Table Of Content

You don’t need to buy gold bars to invest in gold.

A lot of people buy gold stocks instead—because they tend to rise when gold prices do. These are companies that mine or deal with gold, so their stock value often tracks the metal.

If that sounds like something you’re into, this guide breaks down exactly how to buy gold stocks and what to look out for along the way.

How to Buy Gold Stocks In 5 Steps

Buying gold stocks is a simple way to invest in gold through the market. Here's how to get started step by step.

Step 1: Decide What Kind of Gold Stock You Want

Not all gold stocks are the same. Some companies physically mine gold (like Newmont or Barrick Gold), while you can also buy ETFs that hold a basket of gold-related companies.

Mining stocks give you exposure to operational success and risk.

ETFs spread your risk across multiple companies in one trade.

Before buying anything, decide your goal: Do you want leveraged exposure to gold prices, stable dividend income, or broad diversification?

Your answer will shape what type of gold ETF or individual stock fits your strategy.

Feature | Gold ETFs | Gold Mining Stocks |

|---|---|---|

Tracks gold price | Directly or indirectly | Indirectly via company earnings |

Diversification | High (multiple holdings) | Low (individual company risk) |

Volatility | Lower | Higher |

Potential returns | Steady | Higher (if company performs well) |

Best for | Broad gold exposure | Leverage on gold price increases |

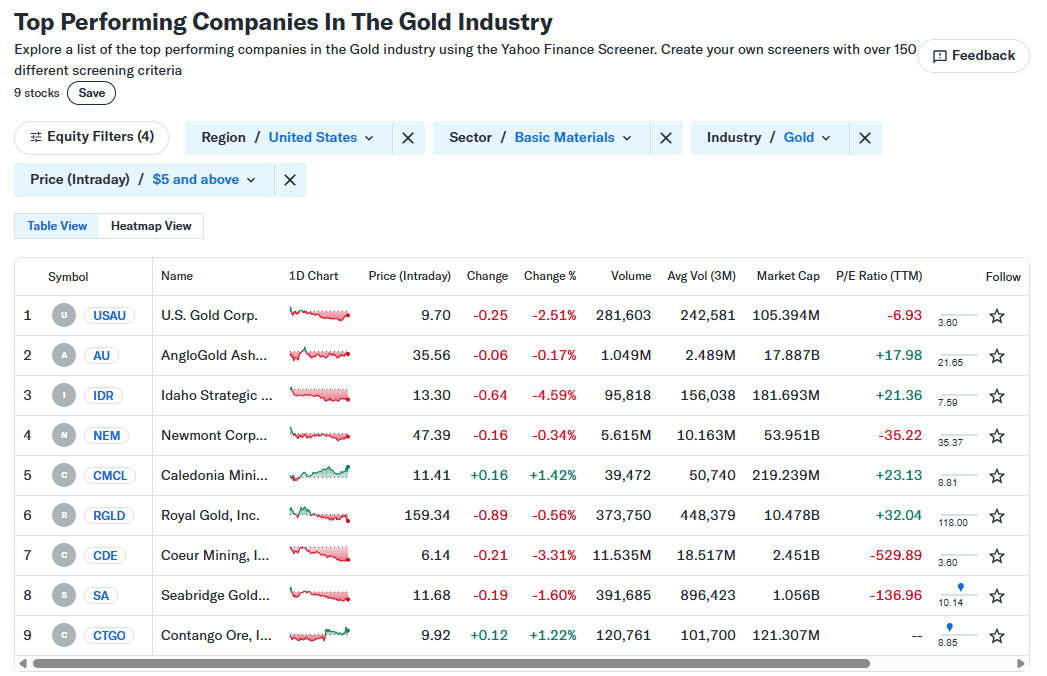

Step 2: Research Individual Companies or ETFs

Once you've picked a category, dig into the fundamentals. For mining companies, examine their production costs, gold reserves, debt levels, and jurisdiction risks.

A miner with low production costs and high reserves in a stable country is generally more attractive.

For ETFs, look at:

The top holdings

Expense ratio

Tracking method (passive vs. active)

Popular gold ETFs include GDX (VanEck Gold Miners ETF) and GDXJ (for junior miners). You can use platforms like Yahoo Finance or Seeking Alpha to compare performance and financials.

Always check the stock’s performance versus gold itself to see how it's tracking historically.

Step 3: Choose a Brokerage Account

To buy gold stocks, you’ll need a brokerage account. Most major platforms—like Fidelity, Schwab, Robinhood, or E*TRADE—offer gold stocks and ETFs.

If you already have an account, you’re set. If not:

Choose a platform with low trading fees and good research tools.

Consider user interface and whether it supports fractional shares, especially if you’re investing with a smaller budget.

Pro tip: Some brokerages also let you simulate trades or create watchlists. That’s helpful when you’re just starting to learn the market.

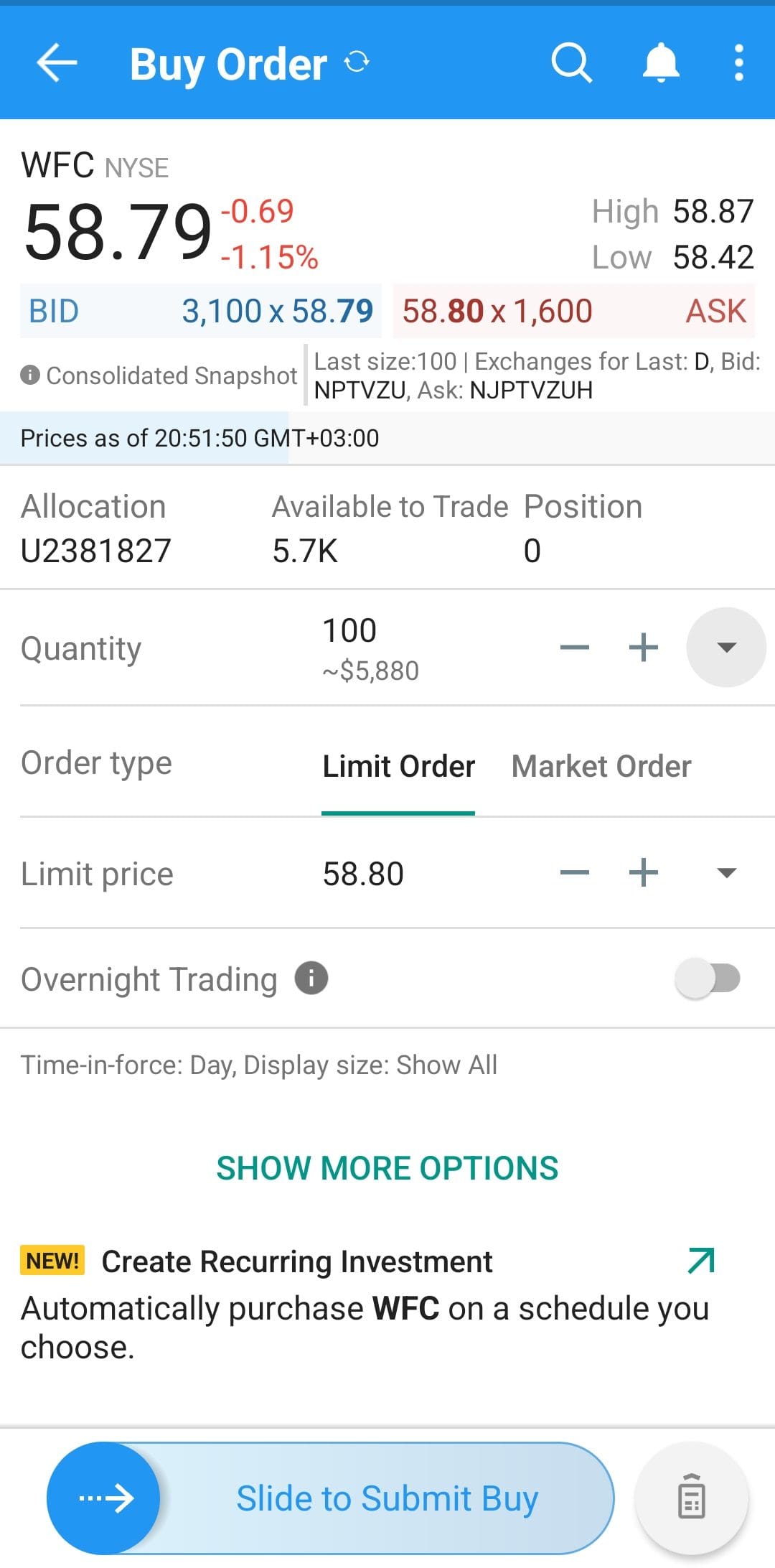

Step 4: Place Your Order (and Set a Strategy)

Once your account is ready, search the ticker symbol of the gold stock or ETF you want to buy. You’ll typically have options like:

Market order: Buys at the current price

Limit order: Sets your max price to buy or sell

If you’re a beginner investing for the long term, you might want to start with a lump-sum purchase or dollar-cost averaging (investing the same amount each month).

Also think about your exit strategy—will you sell if gold drops, or hold through volatility?

Step 5: Monitor Your Investment and Stay Informed

Gold stocks can be volatile—even more than gold itself—because they’re tied to company performance, geopolitical factors, and market sentiment.

To stay on top of things:

Subscribe to alerts from your brokerage

Follow gold news (sites like kitco.com or investing.com)

Review company earnings if you own individual stocks

Don’t panic if gold dips. Long-term gold investors often use it as a hedge during inflation or recession periods. If you’ve done your research and picked a solid company or fund, staying the course may be your best move.

Popular ETFs and Gold Mining Stocks to Consider

Investing in gold can mean different things—some people prefer ETFs for broad exposure, while others want the upside potential of individual mining companies.

Here’s a quick look at some of the most popular and trusted options in each category.

-

Gold ETFs

Gold ETFs let you invest in a basket of gold-related companies or track the price of gold itself. They’re a good option if you want diversification without picking individual stocks.

SPDR Gold Shares (GLD) – Tracks the price of gold and is one of the most traded gold ETFs.

iShares Gold Trust (IAU) – Similar to GLD, but with a slightly lower expense ratio.

VanEck Gold Miners ETF (GDX) – Holds large-cap gold mining stocks like Newmont and Barrick.

VanEck Junior Gold Miners ETF (GDXJ) – Focuses on smaller, more volatile mining companies.

-

Gold Mining Stocks

These are individual companies involved in gold mining and production. They carry more risk but also more potential upside if gold prices rise.

Newmont Corporation (NEM) – One of the largest and most established gold miners in the world.

Barrick Gold (GOLD) – A major player with global operations and strong reserves.

Agnico Eagle Mines (AEM) – Known for steady production and reliable dividends.

Franco-Nevada (FNV) – A royalty and streaming company, offering exposure with lower operational risk.

FAQ

Gold prices, company performance, production costs, and global market trends can all impact how gold stocks move.

Yes, especially ETFs. They offer exposure to gold without the complexity of owning physical metal or analyzing individual companies in depth.

Some gold mining companies do pay dividends, but payout amounts can vary based on gold prices and company earnings.

Yes, if the company has poor management, high debt, or production issues, its stock can underperform even when gold is rising.

Physical gold is generally more stable. Gold stocks can be riskier due to company-specific factors but may offer higher returns.

They can, especially if gold prices rise in response to inflation. But company-specific risks still apply.

Majors are more stable, while juniors can offer higher growth potential with more risk. It depends on your risk tolerance.

Yes, most IRAs and 401(k)s allow you to invest in gold stocks and gold ETFs through your brokerage.