow by companies focused on gold production.

- Review company profiles: Click into companies like Newmont Corporation (NEM) or Barrick Gold (GOLD) to check fundamentals, analyst ratings, and recent performance.

- Click ‘buy/sell’ from the stock’s page: Once you’ve chosen a stock, click the “buy/sell” button directly from its profile page to open the order window.

- Enter trade details and submit: Enter the number of shares, your order type (market or limit), and the account you’re using. Then preview and submit the order to complete the trade.

How to Buy Gold Mutual Funds on Fidelity

Fidelity offers a wide selection of mutual funds with exposure to gold and precious metals. Some are actively managed, others passively track gold miners or commodities.

-

Follow These Steps

- Search for mutual funds in the ‘Research’ tab

Go to “Research” → “Mutual Funds” and use filters like “Precious Metals” or “Natural Resources” to narrow your results. - Compare fund performance and fees

Look for popular gold-focused funds like FSAGX (Fidelity Select Gold Portfolio) or VGPMX (Vanguard Precious Metals Fund). Check expense ratios, minimum investments, and 5-year performance. - Select ‘Buy’ from the fund page

Click into the mutual fund you want, then select “Buy.” Fidelity will prompt you to choose the account and amount you wish to invest. - Review order and confirm purchase

Preview your transaction, including NAV pricing and contribution source (cash or rollover). Confirm to complete the investment.

Understanding Fidelity’s Gold Investment Fees & Costs

Investment Type | Typical Costs | Details |

|---|---|---|

Gold ETFs (e.g., GLD) | Expense ratios: ~0.25%–0.40% | No commissions if bought online; GLD has 0.40% annual fee, IAU has 0.25% |

Gold Mining Stocks | Standard stock commission: $0 (online trades) | No annual fees; bid-ask spread applies |

Gold Mutual Funds | Expense ratios: ~0.70%–1.00% | Some have minimum investments; FSAGX charges around 0.82% annually |

Gold in IRAs | No IRA-specific fee for ETFs/funds | Standard Fidelity IRA fees apply; no physical gold allowed in Fidelity IRAs |

Tips for Investing in Gold on Fidelity

Whether you're buying gold ETFs, mining stocks, or mutual funds on Fidelity, a few innovative strategies can improve your results:

Know Your Goal: Are you investing in gold as a hedge, for growth, or as part of a retirement portfolio? Your goal determines the best type of gold exposure.

Watch the Fees: ETFs and mutual funds come with ongoing fees. Always compare expense ratios and fund performance before committing.

Understand the Risks: Gold stocks are more volatile than ETFs backed by bullion. Mutual funds add management risk as well.

Check Fund Holdings: Don't assume all gold funds are equal — some include other precious metals or energy stocks.

Use Research Tools: Fidelity offers stock screeners, fund comparisons, and analyst ratings. Use these tools to make informed choices.

Diversify Your Portfolio: Gold should be one part of a balanced portfolio. Overexposure can increase volatility rather than reduce it.

Using Fidelity for Gold IRA Investments

Fidelity allows investors to hold gold-related investments within certain retirement accounts — including traditional and Roth IRAs — but with a key limitation: you cannot hold physical gold bullion directly in a Fidelity IRA.

Instead, you can invest in gold ETFs (like GLD), mutual funds (like FSAGX), or mining stocks (like NEM or GOLD) within your IRA, offering tax advantages while maintaining exposure to gold.

If you want to hold physical gold in an IRA, you'll need to use a self-directed IRA provider that allows IRS-approved precious metals storage.

Can You Buy Physical Gold Through Fidelity?

No, Fidelity does not sell physical gold like coins or bullion bars. Investors looking to own tangible gold will need to use a dedicated precious metals dealer.

Fidelity focuses on “paper gold” — ETFs, mining stocks, and mutual funds tied to gold performance.

If you're interested in physical gold, check out trusted online dealers like SD Bullion or APMEX instead.

FAQ

No, Fidelity does not sell physical gold coins or bullion — only gold-related securities.

Yes, gold ETFs like GLD or IAU can be held in Roth IRAs for tax-advantaged growth.

Minimums vary but often range from $1,000 to $2,500 depending on the fund.

Yes, Fidelity allows fractional share investing for most ETFs, including gold ETFs.

Yes, but gold futures are only available on Fidelity’s Active Trader Pro and require special approval.

Only the cash in your account is insured (SIPC); your investment value fluctuates with market prices.

FSAGX is Fidelity's Select Gold Portfolio fund — it invests in gold-related stocks and is actively managed.

Both track gold prices, but IAU has a lower expense ratio and different share pricing structure.